The most important point with respect to exposure to the real estate sector in Spain in the third quarter of 2012 is, as mentioned earlier, the increase in provisions to cover the additional impairment in the value of assets associated with the real estate industry owing to the country’s worsening macroeconomic situation. Following the increase in provisions for loan-losses, and for foreclosures and assets purchases, at the close of the first nine months of 2012 the Group meets two-thirds of the requirements imposed by Royal Decree-Laws 02/2012 and 18/2012.

Including the figures from Unnim, the Group’s exposure to this sector increases by €2,652m, but with a high coverage ratio (48% of non-performing plus substandard loans). Foreclosures and asset purchases amount to an additional €3,267m, although they also have a high coverage ratio (65%).

It should be stressed that the Unnim deal includes an asset protection scheme (EPA) by which the Deposit Guarantee Fund (FGD) will take on 80% of any losses of a predetermined asset portfolio for a period of 10 years, after making use of existing provisions. The risk of incorporating Unnim portfolios to the BBVA Group is therefore extremely limited, not only due to their high coverage ratio, but also because of the existence of the EPA.

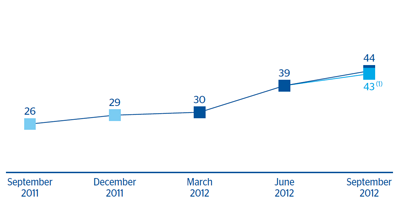

As a result of the above, there has been an increase over the quarter of the coverage of non-performing and substandard loans of the BBVA Group of 5 percentage points to 44%, and that of foreclosures and asset purchases has increased by 14 percentage points to 50%.