The Group’s income from fees and commissions for the period January-September 2012 totaled €3,690m, picking up their year-on-year growth rate to 7.8% (compared with 6.6% in the first half of 2012). Strong activity in emerging markets and the greater contribution of Garanti this year amply offset the negative impacts from sluggish activity in Spain and the regulatory changes implemented in some of the areas where the Bank operates. By business area, this heading remained stable in the euro zone. In Mexico, revenue from credit cards and the pensions business increased. In Turkey, strong activity practically offsets negative regulatory effects. In the United States they fell, basically as a result of regulatory pressures. In South America they grew, in line with the strong activity mentioned above.

NTI generated in the first nine months of 2012 increased by 9.8% year-on-year to €1,167m. NTI was significantly affected by a particularly weak third quarter of 2011, when amid a worsening debt crisis there was an exceptional loss of asset values, in addition to reduced business activity and the lack of earnings from portfolio sales.

Revenue from dividends amounted to €373m, 12.2% up on the figure 12 months earlier. This heading basically includes the remuneration from the Group’s stake in Telefónica and, to a lesser extent, the dividends collected in the Global Markets unit.

Income by the equity method totaled €543m, up 37.9% year-on-year. Practically all of this amount comes from the stake in CNCB.

Finally, the other operating income and expenses heading fell by 31.6% to €112m. The positive performance of the insurance business failed to offset the increased allocations to the various deposit guarantee funds in the countries where BBVA operates.

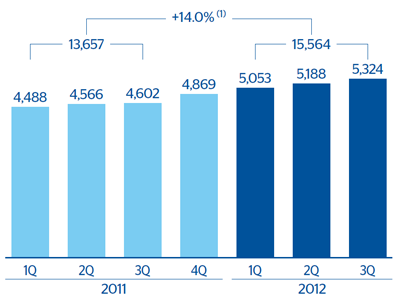

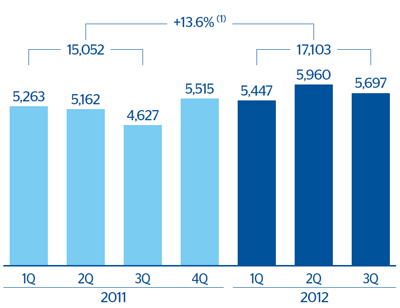

Overall, in the first nine months of 2012 the Group generated gross income of €17,103m, up 13.6% year-on-year, boosted mainly by recurring revenue. Gross income excluding NTI and dividends reached €15,564m, up 14.0% over the previous 12 months. This increase is particularly significant given the context in which it was generated. It is supported by the Group’s balanced geographical diversification between emerging and developed markets, and on its customer-centric business model.