Report 4Q 2025

BBVA posts record profit of €10.5 billion in 2025 and will distribute a dividend of more than €5.2 billion

The share

The global economy has shown greater strength than expected during 2025 given the high levels of uncertainty, trade and geopolitical tensions, and the United States administration's immigration restrictions. The negative effects of protectionist policies have been mitigated by lower effective tariffs than initially announced, fiscal stimulus and the strong growth in investment in artificial intelligence, particularly in the United States. Low financial volatility, supported by the Federal Reserve's (hereinafter, Fed) expansionary monetary policy, has also supported global activity.

Overall, BBVA Research anticipates that global growth will reach 3.2% in 2025, two tenths above the previous scenario, and will stand at 3.1% in 2026. For the United States, better than expected performance in recent months raises the growth forecast for 2025 to 2.0% (three tenths higher the previous forecast) and 1.9% for 2026 (one tenth higher). In the case of the Eurozone, the expectation of a gradual slowdown in activity remains: compared to GDP growth of 1.4% in 2025 (one tenth higher than the previous forecast), in 2026 it could be 1.1%, in a context where the impact of tariffs and political instability in some countries in the bloc could be partially offset by increased spending on defense and infrastructure. In China, the economic growth could close 2025 with an increase of 5%, equal to that of 2024 and two tenths higher than previously forecast. For 2026, BBVA Research maintains its expectations of moderation, with annual growth of 4.5%.

The tariff increase is expected to push inflation in the United States to around 3% by the end of 2026, limiting the Fed's scope for interest rate cuts. Following the cuts in 2025, which brought the benchmark rate to 3.75%, BBVA Research forecasts two additional rate cuts to 3.25%. In the Eurozone, the ECB is expected to keep the deposit facility interest rate unchanged (at 2%) if inflationary pressures remain contained (the headline rate closed 2025 at 2.0% and could remain around this level at the end of 2026) and downside risks to growth do not intensify. In China, monetary conditions are likely to continue to ease given the current context of very low inflation.

The balance of risks for the global economy remains weighted to the downside, but somewhat more balanced than in the previous scenario. In addition to protectionist measures in trade and immigration, and the structural challenges facing Europe and China, other negative factors include increased geopolitical tensions (potential interventions of the United States in Latin America, the Middle East or the Arctic) and uncertainty about the Fed's independence and its potential impact on financial markets. On a positive note, however it is worth mentioning the boost in investment in artificial intelligence and its medium-term effect on the productivity of economies that promote its adoption.

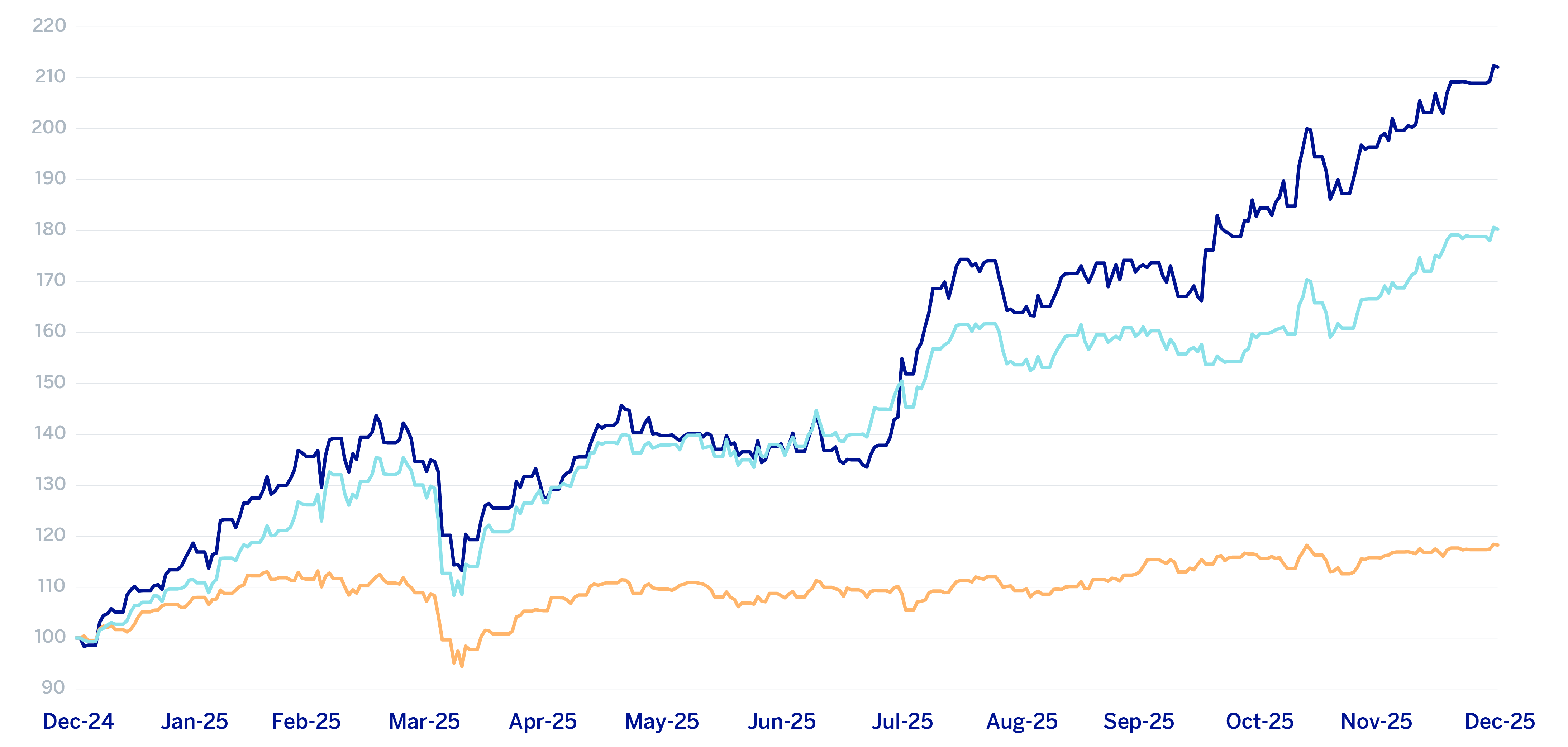

The main indexes have shown a very positive performance in 2025. In Europe, the Stoxx Europe 600 index increased by 16.7% compared to the end of 2024, and in Spain the Ibex 35 rose by 49.3% in the same period, showing a better relative performance. In the United States, the S&P 500 index also increased by 16.4%.

With regard to the banking sector indexes, the performance during 2025 was much better than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased by 66.9% and 80.3% respectively, while in the United States, the S&P Regional Banks sector index rose by 7.4% in the period.

As for BBVA’s share price, it increased by 114.1% during the year, outperforming its sector index, closing 2025 at €20.05.

BBVA share evolution

Compared with European indexes (base indice 100=31-12-24)

BBVA

Eurostoxx-50

Eurostoxx Banks

| THE BBVA SHARE AND SHARE PERFORMANCE RATIOS | ||

|---|---|---|

| 31/12/2025 | 30/09/2025 | |

| Number of shareholders | 657,193 | 669,979 |

| Number of shares issued (millions) | 5,709 | 5,763 |

| Closing price (euros) | 20.05 | 16.34 |

| Book value per share (euros) (1) | 10.19 | 10.02 |

| Tangible book value per share (euros) (1) | 9.69 | 9.55 |

| Market capitalization (millions of euros) | 114,465 | 94,172 |

| (1) For more information, see Alternative Performance Measures at the end of the quarterly report. | ||

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.60 per share, to be paid presumably on April as final dividend of 2025 is expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the 2025 financial year will be 50% of the attributable profit, with a cash distribution of €0.92 per share, taking into account that in November 2025, €0.32 gross was distributed in cash for each of the outstanding shares entitled to receive said distribution as an interim dividend for the year.

On December 31, 2025 the number of BBVA shares outstanding was 5,709 million. The number of shareholders reached 657,193, and by type of investor, 67.79% of the capital was held by institutional investors and the remaining 32.21% was in the hands of retail shareholders.

BBVA shares are included on the main stock market indexes. At the end of December 2025, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 13.4%, 2.7% and 0.9%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 6.5% and the Euro Stoxx Banks index for the eurozone with a weighting of 10.5%. Moreover BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

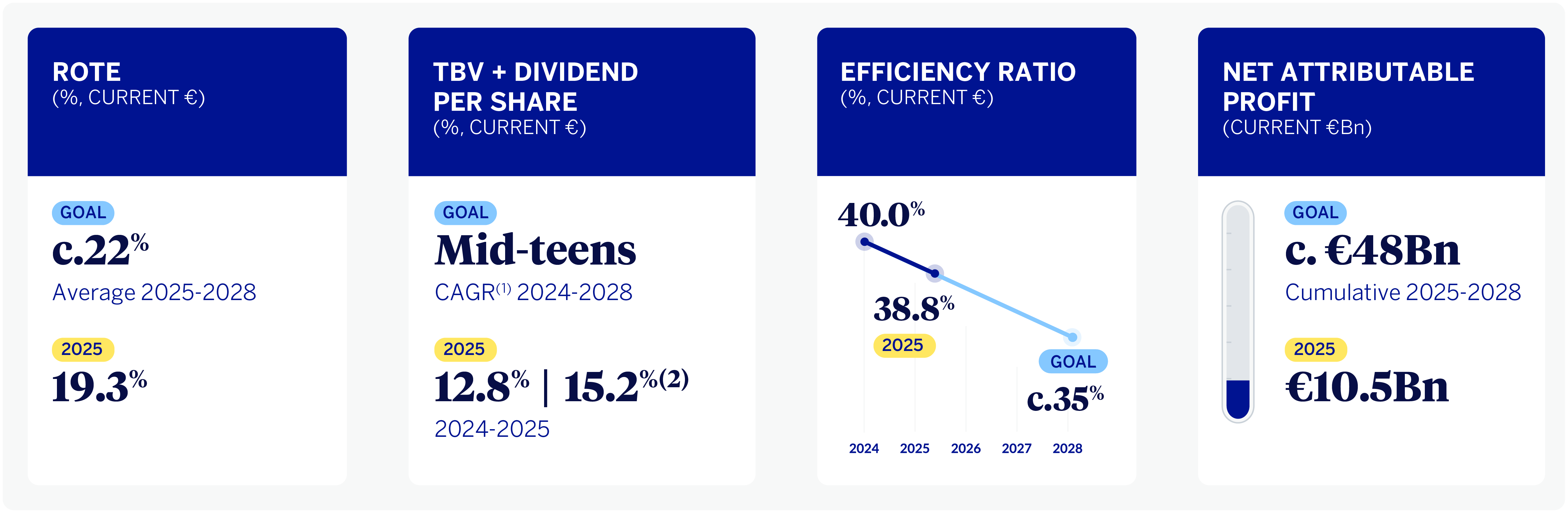

In 2025, the Group has made significant progress in the execution of its new 2025-2029 Strategic Plan, which aims to establish a new axis of differentiation by radically incorporating the customer perspective, as well as driving and strengthening the Group's commitment to growth and value creation. Thus, on July 31, the Group presented its financial objectives for the period 2025-2028, which are part of the strategic plan presented at the beginning of the year.

GROUP FINANCIAL KPIS GOALS EVOLUTION

(1) Compound Annual Growth Rate.

(2) Excluding the effect of Share Buybacks.

BBVA continues to focus on innovation as a key driver for achieving these goals and continuing to lead the transformation of the sector. Thanks to artificial intelligence and next-generation technologies, the Group amplifies its positive impact on customers, helping them make the best decisions.

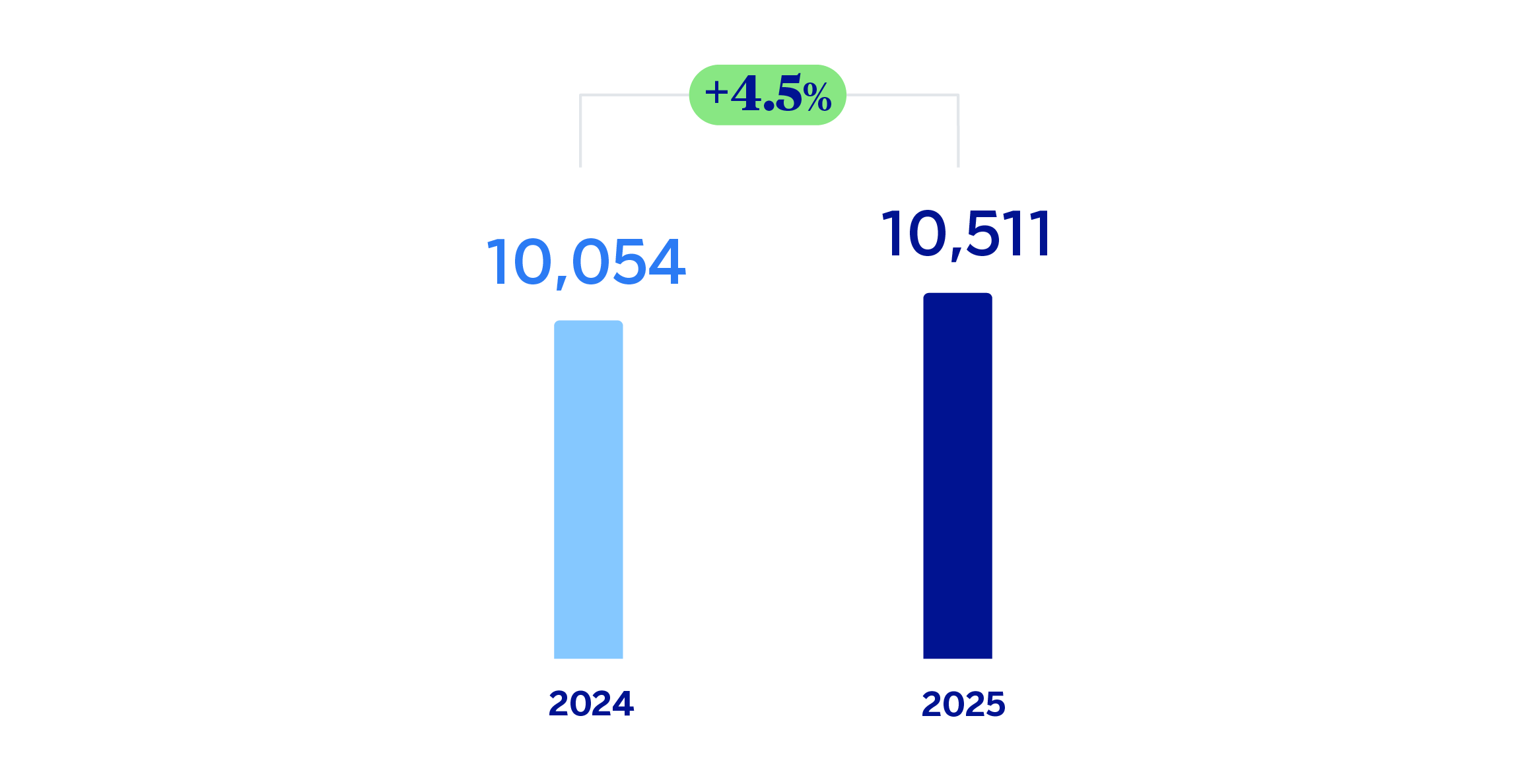

In this context, the BBVA Group achieved a cumulative result of €10,511m, by the end of December 2025, representing an increase of 4.5% over the previous year, supported by the strong performance of recurring revenues from the banking business If the exchange rates variation is excluded, this growth increases to 19.2% favored by the solid evolution in gross income, which increased by 16.3% in constant terms, with a growth rate that is significantly higher than that of operating expenses (+10.5% at constant exchange rates, impacted by an environment of still high inflation). As a result of this evolution, the efficiency ratio stood at 38.8% as of December 31, 2025, which represents an improvement of 206 basis points compared to December 31, 2024.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

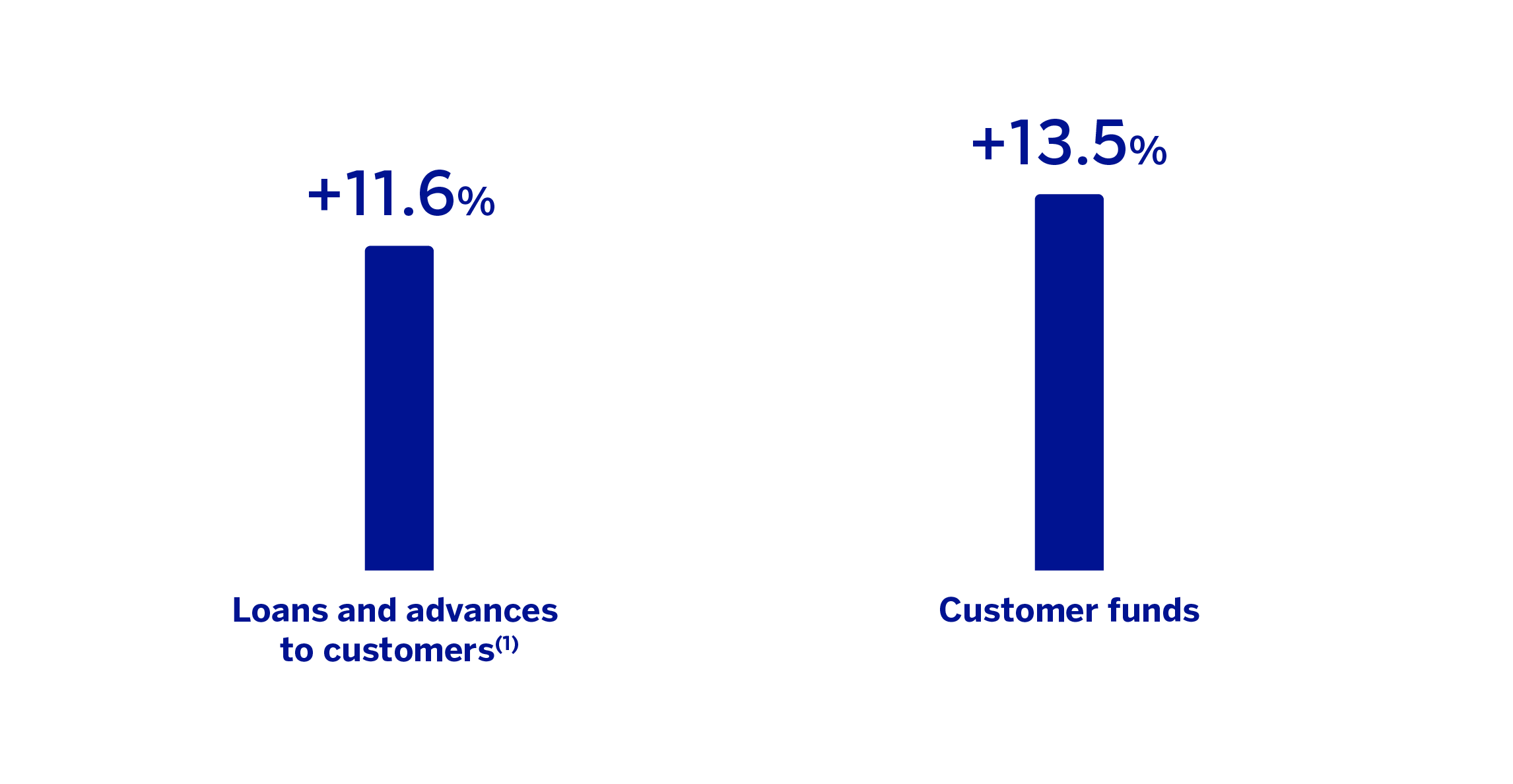

During 2025 the Group maintained a limited credit gap, supported by a solid capacity to raise stable funding. The increased dynamism of lending activity was accompanied by sustained growth in customer base deposits, allowing the Group to absorb the increase in lending without creating structural tensions on the balance sheet. As a result, the Group's funding profile remained aligned with the principles of prudent liquidity management, reinforcing balance sheet stability and the resilience of the business model in a still challenging macroeconomic environment.

In particular, in 2025, loans and advances to customers increased by 11.6%, driven by the dynamism of the wholesale segment. Of particular note within this segment was the higher volume of loans to business, which grew by 14.2% at the Group level. Loans to individuals increased by 8.3%, with consumer and mortgage loans showing greater dynamism.

Customer funds grew by 13.5% during the year, boosted by both customer deposits, which increased by 12.3% at Group level, and by mutual funds and customer portfolios, which grew by 17.2%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2024)

(1) The growth of non-performing loans and advances to customers under management (excluding repos) stands at 11.7%.

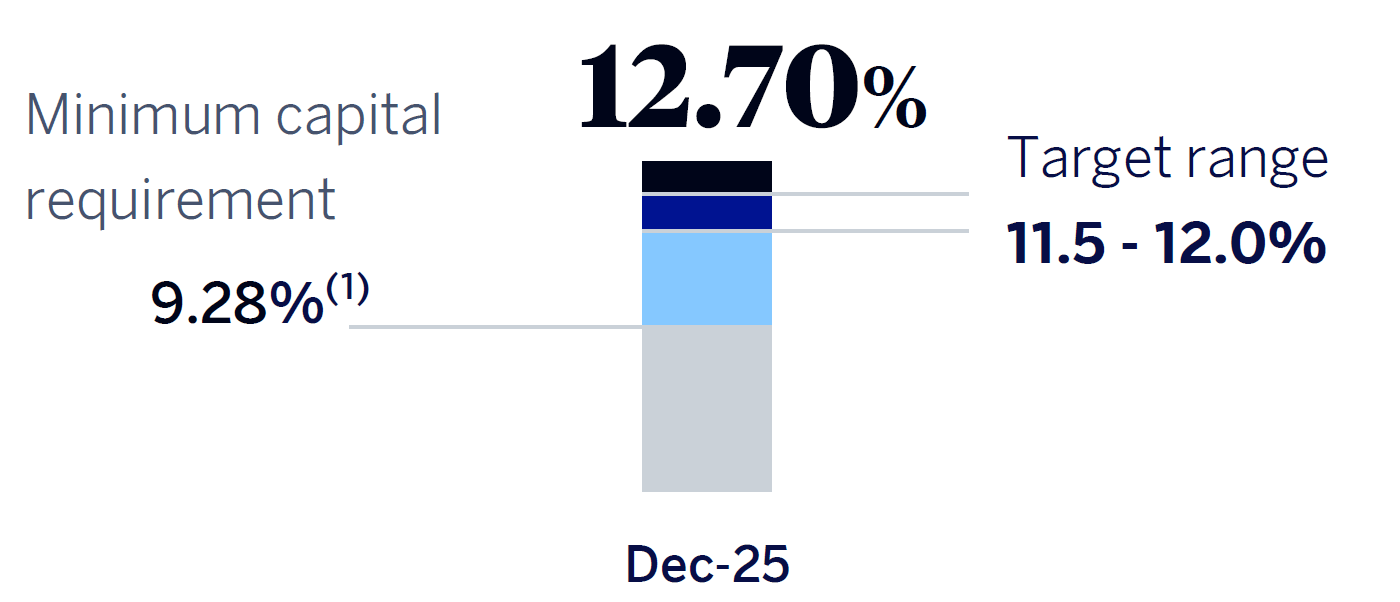

The BBVA Group's CET11 ratio stood at 12.70% as of December 31, 2025, which allows it to maintain a large management buffer over the Group's CET1 requirement as of that date (9.28%2), and is also above the Group's target management range of 11.5% - 12.0% of CET1.

CET1 RATIO

(1) Considering the latest official updates to the countercyclical capital buffer and the buffer against systemic risks, applied on the basis of exposure as of September 30, 2025, and incorporating the increase in the percentage of the countercyclical capital buffer applicable to exposures located in Spain approved by the Bank of Spain and published on October 1, 2025, applied on said exposure basis. Furthermore, from January 1, 2026, the minimum regulatory requirement for the Group would be reduced to 8.97%, in accordance with the result of the Supervisory Review and Evaluation Process (SREP) communicated by the European Central Bank (ECB).

1 As of 31-12-2025, there were no differences between fully loaded and phased-in ratios given that the impact associated with the transitional adjustments is nil.

2 Considering the latest official updates to the countercyclical capital buffer and the systemic risk buffer, applied on the basis of exposure as of September 30, 2025, and incorporating the increase in the percentage of the countercyclical capital buffer applicable to exposures located in Spain approved by the Bank of Spain and published on October 1, 2025, applied on that exposure basis. For its part, as of January 1, 2026, the minimum regulatory requirement for the Group would be reduced to 8.97%, in accordance with the outcome of the Supervisory Review and Evaluation Process (SREP) communicated by the European Central Bank (ECB).

Cash distributions

During the 2025 financial year, the Annual General Shareholders' Meeting and the Board of Directors approved the payment of the following cash amounts:

The Annual General Shareholders' Meeting of BBVA held on March 21, 2025, approved, under item 1.3 of the Agenda, such cash distribution against the 2024 results as a final dividend for the 2024 financial year, for an amount equal to €0.41 gross (€0.3321 net of withholding tax) per outstanding BBVA share entitled to participate in this distribution, which was paid on April 10, 2025. The total amount paid, excluding dividends paid in respect of treasury shares held by the Group's companies other than BBVA, S.A., amounted to €2,357 million.

By means of an inside information notice (información privilegiada) dated September 29, 2025, BBVA announced that the Board of Directors had approved the payment of a cash interim dividend of €0.32 gross (€0.2592 net of withholding tax) per each outstanding BBVA share entitled to participate in this distribution, which was paid on November 7, 2025. The total amount paid, excluding dividends paid in respect of treasury shares held by the Group's companies other than BBVA, S.A., amounted to €1,840 million.

A cash gross distribution in the amount of €0.60 per share for each of the outstanding shares entitled to receive said distribution, to be paid presumably on April as final dividend of 2025 is expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the 2025 financial year will be 50% of the attributable profit, with a cash distribution of €0.92 per share, taking into account that in November 2025, €0.32 gross was distributed in cash for each of the outstanding shares entitled to receive said distribution as an interim dividend for the year.

Share buyback programs

On January 30, 2025, BBVA announced, among other matters, the execution of a share buyback program of BBVA shares, with the purpose of reducing BBVA’s share capital, for a monetary amount of €993 million, subject to obtaining the corresponding regulatory authorizations and to the communication of the specific terms and conditions of the share buyback program before its execution.

On October 30, 2025, after receiving the required authorization from the ECB, BBVA announced by means of an Inside Information notice the execution of a time-scheduled buyback program for the repurchase of own shares, with the purpose of reducing BBVA's share capital, all in accordance with the Regulations, for a maximum monetary amount of €993 million. The execution was carried out externally by Citigroup Global Markets Europe AG.3 By means of an Other Relevant Information notice dated December 10, 2025, BBVA announced the completion of the share buyback program upon reaching the maximum monetary amount, having acquired a total of 54,316,765 BBVA shares, between October 31 and December 10, 2025, representing, approximately, 0.93% of BBVA's share capital as of such date. On December 23, 2025, BBVA notified through an Other Relevant Information notice the partial execution of the share capital reduction resolution adopted by the Annual General Shareholders’ Meeting of BBVA held on March 21, 2025, under item 3 of the Agenda, through the reduction of BBVA’s share capital in a nominal amount of €26,615,214.85 and the consequent redemption, charged to unrestricted reserves, of the 54,316,765 BBVA shares of €0.49 par value each acquired derivatively by BBVA in execution of the aforementioned BBVA share buyback program and which were held as treasury shares.

On December 19, 2025, and after receiving the required authorization from the ECB, BBVA announced, by means of an Inside Information notice, that the Board of Directors of BBVA, at its meeting on December 18, 2025, had agreed to carry out the execution of a framework share buyback program for the repurchase of BBVA shares, all in accordance with the Regulations. This program will be executed in several tranches for a maximum monetary amount of €3,960 million, with the purpose of reducing BBVA's share capital (the "Framework Program"), without prejudice to the possibility of suspending or terminating the Framework Program early if circumstances warrant. It also announced that the Board of Directors agreed to execute a first tranche of the Framework Program in compliance with the Regulations, for the purpose of reducing BBVA's share capital for a maximum monetary amount of €1,500 million. The execution of this tranche started on December 22, 2025, and is carried out externally by J.P. Morgan SE. Between December 22, 2025 and January 30, 2026, J.P. Morgan SE has acquired 31,242,848 BBVA shares within this program.

As of December 31, 2025, BBVA’s share capital amounted to €2,797,394,663.00 divided into 5,708,968,700 shares.

3 The Regulations refers to the Regulation (EU) No. 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse and Commission Delegated Regulation (EU) No. 2016/1052 of March 8, 2016.

Business Areas

Click on each area to learn more

Spain

Spain

HIGHLIGHTS FOR THE PERIOD

|

RESULTS

| |

| Net interest income | Gross income |

| 6,588 | 10,027 |

| +3.2% (2) | +6.2% (2) |

| Operating income | Net atributable profit |

| 6,704 | 4,175 |

| +10.0% (2) | +11.3% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 31-12-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +8.0% | +8.9% |

RISKS |

| NPL coverage ratio |

| 59% | 67% |

| NPL ratio |

| 3.7% | 3.0% |

| Cost of risk |

| 0.38% | 0.34% |

(2) Year-on-year changes.

Mexico

Mexico

HIGHLIGHTS FOR THE PERIOD

|

RESULTS

| |

| Net interest income | Gross income |

| 11,424 | 15,198 |

| +8.1% (2) | +8.4% (2) |

| Operating income | Net atributable profit |

| 10,576 | 5,264 |

| +8.2% (2) | +5.7% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 31-12-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +7.6% | +13.4% |

RISKS |

| NPL coverage ratio |

| 121% | 124% |

| NPL ratio |

| 2.7% | 2.7% |

| Cost of risk |

| 3.39% | 3.31% |

(2) Year-on-year changes.

Turkey

Turkey

HIGHLIGHTS FOR THE PERIOD

|

RESULTS

| |

| Net interest income | Gross income |

| 3,079 | 5,213 |

| +169.5% (2) | +89.3% (2) |

| Operating income | Net atributable profit |

| 2,898 | 805 |

| +158.7% (2) | n.s.(2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 31-12-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +51.2% | +61.6% |

RISKS |

| NPL coverage ratio |

| 96% | 76% |

| NPL ratio |

| 3.1% | 3.9% |

| Cost of risk |

| 1.27% | 1.94% |

(2) Year-on-year changes.

South America

South America

HIGHLIGHTS FOR THE PERIOD

|

RESULTS

| |

| Net interest income | Gross income |

| 4,830 | 5,363 |

| +1.6% (2) | +19.3% (2) |

| Operating income | Net atributable profit |

| 3,007 | 726 |

| +33.5% (2) | +71.5% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 31-12-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +13.9% | +12.9% |

RISKS |

| NPL coverage ratio |

| 88% | 92% |

| NPL ratio |

| 4.5% | 4.0% |

| Cost of risk |

| 2.87% | 2.50% |

(2) Year-on-year changes.

Rest of business

Rest of business

HIGHLIGHTS FOR THE PERIOD

|

RESULTS

| |

| Net interest income | Gross income |

| 828 | 1,807 |

| +15.9% (2) | +27.8% (2) |

| Operating income | Net atributable profit |

| 878 | 627 |

| +25.9% (2) | +29.4% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 31-12-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +37.8% | +54.0% |

RISKS |

| NPL coverage ratio |

| 102% | 173% |

| NPL ratio |

| 0.3% | 0.2% |

| Cost of risk |

| 0.17% | 0.16% |

(2) Year-on-year changes.

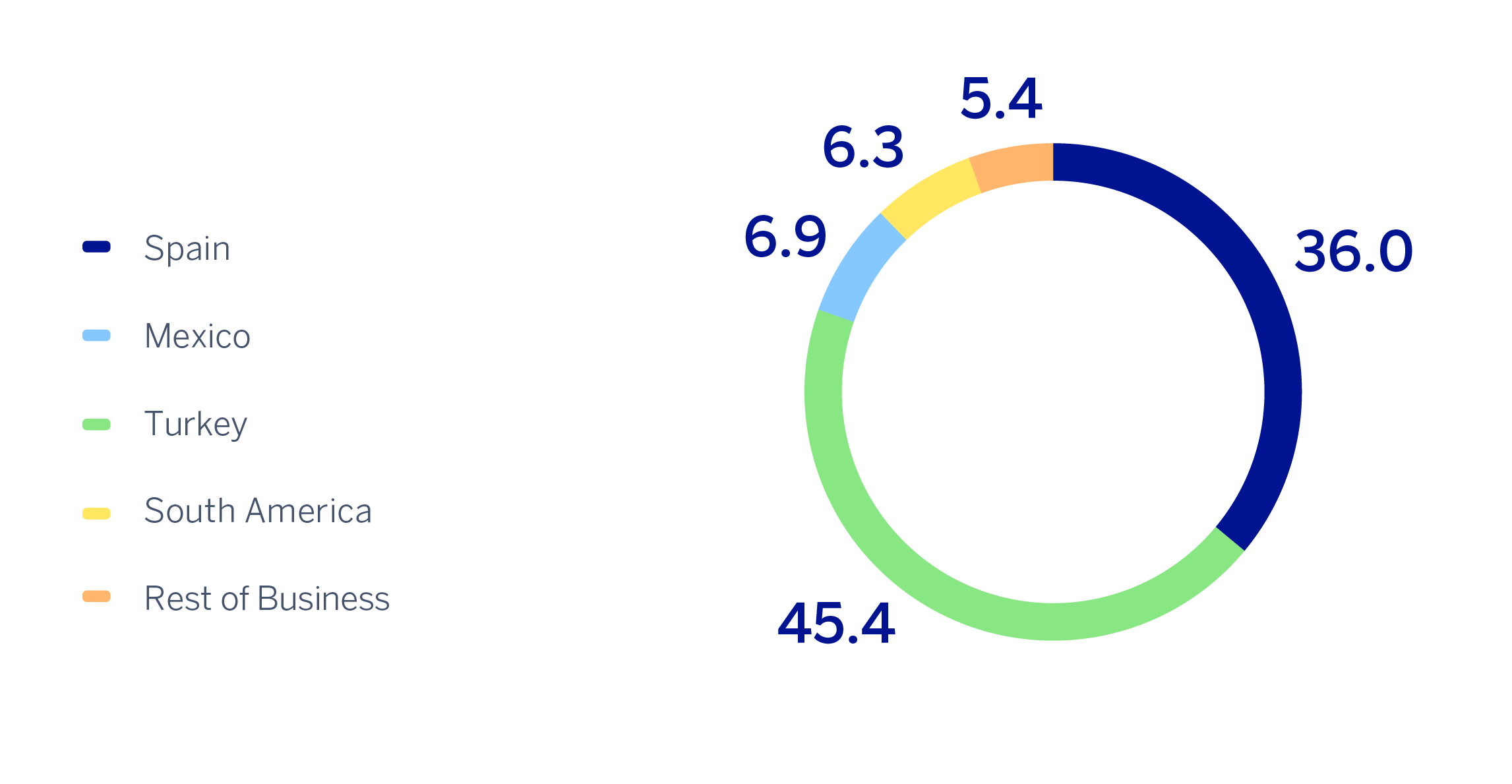

* Gross income.

(1) At constant exchange rate.

(2) At constant exchange rates.

According to the accumulated results of the business areas by the end of December 2025, in each of them it is worth mentioning:

Spain generated a net attributable profit of €4,175m, that is, 11.3% above the result achieved in the same period of 2024, driven by the evolution of the recurring revenue from the banking business.

BBVA Mexico achieved a cumulative net attributable profit of €5,264m, which represents a year-on-year growth of 5.7%, excluding the impact of the Mexican peso, explained mainly by the favorable evolution of the net interest income.

Turkey reached a net attributable profit of €805m, with a year-on-year growth of 31.8%, as a result of the good performance of net interest income and a less negative hyperinflation impact.

South America generated a net attributable profit of €726m in 2025, which represents a year-on-year growth of 14.3%, favored by an improved net attributable profit in Peru and Colombia and a less negative hyperinflation adjustment in Argentina.

Rest of Business achieved an accumulated net attributable profit of €627m, 29.4% higher than in the same period of the previous year, favored by the evolution of the recurring revenues and the net trading income (hereinafter, NTI).

The Corporate Center recorded a net attributable loss of €-1,086m.

Lastly, and for a better understanding of the Group's activity and results, supplementary information is provided below for the wholesale business, Corporate & Investment Banking (CIB), carried out by BBVA in the countries where it operates. CIB generated a net attributable profit of €3,073m4. Excluding the impact of currency fluctuations, this result represents a 31.9% increase over the previous year, which reflects again the strength of the Group's wholesale businesses, with the aim of offering a value proposition focused on the needs of its customers.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 2025)

(1) Excludes the Corporate Center.

4 The additional pro forma information from CIB excludes the application of hyperinflation accounting and the Group's wholesale business in Venezuela.

Read legal disclaimer of this report.

News

Contact

Shareholder attention line

Shareholder attention line

912 24 98 21

Subscription service

Subscription service Shareholder Office

Shareholder Office Contact email

Contact email