Report 2Q 2025

BBVA earns €5.45 billion through June, expects accumulated profit of €48 billion for 2025-2028, with an average ROTE of about 22 percent

The share

The United States' tariffs have risen notably, reaching historically high levels. Moreover, uncertainty about their final level remains a persistent source of risk. Trade negotiations between the United States and its main partners continue, and disputes persist over the legal validity of tariffs.

In this context, and given expectations of high fiscal deficits and concerns about the Fed's autonomy, the United States risk premium has risen, contributing to higher yields on long-term sovereign debt and has favored a depreciation of the dollar.

Although global growth remains relatively resilient, BBVA Research estimates that protectionism and uncertainty will negatively affect economic activity. Specifically, it forecasts that global GDP will increase 3.0% in 2025, three tenths below the previous forecast and four tenths less than in 2024.

Growth in the United States is likely to decelerate more than previously forecasted, from 2.8% in 2024 to 1.7% in 2025 (eight tenths lower than the previous forecast). In China, growth could reach 4.8% in 2025, down from 5.0% growth in 2024, but up from the previous forecast of 4.5%, thanks mainly to recent economic stimulus and a smaller than expected increase in United States tariffs on the country's exports. In the Eurozone, the impact of United States tariffs is likely to be mitigated by fiscal spending, mainly on defense and infrastructure. Growth is expected to be around 0.9% in 2025, similar to the previous forecast (+1.0%) and to the growth seen in 2024 (+0.9%).

Tariffs are likely to reverse the downward trend in United States inflation, which would lead the Fed to keep interest rates unchanged at 4.5% for longer. Monetary easing could resume in late 2025 if price pressures prove to be transitory. In the Eurozone, contained inflationary pressures have allowed the European Central Bank to recently cut the deposit facility rate to 2%. While a further cut in the second half of 2025 is possible, the ECB may choose to leave interest rates unchanged at current levels. In China, in a context of near-zero inflation, monetary conditions are likely to ease further.

Uncertainty about the global economy evolution remains high. In addition to significant risks related to new United States policies, geopolitical risks remain present. Although energy prices remain relatively low, tensions in the Middle East and Ukraine could lead to further supply shocks.

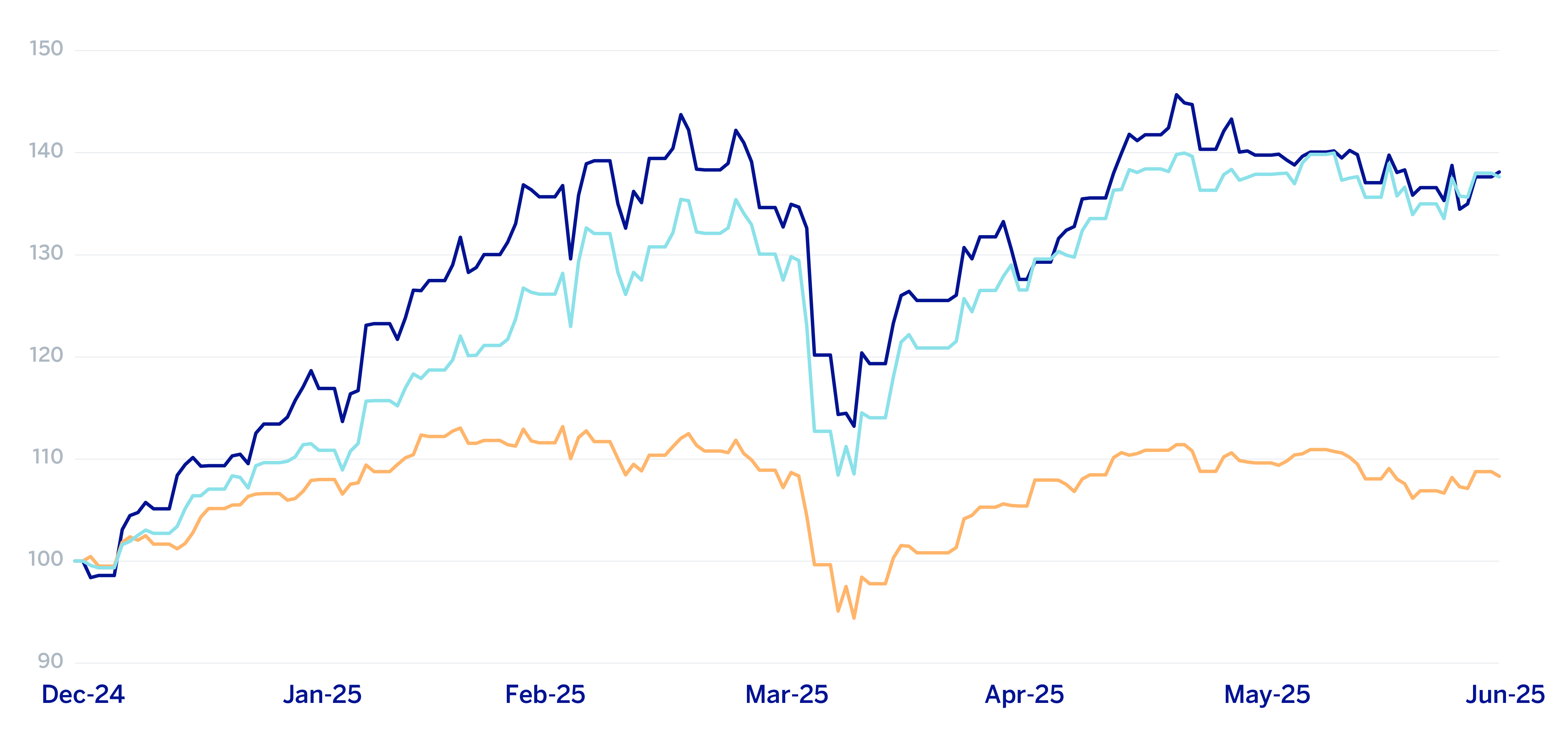

The main indexes have shown a positive performance during the second quarter of 2025. In Europe, the Stoxx Europe 600 index rose by 6.6% compared to the end of March 2025, and in Spain the Ibex 35 increased by 20.7% in the same period, showing a better relative performance. In the United States, the S&P 500 index increased by 5.5%.

With regard to the banking sector indexes, the performance in the second quarter of 2025 was better than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased by 29.1% and 37.6% respectively, while in the United States, the S&P Regional Banks sector index decreased by -1.5% in the period.

BBVA’s share price increased by 38.1% during the quarter, outperforming its sector index, closing the month of June 2025 at €13.06.

BBVA share evolution

Compared with European indexes (base indice 100=31-12-24)

BBVA

Eurostoxx-50

Eurostoxx Banks

| THE BBVA SHARE AND SHARE PERFORMANCE RATIOS | ||

|---|---|---|

| 30/06/2025 | 31/03/2025 | |

| Number of shareholders | 681,425 | 690,635 |

| Number of shares issued (millions) | 5,763 | 5,763 |

| Closing price (euros) | 13.06 | 12.55 |

| Book value per share (euros) (1) | 9.87 | 9.58 |

| Tangible book value per share (euros) (1) | 9.43 | 9.14 |

| Market capitalization (millions of euros) | 75,269 | 72,300 |

| (1) For more information, see Alternative Performance Measures at the end of the quarterly report. | ||

Regarding shareholder remuneration, as approved by the General Shareholders' Meeting on March 21, 2025, under item 1.3 of the agenda, on April 10, 2025, a cash payment of €0.41 gross per outstanding BBVA share was made against 2024 earnings, with the right to receive this amount as a final dividend for 2024. Thus, the total amount of cash distributions for 2024, taking into account that €0.29 gross per share were distributed in October 2024, amounted to €0.70 gross per share.

Additionally, on January 30, 2025, a BBVA share repurchase program for an amount of €993m million was announced, which is pending execution in its entirety as of the date of this document.

On June 30, 2025, the number of BBVA shares outstanding was 5,763 million. The number of shareholders reached 681,425 and, by type of investor, 65.34% of the capital belonged to institutional investors and the remaining 34.66% was in the hands of retail shareholders.

BBVA shares are included on the main stock market indexes. At the closing of June 2025, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 10.5%, 2.0% and 0.7%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 5.3% and the Euro Stoxx Banks index for the eurozone with a weighting of 8.7%. Moreover BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

In the first half of 2025, the Group has made significant progress in the execution of its new 2025-2029 Strategic Plan, which aims to establish a new axis of differentiation by radically incorporating the customer perspective, as well as driving and strengthening the Group's commitment to growth and value creation.

BBVA continues to focus on innovation as a key driver to achieve these goals and continue leading the transformation of the sector. Thanks to artificial intelligence and next-generation technologies, the Group amplifies its positive impact on customers, helping them make the best decisions.

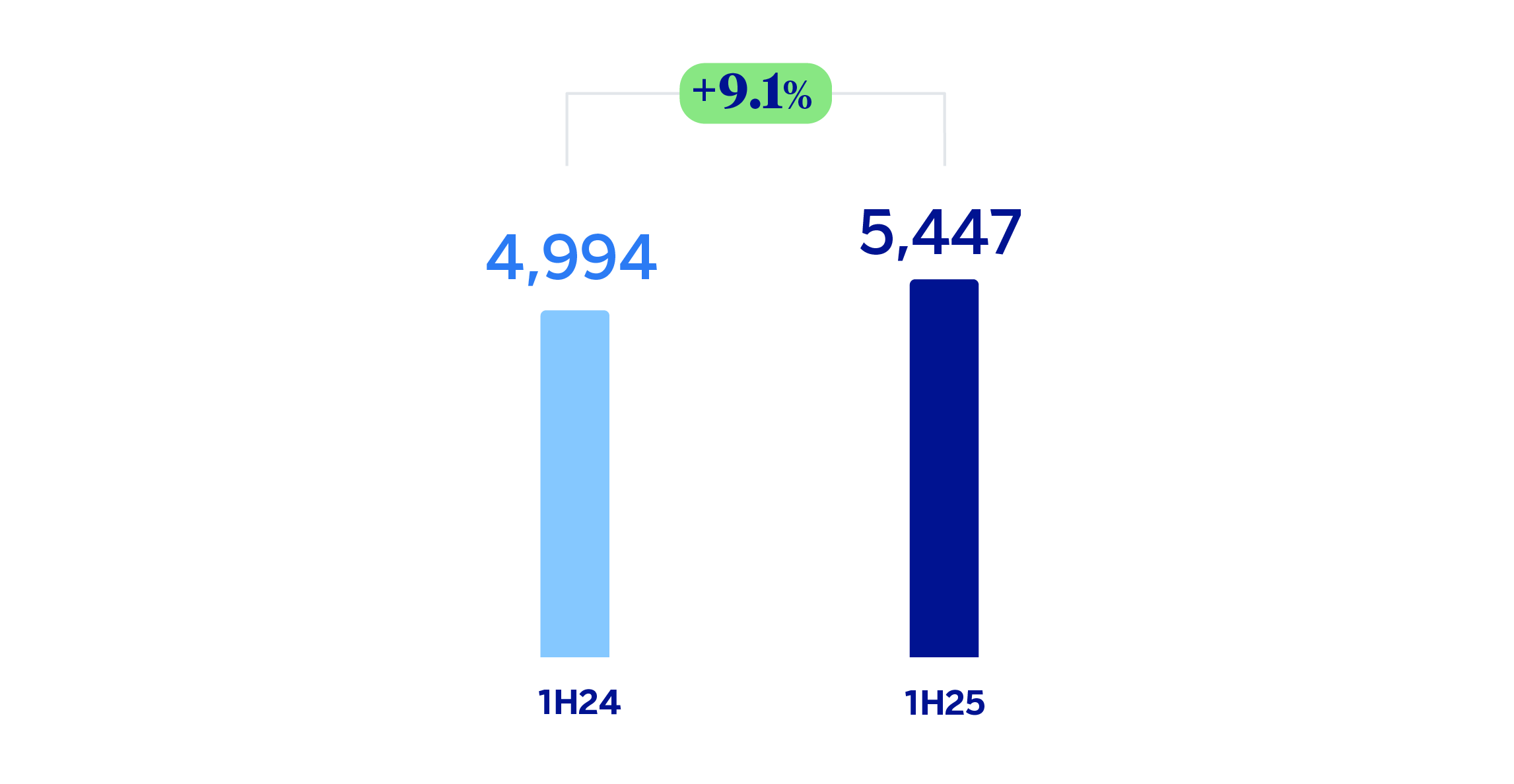

In this context, the BBVA Group achieved a cumulative result of €5,447m, by the end of June 2025, representing a year-on-year increase of 9.1%. If the exchange rate variation is excluded, this increases to 31.4%, supported by solid results that are driven by the strong performance of recurring revenues from the banking business, this is, in the favorable evolution of the net interest income and fees. In addition, there was a negative impact on the other operating income and expenses line significantly lower than in the same period of 2024, mainly due to a lower hyperinflation adjustment.

In constant terms, meaning the exclusion of the effect of currency variations, operating expenses increased by 10.2% at Group level, affected by an environment of still high inflation in the countries where the Group has a presence, the growth of the workforce and the higher level of technological investments made in recent years. Thanks to the remarkable growth in gross income, which increased by 19.6%, a notably higher growth rate than operating expenses, the efficiency ratio fell to 37.6% as of June 30, 2025, which represents an improvement of 322 basis points compared to the ratio as of June 30, 2024, at constant exchange rates.

The provisions for impairment on financial assets increased (+9.7% in year-on-year terms and at constant exchange rates), due to year-on-year growth in lending to companies and, to a lesser extent, to retail customers.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

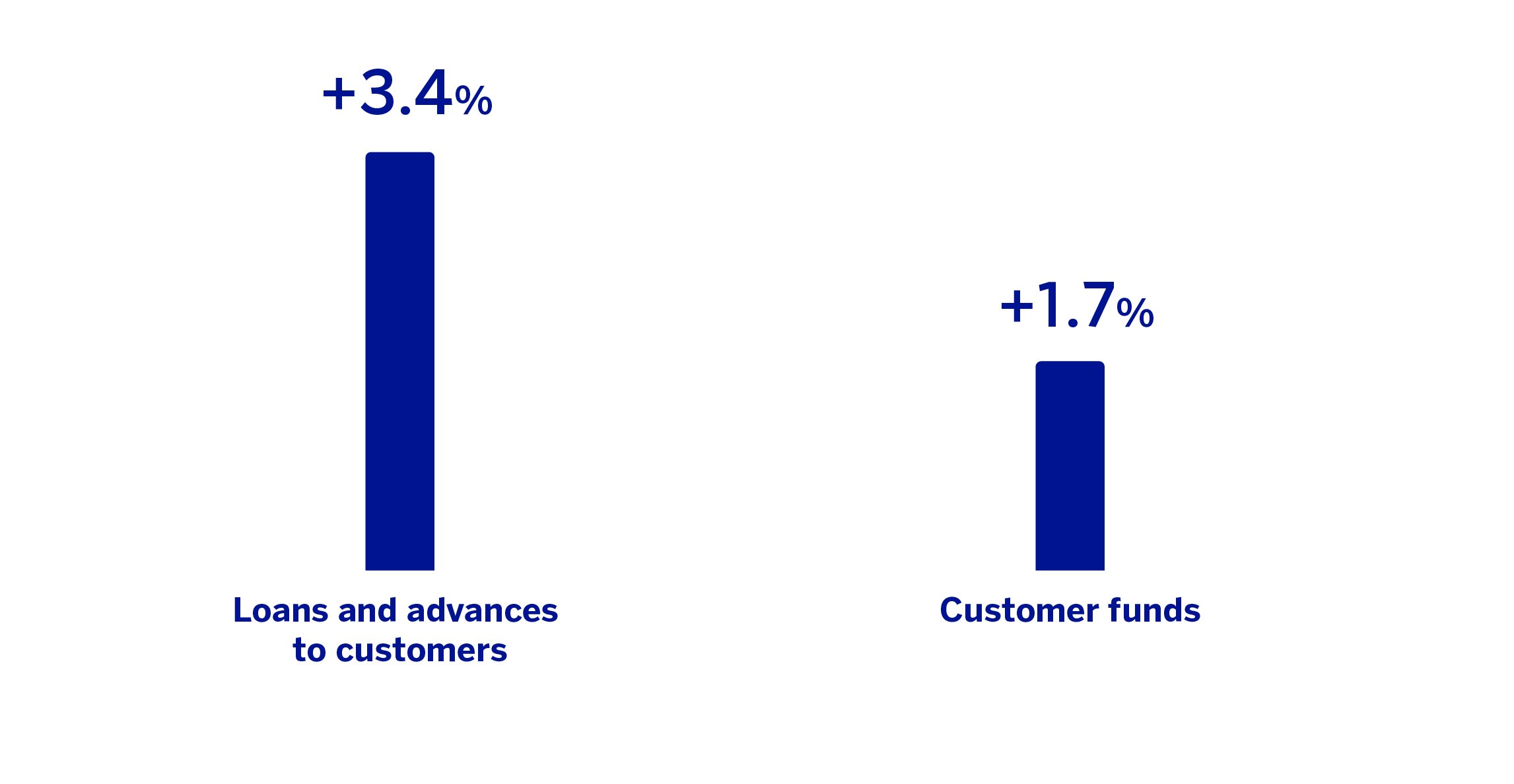

In the first half of 2025, loans and advances to customers increased by 3.4%, driven by the dynamism of the wholesale segment. Of particular note within this segment was the higher volume of loans to companies, which grew by 3.4% at the Group level, and, to a lesser extent, loans to the public sector, up 18.6%.

Customer funds grew by 1.7% in the first six months of the year, driven by mutual funds and managed portfolios.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2024)

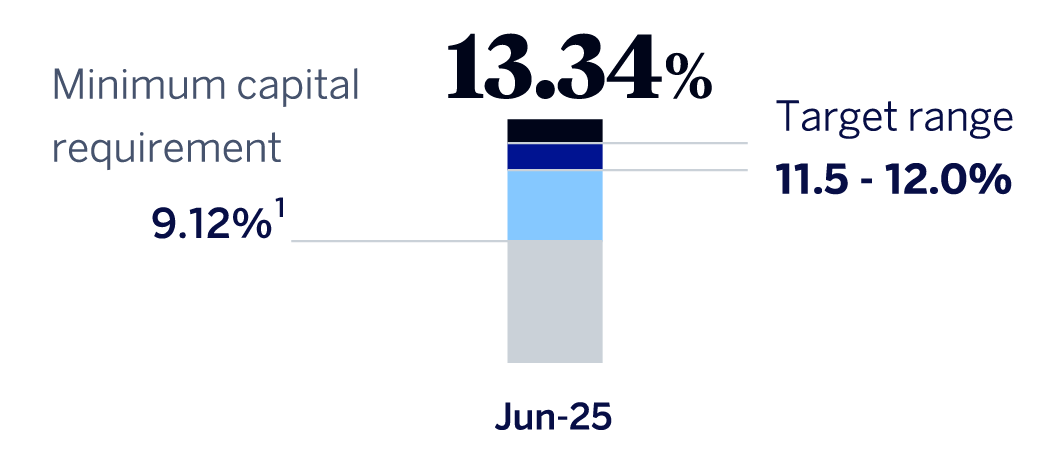

The BBVA Group's CET11 ratio stood at 13.34% as of June 30, 2025, which allows it to maintain a large management buffer over the Group's CET1 requirement as of that date (9.12%2), placing above the Group's target management range of 11.5% - 12.0% of CET1.

CET1 RATIO

1 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of March 31, 2025.

1 For the periods shown, there were no differences between fully loaded and phased-in ratios given that the impact associated with the transitional adjustments is nil.

2 Considering the last official updates of the countercyclical capital buffer and systemic risk buffer, calculated on the basis of exposure as of March 31, 2025.

On April 30, 2024, due to a media report, BBVA published an inside information notice (información privilegiada) stating that it had informed the chairman of the Board of Directors of Banco de Sabadell, S.A. (the "Target Company") of the interest of BBVA’s Board of Directors in initiating negotiations to explore a possible merger between the two entities. On the same date, BBVA sent to the chairman of the Target Company the written proposal for the merger of the two entities. The content of the written proposal sent to the Board of Directors of the Target Company was published on May 1, 2024, by BBVA through the publication of an inside information notice (información privilegiada) with the CNMV.

On May 6, 2024, the Target Company published an inside information notice (información privilegiada) informing of the rejection of the proposal by its Board of Directors.

Following such rejection, on May 9, 2024, BBVA announced, through the publication of an inside information notice (información privilegiada) (the "Prior Announcement"), the decision to launch a voluntary tender offer (the "Offer") for the acquisition of all of the issued and outstanding shares of the Target Company. The consideration offered by BBVA to the shareholders of the Target Company, after the adjustments implemented thereto in October, 2024, March, 2025 and April 2025 as a result of the interim and final dividends paid by both companies against their respective 2024 financial year results, consists of one (1) newly issued ordinary share of BBVA and €0.70 in cash for each five point three four five six (5.3456) ordinary shares of the Target Company, subject to certain further adjustments in the event of future dividend distributions as set forth in the Prior Announcement. As provided in the Prior Announcement, and as a consequence of the cash interim dividend against 2025 results announced by Banco Sabadell on July 24, 2025, in the gross amount of €0.07 per share, to be paid on August 29, 2025, BBVA will adjust once again the consideration offered. From the ex-dividend date of said distribution, the consideration will be one (1) newly issued ordinary share of BBVA and €0.70 in cash for every five point five four eight three (5.5483) ordinary shares of Banco Sabadell.

Pursuant to the provisions of Royal Decree 1066/2007, of July 27, 2007, on the rules governing tender offers ("Royal Decree 1066/2007"), the Offer is subject to mandatory clearance by the CNMV. Additionally, pursuant to the provisions of Law 10/2014 and Royal Decree 84/2015, the acquisition by BBVA of control of the Target Company resulting from the Offer is subject to the duty of prior notification to the Bank of Spain and the obtention of the non-opposition of the European Central Bank (a condition that was satisfied on September 5, 2024, as described below).

In addition, completion of the Offer is also subject to the satisfaction of the conditions specified in the Prior Announcement, in particular (i) the acceptance of the Offer by a number of shares that allows BBVA to acquire at least more than half of the effective voting rights of the Target Company at the end of the Offer acceptance period, excluding the treasury shares that the Target Company may hold at that time, as this condition was amended by BBVA in accordance with the publication of the inside information notice (información privilegiada) dated January 9, 2025, (ii) approval by BBVA’s General Shareholders’ Meeting of the increase of BBVA’s share capital through the issue of new ordinary shares through non-cash contributions in an amount that is sufficient to cover the consideration in shares offered to the shareholders of the Target Company (which condition was satisfied on July 5, 2024, as described below), (iii) in accordance with the provisions of article 26.1 of the Royal Decree 1066/2007, the authorization of the economic concentration resulting from the Offer by the Spanish antitrust authorities (a condition that was satisfied on June 30, 2025, as described below), and (iv) the authorization of the indirect acquisition of control of the Target Company’s banking subsidiary in the United Kingdom, TSB Bank PLC, by the United Kingdom Prudential Regulation Authority (“PRA”) (a condition that was satisfied on September 2, 2024, as described below).

On July 5, 2024, the BBVA’s Extraordinary General Shareholders' Meeting resolved to authorize, with 96% votes in favor, an increase in the share capital of BBVA of up to a maximum nominal amount of €551,906,524.05 through the issuing and putting into circulation of up to 1,126,339,845 ordinary shares of €0.49 par value each to cover the consideration in shares offered to the shareholders of the Target Company. On March 21, 2025, BBVA’s Ordinary General Shareholders’ Meeting approved the renewal of such resolution for its exercise within a one (1) year period from such date. On September 3, 2024, BBVA announced, through the publication of an inside information notice (información privilegiada) that, on September 2, 2024, it received the authorization from the PRA for BBVA's indirect acquisition of control of TSB Bank PLC as a result of the Offer.

On September 5, 2024, BBVA announced, through the publication of an inside information notice (información privilegiada) that it received the decision of non-opposition from the European Central Bank to BBVA's taking control of the Target Company as a result of the Offer.

On April 30, 2025, the Spanish National Markets and Competition authority announced its decision to authorize the economic concentration resulting from the Offer (“CNMC Resolution”), subject to compliance by BBVA with certain remedies mainly to ensure financial inclusion, territorial cohesion, protection for vulnerable customers and lending to small and medium-sized enterprises (SMEs) and self-employed customers.

These remedies will have, in general, a duration of three years (except for certain specific commitments with a different duration) from when BBVA takes control of the Target Company (other than, only with respect to BBVA, certain remedies related to the commitment to preserve physical presence in certain territories and the maintenance of commercial terms and conditions for certain products and services which entered into force on the date the CNMC Resolution became effective, once the resolution was adopted by the Council of Ministers on June 24, 2025).

In accordance with Article 58 of Law 15/2007, of 3rd July, on Competition Defense, on May 27, 2025, the Ministry of Economy, Trade and Business notified BBVA of its decision to refer to the Council of Ministers the CNMC Resolution for review on the grounds of general interest other than competition.

The Council of Ministers adopted a resolution on June 24, 2025 authorizing the economic concentration resulting from completion of the Offer subject to an additional condition to those commitments included in the CNMC Resolution aimed at protecting the following general interest concerns, other than those relating to the defense of competition: (i) ensuring an adequate maintenance of the objectives of the sectoral regulation linked to support for growth and business activity; (ii) protection of workers; (iii) territorial cohesion; (iv) social policy objectives related to the social work of their respective foundations, financial consumer protection and affordable housing; and (v) promotion of research and technological development (the “Council of Ministers’ Authorization”).

The Council of Ministers’ Authorization requires, for a period of three years from June 24, 2025, that BBVA and the Target Company maintain separate legal personality and shareholders’ equity and preserve its respective autonomy in the management of its operations with the aim of protecting the general interest concerns identified above (the “Autonomy Condition”). The Autonomy Condition must be materialized, at least, in the maintenance of autonomous management and decision-making in the respective entities, with a view to maximizing the value of each entity. Following such period of time, the Spanish Secretary of State for Economy and Business Support (Secretaría de Estado de Economía y Apoyo a la Empresa) will evaluate the efficacy of the Autonomy Condition and the Council of Ministers will determine whether to extend it for an additional maximum period of two years.

The Council of Ministers also confirmed the remedies already committed by BBVA as a condition of the CNMC Resolution described above.

The aforementioned decision by the Council of Ministers brought an end to the authorization procedure under Spanish Competition Law for the economic concentration resulting from the Offer, with BBVA having the right to withdraw the Offer pursuant to the provisions of Article 26.1(c) of Royal Decree 1066/2007, as the authorization was subject to conditions. BBVA, announced through the publication of an inside information notice (información privilegiada) dated June 30, 2025, its decision not to withdraw the Offer for this reason. As a result, the condition requiring the obtainment of the authorization of the economic concentration resulting from completion of the Offer is considered satisfied.

The detailed terms of the Offer will be set out in the prospectus, which was submitted to the CNMV together with the request for the authorization of the Offer on May 24, 2024, and will be published after obtaining the mandatory clearance of the CNMV.

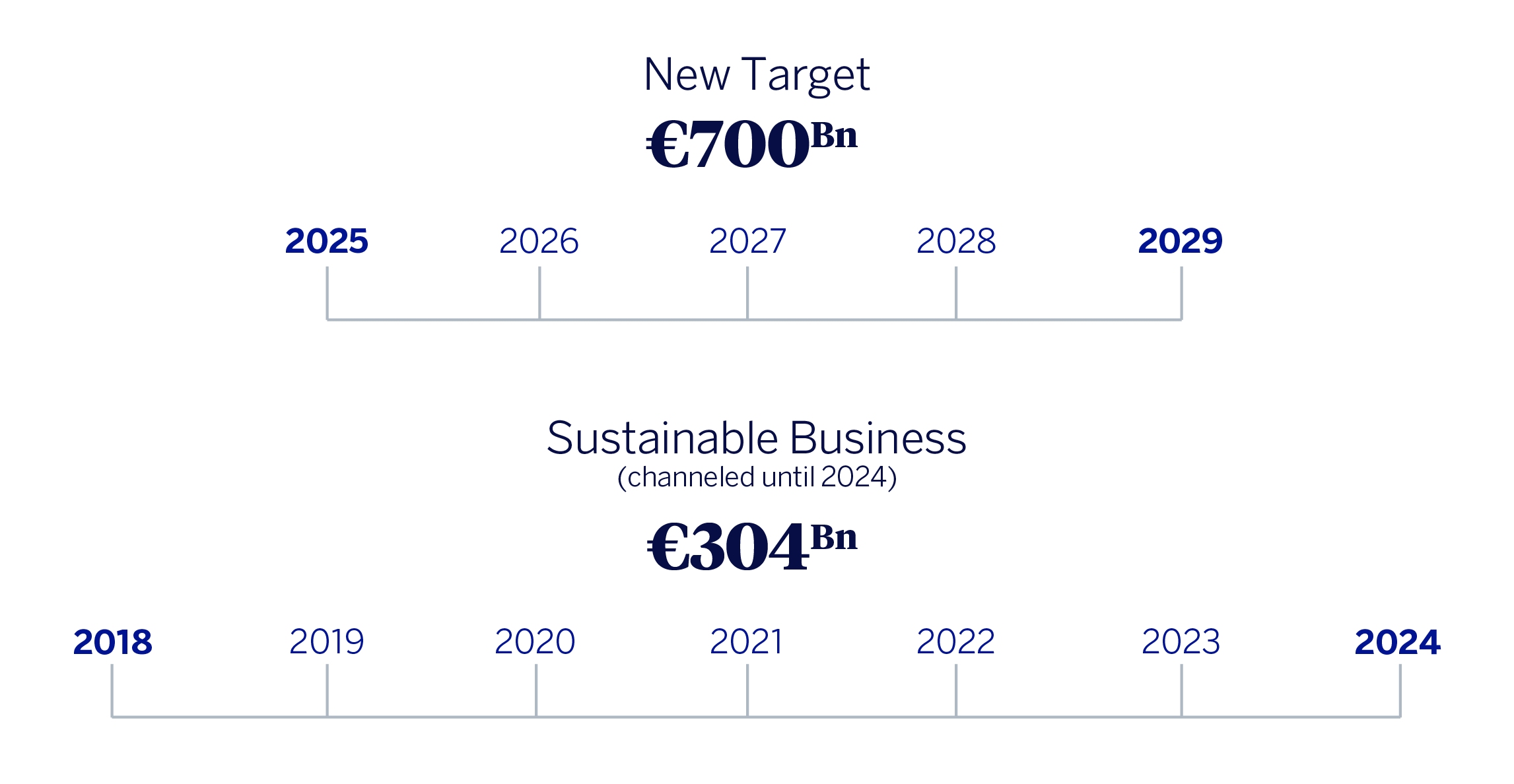

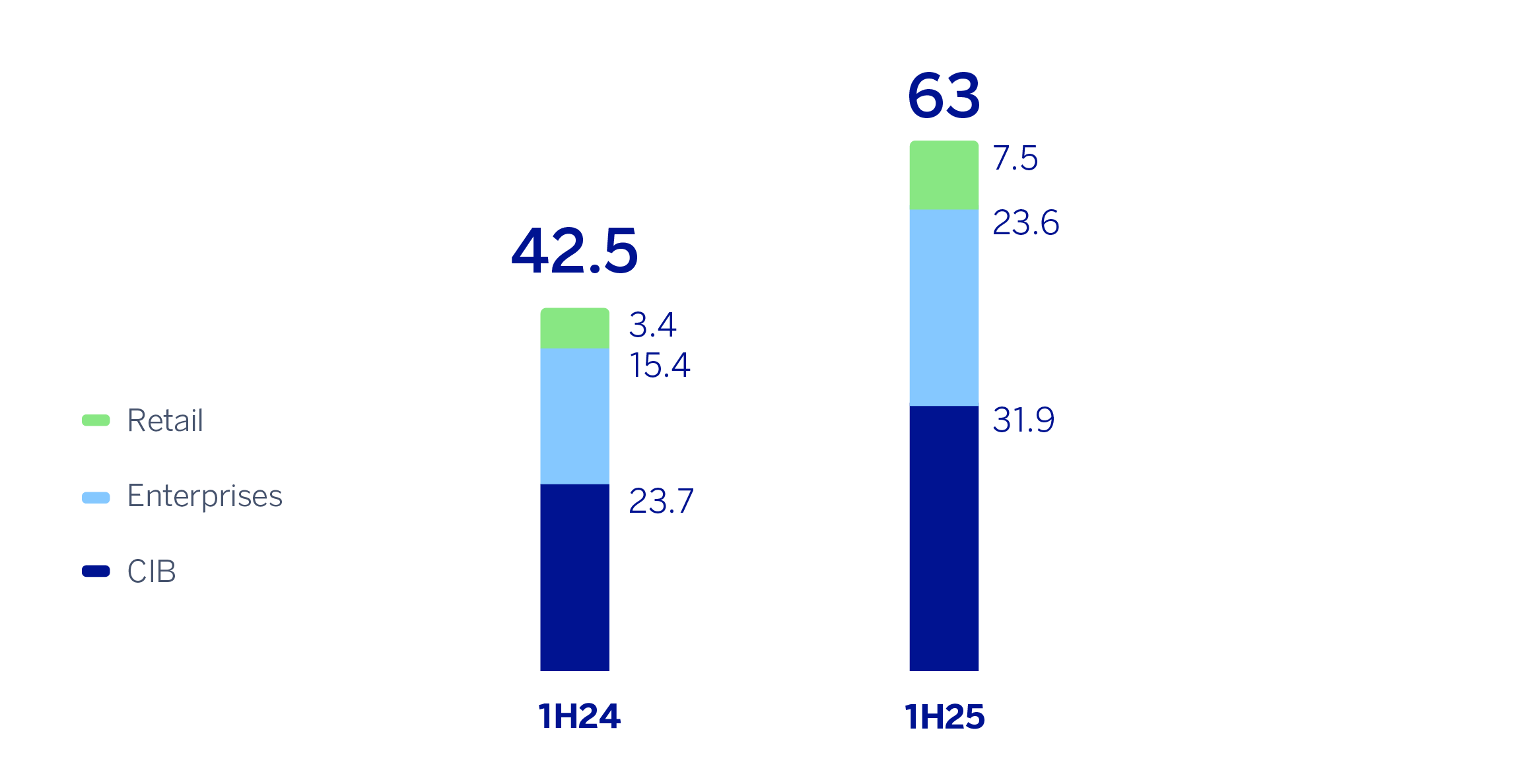

BBVA aims to promote sustainability as a driver of differential growth, leveraging the need to finance investments to meet the increasing demand for efficient and clean energy. As part of its new and ambitious target of channeling €700 billion in sustainable business for the 2025–2029 period3, the BBVA Group has channeled approximately €63.0 billion in the first 6 months of 2025, representing a 48%4 increase. Of this amount, 76% corresponds to the environmental impact area, while the remaining 24% relates to opportunities in the social sphere.

CHANNELING OF SUSTAINABLE BUSINESS

BREAKDOWN BY CUSTOMER SEGMENTS (€BN)

BBVA’s sustainable business channeling includes aspects related to climate change and natural capital (which encompasses activities connected to water, agriculture, and the circular economy), as well as the promotion and financing of social initiatives (including social, educational, and health infrastructure; support for entrepreneurs and young businesses; and financial inclusion for the most disadvantaged groups). This channeling refers to financial flows linked to activities, clients, or products deemed sustainable by BBVA. Moreover, it is a cumulative concept, as it reflects amounts originated from a specific date. Some of these flows are not recorded on the balance sheet (such as client bond placements or guarantees), or they may have already matured.

During the first half of 2025, BBVA has channeled nearly €7.5 billion in the retail segment, representing a year-on-year growth of 119%5. As part of its bet on sustainability, BBVA has developed digital tools to help its individual customers adopt more responsible energy consumption habits. These solutions provide indicative estimates of potential savings that can be achieved by implementing energy efficiency measures in areas such as the home or transportation.

It is worth highlighting the strong performance in financing for the acquisition of hybrid or electric vehicles, which reached approximately €742 million.

The corporate business unit channeled approximately €23.6 billion during the same period, representing a year-on-year growth of 53%. During this period, BBVA has continued to provide specialized advisory services to its corporate clients in sustainable solutions, aimed at generating potential economic savings through cross-cutting initiatives such as energy efficiency, fleet renewal, and water resource management. A particularly noteworthy aspect has been financing linked to natural capital, which reached nearly €2.34 billion. Mexico’s contribution remains essential, accounting for around half of this amount, especially concentrated in the agricultural sector.

Between January and June 2025, CIB (Corporate & Investment Banking) channeled approximately €31.9 billion, representing a 34% increase. BBVA has continued to actively promote the financing of clean technologies and renewable energy projects within the wholesale segment, as well as solutions such as sustainability-linked reverse factoring (confirming), among other strategic lines. Among these initiatives, the financing of renewable energy projects stands out, reaching €1.6 billion during the first half of the year.

Relevant initiatives in the field of sustainability

In April 2025, the Energy Tech Summit 2025 was held in Bilbao, where BBVA, as a main sponsor, organized several side events such as Growth Meets Capital, Growth Meets Industry, and Growth Meets Infrastructure. The summit brought together more than 1,500 cleantech experts from over 40 countries.

Key takeaways from the event include:

The importance of public-private collaboration to bridge the innovation gap in Europe and scale essential technological projects for the energy transition.

The need for more agile regulatory frameworks in Europe.

Providing financing instruments and risk mitigation tools to support innovative solutions.

The relevance of green hydrogen, artificial intelligence, electric mobility, and energy storage as key technologies for decarbonization.

Coinciding with the event, BBVA announced the first project finance in the Iberian Peninsula for a renewable hydrogen plant in Bilbao, a project expected to be operational in the first half of 2026.

3 The 2029 Objective includes the channeling of financial flows, on a cumulative basis, related to activities, clients, or products considered sustainable or that promote sustainability, in accordance with internal standards inspired by existing regulations, market standards such as the Green Bond Principles, Social Bond Principles, and Sustainability-Linked Bond Principles of the International Capital Market Association, as well as the Green Loan Principles, Social Loan Principles, and Sustainability-Linked Loan Principles of the Loan Market Association, and market best practices. The above is understood without prejudice to the fact that such channeling, both at its initial moment and at a later time, may not be recorded on the balance sheet. To determine the amounts of channeled sustainable business, internal criteria are used based on both internal and external information, whether public, provided by clients, or by a third party (primarily data providers and independent experts).This Sustainable Business Channeling Objective does not include the activities of BBVA Asset Management or the BBVA Microfinance Foundation.

4 The products and eligibility and accounting criteria are described in the Guide for Sustainable Business Channeling (link to the report).

5 Growth compared to the same period of the previous year, excluding the activity of BBVA Asset Management and the BBVA Microfinance Foundation.

Business Areas

Click on each area to learn more

Spain

Spain

HIGHLIGHTSGrowth in lending and customer funds Dynamic recurring revenues, boosted by net interest income in the quarter Attributable profit continues its quarterly growth trend and once again surpasses €1 billion Stability of the cost of risk compared to March |

RESULTS

| |

| Net interest income | Gross income |

| 3,230 | 5,016 |

| +1.5% (2) | +9.2% (2) |

| Operating income | Net atributable profit |

| 3,446 | 2,144 |

| +16.5% (2) | +21.2% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 30-06-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +5.2% | +1.3% |

RISKS |

| NPL coverage ratio |

| 59% | 61% |

| NPL ratio |

| 3.7% | 3.5% |

| Cost of risk |

| 0.38% | 0.32% |

(2) Year-on-year changes.

Mexico

Mexico

HIGHLIGHTSGrowth in lending activity, again driven by the retail segment Favorable evolution of the net interest income Good NTI behavior during the first half Quarterly attributable profit remains at high levels |

RESULTS

| |

| Net interest income | Gross income |

| 5,511 | 7,349 |

| +8.9% (2) | +9.5% (2) |

| Operating income | Net atributable profit |

| 5,102 | 2,578 |

| +9.2% (2) | +6.3% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 30-06-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +2.6% | +6.9% |

RISKS |

| NPL coverage ratio |

| 121% | 125% |

| NPL ratio |

| 2.7% | 2.7% |

| Cost of risk |

| 3.39% | 3.24% |

(2) Year-on-year changes.

Turkey

Turkey

HIGHLIGHTSIncrease in lending activity and customer funds Growth in net interest income supported by activity growth Lower year-on-year impact from hyperinflation Favorable evolution of the attributable profit |

RESULTS

| |

| Net interest income | Gross income |

| 1,307 | 2,409 |

| +174.7% (2) | +94.9% (2) |

| Operating income | Net atributable profit |

| 1,329 | 412 |

| +156.2% (2) | n.s.(2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 30-06-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +25.4% | +30.0% |

RISKS |

| NPL coverage ratio |

| 96% | 86% |

| NPL ratio |

| 3.1% | 3.4% |

| Cost of risk |

| 1.27% | 1.64% |

(2) Year-on-year changes.

South America

South America

HIGHLIGHTSGrowth in lending activity and customer funds Significantly lower year-on-year hyperinflation adjustment in Argentina Decrease in loan loss provisions and improvement of risk indicators Increase in the area's half-year attributable profit |

RESULTS

| |

| Net interest income | Gross income |

| 2,382 | 2,714 |

| -8.8% (2) | +26.7% (2) |

| Operating income | Net atributable profit |

| 1,521 | 421 |

| +45.3% (2) | +128.8% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 30-06-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +7.4% | +4.8% |

RISKS |

| NPL coverage ratio |

| 88% | 89% |

| NPL ratio |

| 4.5% | 4.2% |

| Cost of risk |

| 2.87% | 2.33% |

(2) Year-on-year changes.

Rest of business

Rest of business

HIGHLIGHTSDynamism of lending activity in all geographical areas in the first half of the year Favorable evolution of recurring revenues Positive behavior of risk indicators Year-on-year improvement in cumulative attributable profit in the first half of the year |

RESULTS

| |

| Net interest income | Gross income |

| 376 | 831 |

| +14.9% (2) | +24.3% (2) |

| Operating income | Net atributable profit |

| 433 | 304 |

| +23.2% (2) | +30.7% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-24. Balances as of 30-06-25. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +16.0% | -1.3% |

RISKS |

| NPL coverage ratio |

| 102% | 140% |

| NPL ratio |

| 0.3% | 0.2% |

| Cost of risk |

| 0.17% | 0.15% |

(2) Year-on-year changes.

* Gross income.

(1) At constant exchange rate.

(2) At constant exchange rates.

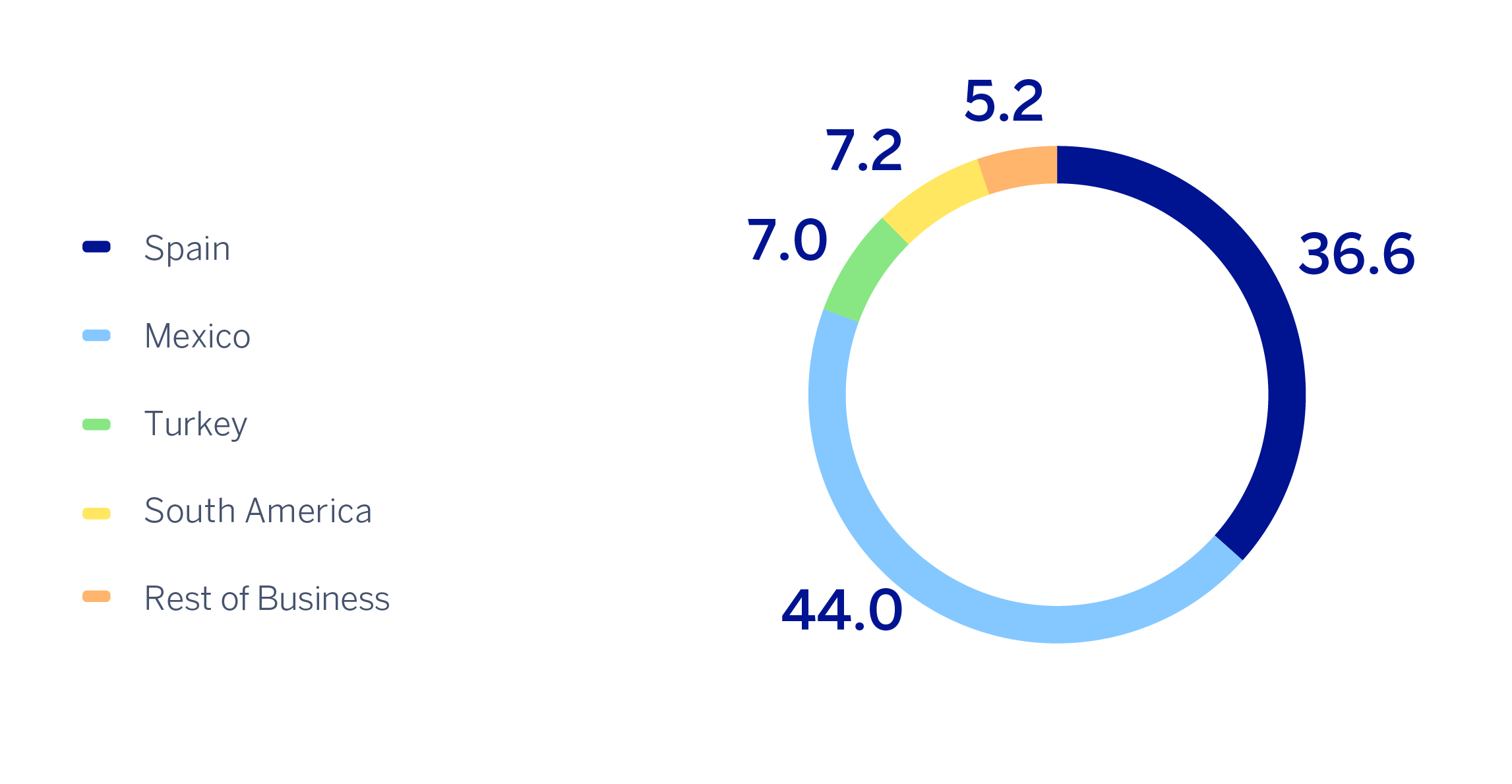

According to the accumulated results of the business areas by the end of June 2025, in each of them it is worth mentioning:

Spain generated a net attributable profit of €2,144m, that is 21.2% above the result achieved in the same period of 2024, driven by the evolution of all components of the gross income.

BBVA Mexico achieved a cumulative net attributable profit of €2,578m, which represents a year-on-year growth of 6.3%, excluding the impact of the Mexican peso, mainly due to the evolution of the net interest income.

Turkey generated a net attributable profit of €412m, with a year-on-year growth of 17.3%, as a result of the good performance of recurring revenues in banking business (net interest income and net fees and commissions) and a less negative hyperinflation impact.

South America generated a net attributable profit of €421m in the first half of 2025, which represents a year-on-year variation of 33.0%, derived from a less negative hyperinflation adjustment in Argentina.

Rest of Business achieved an accumulated net attributable profit of €304m, this is, excluding the currency evolution, 30.7% higher than in the same period of the previous year, favored by the evolution of the recurrent revenues and the net trading income (hereinafter, NTI).

The Corporate Center recorded a net attributable loss of €-411m, which is an improvement compared with the €-541m recorded in the same period of the previous year.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business, Corporate & Investment Banking (CIB), carried out by BBVA in the countries where it operates. CIB generated a net attributable profit of €1,553m6, excluding the impact of exchange rate fluctuations, up 33.5% compared to the same period of the previous year and reflects the strength of the Group's wholesale businesses, with the aim of offering a value proposition focused on the needs of its customers.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 1H25)

(1) Excludes the Corporate Center.

6 The additional pro forma CIB information does not include the application of hyperinflation accounting or the Group's wholesale business in Venezuela.

Read legal disclaimer of this report.

News

Contact

Shareholder attention line

Shareholder attention line

912 24 98 21

Subscription service

Subscription service Shareholder Office

Shareholder Office Contact email

Contact email