Highlights

2025-2029 Strategic Plan

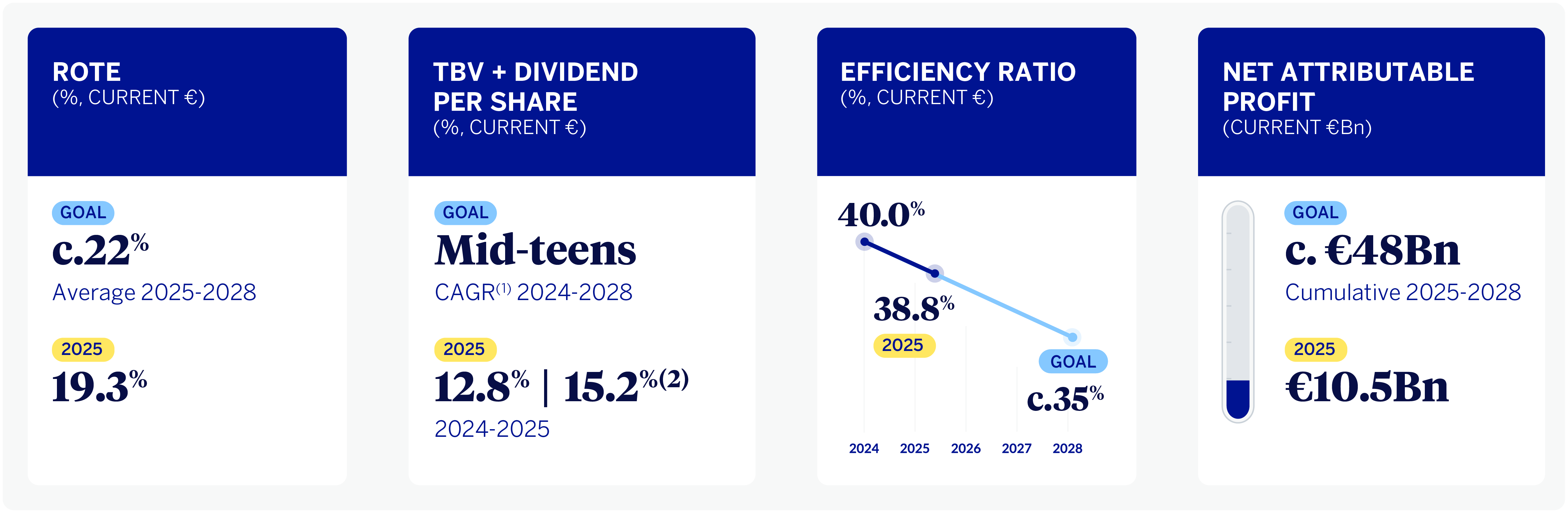

In 2025, the Group has made significant progress in the execution of its new 2025-2029 Strategic Plan, which aims to establish a new axis of differentiation by radically incorporating the customer perspective, as well as driving and strengthening the Group's commitment to growth and value creation. Thus, on July 31, the Group presented its financial objectives for the period 2025-2028, which are part of the strategic plan presented at the beginning of the year.

GROUP FINANCIAL KPIS GOALS EVOLUTION

(1) Compound Annual Growth Rate.

(2) Excluding the effect of Share Buybacks.

BBVA continues to focus on innovation as a key driver for achieving these goals and continuing to lead the transformation of the sector. Thanks to artificial intelligence and next-generation technologies, the Group amplifies its positive impact on customers, helping them make the best decisions.

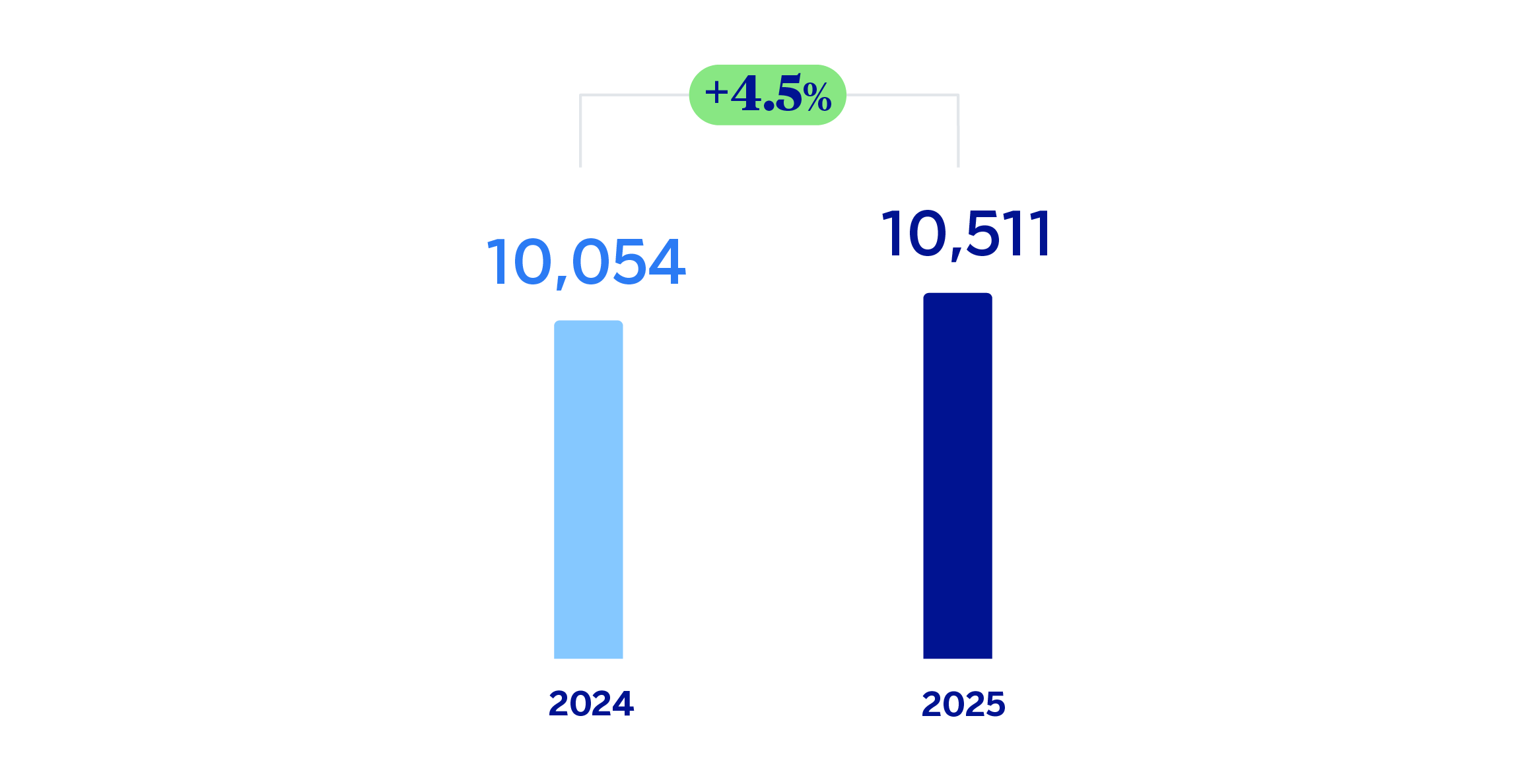

Results and business activity

In this context, the BBVA Group achieved a cumulative result of €10,511m, by the end of December 2025, representing an increase of 4.5% over the previous year, supported by the strong performance of recurring revenues from the banking business If the exchange rates variation is excluded, this growth increases to 19.2% favored by the solid evolution in gross income, which increased by 16.3% in constant terms, with a growth rate that is significantly higher than that of operating expenses (+10.5% at constant exchange rates, impacted by an environment of still high inflation). As a result of this evolution, the efficiency ratio stood at 38.8% as of December 31, 2025, which represents an improvement of 206 basis points compared to December 31, 2024.

The provisions for impairment on financial assets increased by 15.5% compared to the balances at the end of 2024 and at constant exchange rates, a rate that is below the growth in lending, 16.2% also at constant exchange rates.

During 2025 the Group maintained a limited credit gap, supported by a solid capacity to raise stable funding. The increased dynamism of lending activity was accompanied by sustained growth in customer base deposits, allowing the Group to absorb the increase in lending without creating structural tensions on the balance sheet. As a result, the Group's funding profile remained aligned with the principles of prudent liquidity management, reinforcing balance sheet stability and the resilience of the business model in a still challenging macroeconomic environment.

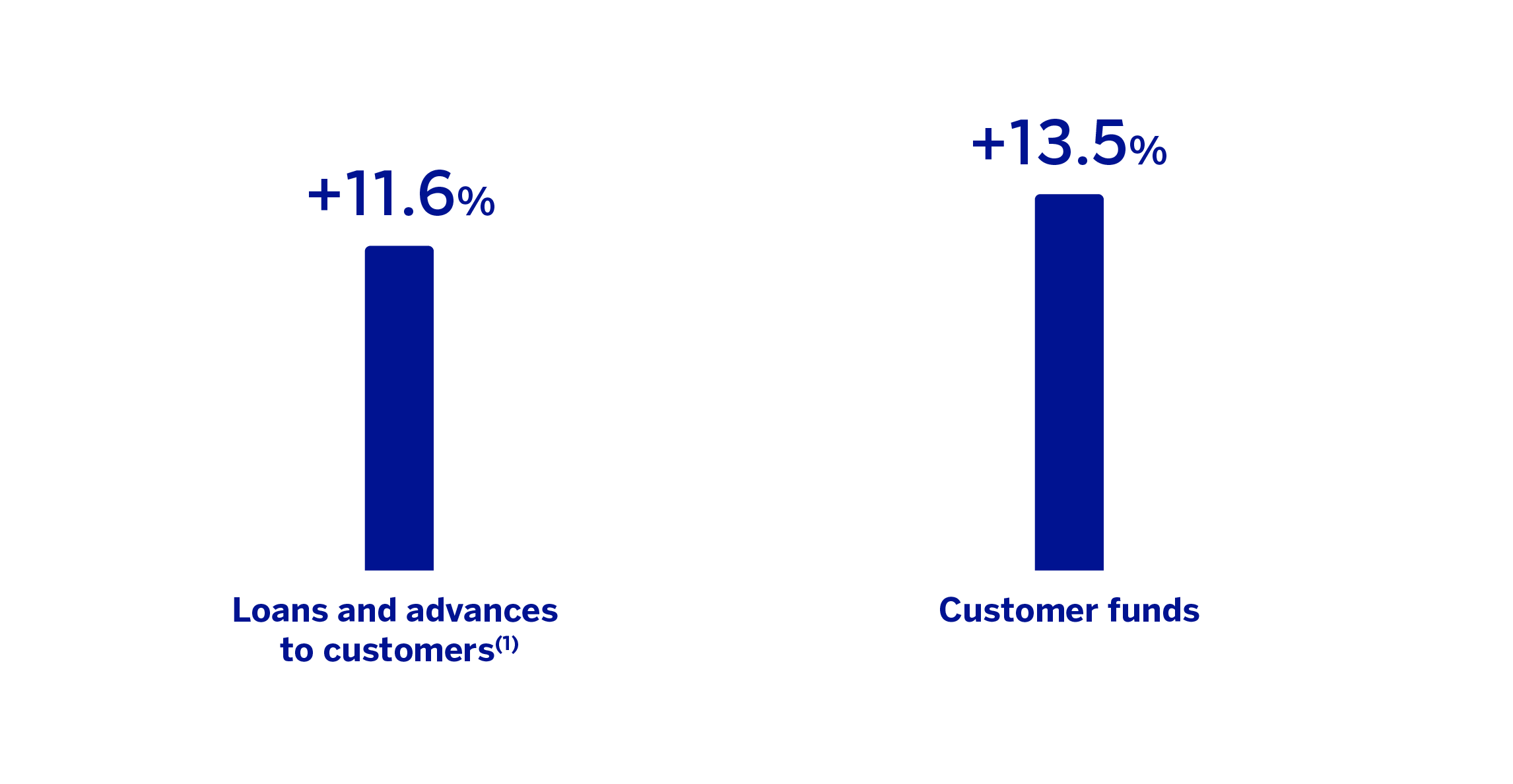

In particular, in 2025, loans and advances to customers increased by 11.6%, driven by the dynamism of the wholesale segment. Of particular note within this segment was the higher volume of loans to business, which grew by 14.2% at the Group level. Loans to individuals increased by 8.3%, with consumer and mortgage loans showing greater dynamism.

Customer funds grew by 13.5% during the year, boosted by both customer deposits, which increased by 12.3% at Group level, and by mutual funds and customer portfolios, which grew by 17.2%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2024)

(1) The growth of non-performing loans and advances to customers under management (excluding repos) stands at 11.7%.

Business areas

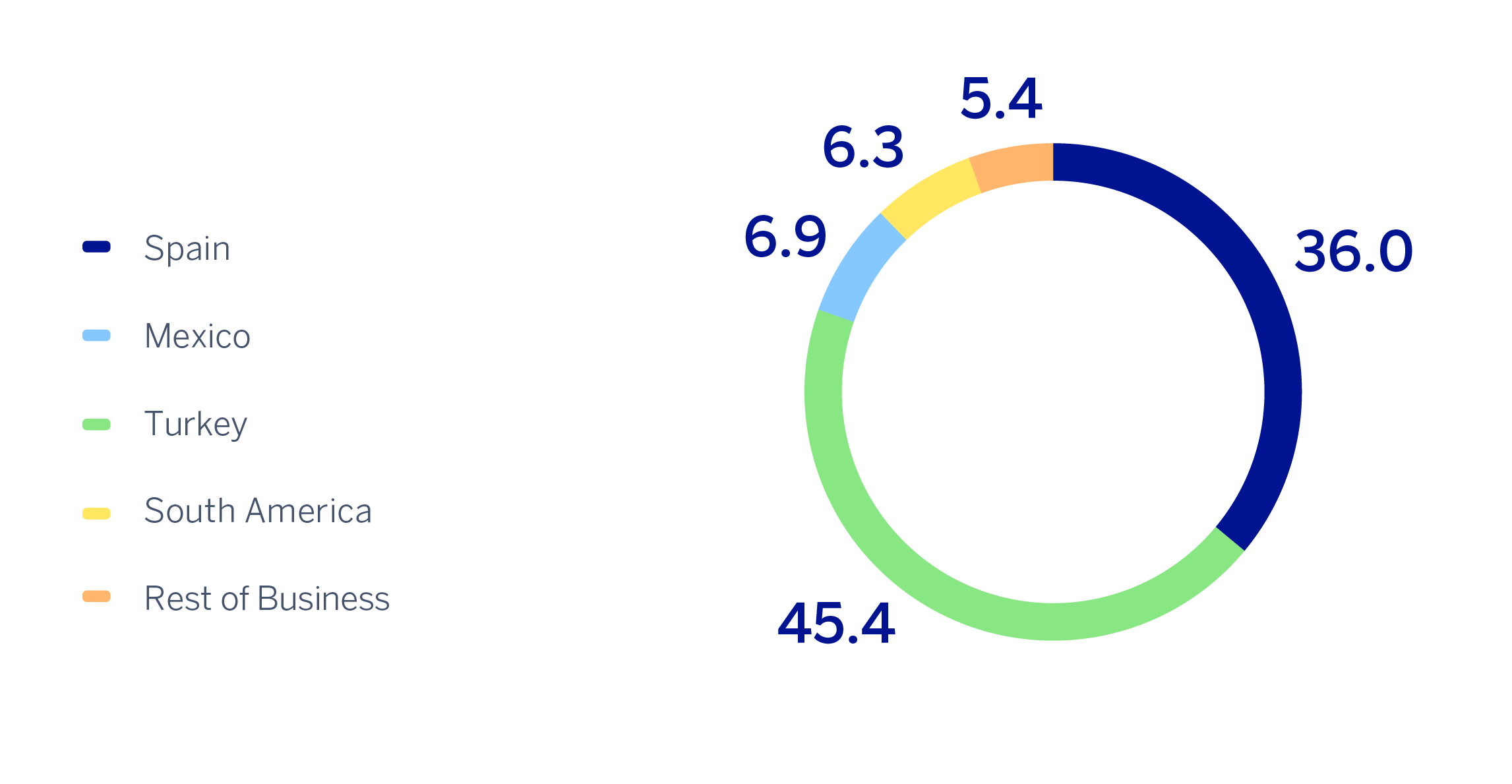

According to the accumulated results of the business areas by the end of December 2025, in each of them it is worth mentioning:

Spain generated a net attributable profit of €4,175m, that is, 11.3% above the result achieved in the same period of 2024, driven by the evolution of the recurring revenue from the banking business.

BBVA Mexico achieved a cumulative net attributable profit of €5,264m, which represents a year-on-year growth of 5.7%, excluding the impact of the Mexican peso, explained mainly by the favorable evolution of the net interest income.

Turkey reached a net attributable profit of €805m, with a year-on-year growth of 31.8%, as a result of the good performance of net interest income and a less negative hyperinflation impact.

South America generated a net attributable profit of €726m in 2025, which represents a year-on-year growth of 14.3%, favored by an improved net attributable profit in Peru and Colombia and a less negative hyperinflation adjustment in Argentina.

Rest of Business achieved an accumulated net attributable profit of €627m, 29.4% higher than in the same period of the previous year, favored by the evolution of the recurring revenues and the net trading income (hereinafter, NTI).

The Corporate Center recorded a net attributable loss of €-1,086m.

Lastly, and for a better understanding of the Group's activity and results, supplementary information is provided below for the wholesale business, Corporate & Investment Banking (CIB), carried out by BBVA in the countries where it operates. CIB generated a net attributable profit of €3,073m1. Excluding the impact of currency fluctuations, this result represents a 31.9% increase over the previous year, which reflects again the strength of the Group's wholesale businesses, with the aim of offering a value proposition focused on the needs of its customers.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 2025)

(1) Excludes the Corporate Center.

Solvency

The BBVA Group's CET12 ratio stood at 12.70% as of December 31, 2025, which allows it to maintain a large management buffer over the Group's CET1 requirement as of that date (9.28%3), and is also above the Group's target management range of 11.5% - 12.0% of CET1.

Shareholder remuneration

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.60 per share for each of the outstanding shares entitled to receive said distribution, to be paid presumably on April as final dividend of 2025 is expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the 2025 financial year will be 50% of the attributable profit, with a cash distribution of €0.92 per share, taking into account that in November 2025, €0.32 gross was distributed in cash for each of the outstanding shares entitled to receive said distribution as an interim dividend for the year.

1 The additional pro forma information from CIB excludes the application of hyperinflation accounting and the Group's wholesale business in Venezuela.

2 As of 31-12-2025, there were no differences between fully loaded and phased-in ratios given that the impact associated with the transitional adjustments is nil.

3 Considering the latest official updates to the countercyclical capital buffer and the systemic risk buffer, applied on the basis of exposure as of September 30, 2025, and incorporating the increase in the percentage of the countercyclical capital buffer applicable to exposures located in Spain approved by the Bank of Spain and published on October 1, 2025, applied on that exposure basis. For its part, as of January 1, 2026, the minimum regulatory requirement for the Group would be reduced to 8.97%, in accordance with the outcome of the Supervisory Review and Evaluation Process (SREP) communicated by the European Central Bank (ECB).

Read legal disclaimer of this report.