Macroeconomic environment

The global economy has shown greater strength than expected during 2025 given the high levels of uncertainty, trade and geopolitical tensions, and the United States administration's immigration restrictions. The negative effects of protectionist policies have been mitigated by lower effective tariffs than initially announced, fiscal stimulus and the strong growth in investment in artificial intelligence, particularly in the United States. Low financial volatility, supported by the Federal Reserve's (hereinafter, Fed) expansionary monetary policy, has also supported global activity.

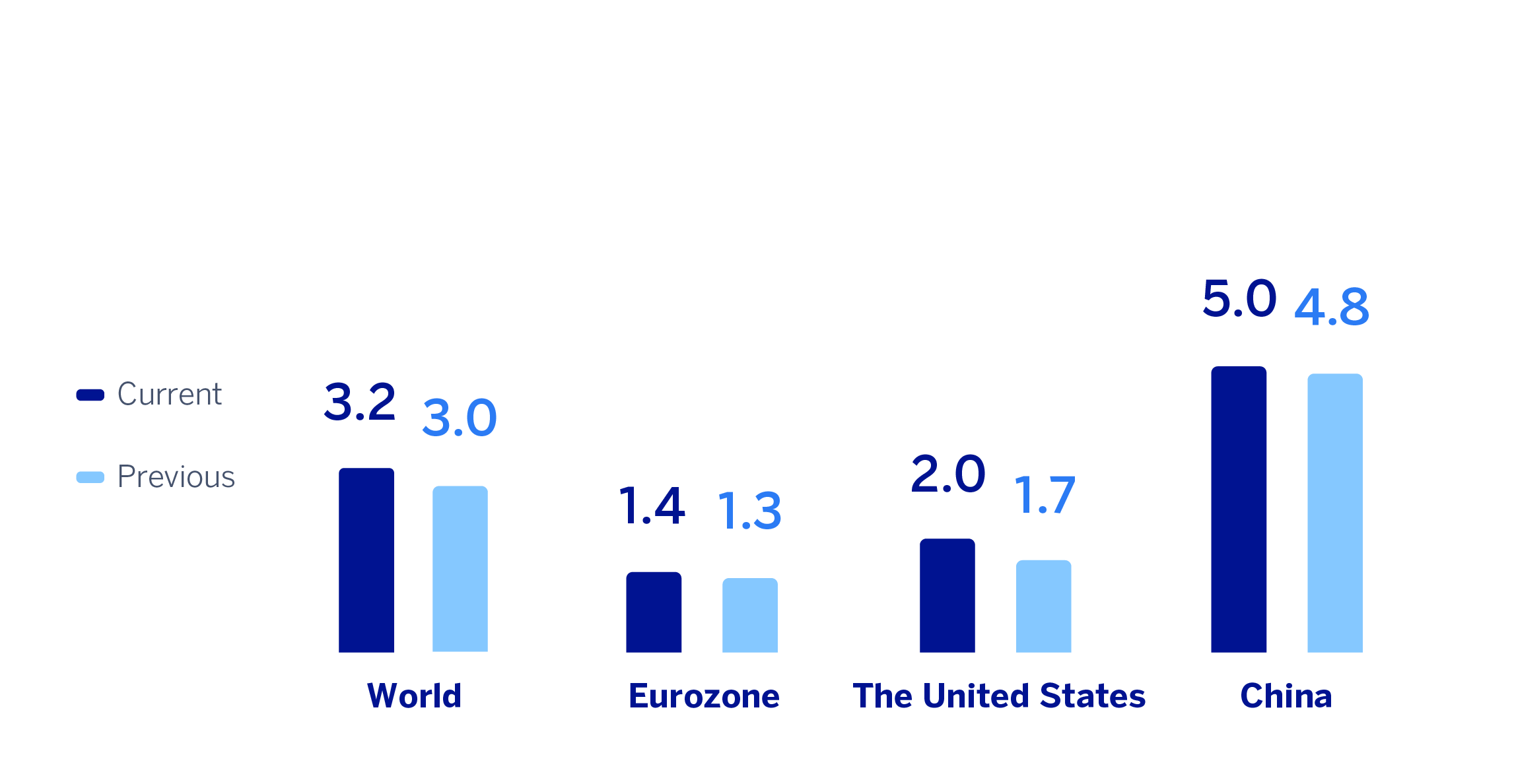

Overall, BBVA Research anticipates that global growth will reach 3.2% in 2025, two tenths above the previous scenario, and will stand at 3.1% in 2026. For the United States, better than expected performance in recent months raises the growth forecast for 2025 to 2.0% (three tenths higher the previous forecast) and 1.9% for 2026 (one tenth higher). In the case of the Eurozone, the expectation of a gradual slowdown in activity remains: compared to GDP growth of 1.4% in 2025 (one tenth higher than the previous forecast), in 2026 it could be 1.1%, in a context where the impact of tariffs and political instability in some countries in the bloc could be partially offset by increased spending on defense and infrastructure. In China, the economic growth could close 2025 with an increase of 5%, equal to that of 2024 and two tenths higher than previously forecast. For 2026, BBVA Research maintains its expectations of moderation, with annual growth of 4.5%.

The tariff increase is expected to push inflation in the United States to around 3% by the end of 2026, limiting the Fed's scope for interest rate cuts. Following the cuts in 2025, which brought the benchmark rate to 3.75%, BBVA Research forecasts two additional rate cuts to 3.25%. In the Eurozone, the ECB is expected to keep the deposit facility interest rate unchanged (at 2%) if inflationary pressures remain contained (the headline rate closed 2025 at 2.0% and could remain around this level at the end of 2026) and downside risks to growth do not intensify. In China, monetary conditions are likely to continue to ease given the current context of very low inflation.

The balance of risks for the global economy remains weighted to the downside, but somewhat more balanced than in the previous scenario. In addition to protectionist measures in trade and immigration, and the structural challenges facing Europe and China, other negative factors include increased geopolitical tensions (potential interventions of the United States in Latin America, the Middle East or the Arctic) and uncertainty about the Fed's independence and its potential impact on financial markets. On a positive note, however it is worth mentioning the boost in investment in artificial intelligence and its medium-term effect on the productivity of economies that promote its adoption.

GDP GROWTH ESTIMATES IN 2025

(PERCENTAGE. YEAR-ON-YEAR VARIATION)

Source: BBVA Research estimates.

Read legal disclaimer of this report.