South America

Highlights for the period January - December 2025

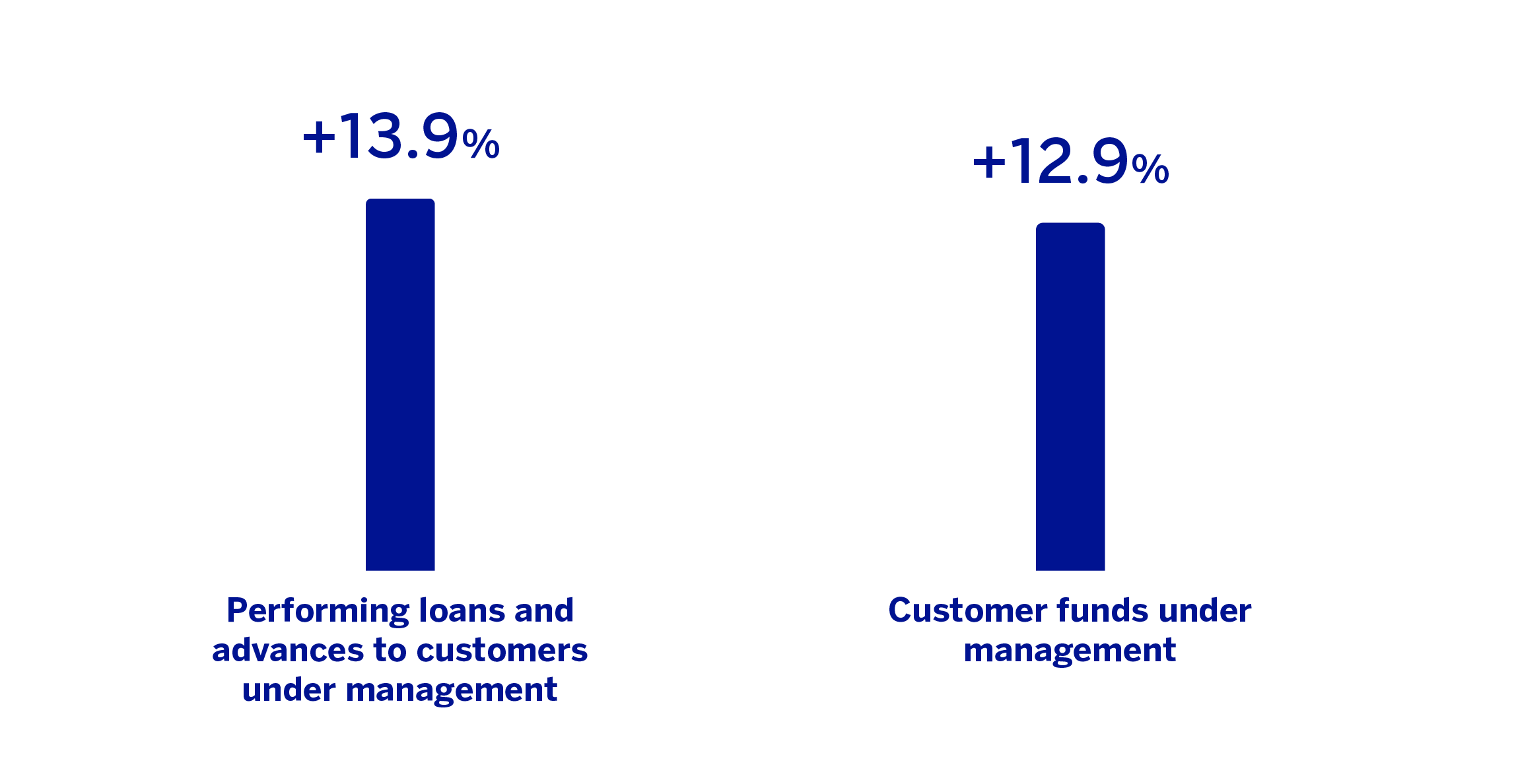

- Balanced growth in lending activity and customer funds

- Cumulative hyperinflation adjustment in Argentina at the end of 2025 was significantly lower than in 2024

- Peru and Colombia continue showing good performance in terms of asset quality

- Year-on-year increase in the net attributable profit of this business area

BUSINESS ACTIVITY (1)

(VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO 31-12-24)

(1) Excluding repos.

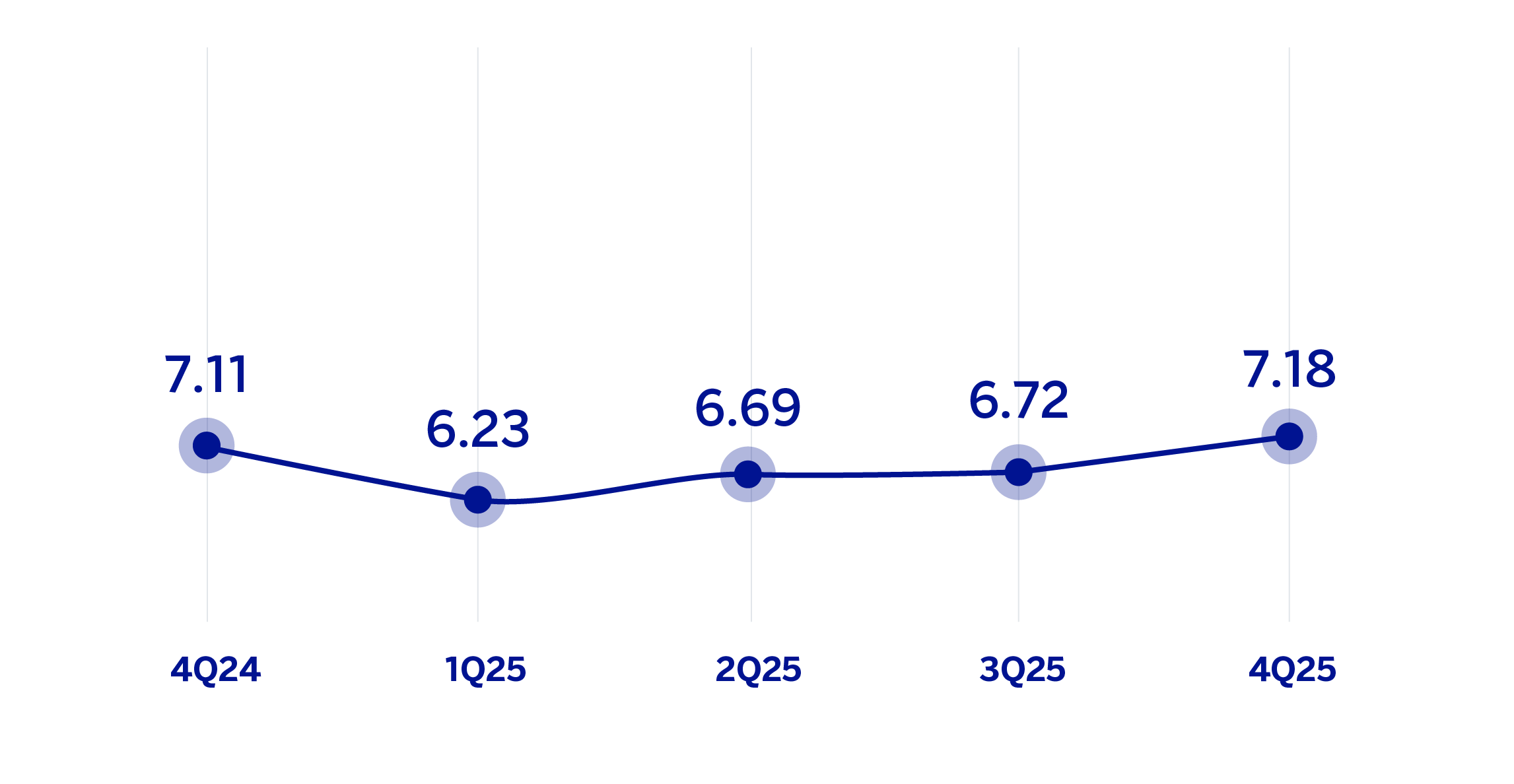

NET INTEREST INCOME / AVERAGE TOTAL ASSETS

(PERCENTAGE AT CONSTANT EXCHANGE RATES)

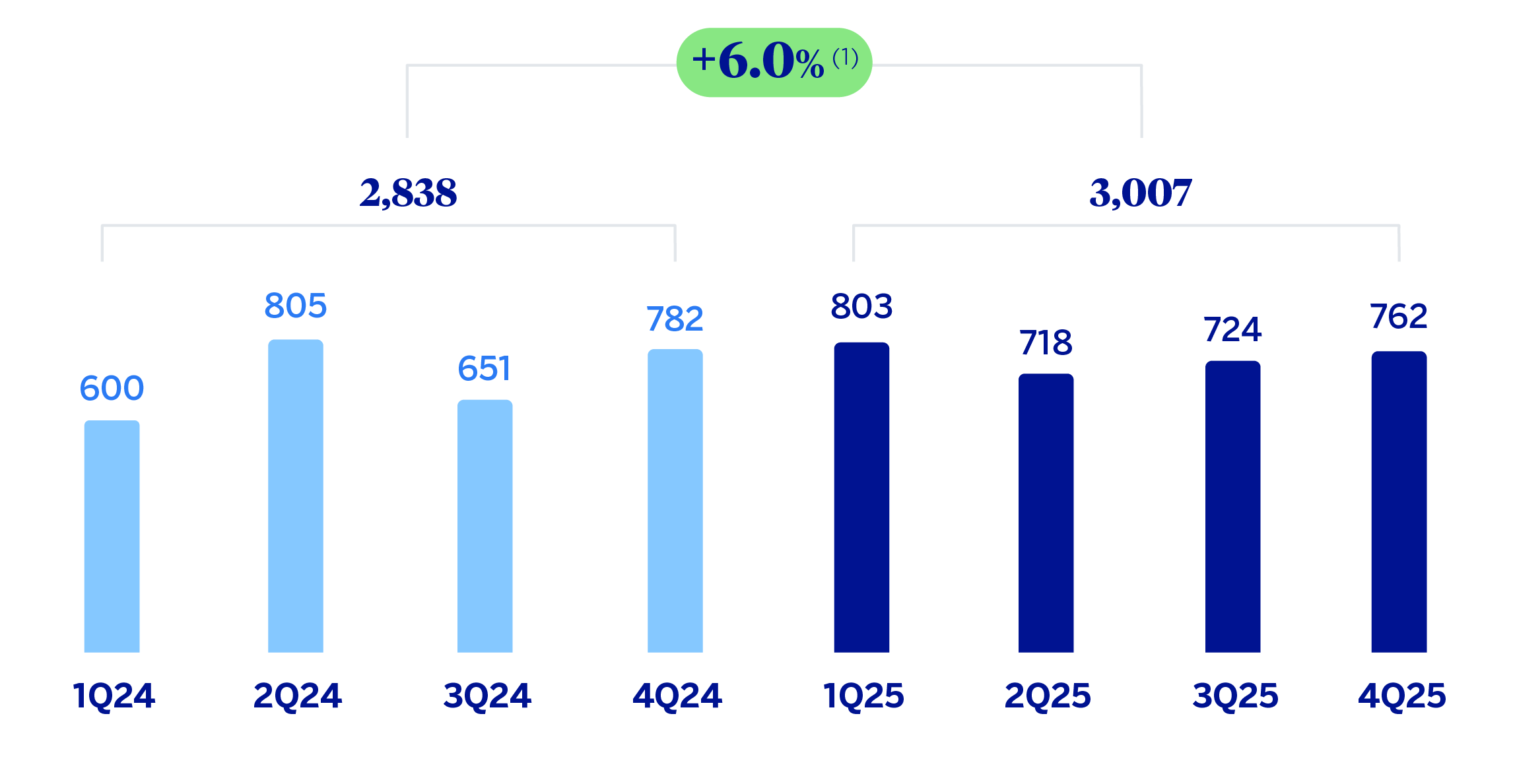

OPERATING INCOME

(MILLIONS OF EUROS AT CURRENT EXCHANGE RATES)

(1) At constant exchange rates: +33.5%.

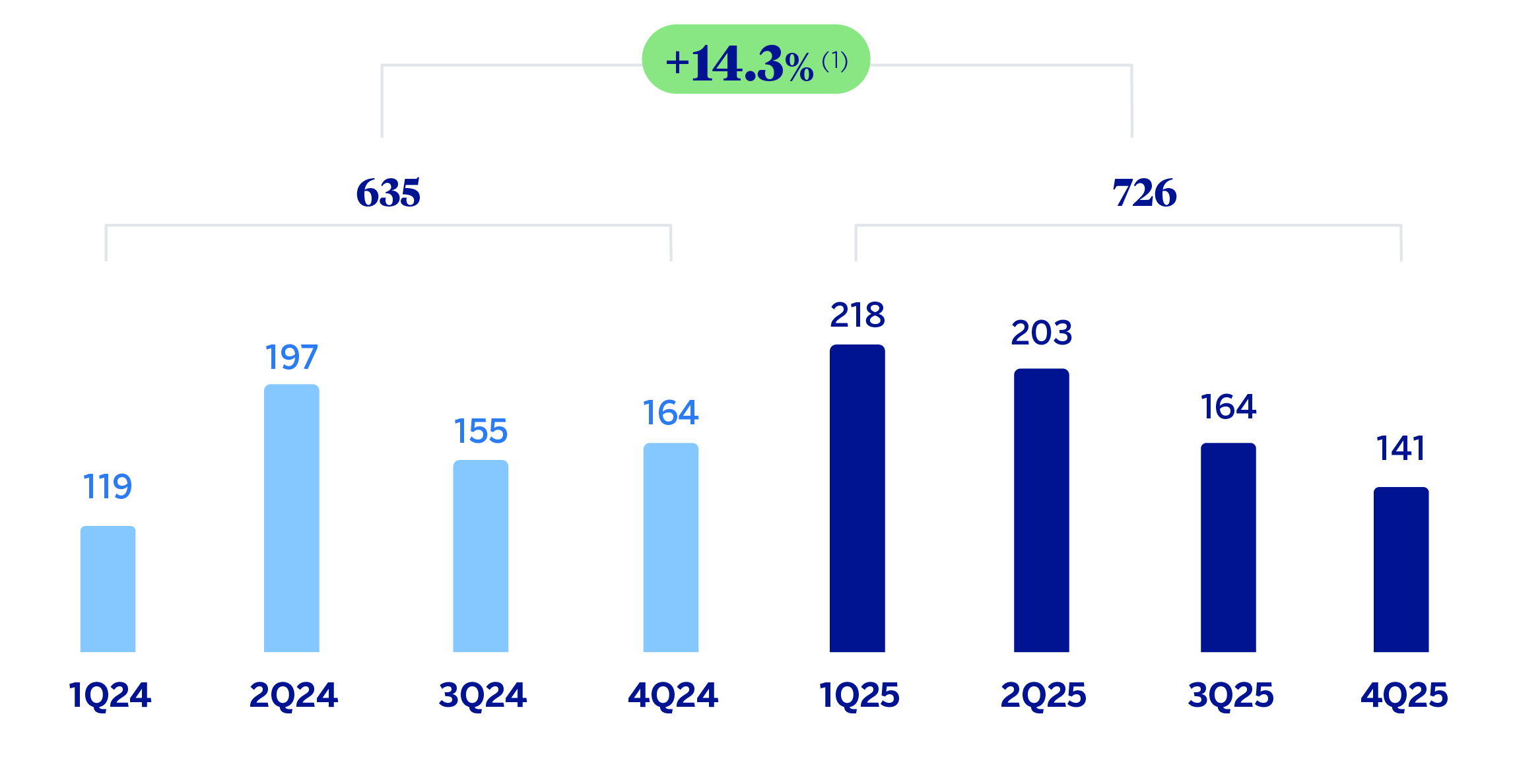

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS AT CURRENT EXCHANGE RATES)

(1) At constant exchange rates: +71.5%.

| FINANCIAL STATEMENTS AND RELEVANT BUSINESS INDICATORS (MILLIONS OF EUROS AND PERCENTAGE) | ||||

|---|---|---|---|---|

| Income statement | 2025 | 𝚫 % | 𝚫 % (1) | 2024 |

| Net interest income | 4,830 | (13.6) | 1.6 | 5,589 |

| Net fees and commissions | 897 | 7.6 | 20.7 | 834 |

| Net trading income | 568 | (28.8) | (20.4) | 798 |

| Other operating income and expenses | (932) | (48.6) | (45.6) | (1,815) |

| Gross income | 5,363 | (0.8) | 19.3 | 5,405 |

| Operating expenses | (2,356) | (8.2) | 5.0 | (2,567) |

| Personnel expenses | (1,064) | (10.4) | 3.9 | (1,188) |

| Other administrative expenses | (1,082) | (6.2) | 7.9 | (1,153) |

| Depreciation | (210) | (7.2) | (3.7) | (226) |

| Operating income | 3,007 | 6.0 | 33.5 | 2,838 |

| Impairment on financial assets not measured at fair value through profit or loss | (1,208) | (11.8) | (5.2) | (1,369) |

| Provisions or reversal of provisions and other results | (42) | (67.1) | (64.4) | (127) |

| Profit (loss) before tax | 1,758 | 31.0 | 104.1 | 1,342 |

| Income tax | (582) | 86.1 | 296.8 | (313) |

| Profit (loss) for the period | 1,176 | 14.3 | 64.5 | 1,029 |

| Non-controlling interests | (450) | 14.2 | 54.4 | (394) |

| Net attributable profit (loss) | 726 | 14.3 | 71.5 | 635 |

| Balance sheets | 31-12-25 | 𝚫 % | 𝚫 % (1) | 31-12-24 |

| Cash, cash balances at central banks and other demand deposits | 8,075 | (9.3) | 1.2 | 8,906 |

| Financial assets designated at fair value | 10,499 | (3.5) | 4.6 | 10,884 |

| Of which: Loans and advances | 297 | 44.9 | 39.6 | 205 |

| Financial assets at amortized cost | 54,336 | 8.7 | 14.4 | 49,983 |

| Of which: Loans and advances to customers | 51,151 | 9.2 | 14.8 | 46,846 |

| Tangible assets | 1,146 | (10.2) | (7.3) | 1,277 |

| Other assets | 2,592 | (12.1) | (6.7) | 2,948 |

| Total assets/liabilities and equity | 76,648 | 3.6 | 10.2 | 73,997 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 2,428 | 17.9 | 14.4 | 2,060 |

| Deposits from central banks and credit institutions | 4,011 | (6.6) | (4.1) | 4,292 |

| Deposits from customers | 53,375 | 5.2 | 11.9 | 50,738 |

| Debt certificates | 4,010 | 6.9 | 12.1 | 3,752 |

| Other liabilities | 5,567 | (8.2) | 4.5 | 6,066 |

| Allocated regulatory capital | 7,257 | 2.3 | 9.4 | 7,090 |

| Relevant business indicators | 31-12-25 | 𝚫 % | 𝚫 % (1) | 31-12-24 |

| Performing loans and advances to customers under management (2) | 50,480 | 8.2 | 13.9 | 46,663 |

| Non-performing loans | 2,314 | (3.1) | (2.3) | 2,387 |

| Customer deposits under management (3) | 53,375 | 5.2 | 11.9 | 50,738 |

| Off-balance sheet funds (4) | 8,289 | 4.5 | 19.5 | 7,936 |

| Risk-weighted assets | 55,178 | (2.3) | 3.9 | 56,489 |

| RORWA (5) | 2.12 | 1.94 | ||

| Efficiency ratio (%) | 43.9 | 47.5 | ||

| NPL ratio (%) | 4.0 | 4.5 | ||

| NPL coverage ratio (%) | 92 | 88 | ||

| Cost of risk (%) | 2.50 | 2.87 | ||

| (1) At constant exchange rate. (2) Excluding repos. (3) Excluding repos and including specific marketable debt securities. (4) Includes mutual funds and customer portfolios in Colombia and Peru. (5) For more information on the calculation methodology, as well as the calculation of the metric at the consolidated Group level, see Alternative Performance Measures at this report. |

||||

| SOUTH AMERICA. DATA PER COUNTRY (MILLIONS OF EUROS) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Country | Operating income | Net attributable profit (loss) | |||||||

| 2025 | 𝚫 % | 𝚫 % (1) | 2024 | 2025 | 𝚫 % | 𝚫 % (1) | 2024 | ||

| Argentina | 728 | 5.3 | n.s. | 691 | 133 | (27.1) | n.s. | 182 | |

| Colombia | 609 | (2.0) | 1.8 | 622 | 143 | 58.5 | 64.7 | 90 | |

| Peru | 1,219 | 1.8 | 1.0 | 1,198 | 295 | 29.9 | 29.0 | 227 | |

| Other countries (2) | 451 | 37.7 | 42.8 | 327 | 155 | 14.5 | 19.5 | 136 | |

| Total | 3,007 | 6.0 | 33.5 | 2,838 | 726 | 14.3 | 71.5 | 635 | |

| (1) At constant exchange rates. (2) Chile (Forum), Uruguay and Venezuela. Additionally, it includes eliminations and other charges. |

|||||||||

| SOUTH AMERICA. RELEVANT BUSINESS INDICATORS PER COUNTRY (MILLIONS OF EUROS) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Argentina | Colombia | Peru | ||||||

| 31-12-25 | 31-12-24 | 31-12-25 | 31-12-24 | 31-12-25 | 31-12-24 | |||

| Performing loans and advances to customers under management (1)(2) | 8,159 | 4,392 | 17,345 | 16,196 | 19,787 | 18,946 | ||

| Non-performing loans (1) | 428 | 64 | 795 | 1,002 | 913 | 1,118 | ||

| Customer deposits under management (1)(3) | 10,088 | 5,767 | 18,614 | 17,824 | 20,822 | 20,102 | ||

| Off-balance sheet funds (1)(4) | 2,085 | 1,777 | 3,003 | 2,635 | 3,200 | 2,525 | ||

| Risk-weighted assets | 10,195 | 11,037 | 18,829 | 18,868 | 20,069 | 20,384 | ||

| RORWA (5) | 1.81 | 3.65 | 0.80 | 0.46 | 3.13 | 2.40 | ||

| Efficiency ratio (%) | 51.5 | 59.5 | 46.3 | 46.9 | 38.6 | 36.5 | ||

| NPL ratio (%) | 4.9 | 1.4 | 4.3 | 5.7 | 3.7 | 4.9 | ||

| NPL coverage ratio (%) | 84 | 145 | 88 | 82 | 99 | 90 | ||

| Cost of risk (%) | 5.67 | 4.48 | 2.19 | 2.83 | 1.67 | 2.83 | ||

| (1) Figures at constant exchange rates. (2) Excluding repos. (3) Excluding repos and including specific marketable debt securities. (4) Includes mutual funds and customer portfolios (in Colombia preliminary data as of December 31, 2025). (5) For more information on the calculation methodology, as well as the calculation of the metric at the consolidated Group level, see Alternative Performance Measures at this report. |

||||||||

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. These rates, together with the changes at current exchange rates, can be found in the attached tables of the financial statements and relevant business indicators.

Activity and results

The most relevant aspects related to the area's activity during 2025 were:

Lending activity (performing loans under management) recorded an increase of +13.9%, with a more dynamic growth in the wholesale portfolio that grew at a rate of 14.5%, above the growth of the retail portfolio (+13.1%).

Customer funds under management grew by 12.9% compared to the closing balances at the end of 2024, with an 11.9%increase in customer base deposits, where the evolution of demand deposits stands out (+13.3%), and a 19.5% growth in off-balance sheet funds.

The most relevant aspects related to the area's activity during the fourth quarter of the year 2025 have been:

Lending activity registered a positive variation of 4.0%, mainly supported by the dynamism of commercial loans (+5.1%), credit consumption and credit cards (+3.6%, overall).

With regard to the quality of the credit, the area's NPL ratio stood at 4.0%, which represents a decrease of 3 basis points compared to the previous quarter, favored by the performance in Peru and Colombia. For its part, the coverage ratio for the area was 92%, representing a decrease of 82 basis points compared to the end of September, with a decline mainly occurring in Argentina.

Customer funds under management increased at a rate of 3.8%, with growth of 4.6% in customer deposits and a variation of -1.4% in off-balance sheet funds.

South America generated a net attributable profit of €726m at the end of 2025, which represents a year-on-year growth of 14.3% at current exchange rates, favored by an improved net attributable profit in Peru and Colombia and a less negative hyperinflation adjustment in Argentina.

Meanwhile, the impact of the adjustment for hyperinflation of subsidiaries domiciled in Argentina stands out, which implies, among other effects, the recording of the loss on the monetary position in the item "Other operating income and expenses" in the income statement. This impact amounted to €356m in the period January - December 2025, significantly lower than the €1,419m recorded in the period January - December 2024.

More detailed information on the most representative countries of the business area is provided below.

Argentina

Macro and industry trends

The third quarter of 2025 has ended with a recovery in economic activity, amid declining political instability and lower exchange rate tensions. BBVA Research maintains its GDP growth forecast for 2025 at 4.5%, in line with the previous scenario, and expects a gradual moderation in growth to rates of 3% by 2026. Inflation has maintained the downward trend observed throughout 2025 standing at 31.5% in December. For 2026, inflationary pressures are expected to continue easing, with the overall rate reaching 20% by the end of the year.

The banking system continues to grow at a high pace, although the inflation control entails that the credit and deposit volume growth is more moderate than in previous quarters. With data at the end of December 2025, total lending increased by 81.3% compared to December 2024, favored by consumer, corporate and, above all, mortgage portfolios, which grew by 70.1%, 81.0% and 245% year-on-year, respectively. For their part, deposits continue to decelerate, and at the end of December recorded a year-on-year growth of 41.3%. Finally, the NPL ratio has rebounded due to the growth in household credit defaults, standing at 4.54% at the end of October 2025.

Activity and results

In 2025, performing loans under management grew by 85.8% (+16.0% in the fourth quarter), driven mainly by the growth in corporate loans and all the loans to individuals, highlighting growth in terms of volume of consumer loans (+75.8%) and credit cards (+52.4%) and the dynamism of mortgage loans (+174.2%). At the end of December 2025, the NPL ratio stood at 4.9%, an increase of 111 basis points compared to the end of September 2025, mainly due to retail portfolio NPL entries affecting the NPL coverage ratio, which stood at 84%, below the level recorded at the end of September 2025.

On balance sheet funds recorded a 74.9% growth in 2025 (+10.6% in the fourth quarter), with growth in time deposits (+116.2%) higher than demand deposits (+53.2%). For its part, mutual funds (off-balance sheet funds) also had a good performance in the year (+17.3%, -10.8% in the fourth quarter).

Regarding the evolution of the income statement15, the cumulative net attributable profit at the end of December 2025 stood at €133m, showing a lower impact from hyperinflation compared to the end of December 2024. Net interest income continues to be affected, among other factors, by price effect and the higher cost of funds due to the growth in customer balances, which was not offset by the higher lending volume. Net fees and commissions grew by 13.4% year-on-year, driven by payment methods activity. On the other hand, a significantly lower negative adjustment for hyperinflation was recorded (mainly reflected in the "Other operating income and expenses" line) and higher operating expenses, both in personnel (mainly due to fixed compensation to staff) and in other operating expenses. With regard to loan-loss provisions, there was an increase in requirements in the retail portfolio, partly affected by a higher portfolio volume. As a result of the above, the cost of risk stood at 5.67%, which represents an increase of 77 basis points in the quarter. Thus, the result of the fourth quarter reached €29m, which represents an increase from the previous quarter, mainly due to favorable evolution of net interest income (quarterly improvement of customer spread) and NTI (due to higher results from trading government bonds and the sale of ALCO portfolios). This was partially offset by a more negative adjustment from hyperinflation in the quarter and by higher impairment on financial assets compared to the third quarter of 2025, associated with higher requirements in the retail portfolios.

Colombia

Macro and industry trends

Private consumption and fiscal expenditure have continued to contribute to the dynamism of economic activity during the second half of 2025. BBVA Research expects growth for the year as a whole to reach 2.7%, two tenths of a percentage point above the previous scenario; growth in 2026 could be similar, standing at 2.8%. The boost in domestic demand has also limited the correction in inflation, which closed December at 5.1%, and has led the central bank to keep interests rates unchanged at 9.25%. The announced increase in the minimum wage anticipates additional inflationary pressures for 2026. The overall inflation rate could end the year at 6.5%, two percentage points higher than expected in the previous scenario, and the central bank could respond by tightening its monetary policy with interest rate hikes to 12.25%.

Total credit growth in the banking system stood at 6.6% year-on-year in October 2025, with growth across all portfolios. Thus, corporate lending, mortgage lending, and consumer lending portfolios showed year-on-year growth rates of 5.6%, 11.8% and 5.5%, respectively in October 2025. On the other hand, total deposits grew by 9.1% year-on-year at the end of October 2025, with a more balanced evolution by portfolios than in previous quarters. Thus, demand and time deposits grew by 9.1% and 9.2% year-on-year respectively. The system's NPL ratio has improved in the last few months, standing at 4.01% in October 2025, 101 basis points below the figure for the same month of the previous year.

Activity and results

Lending activity grew at a rate of 7.1% compared to the end of 2024, and 1.0% in the fourth quarter. In terms of asset quality indicators, they improved with respect to the end of 2024: the NPL ratio stood at 4.3%, a decrease of 20 basis points with respect to the previous quarter, as a result of the containment of inflows and the good recovery dynamics of the quarter, as well as the write-offs mainly in retail portfolios. On the other hand, coverage stood at 88%, remaining virtually stable compared to the previous quarter (-7 basis points).

Customer funds grew by 5.7% compared to the end of 2024, mainly thanks to the growth of demand deposits (+5.8%) and, to a lesser extent, off-balance sheet funds (+14.0%) and time deposits (+3.0%). In the fourth quarter, growth in demand deposit balances (+10.1%) drove growth in customer deposits (+3.7%), and off-balance sheet funds grew by 2.1%.

The cumulative net attributable profit at the end of December 2025 stood at €143m, that is, 58.5% higher than at the end of the same period of the previous year (at current exchange rates), favored by the increase in recurring revenues, a more efficient cost management, and particularly, a lower level of provisions for impairment on financial assets associated with lower requirements in the retail portfolio as a result of lower entries into NPLs. Meanwhile, the cumulative cost of risk at December 31, 2025 stood at 2.19%, down 4 basis points in the quarter. Fourth quarter net attributable profit stood down€21m, down 56.8% from the previous quarter at current exchange rates, due to lower NTI, lower insurance business results, growth in operating expenses, and higher loan-loss provisions. In addition, the quarter was impacted by the increase in corporate income tax expense resulting in a higher effective tax rate.

Perú

Macro and industry trends

Economic activity has continued a relatively favorable performance during the second half of 2025, thanks to the boost from private consumption, withdrawals from private pension funds, and relatively positive developments in foreign trade prices. According to BBVA Research, GDP growth could stand at 3.3% in 2025, two tenths above the previous forecast, and reach 3.1% in 2026 amid growing domestic political uncertainty and the calling of elections. Controlled inflation, which ended at 1.5% in December and is expected to rise gradually to 2.5% by the end of 2026, and low interest rates, which could remain unchanged at the current 4.25%, support growth expectations going forward.

Total lending in the Peruvian banking system continued the trend of recent quarters and increased 4.9% year-on-year in November 2025, with growth in all portfolios. Thus, the consumer credit portfolio grew by 10.9% year-on-year, the mortgage portfolio increased by 6.6% and the corporate loan portfolio by 2.4% year-on-year. For their part, the system's total deposits registered a year-on-year growth of 3.4% in October 2025, due to the contraction in time deposits (-4.8% year-on-year), which was partially offset by 7.9% growth in demand deposits. Finally, the system's NPL ratio continued on a downward trend, reaching a rate of 3.26% in November 2025.

Activity and results

Lending activity grew by 4.4% compared to the end of December 2024, focused on the retail portfolios, mainly consumer loans (+19.3%) and mortgages (+9.2%), which more than offset the deleveraging in the wholesale portfolios (-0.7%). In the fourth quarter of 2025, lending growth stood at 2.2%, with growth in the retail portfolio (+2.9%), faster than the wholesale portfolio (+1.7%). Regarding the asset quality indicators, the NPL ratio was lower than at the end of September 2025 (-29 basis points) placing at 3.7%, where ongoing strong recovery performance and management of non-performing loans during the quarter continue. The coverage ratio was 99%, remaining virtually stable compared to the end of September (+9 basis points) and the cumulative cost of risk at the end of December 2025 stood at 1.67%, 10 basis points below the same figure at the end of September 2025, and below the cumulative cost of risk at the end of 2024.

Customers funds under management increased during 2025 (+6.2%), thanks to the favorable performance of demand deposits (+12.2%) and off-balance sheet funds (+26.7%).

BBVA Peru's cumulative attributable profit stood at the end of December 2025 at €295m, which represents a year-on-year increase of 29.9% at current exchange rates, originated in lower provisions for impairment on financial assets, which were significantly lower than in the same period of 2024 (-38.1% at current exchange rates) due, among other factors, to a lower requirement for retail products as a result of the improved asset quality of the portfolio in the last quarters. Apart from the above, good performance of recurring revenues. The net attributable profit of the quarter stood at € 68m, which is a variation of -3.2% compared to the previous quarter, at current exchange rates, mainly as a result of the growth in operating expenses.

15 At current rates, that is, the impact of exchange rate fluctuations on the profit and loss account is not excluded.

Read legal disclaimer of this report.