Additional pro forma information: Corporate & Investment Banking

Highlights for the period January - December 2025

- Sustained growth in lending continues

- Favorable performance of recurring revenues

- Solid gross income in all business divisions

- Growth in net attributable profit in the year

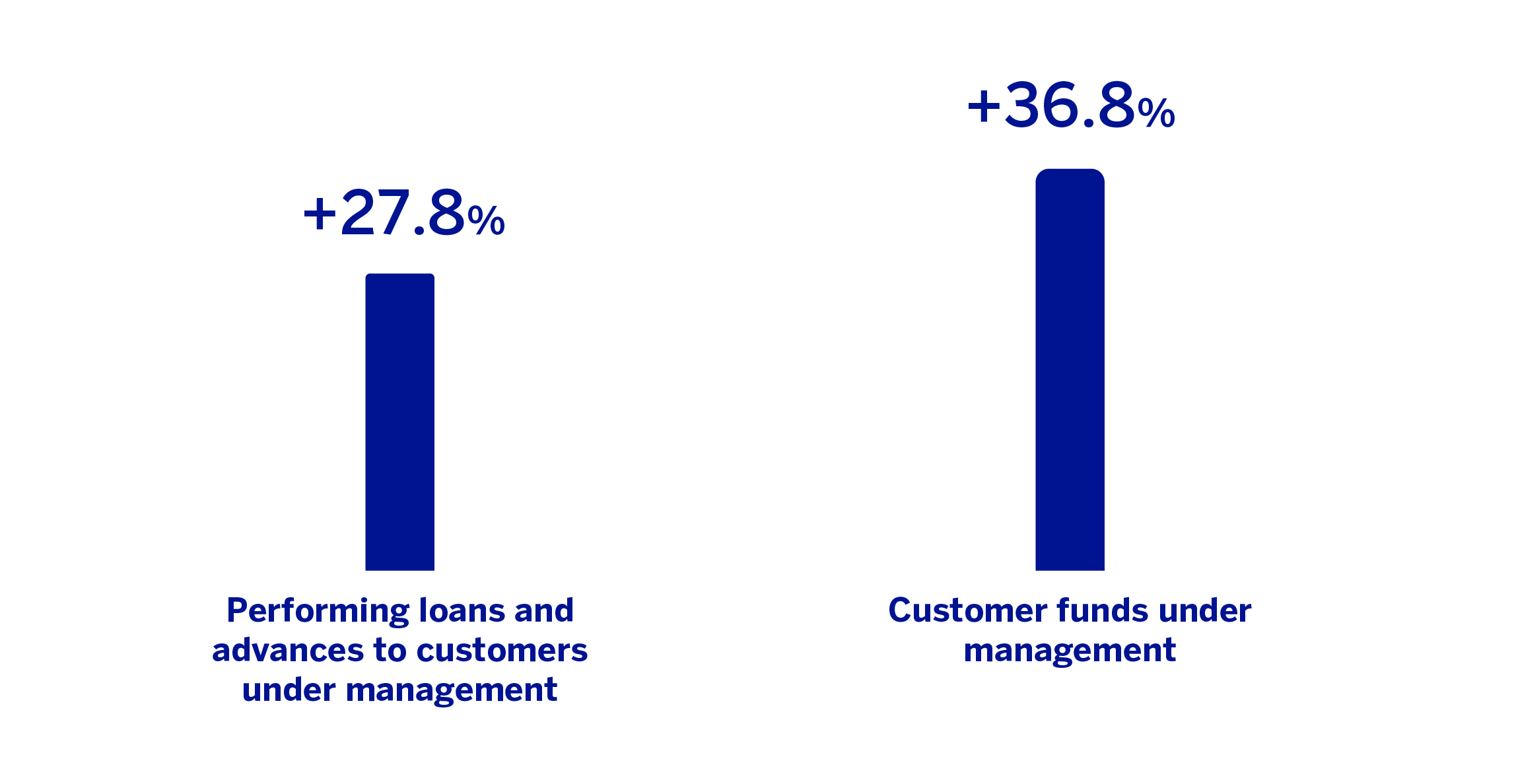

BUSINESS ACTIVITY (1) (VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO 31-12-24)

(1) Excluding repos.

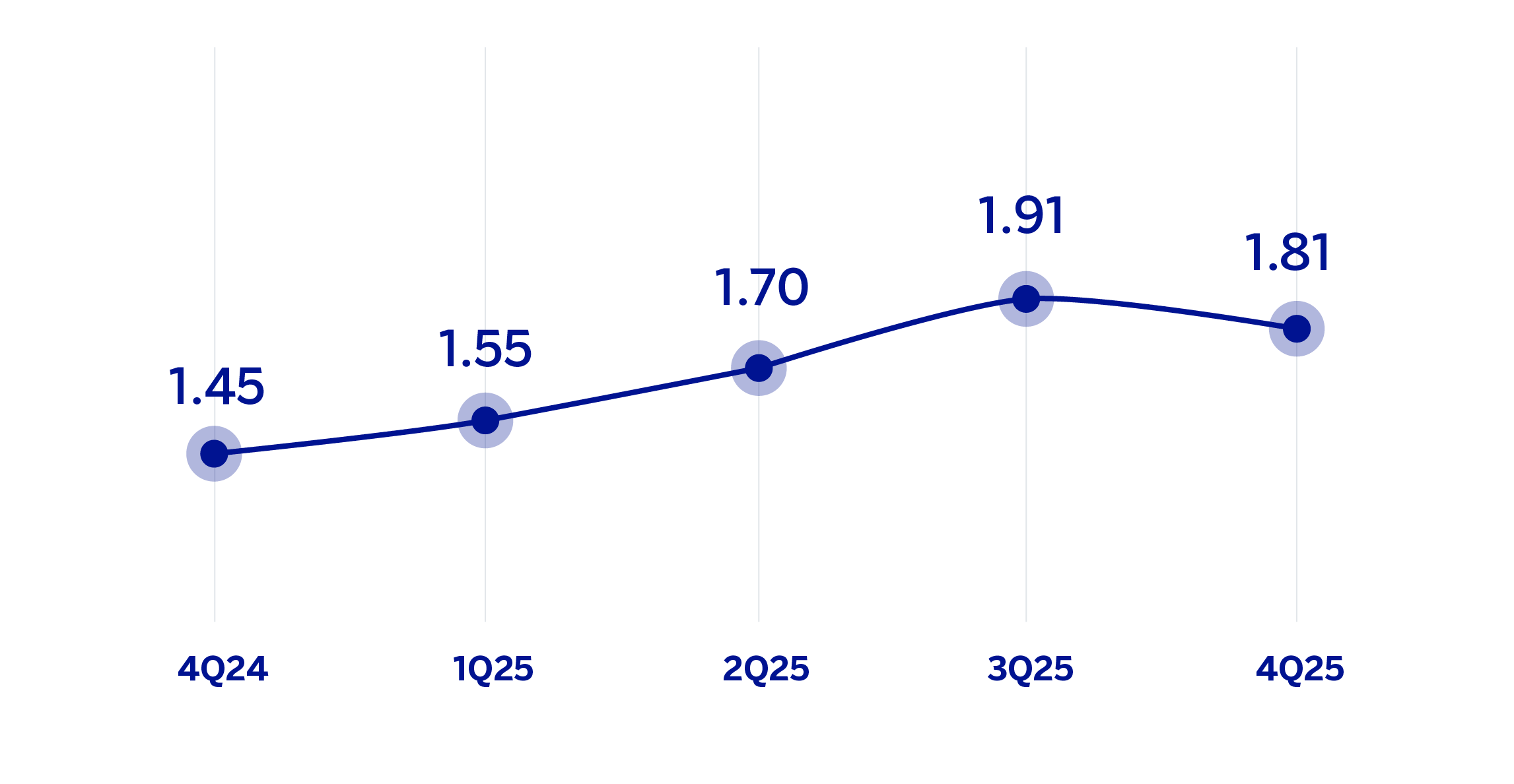

RECURRING REVENUES / AVERAGE TOTAL ASSETS

(PERCENTAGE AT CONSTANT EXCHANGE RATES)

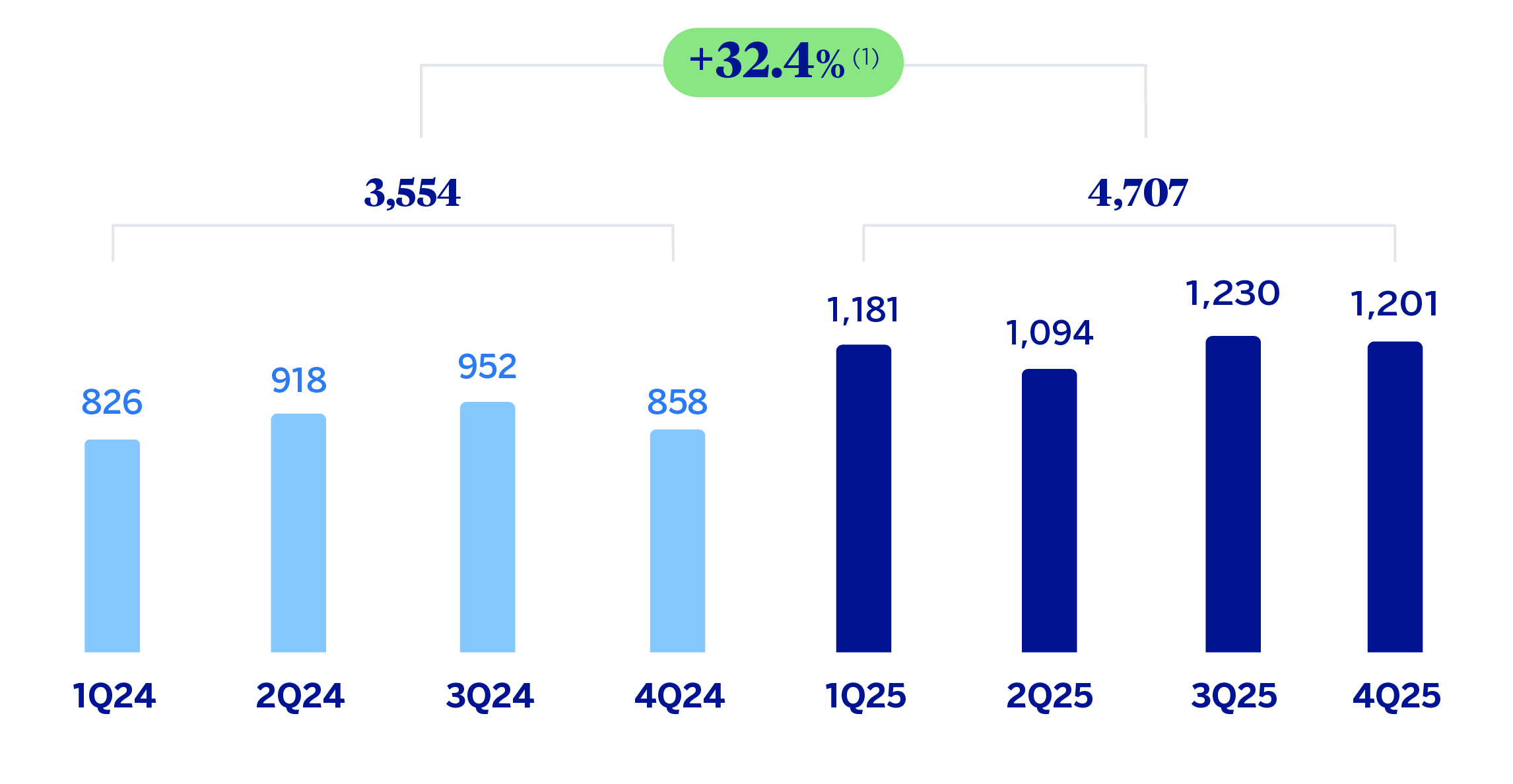

OPERATING INCOME

(MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +13.8%.

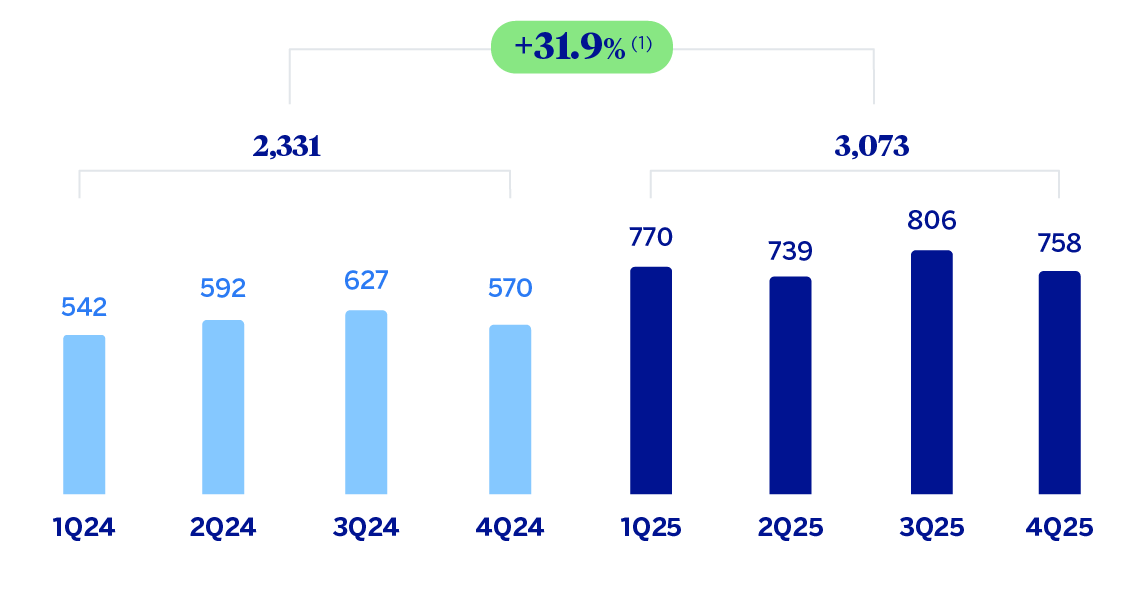

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +13.5%.

The additional pro forma information from CIB excludes the application of hyperinflation accounting and the Group's wholesale business in Venezuela.

| FINANCIAL STATEMENTS AND RELEVANT BUSINESS INDICATORS (MILLIONS OF EUROS AND PERCENTAGE) | ||||

|---|---|---|---|---|

| Income statement | 2025 | 𝚫 % | 𝚫 % (1) | 2024 (2) |

| Net interest income | 3,276 | 25.8 | 48.5 | 2,604 |

| Net fees and commissions | 1,381 | 16.5 | 26.8 | 1,185 |

| Net trading income | 1,948 | (5.4) | 4.9 | 2,060 |

| Other operating income and expenses | (47) | (17.4) | (8.6) | (56) |

| Gross income | 6,558 | 13.2 | 28.6 | 5,792 |

| Operating expenses | (1,851) | 11.9 | 19.7 | (1,654) |

| Personnel expenses | (899) | 17.3 | 24.0 | (767) |

| Other administrative expenses | (822) | 6.4 | 15.9 | (773) |

| Depreciation | (130) | 13.0 | 16.4 | (115) |

| Operating income | 4,707 | 13.8 | 32.4 | 4,138 |

| Impairment on financial assets not measured at fair value through profit or loss | 70 | (36.4) | (0.1) | 111 |

| Provisions or reversal of provisions and other results | (21) | 93.1 | 109.3 | (11) |

| Profit (loss) before tax | 4,756 | 12.2 | 31.6 | 4,237 |

| Income tax | (1,353) | 13.3 | 34.3 | (1,194) |

| Profit (loss) for the period | 3,402 | 11.8 | 30.5 | 3,043 |

| Non-controlling interests | (329) | (2.1) | 19.2 | (336) |

| Net attributable profit (loss) | 3,073 | 13.5 | 31.9 | 2,707 |

| Balance sheets | 31-12-25 | 𝚫 % | 𝚫 % (1)| 31-12-24 (2)

| |

| Cash, cash balances at central banks and other demand deposits | 11,935 | 27.9 | 41.1 | 9,333 |

| Financial assets designated at fair value | 131,968 | 17.6 | 17.5 | 112,237 |

| Of which: Loans and advances | 48,177 | 31.0 | 31.2 | 36,785 |

| Financial assets at amortized cost | 138,015 | 20.4 | 25.1 | 114,620 |

| Of which: Loans and advances to customers | 113,937 | 22.6 | 27.9 | 92,966 |

| Inter-area positions | — | — | — | — |

| Tangible assets | 251 | 29.0 | 40.8 | 194 |

| Other assets | 4,210 | (73.9) | (74.2) | 16,111 |

| Total assets/liabilities and equity | 286,378 | 13.4 | 15.7 | 252,495 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 97,375 | 21.0 | 21.0 | 80,460 |

| Deposits from central banks and credit institutions | 40,956 | 18.4 | 18.5 | 34,589 |

| Deposits from customers | 90,591 | 32.5 | 39.7 | 68,346 |

| Debt certificates | 10,084 | 54.8 | 54.9 | 6,516 |

| Inter-area positions | 25,719 | (40.4) | (39.8) | 43,188 |

| Other liabilities | 8,858 | 28.9 | 36.2 | 6,872 |

| Allocated regulatory capital | 12,795 | 2.2 | 6.8 | 12,523 |

| Relevant business indicators | 31-12-25 | 𝚫 % | 𝚫 % (1)| 31-12-24 (2)

| |

| Performing loans and advances to customers under management (3) | 113,835 | 22.5 | 27.8 | 92,914 |

| Non-performing loans | 594 | (0.9) | 25.4 | 599 |

| Customer deposits under management (3) | 83,407 | 30.0 | 37.7 | 64,174 |

| Off-balance sheet funds (4) | 4,346 | 13.1 | 21.6 | 3,844 |

| Efficiency ratio (%) | 28.2 | 28.6 | ||

| General note: For the translation of the income statement in those countries where hyperinflation accounting is applied, the punctual exchange rate as of December 31, 2025. (1) At constant exchange rates. (2) Revised balances. For more information, please refer to the “Business Areas” section. (3) Excluding repos. (4) Includes mutual funds, customer portfolios and other off-balance sheet funds. |

||||

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. For the conversion of these figures in those countries in which accounting for hyperinflation is applied, the end of period exchange rate as of December 31, 2025 is used. These rates, together with changes at current exchange rates, can be found in the attached tables of financial statements and relevant business indicators. When making comments referring to Europe in this area, Spain is excluded.

Activity

The most relevant aspects related to the area's activity in 2025 were:

Growth in lending activity in the Group's wholesale businesses stood at 27.8% compared to the end of 2024; Rest of Business (the United States, Asia and Europe) and Spain driving this growth, with significant operations in project finance and corporate loans, and strong performance in transactional banking.

Customer funds increased by 36.8%, boosted in particularly by the growth in customer deposits in Spain and in Rest of Business.

The most relevant aspects related to the area's activity in the fourth quarter of 2025 were:

Lending stood at the end of December 2025, 11.2% above the balance at September 30, 2025, continuing the upward trend shown in recent quarters. Notable growth was observed both in Investment Banking & Finance (IB&F), especially in the Rest of Business, followed by Mexico and Spain.

Customer funds increased by 11.9% during the fourth quarter of the year 2025 especially in Spain, thanks to notable transactions with customers and credit institutions.

Results

CIB generated a net attributable profit of €3,073m in 202516. Excluding the impact of currency fluctuations, this result represents a 31.9% increase over the previous year, which reflects again the strength of the Group's wholesale businesses, with the aim of offering a value proposition focused on the needs of its customers.

All business divisions posted double-digit revenue growth: Global Markets with good behavior in all its products, particularly in currency, interest rates and equities; Global Transaction Banking (GTB), thanks to the positive evolution of recurring revenues, mainly net interest income; excellent results in IB&F, with singular operations that have generated commission income and a positive evolution of net interest income.

The most relevant aspects of the year-on-year income statement evolution of this aggregate as of end of December 2025 are summarized below:

Net interest income increased by 48.5%, thanks to the continued growth of the portfolio in both 2024 and in 2025, as well as effective price management. By geographical areas, the performance of Spain, the United States, Turkey and Mexico stands out.

Net fees and commissions grew by 26.8%, with significant activity in almost all the geographical areas, particularly Rest of Business and Mexico. All business lines have been boosted by significant agreements throughout the year, with IB&F's operations standing out.

Year-on-year increase in the NTI (+4.9%), with a particularly strong performance in the United States thanks to the commercial activity in interest rates, credit, and equities.

Operating expenses grew by 19.7%. Higher personnel expenses were recorded, associated with strategic plans and new capacities. There were also higher overheads due to higher technological expenses resulting from the execution of strategic projects for the area. However, the efficiency ratio stood at 28.2% at the end of December, a significant improvement of 209 basis points compared to 2024, thanks to the strong boost in gross income.

Provisions for impairment on financial assets line recorded a release of €70m, mainly originating from customers in the real estate sector in Turkey.

In the fourth quarter of 2025 and excluding the effect of the variation in exchange rates, the Group's wholesale business generated a net attributable profit of €758m, which is 5.9% lower compared to the previous quarter. This evolution is mainly due to the growth in operating expenses, which offset the positive performance of the area's gross income.

16 The additional pro forma information from CIB excludes the application of hyperinflation accounting and the Group's wholesale business in Venezuela.

Read legal disclaimer of this report.