Balance sheet and business activity

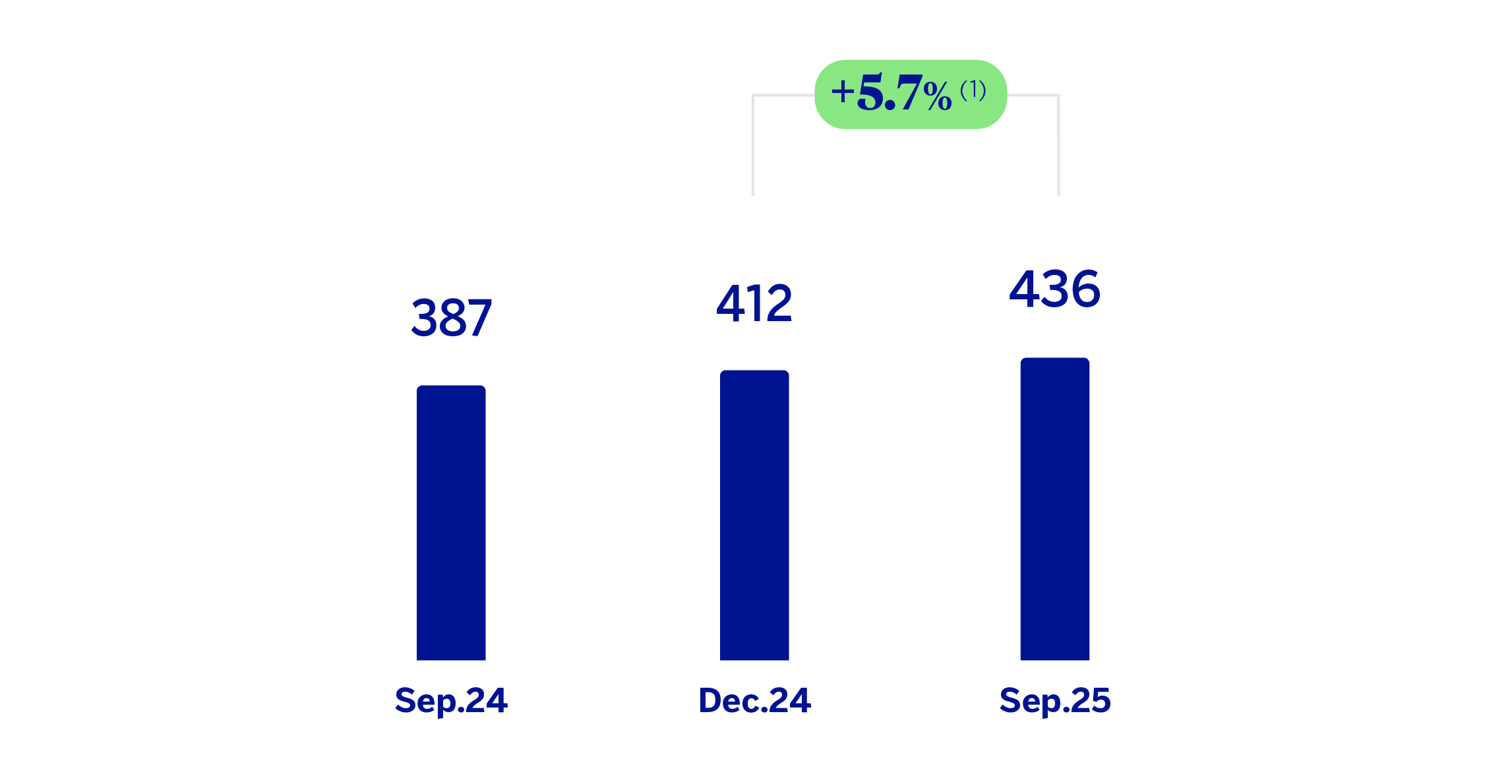

During the first nine months of 2025, loans and advances to customers increased by 5.7%, driven by the dynamism of the wholesale segment. Of particular note within this segment was the higher volume of loans to business, which grew by 5.9% at the Group level. Loans to individuals increased by 4.2%, with consumer and mortgage loans showing greater dynamism (8.9% and 2.9%, respectively).

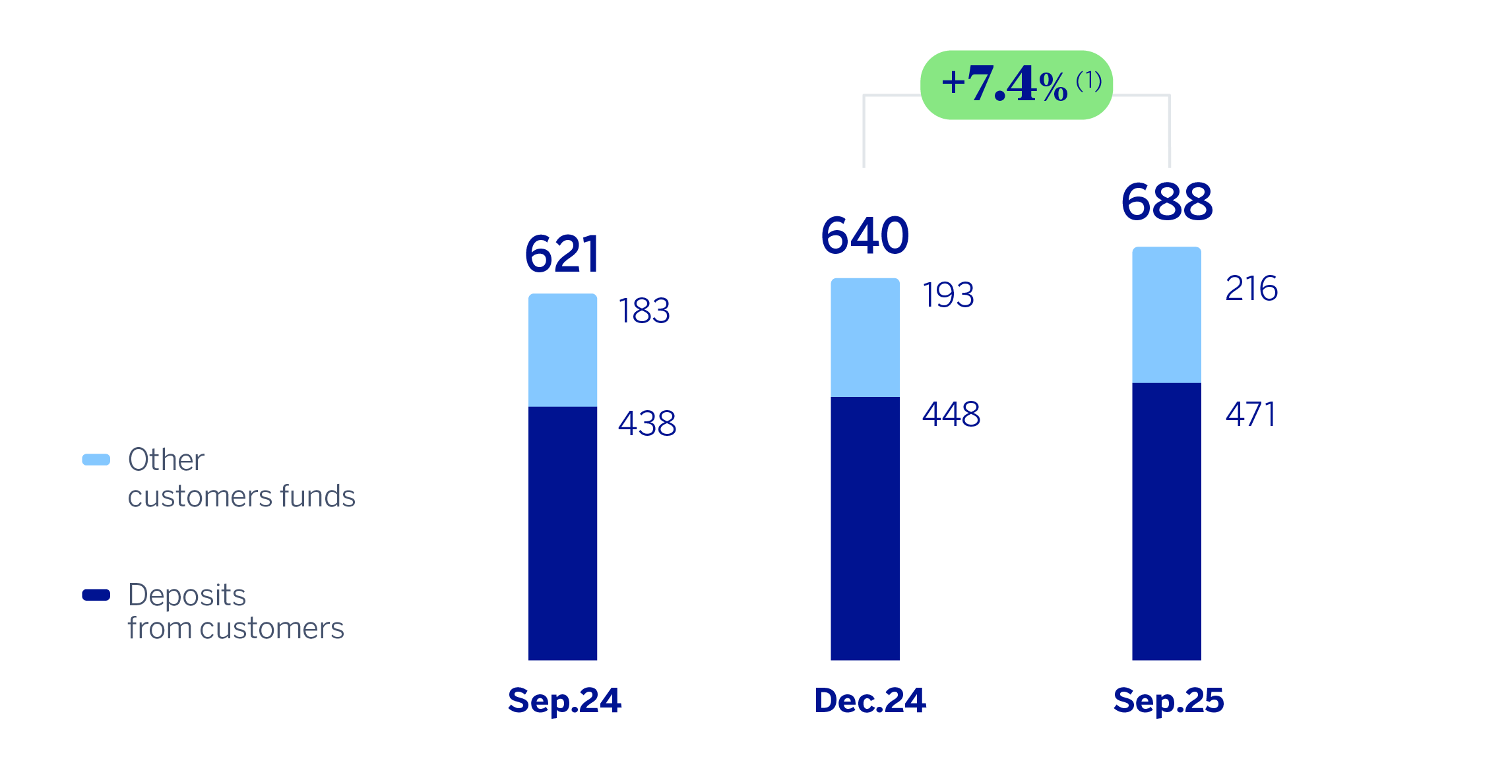

Customer funds grew by 7.4% in the first nine months of the year, driven not only by mutual funds and managed portfolios, which grew by 13.2%, but also by deposits from customers, which increased by 5.3% at Group level, driven largely by time deposits (+12.6%).

| CONSOLIDATED BALANCE SHEET (MILLIONS OF EUROS) | ||||

|---|---|---|---|---|

| 30-09-25 | 𝚫 % | 31-12-24 | 30-09-24 | |

| Cash, cash balances at central banks and other demand deposits | 57,125 | 11.7 | 51,145 | 58,588 |

| Financial assets held for trading | 111,037 | 1.9 | 108,948 | 127,551 |

| Non-trading financial assets mandatorily at fair value through profit or loss | 10,845 | 2.8 | 10,546 | 9,560 |

| Financial assets designated at fair value through profit or loss | 942 | 12.7 | 836 | 869 |

| Financial assets at fair value through accumulated other comprehensive income | 59,562 | 0.9 | 59,002 | 59,961 |

| Financial assets at amortized cost | 536,003 | 6.7 | 502,400 | 475,861 |

| Loans and advances to central banks and credit institutions | 32,815 | 6.2 | 30,909 | 31,615 |

| Loans and advances to customers | 436,165 | 5.7 | 412,477 | 386,731 |

| Debt securities | 67,023 | 13.6 | 59,014 | 57,515 |

| Investments in joint ventures and associates | 1,006 | 1.7 | 989 | 973 |

| Tangible assets | 9,253 | (5.2) | 9,759 | 9,351 |

| Intangible assets | 2,667 | 7.1 | 2,490 | 2,322 |

| Other assets | 24,622 | (6.3) | 26,287 | 24,304 |

| Total assets | 813,063 | 5.3 | 772,402 | 769,341 |

| Financial liabilities held for trading | 86,758 | 0.2 | 86,591 | 98,313 |

| Other financial liabilities designated at fair value through profit or loss | 17,273 | 15.5 | 14,952 | 14,443 |

| Financial liabilities at amortized cost | 617,649 | 5.7 | 584,339 | 571,381 |

| Deposits from central banks and credit institutions | 49,176 | 0.2 | 49,074 | 48,547 |

| Deposits from customers | 471,364 | 5.3 | 447,646 | 437,834 |

| Debt certificates | 77,428 | 10.8 | 69,867 | 67,325 |

| Other financial liabilities | 19,681 | 10.9 | 17,753 | 17,676 |

| Liabilities under insurance and reinsurance contracts | 12,303 | 12.0 | 10,981 | 10,970 |

| Other liabilities | 17,271 | 11.2 | 15,525 | 17,461 |

| Total liabilities | 751,253 | 5.5 | 712,388 | 712,568 |

| Non-controlling interests | 4,165 | (4.5) | 4,359 | 3,883 |

| Accumulated other comprehensive income | (18,674) | 8.4 | (17,220) | (17,647) |

| Shareholders’ funds | 76,319 | 4.7 | 72,875 | 70,536 |

| Total equity | 61,809 | 3.0 | 60,014 | 56,772 |

| Total liabilities and equity | 813,063 | 5.3 | 772,402 | 769,341 |

| Memorandum item: | ||||

| Guarantees given | 68,531 | 6.7 | 64,257 | 63,571 |

| LOANS AND ADVANCES TO CUSTOMERS (MILLIONS OF EUROS) | ||||

|---|---|---|---|---|

| 30-09-25 | 𝚫 % | 31-12-24 | 30-09-24 | |

| Public sector | 26,350 | 19.2 | 22,108 | 21,823 |

| Individuals | 185,250 | 4.2 | 177,751 | 169,967 |

| Mortgages | 97,281 | 2.9 | 94,577 | 92,707 |

| Consumer | 49,625 | 8.9 | 45,562 | 43,211 |

| Credit cards | 26,756 | 2.6 | 26,067 | 22,779 |

| Other loans | 11,588 | 0.4 | 11,544 | 11,269 |

| Business | 222,487 | 5.9 | 210,017 | 191,511 |

| Non-performing loans | 13,813 | (2.8) | 14,211 | 14,590 |

| Loans and advances to customers (gross) | 447,901 | 5.6 | 424,087 | 397,891 |

| Allowances (1) | (11,736) | 1.1 | (11,611) | (11,160) |

| Loans and advances to customers | 436,165 | 5.7 | 412,477 | 386,731 |

| (1) Allowances include valuation adjustments for credit risk throughout the expected residual life in those financial instruments that have been acquired (mainly originating from the acquisition of Catalunya Banc, S.A.). As of September 30, 2025, December 31, 2024 and September 30, 2024 the remaining amount was €81m, €107m and €114m, respectively. | ||||

LOANS AND ADVANCES TO CUSTOMERS

(BILLIONS OF EUROS)

(1) At constant exchange rates: +10.4%.

CUSTOMER FUNDS

(BILLIONS OF EUROS)

(1) At constant exchange rates: +11.7%.

| CUSTOMER FUNDS (MILLIONS OF EUROS) | ||||

|---|---|---|---|---|

| 30-09-25 | 𝚫 % | 31-12-24 | 30-09-24 | |

| Deposits from customers | 471,364 | 5.3 | 447,646 | 437,834 |

| Current accounts | 341,346 | 2.9 | 331,780 | 314,916 |

| Time deposits | 119,754 | 12.6 | 106,362 | 102,454 |

| Other deposits | 10,264 | 8.0 | 9,503 | 20,464 |

| Other customer funds | 216,417 | 12.4 | 192,604 | 183,213 |

| Mutual funds and investment companies and customer portfolios (1) | 176,953 | 13.2 | 156,265 | 147,769 |

| Pension funds | 32,923 | 4.1 | 31,614 | 30,662 |

| Other off-balance sheet funds | 6,541 | 38.4 | 4,726 | 4,782 |

| Total customer funds | 687,781 | 7.4 | 640,250 | 621,047 |

| (1) Includes the customer portfolios in Spain, Mexico, Peru (preliminary data as of 30-09-2025) and Colombia (preliminary data as of 30-09-2025). | ||||

Read legal disclaimer of this report.