Turkey

Highlights for the period January - September 2025

- Customer funds grew faster than lending activity during the first nine months

- Increased in net interest income driven by growth in activity and in Turkish lira spread

- Strong growth in net fees and commissions and lower year-on-year impact from hyperinflation

- Favorable year-on-year evolution of net attributable profit

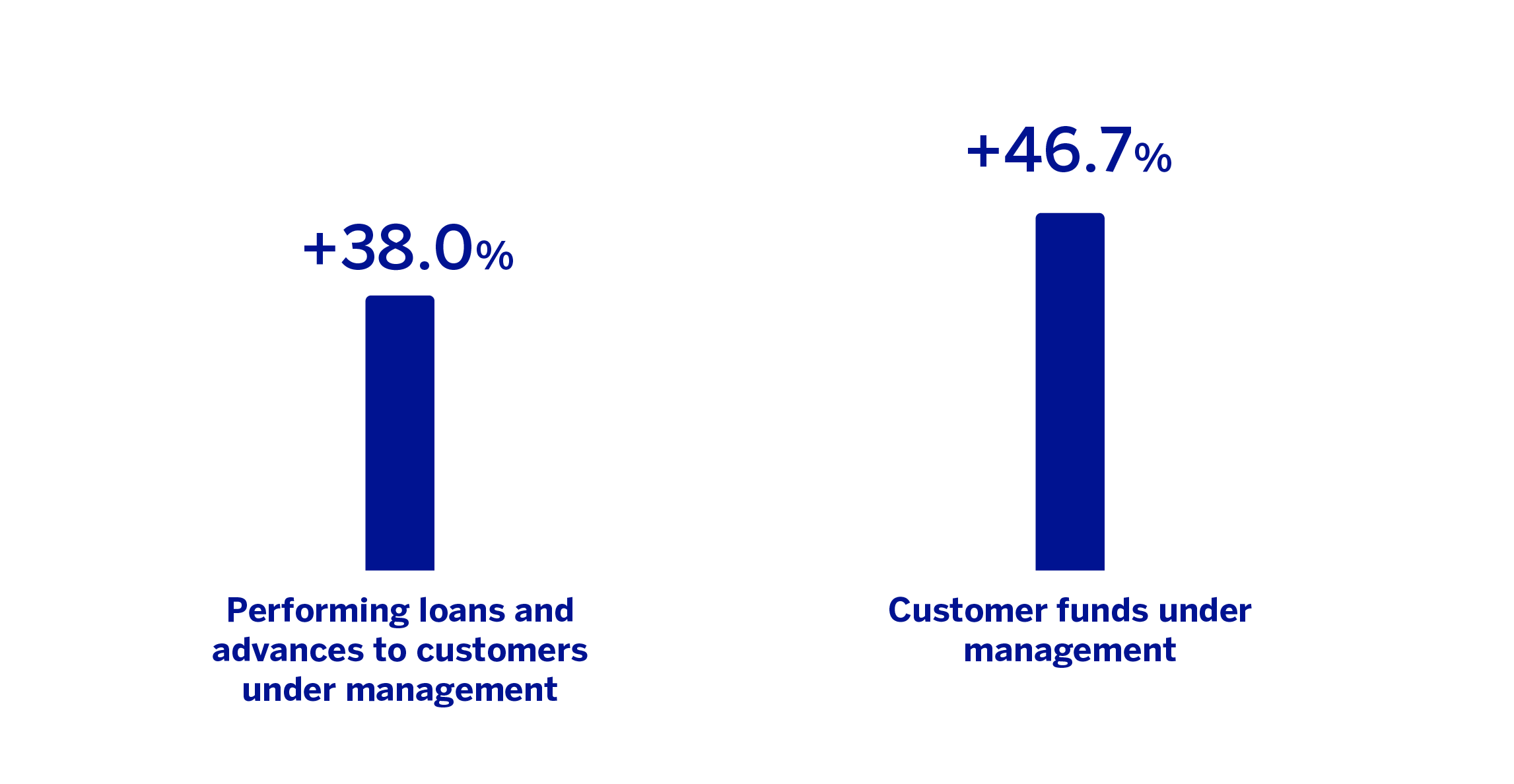

BUSINESS ACTIVITY (1)

(VARIATION AT CONSTANT EXCHANGE RATE COMPARED TO 31-12-24)

(1) Excluding repos.

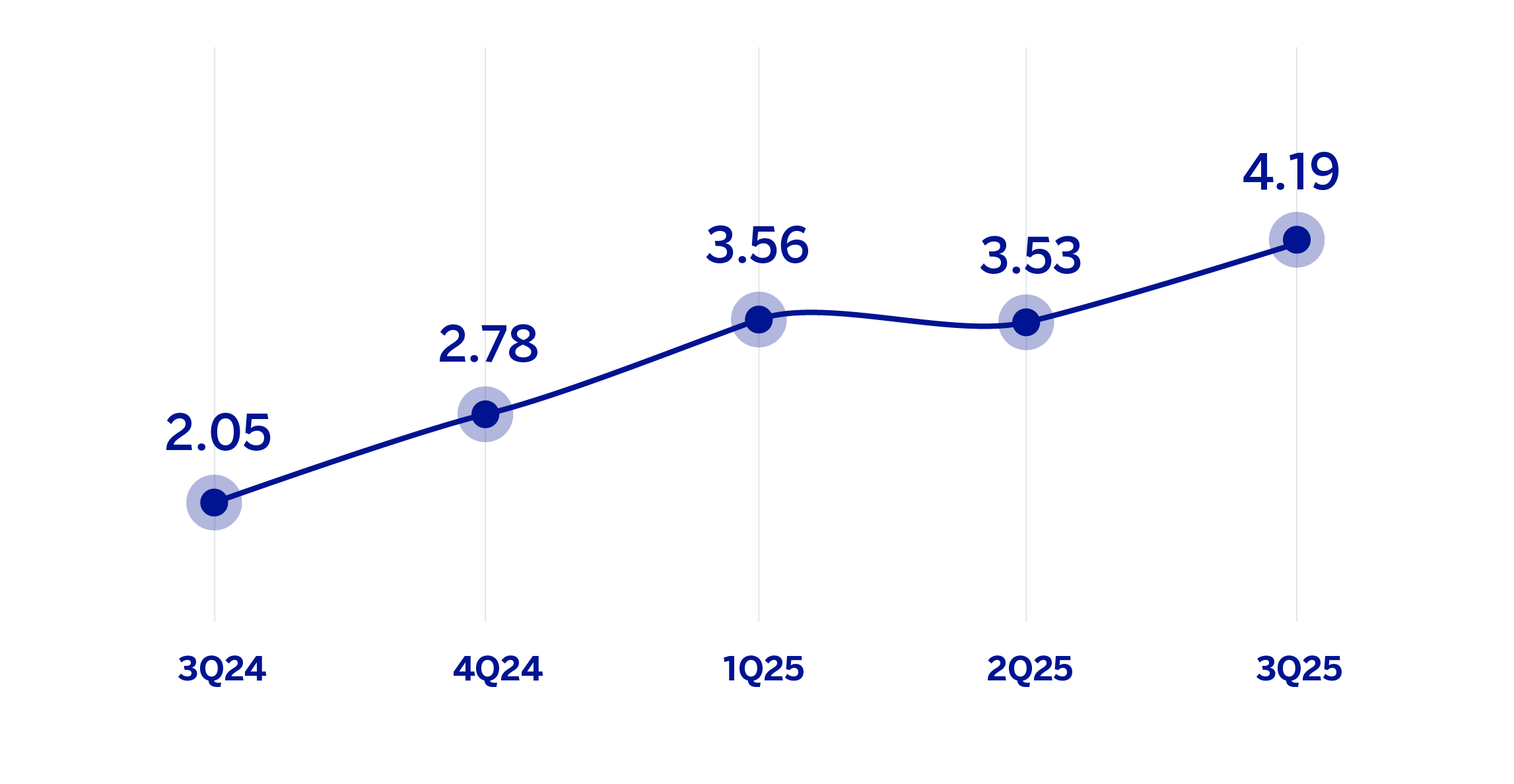

NET INTEREST INCOME / AVERAGE TOTAL ASSETS

(PERCENTAGE AT CONSTANT EXCHANGE RATE)

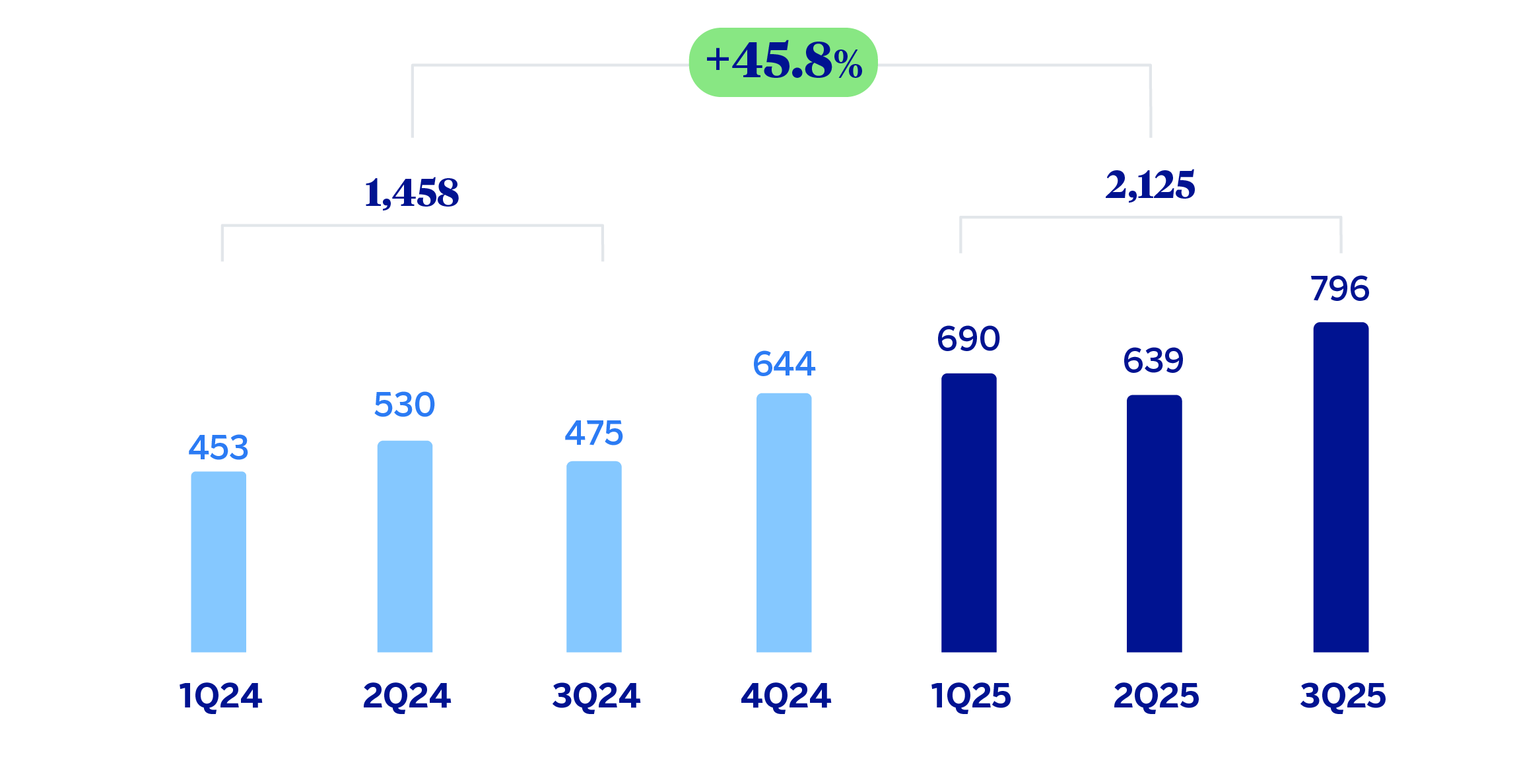

OPERATING INCOME

(MILLIONS OF EUROS AT CURRENT EXCHANGE RATE)

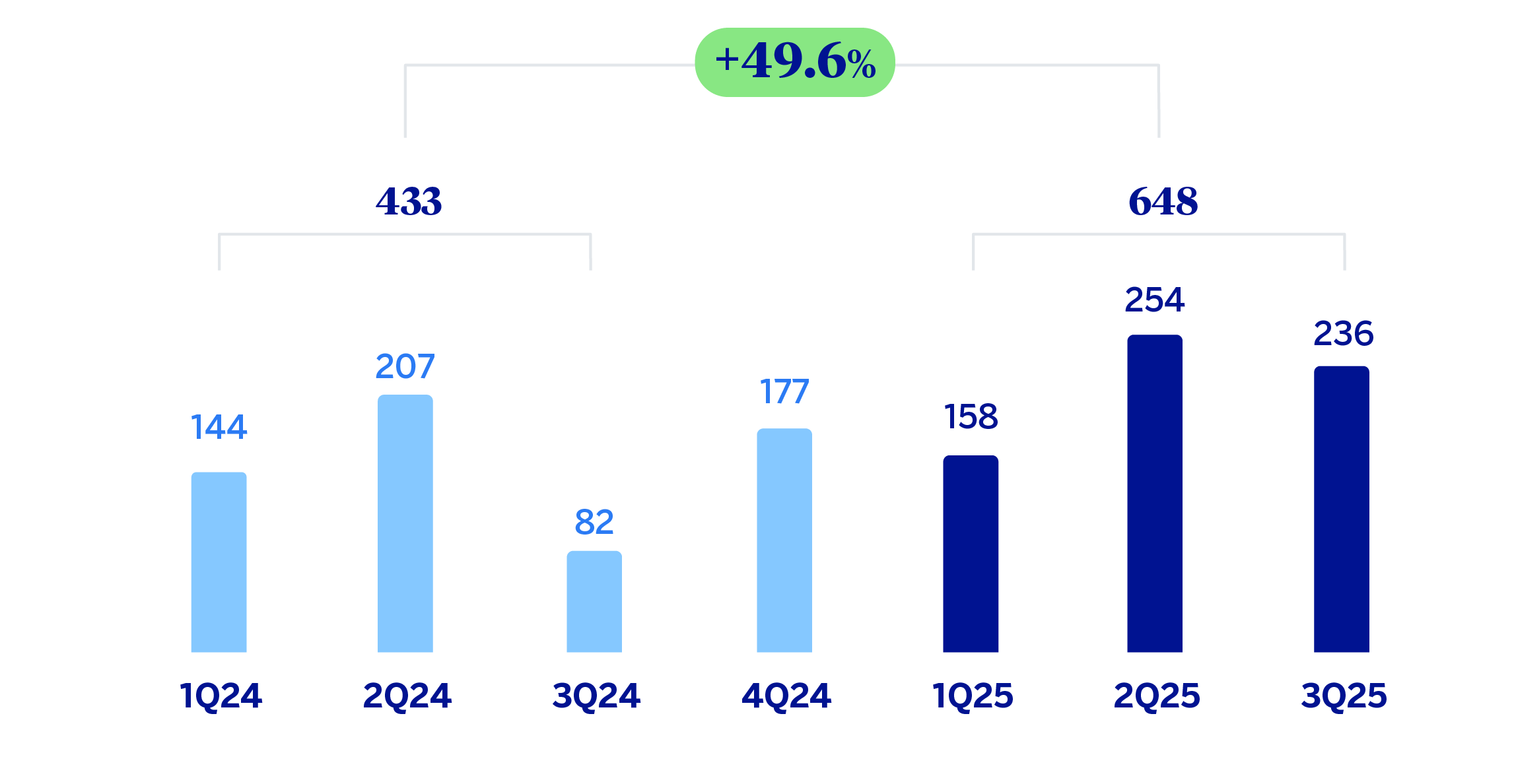

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS AT CURRENT EXCHANGE RATE)

| FINANCIAL STATEMENTS AND RELEVANT BUSINESS INDICATORS (MILLIONS OF EUROS AND PERCENTAGE) | ||||

|---|---|---|---|---|

| Income statement | Jan.-Sep.25 | 𝝙 % | 𝝙 % (1) | Jan.-Sep.24 |

| Net interest income | 2,137 | 131.0 | 185.8 | 925 |

| Net fees and commissions | 1,602 | 14.1 | 41.6 | 1,404 |

| Net trading income | 340 | (59.4) | (49.7) | 836 |

| Other operating income and expenses | (303) | (7.6) | (43.9) | (328) |

| Gross income | 3,776 | 33.1 | 87.4 | 2,838 |

| Operating expenses | (1,651) | 19.6 | 46.4 | (1,380) |

| Personnel expenses | (952) | 17.1 | 45.2 | (813) |

| Other administrative expenses | (523) | 24.8 | 54.4 | (419) |

| Depreciation | (176) | 19.1 | 32.5 | (148) |

| Operating income | 2,125 | 45.8 | 139.5 | 1,458 |

| Impairment on financial assets not measured at fair value through profit or loss | (667) | 100.6 | 150.0 | (333) |

| Provisions or reversal of provisions and other results | (13) | n.s. | n.s. | 98 |

| Profit (loss) before tax | 1,445 | 18.1 | 103.6 | 1,223 |

| Income tax | (674) | (4.9) | 19.2 | (709) |

| Profit (loss) for the period | 771 | 49.8 | n.s. | 515 |

| Non-controlling interests | (123) | 50.7 | n.s. | (81) |

| Net attributable profit (loss) | 648 | 49.6 | n.s. | 433 |

| Balance sheets | 30-09-25 | 𝝙 % | 𝝙 % (1) | 31-12-24 |

| Cash, cash balances at central banks and other demand deposits | 9,996 | 13.2 | 50.5 | 8,828 |

| Financial assets designated at fair value | 4,824 | 7.1 | 42.4 | 4,503 |

| Of which: Loans and advances | 21 | n.s. | n.s. | 2 |

| Financial assets at amortized cost | 67,484 | 4.0 | 38.2 | 64,893 |

| Of which: Loans and advances to customers | 50,628 | 4.8 | 39.3 | 48,299 |

| Tangible assets | 1,826 | (11.5) | 5.7 | 2,064 |

| Other assets | 2,642 | 5.9 | 38.8 | 2,494 |

| Total assets/liabilities and equity | 86,771 | 4.8 | 38.9 | 82,782 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 1,662 | (14.5) | 13.7 | 1,943 |

| Deposits from central banks and credit institutions | 4,274 | 0.2 | 33.1 | 4,267 |

| Deposits from customers | 60,866 | 4.8 | 39.2 | 58,095 |

| Debt certificates | 6,048 | 33.9 | 77.9 | 4,517 |

| Other liabilities | 5,107 | (10.6) | 13.8 | 5,714 |

| Regulatory capital allocated | 8,813 | 6.9 | 41.8 | 8,245 |

| Relevant business indicators | 30-09-25 | 𝝙 % | 𝝙 % (1) | 31-12-24 |

| Performing loans and advances to customers under management (2) | 50,093 | 3.8 | 38.0 | 48,242 |

| Non-performing loans | 2,512 | 24.6 | 65.6 | 2,016 |

| Customer deposits under management (2) | 59,659 | 3.9 | 38.0 | 57,443 |

| Off-balance sheet funds (3) | 23,691 | 31.1 | 74.2 | 18,076 |

| Risk-weighted assets | 69,983 | 8.0 | 43.0 | 64,821 |

| RORWA (4) | 1.49 | 1.17 | ||

| Efficiency ratio (%) | 43.7 | 50.1 | ||

| NPL ratio (%) | 3.7 | 3.1 | ||

| NPL coverage ratio (%) | 78 | 96 | ||

| Cost of risk (%) | 1.76 | 1.27 | ||

| (1) At constant exchange rate. (2) Excluding repos. (3) Includes mutual funds and pension funds. (4) For more information on the calculation methodology, as well as the calculation of the metric at the consolidated Group level, see Alternative Performance Measures at this report. |

||||

Macro and industry trends

Economic activity has been more dynamic than expected in the second quarter of 2025, which, combined with looser monetary conditions and greater fiscal policy support, keeps growth expectations for the coming quarters relatively favorable. According to BBVA Research, GDP growth could reach 3.7% in 2025, two tenths of a percentage point above the previous forecast and remain around 4% in 2026. Meanwhile, inflation has continued to moderate, albeit at a slower pace than anticipated, and is expected to continue doing so going forward: in December, it could reach 32.7%, compared to 33.3% in September, and converge towards levels of 25% throughout 2026. This should allow the Central Bank to continue with gradual interest rate cuts, which could close 2025 at 38.5%, down from 40.5% in September, and reach levels close to 30% throughout 2026.

The Turkish banking system continues to be affected by the impact of inflation. The total volume of credit in the system increased by 40.0% year-on-year at the end of August 2025, similar to the previous months. The stock of credit continues to be driven by consumer credit and credit card portfolios (+46.9% year-on-year) and by corporate lending (+37.8% year-on-year). Total deposits maintained the strength of recent months and grew by 36.2% year-on-year at the end of August 2025, with similar growth in Turkish lira and dollar deposits (+38.3% and +32.5% respectively). Dollarization of the system decreased to 35.9% in August of this year, from 36.9% a year earlier. The system's NPL ratio remains well under control and stood at 2.43% in August 2025. The capital indicators remained at comfortable levels at the same date.

Unless expressly stated otherwise, all comments below on rates of changes for both activity and results will be presented at constant exchange rates. These rates, together with changes at current exchange rates, can be observed in the attached tables of the financial statements and relevant business indicators. For the conversion of these figures, the end of period exchange rate as of September 30, 2025 is used, reflecting the considerable depreciation by the Turkish lira in the last twelve months. Likewise, the Balance sheet, the Risk-Weighted Asset (RWA) and the equity are affected.

Activity15

The most relevant aspects related to the area's activity during the first nine months of 2025 were:

Lending activity (performing loans under management) recorded an increase of 38.0% between January and September 2025, mainly driven by the growth in Turkish lira loans (+30.2%). This growth was largely supported by the performance of credit cards and business banking loans. Foreign currency loans (in US dollars) increased by 15.1%, boosted by the increase in activity with customers focused on foreign trade (with natural hedging of exchange rate risk).

Customer deposits (70.1% of the area's total liabilities as of September 30, 2025) remained the main source of funding for the balance sheet and increased by 38.0% favored by evolution the positive performance of Turkish lira time deposits (+23.7%), which represent a 81.3% of total customer deposits in local currency. Balances deposited in foreign currency (in U.S. dollars) increased by 25.7%, driven by the demand deposits +18.9%. Thus, as of September 30, 2025, Turkish lira deposits accounted for 63% of total customer deposits in the area. For its part, off-balance sheet funds grew by 74.2%.

The most relevant aspects related to the area’s activity in the third quarter of 2025 were:

Lending activity (performing loans under management) increased by 10.0%, mainly driven by the growth in Turkish lira loans (+10.7%, above the quarterly inflation rate, which stood at 7.5%). Within Turkish lira loans, credit cards continued to drive growth, followed to a lesser extent by consumer loans, which grew at rates of 14.7% and 9.1%, respectively. Growth in foreign currency loans slowed down and stood at 2.9%.

In terms of asset quality, the NPL ratio increased by 28 basis points compared to the figure as of the end of June to 3.7%, mainly as a result of the increase in non-performing loans, both in the retail and the wholesale portfolios, partially offset by sales of impaired loans and recoveries. On the other hand, the NPL coverage ratio recorded a decrease of 805 basis points in the quarter due to the increase of non-performing loans, standing at 78% as of September 30, 2025.

In the evolution of customer funds during the quarter, off-balance sheet funds stood out, which recorded growth of 22.2%. On the other hand, customer deposits increased by 9.5% with higher balances in both, US dollar deposits (+10.2%), and Turkish lira balances (+2.0%) driven in both cases by demand deposits.

Results

Turkey reached a net attributable profit of €648m during the first nine months of 2025, which compares very favorably with the result achieved in the same period of the previous year, as a result of the good performance of recurring revenues in banking business (net interest income and net fees and commissions) and a less negative hyperinflation impact.

As mentioned above, the year-on-year comparison of the accumulated income statement at the end of September 2025 at current exchange rate is affected by the depreciation of the Turkish lira in the last year (-21.6%). To isolate this effect, the highlights of the results of the first nine months of 2025 at constant exchange rates are summarized below:

Net interest income grew year-on-year, mainly driven by the dynamism of lending activity and by the improvement of the Turkish lira customer spread. In addition, the central bank has increased the remuneration of certain Turkish lira reserves since February 2024.

Net fees and commissions recorded a significant increase, driven by the solid performance in fees and commissions associated with payment methods, followed by those related to asset management, insurances and guarantees, which compensated the increase of the paid commissions for payroll gatherings.

Lower NTI, due to the currency positions the area maintains, partially offset by higher results from the Global Markets unit.

The other operating income and expenses line had a balance of €-303m, which compares favorably with the previous year. This line incorporates, among others, the loss on the net monetary position, together with its partial offset by the income derived from inflation-linked bonds (CPI linkers). The net impact of both effects was less negative at the end of September 2025, compared with the same period of 2024. This line also includes the results of the subsidiaries of Garanti BBVA and the evolution of the insurance business, whose contribution was increased in both cases compared to the cumulative total at the end of September 2024.

Operating expenses continued growing, mainly due to higher personnel expenses, linked to the growth in the workforce and a salary review in the context of high inflation. On the other hand, operating expenses also increased, highlighting the higher advertising expenditures and, to a lesser extent, technology expenses.

Regarding the impairment on financial assets, higher provisions were recorded, which is explained by the growth of the activity and higher requirements in retail portfolios, partially offset by releases in the wholesale portfolio. Meanwhile, the cumulative cost of risk as of September 30, 2025 stood at 1.76%, with an increase of 12 basis points in the quarter.

The provisions and other results line closed September 2025 at €-13m, which are lower than the releases in the same period of the previous year (€98m) associated with significant recoveries from wholesale customers and the revaluation of real estate recorded in the first nine months of 2024.

In the third quarter of 2025, the net attributable profit of Turkey stood at €279m, which represents a decrease compared to the previous quarter mainly as a result of the increase in the level of impairment on financial assets due to lower level of releases from the wholesale portfolio, along with higher operating expenses. This was partially offset by better performance in recurring revenues and NTI.

15 The variation rates of loans in Turkish lira and loans in foreign currency (U.S. dollars) are calculated based on local activity data and refer only refer to Garanti Bank and therefore exclude the subsidiaries of Garanti BBVA, mainly in Romania and Netherlands.

Read legal disclaimer of this report.