Macroeconomic environment

Economic growth remains relatively dynamic, mainly in the United States and in the services sector, and inflation has moderated in recent months. These trends are taking place in a context in which, on the one hand, the still high interest rates have contributed to a gradual softening of demand and less dynamism in the labor markets, and, on the other hand, supply conditions have improved, due to the fall in the price of raw materials, the increase in labor supply and signs of higher productivity in the United State, among other factors.

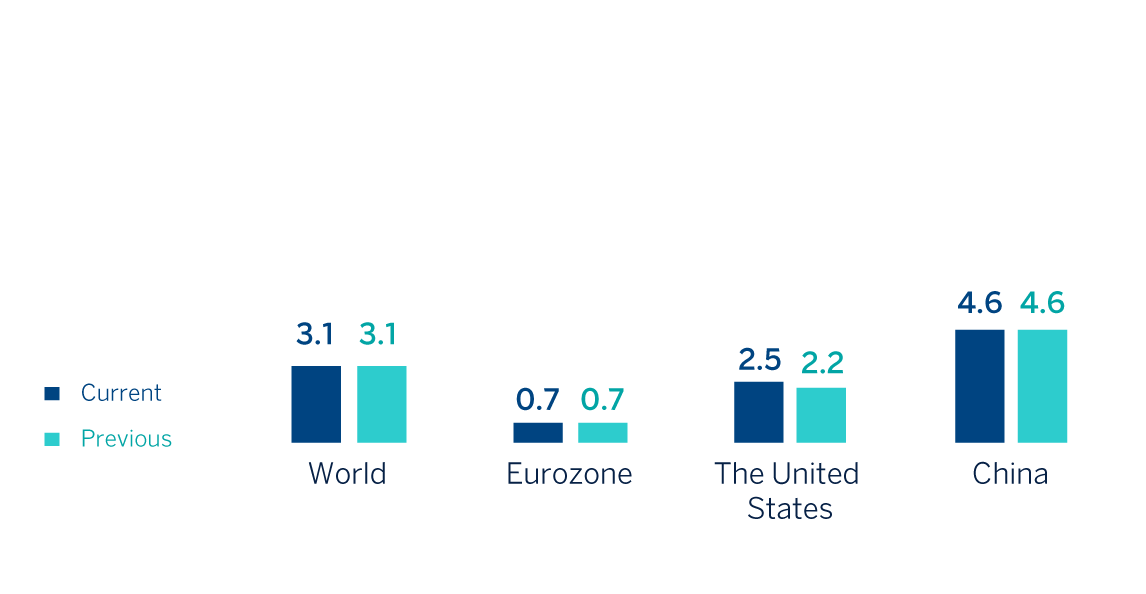

Despite the recent resilience, according to BBVA Research, it is most likely that further moderation in demand paves the way for moderate global GDP growth and an additional slowdown in inflation over the coming months. Global growth will reach 3.1% in 2024 and 3.3% in 2025, unchanged from previous forecasts. In the United States, growth is expected to soften, but better than expected data in recent months, supports an upward revision of the GDP growth forecasts to 2.5% in 2024 and 2.1% in 2025 (30 and 20 basis points above the previous forecasts, respectively). In the Eurozone, the growth forecasts remains unchanged at 0.7% in 2024 and 1.4% in 2025. The activity is expected to remain relatively weak, but it will recover gradually thanks to a steady decline in interest rates and inflation. In China, despite the deceleration observed in the last months and a series of structural challenges, increasing monetary, fiscal and regulatory incentives are expected to help support the economic growth at levels close to 4.6% in 2024 and to 4.2% in 2025, unchanged from previous forecasts.

In this context, recent falls in inflation have reinforced monetary easing in most geographical areas. In United States, the Federal Reserve has started a cycle of interest rate cuts with a downward revision of the reference rate by 50 basis points to 5.0% in September. In the Eurozone, the European Central Bank (hereafter the ECB) has cut deposit facility rates from 4.0% at the beginning June to 3.25% in October. Most likely, according to BBVA Research, interest rates in both regions will continue to reduce gradually over the coming months, until they converge to approximately 3.0% in the United States and 2.5% in the Eurozone, higher levels than those seen in prior years to the coronavirus pandemic.

Risks to growth and inflation are now more balanced. On the one hand, the slowdown in labor markets and structural challenges in China raise fears of a sharp deceleration in activity. On the other hand, the dynamism of demand, the tone of fiscal policy and geopolitical tensions keep risks of high inflation alive.

GDP GROWTH ESTIMATES IN 2024

(PERCENTAGE. YEAR-ON-YEAR VARIATION)

Source: BBVA Research estimates.