Additional pro forma information: Corporate & Investment Banking

Highlights

- Solid credit growth driven by Investment Banking & Finance and Global Transaction Banking

- Favorable evolution of recurring income and NTI continues

- Gross margin strength in all geographical areas

- Increase of net attributable profit in the quarter

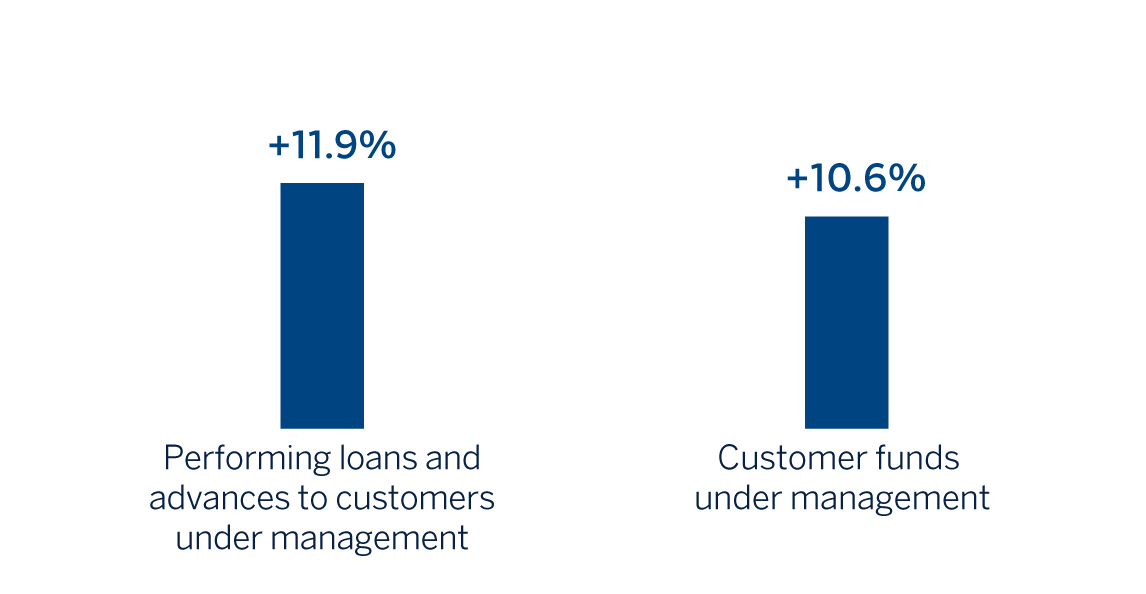

BUSINESS ACTIVITY (1)

(VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO 31-12-23)

(1) Excluding repos.

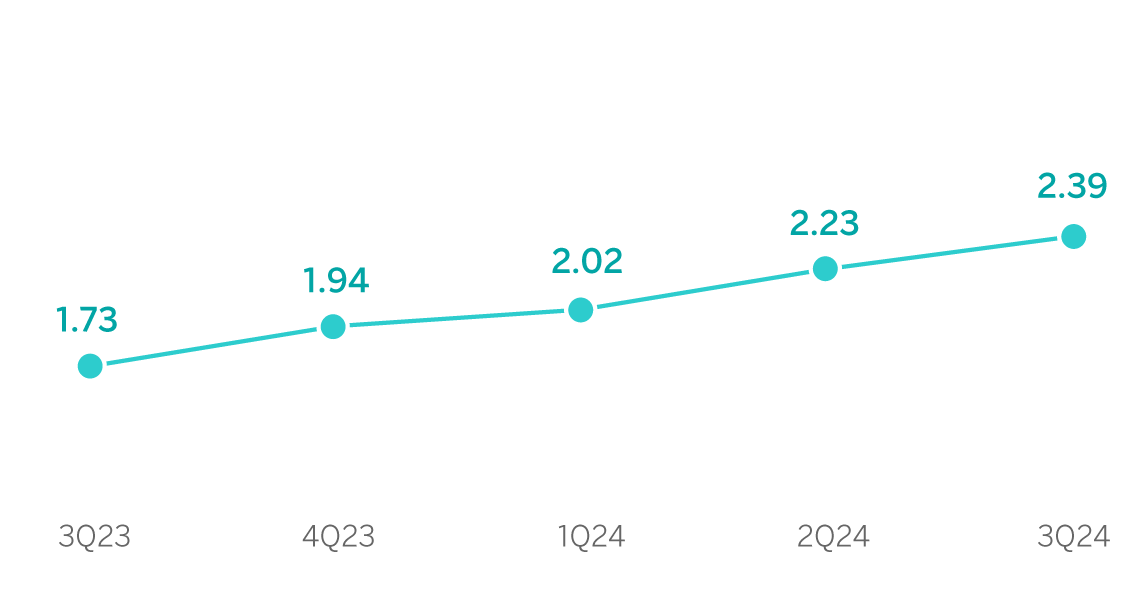

GROSS INCOME / AVERAGE TOTAL ASSETS

(PERCENTAGE AT CONSTANT EXCHANGE RATES)

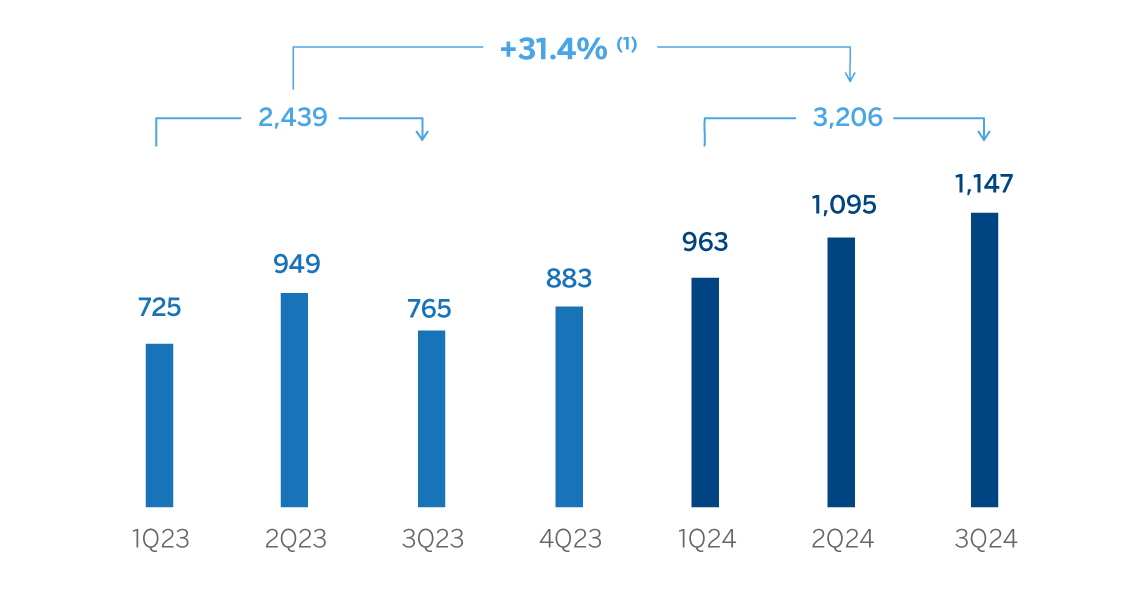

OPERATING INCOME

(MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +15.0%.

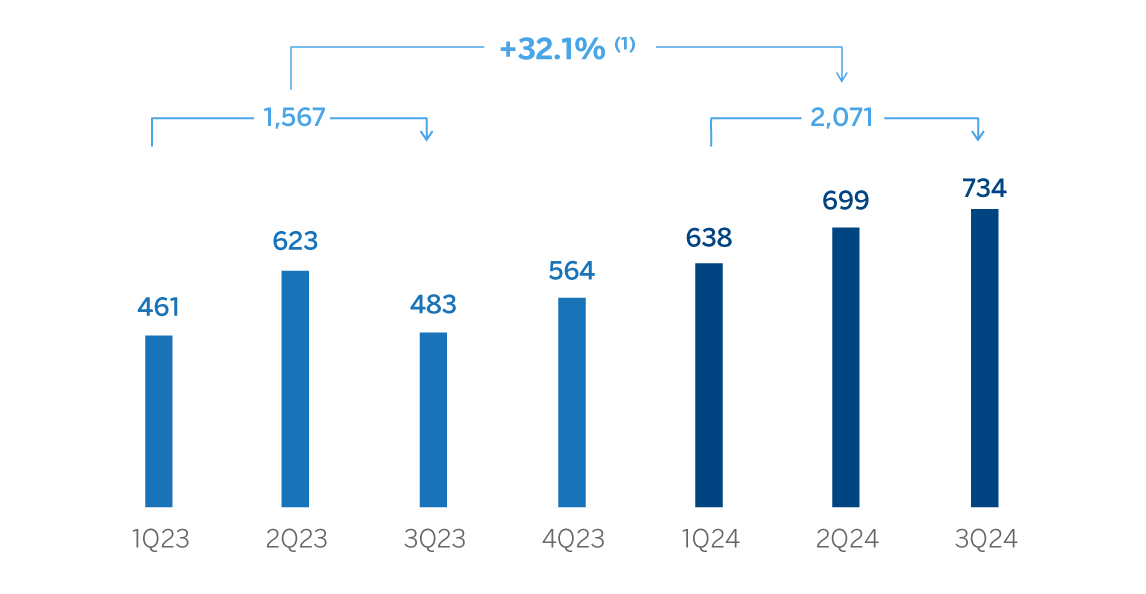

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +18.4%.

The pro forma information of CIB does not include the application of hyperinflation accounting nor the wholesale business of the Group in Venezuela.

| FINANCIAL STATEMENTS AND RELEVANT BUSINESS INDICATORS (MILLIONS OF EUROS AND PERCENTAGE) | ||||

|---|---|---|---|---|

| Income statement | Jan.-Sep.24 | ∆ % | ∆ %(2) | Jan.-Sep.23 (1) |

| Net interest income | 1,841 | 19.1 | 33.2 | 1,545 |

| Net fees and commissions | 883 | 11.1 | 17.8 | 795 |

| Net trading income | 1,616 | 12.4 | 29.2 | 1,438 |

| Other operating income and expenses | (44) | (23.7) | (13.5) | (58) |

| Gross income | 4,295 | 15.5 | 29.0 | 3,720 |

| Operating expenses | (1,089) | 17.0 | 22.1 | (931) |

| Personnel expenses | (525) | 19.8 | 23.3 | (438) |

| Other administrative expenses | (481) | 16.2 | 24.2 | (414) |

| Depreciation | (84) | 5.5 | 5.8 | (79) |

| Operating income | 3,206 | 15.0 | 31.4 | 2,789 |

| Impairment on financial assets not measured at fair value through profit or loss | 44 | n.s. | n.s. | (36) |

| Provisions or reversal of provisions and other results | (2) | n.s. | n.s. | 15 |

| Profit (loss) before tax | 3,248 | 17.4 | 33.5 | 2,768 |

| Income tax | (952) | 18.5 | 36.3 | (803) |

| Profit (loss) for the period | 2,296 | 16.9 | 32.4 | 1,964 |

| Non-controlling interests | (225) | 4.3 | 34.8 | (215) |

| Net attributable profit (loss) | 2,071 | 18.4 | 32.1 | 1,749 |

Balance sheets | 30-09-24 | ∆ % | ∆ %(2) | 31-12-23 |

| Cash, cash balances at central banks and other demand deposits | 6,924 | 41.2 | 43.6 | 4,905 |

| Financial assets designated at fair value | 138,035 | (13.4) | (11.8) | 159,372 |

| Of which: Loans and advances | 57,054 | (32.2) | (32.0) | 84,126 |

| Financial assets at amortized cost | 102,784 | 5.6 | 10.8 | 97,302 |

| Of which: Loans and advances to customers | 82,942 | 5.9 | 11.0 | 78,354 |

| Inter-area positions | — | — | — | — |

| Tangible assets | 146 | 4.0 | 7.6 | 141 |

| Other assets | 16,184 | 52.0 | 68.8 | 10,646 |

| Total assets/liabilities and equity | 264,074 | (3.0) | 0.1 | 272,366 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 94,202 | (27.6) | (27.2) | 130,081 |

| Deposits from central banks and credit institutions | 42,903 | 50.5 | 53.1 | 28,502 |

| Deposits from customers | 62,483 | 4.1 | 11.4 | 60,031 |

| Debt certificates | 5,827 | (4.1) | (2.7) | 6,076 |

| Inter-area positions | 41,286 | 40.8 | 54.2 | 29,315 |

| Other liabilities | 5,298 | (27.5) | (25.9) | 7,310 |

| Regulatory capital allocated | 12,074 | 9.3 | 15.7 | 11,050 |

Relevant business indicators | 30-09-24 | ∆ % | ∆ % (2) | 31-12-23 |

| Performing loans and advances to customers under management (3) | 82,749 | 6.8 | 11.9 | 77,510 |

| Non-performing loans | 867 | (4.1) | 7.9 | 905 |

| Customer deposits under management (3) | 56,718 | 4.1 | 10.8 | 54,483 |

| Off-balance sheet funds (4) | 3,854 | (8.0) | 7.2 | 4,189 |

| Efficiency ratio (%) | 25.4 | 26.5 | ||

General note: For the translation of the income statement in those countries where hyperinflation accounting is applied, the punctual exchange rate as of September 30, 2024 is used.

(1) Revised balances. For more information, please refer to the “Business Areas” section.

(2) At constant exchange rates.

(3) Excluding repos.

(4) Includes mutual funds, customer portfolios and other off-balance sheet funds.

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. For the conversion of these figures in those countries in which accounting for hyperinflation is applied, the end of period exchange rate as of September 30, 2024 is used. These rates, together with changes at current exchange rates, can be found in the attached tables of financial statements and relevant business indicators.

Activity

The most relevant aspects related to the area's activity in the first nine months of 2024 were:

- Solid growth in loan balances, compared to the end of 2023 (+11.9%) highlighting the favorable evolution of Investment Banking & Finance, with relevant Project Finance and Corporate Lending operations. By geographical area, the contribution from Europe, the New York branch and Mexico stood out.

- Customer funds increased (+10.6%) in the first nine months of the year, due to the increase in volumes in an environment of competitive prices, driven by the contribution of the branches in Europe and New York.

The most relevant aspects related to the area's activity in the third quarter of 2024 were:

- A further rebound in lending activity, which was 4.7% higher than at the end of June 2024, with growth in Europe and, to a lesser extent, in the New York branch.

- Growth of Customer funds during the third quarter of the year (+10.0%) mainly due to the evolution in Mexico, followed by Europe.

Results

CIB generated a net attributable profit of €2,071m the first nine months of 2024. These results represent an increase of 32.1% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globally and sustainability, with the purpose of being relevant to its clients15.

All business divisions have achieved good results, particularly highlighting the performance of Global Transaction Banking (GTB), particularly in Mexico, Turkey and South America, the contribution of Global Markets supported the reactivation of commercial activity and of Investment Banking & Finance (IB&F), with an excellent evolution of the interest margin in all geographies supported by volumes and price.

The most relevant aspects of the year-on-year evolution in the income statement of this aggregate as of end of September 2024 are summarized below:

- Net interest income for the quarter was 33.2% higher than in the same period of the previous year, partly due to the good performance of the business, which benefited from higher volumes and, in certain geographical areas, from price management.

- Net fees and commissions increased 17.8%, with positive evolution in all businesses. The primary market debt issuance activity, the liquidity management in South America and relevant operations in Project Finance and Corporate Lending are outstanding.

- Excellent NTI evolution (+29.2%), mainly due to the performance of the Global Markets unit. Commercial activity showed significant growth in all areas, except in Turkey, with a special mention to the performance in Spain, México and Europe. Fixed-income trading was particularly strong during the year, while currency trading slowed down compared to the previous year.

- Operating expenses increased by 22.1% due to new personnel hires carried out during 2023. On the other hand, general expenses continue to be affected by inflation and by higher technology expenses linked to the execution of strategic projects for the area; however, the efficiency ratio stood at 25.4% at the end of September 2024, which represents an improvement of 141 basis points compared to the figure registered at the end of September of 2023.

- Provisions for impairment on financial assets line recorded a net release of €44m, which compares favorably with provisions in the first nine months of 2023, due to the releases made in Turkey.

In the third quarter of 2024 and excluding the effect of the variation in exchange rates, the Group's wholesale businesses generated a net attributable profit of €734m (+5.1% compared to the previous quarter). This performance was mainly due to the favorable performance of net interest income, thanks to the increase in volumes and optimal management of transaction prices in certain geographical areas, together with the evolution of NTI, favored by the performance of the Global Markets unit. In addition, the quarter recorded releases due to lower loan portfolio requirements in South America, Europe and the United States.

15 CIB results do not include the application of hyperinflation accounting.