Macroeconomic environment

The United States' tariffs have risen notably, reaching historically high levels. Moreover, uncertainty about their final level remains a persistent source of risk. Trade negotiations between the United States and its main partners continue, and disputes persist over the legal validity of tariffs.

In this context, and given expectations of high fiscal deficits and concerns about the Fed's autonomy, the United States risk premium has risen, contributing to higher yields on long-term sovereign debt and has favored a depreciation of the dollar.

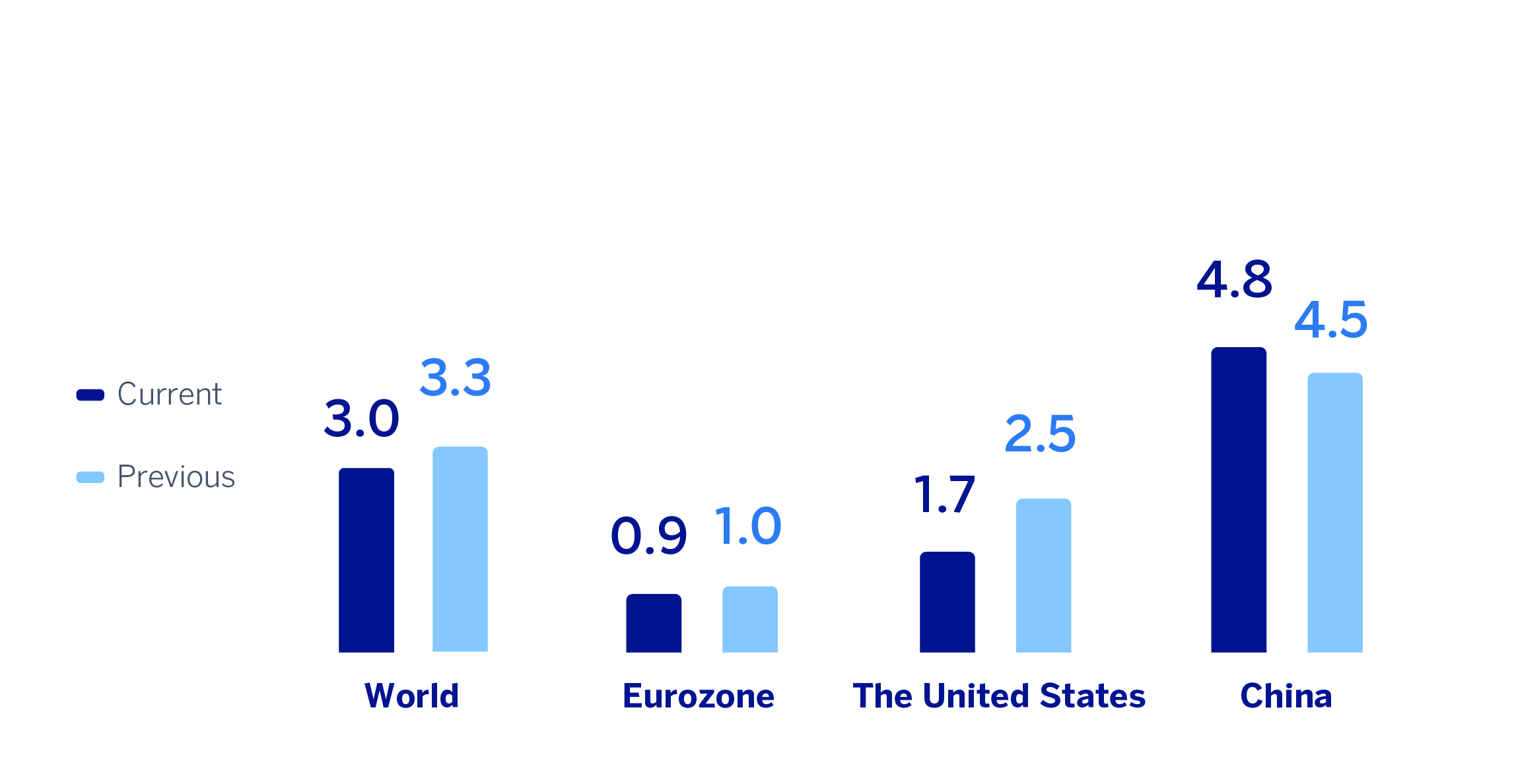

Although global growth remains relatively resilient, BBVA Research estimates that protectionism and uncertainty will negatively affect economic activity. Specifically, it forecasts that global GDP will increase 3.0% in 2025, three tenths below the previous forecast and four tenths less than in 2024.

Growth in the United States is likely to decelerate more than previously forecasted, from 2.8% in 2024 to 1.7% in 2025 (eight tenths lower than the previous forecast). In China, growth could reach 4.8% in 2025, down from 5.0% growth in 2024, but up from the previous forecast of 4.5%, thanks mainly to recent economic stimulus and a smaller than expected increase in United States tariffs on the country's exports. In the Eurozone, the impact of United States tariffs is likely to be mitigated by fiscal spending, mainly on defense and infrastructure. Growth is expected to be around 0.9% in 2025, similar to the previous forecast (+1.0%) and to the growth seen in 2024 (+0.9%).

Tariffs are likely to reverse the downward trend in United States inflation, which would lead the Fed to keep interest rates unchanged at 4.5% for longer. Monetary easing could resume in late 2025 if price pressures prove to be transitory. In the Eurozone, contained inflationary pressures have allowed the European Central Bank to recently cut the deposit facility rate to 2%. While a further cut in the second half of 2025 is possible, the ECB may choose to leave interest rates unchanged at current levels. In China, in a context of near-zero inflation, monetary conditions are likely to ease further.

Uncertainty about the global economy evolution remains high. In addition to significant risks related to new United States policies, geopolitical risks remain present. Although energy prices remain relatively low, tensions in the Middle East and Ukraine could lead to further supply shocks.

GDP GROWTH ESTIMATES IN 2025

(PERCENTAGE. YEAR-ON-YEAR VARIATION)

Source: BBVA Research estimates.

Read legal disclaimer of this report.