Spain

Highlights

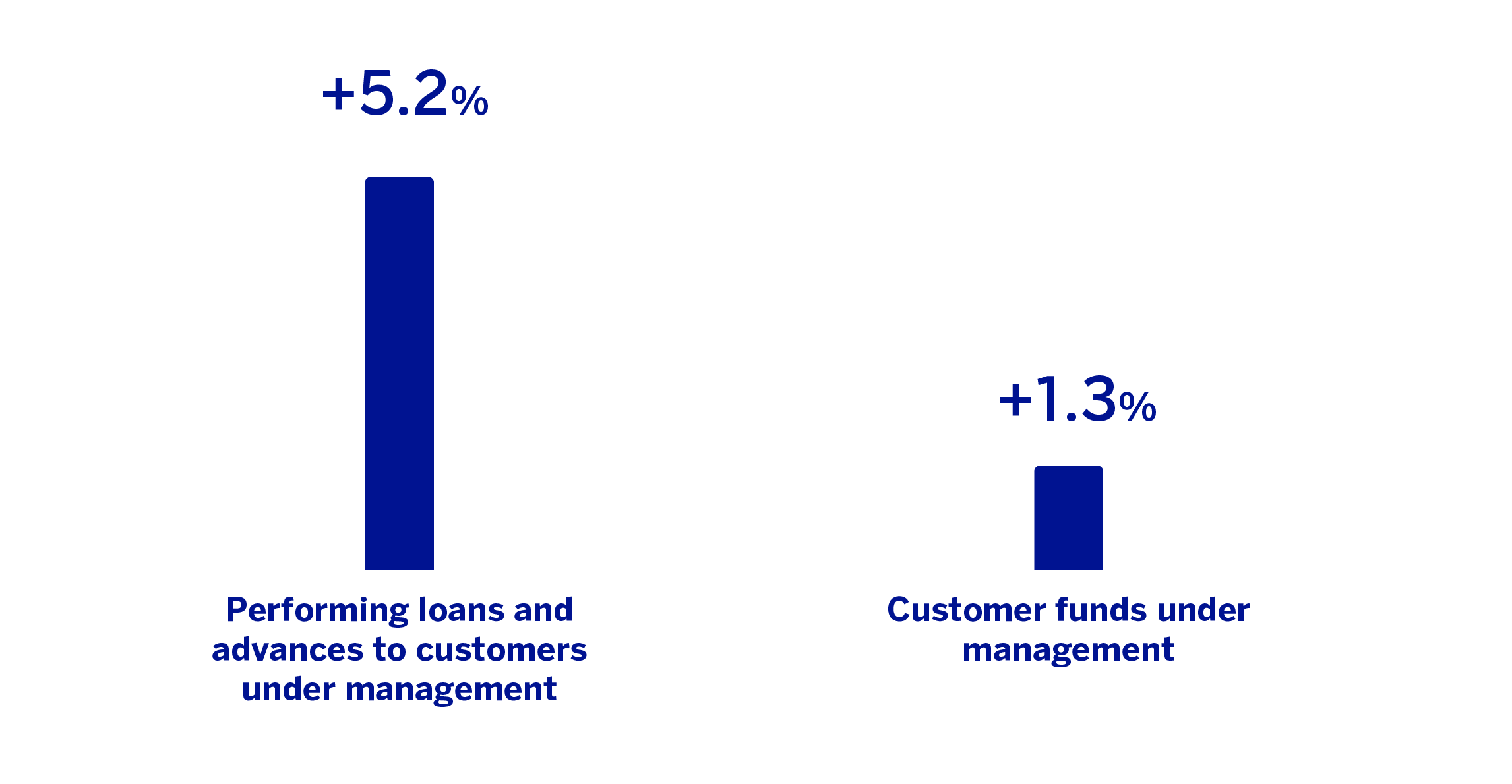

- Growth in lending and customer funds

- Dynamic recurring revenues, boosted by net interest income in the quarter

- Attributable profit continues its quarterly growth trend and once again surpasses €1 billion

- Stability of the cost of risk compared to March

BUSINESS ACTIVITY (1)

(VARIATION COMPARED TO 31-12-24)

(1) Excluding repos.

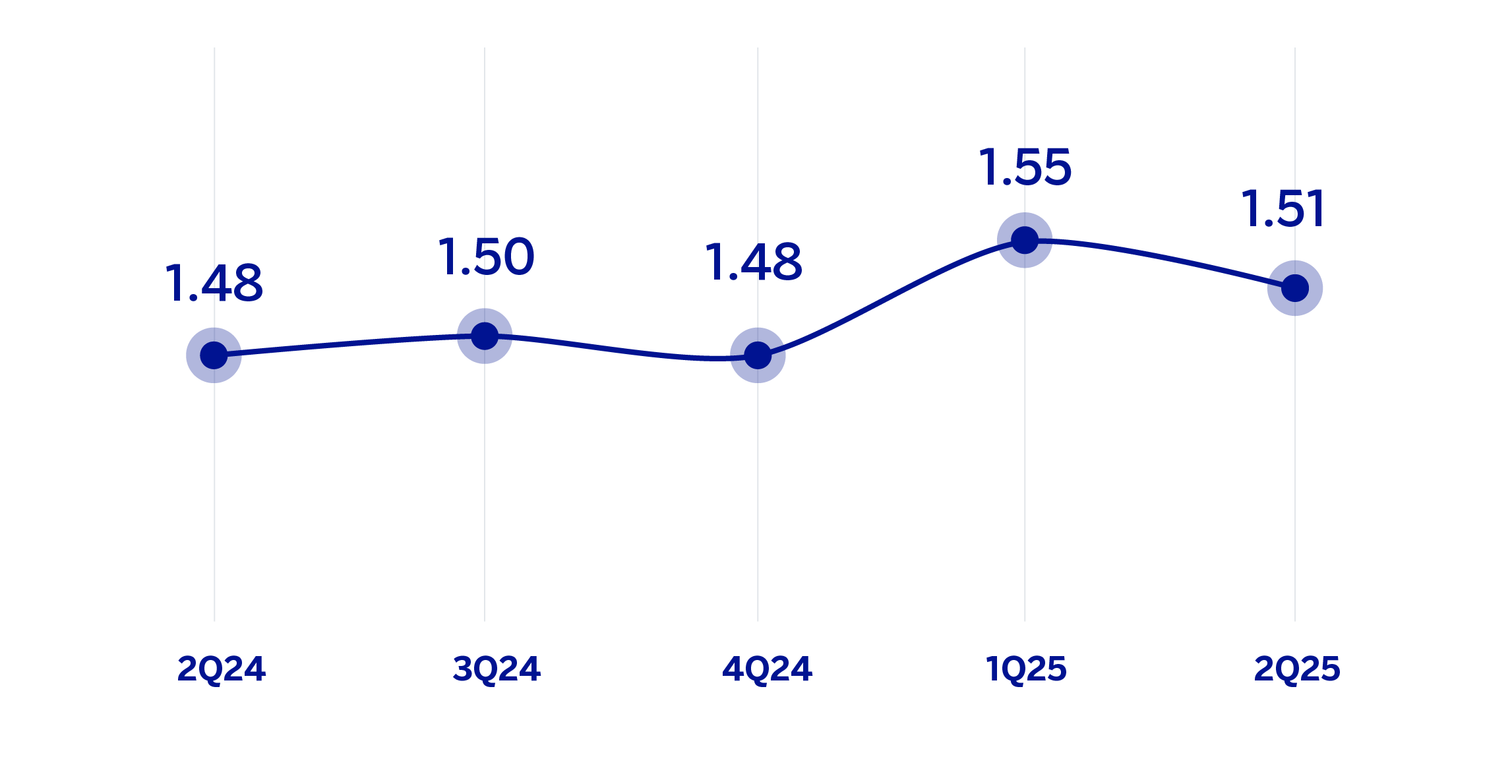

NET INTEREST INCOME / AVERAGE TOTAL ASSETS

(PERCENTAGE)

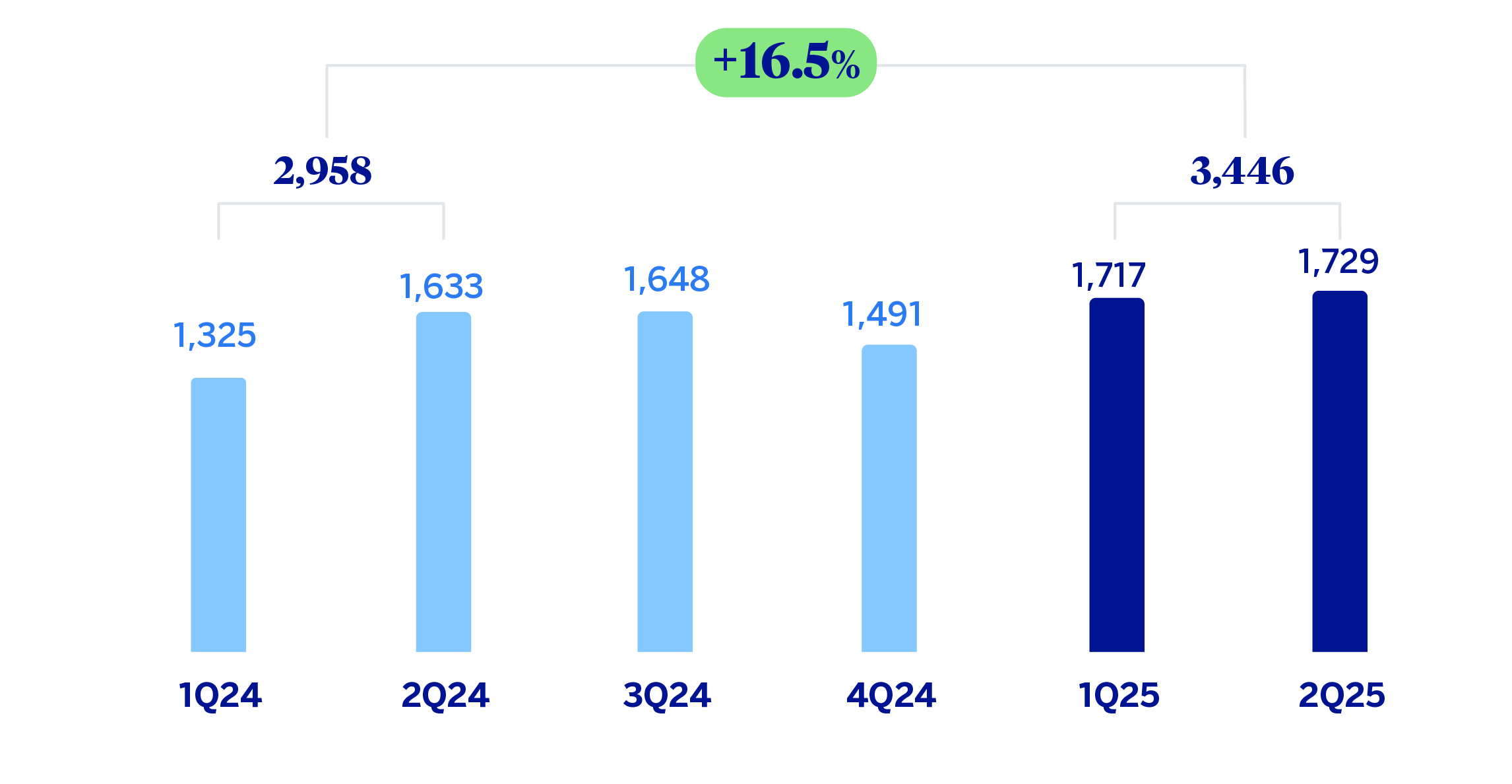

OPERATING INCOME (MILLIONS OF EUROS)

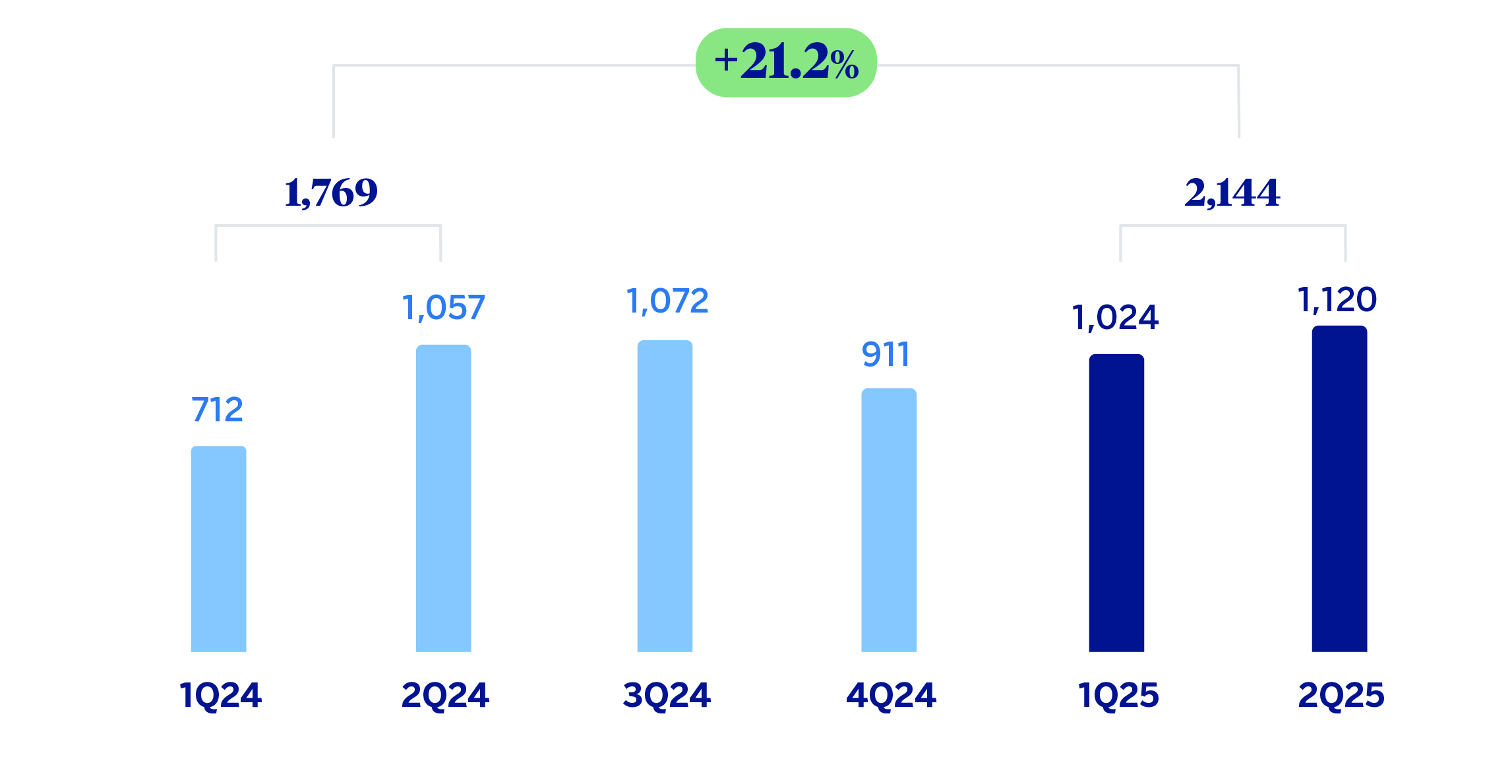

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

| FINANCIAL STATEMENTS AND RELEVANT BUSINESS INDICATORS (MILLIONS OF EUROS AND PERCENTAGE) | |||

|---|---|---|---|

| Income statement | 1H25 | 𝚫 % | 1H24 (1) |

| Net interest income | 3,230 | 1.5 | 3,184 |

| Net fees and commissions | 1,176 | 5.2 | 1,119 |

| Net trading income | 401 | 5.9 | 378 |

| Other operating income and expenses | 209 | n.s. | (88) |

| Of which: Insurance activities | 201 | 2.1 | 197 |

| Gross income | 5,016 | 9.2 | 4,592 |

| Operating expenses | (1,570) | (3.9) | (1,634) |

| Personnel expenses | (869) | 0.8 | (863) |

| Other administrative expenses | (513) | (12.8) | (589) |

| Depreciation | (187) | 2.5 | (183) |

| Operating income | 3,446 | 16.5 | 2,958 |

| Impairment on financial assets not measured at fair value through profit or loss | (301) | (9.7) | (334) |

| Provisions or reversal of provisions and other results | (40) | (22.9) | (52) |

| Profit (loss) before tax | 3,105 | 20.7 | 2,572 |

| Income tax | (959) | 19.5 | (802) |

| Profit (loss) for the period | 2,146 | 21.2 | 1,770 |

| Non-controlling interests | (2) | 6.1 | (1) |

| Net attributable profit (loss) excluding non-recurring impacts | 2,144 | 21.2 | 1,769 |

| Balance sheets | 30-06-25 | 𝚫 % | 31-12-24 (1) |

| Cash, cash balances at central banks and other demand deposits | 7,744 | (39.2) | 12,734 |

| Financial assets designated at fair value | 107,499 | (1.9) | 109,569 |

| Of which: Loans and advances | 34,036 | (4.3) | 35,564 |

| Financial assets at amortized cost | 253,008 | 6.6 | 237,279 |

| Of which: Loans and advances to customers | 188,584 | 5.0 | 179,667 |

| Inter-area positions | 44,267 | (0.4) | 44,464 |

| Tangible assets | 2,747 | (1.2) | 2,781 |

| Other assets | 3,831 | (20.1) | 4,793 |

| Total assets/liabilities and equity | 419,097 | 1.8 | 411,620 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 74,975 | (0.2) | 75,143 |

| Deposits from central banks and credit institutions | 29,695 | 5.8 | 28,067 |

| Deposits from customers | 230,120 | 1.6 | 226,391 |

| Debt certificates | 47,857 | 0.9 | 47,424 |

| Inter-area positions | — | — | — |

| Other liabilities | 20,974 | 7.8 | 19,448 |

| Regulatory capital allocated | 15,477 | 2.2 | 15,145 |

| Relevant business indicators | 30-06-25 | 𝚫 % | 31-12-24 |

| Performing loans and advances to customers under management (2) | 185,833 | 5.2 | 176,720 |

| Non-performing loans | 7,544 | (2.0) | 7,700 |

| Customer deposits under management (1)(2) | 220,363 | 0.2 | 219,923 |

| Off-balance sheet funds (1)(3) | 112,655 | 3.6 | 108,694 |

| Risk-weighted assets (1) | 120,209 | (0.4) | 120,661 |

| RORWA (4) | 3.56 | 3.13 | |

| Efficiency ratio (%) | 31.3 | 35.4 | |

| NPL ratio (%) | 3.5 | 3.7 | |

| NPL coverage ratio (%) | 61 | 59 | |

| Cost of risk (%) | 0.32 | 0.38 | |

| (1) Revised balances. For more information, please refer to the “Business Areas” section. (2) Excluding repos. (3) Includes mutual funds, customer portfolios and pension funds. (4) For more information on the calculation methodology, as well as the calculation of the metric at the consolidated Group level, see Alternative Performance Measures at this report. |

|||

Macro and industry trends

Economic activity continued to show dynamism in the first half of 2025 and the outlook going forward is relatively positive. Growth is likely to be supported by restrained energy prices, a more expansionary monetary policy tone in Europe, a greater capacity for growth in the services sector supported by higher immigration and productivity gains, increased investment in the construction sector and also rising defense spending. Moreover, according to BBVA Research, the expansion is likely to lose momentum, with GDP growth slowing from 3.2% in 2024 to 2.5% in 2025. This is three tenths lower than the previous forecast, driven by factors such as revisions to past growth data, global protectionism, high policy uncertainty and exchange rate appreciation. Annual inflation continues under control; it reached 2.3% in June and is likely to remain around 2.0% in the second half of 2025.

As for the banking system, with data at the end of May 2025, the volume of credit to the private sector grew by 2.1% year-on-year, with similar growth in the portfolios of credit to households and credit to non-financial companies. System credit grew in 2024 for the first time since 2009 (with the exception of 2020 due to COVID support measures), a trend that has been confirmed in the first months of 2025. Customer deposits grew by 7.5% year-on-year in May 2025, due to a 8.2% increase in demand deposits, and 3.4% in time deposits. The NPL ratio stood at 3.18% in April 2025, 41 basis points lower than in April last year. It should also be noted that the system maintains comfortable levels of solvency and liquidity.

Activity

The most relevant aspects related to the area's activity during the first half of 2025 were:

Lending balances were 5.2% higher than at the end of December 2024, driven again by the performance of the larger corporate segments (+7.1%), the public sector (+30.0%) and, to a lesser extent, by all consumer credit and credit cards (+3.2%).

Total customer funds grew by 1.3%, with an increase in off-balance sheet funds (mutual and pension funds) of 3.6% and stability in customer deposits, which grew by 0.2%.

The most relevant aspects related to the area's activity during the second quarter of 2025 were:

Growth in lending activity of 2.2%, compared to March, driven mainly by loans to the public sector (+23.4%) and with good dynamics in the medium-sized companies portfolio (+3.2%) and in consumer loans (+2.2% together with credit cards).

Regarding credit quality, the NPL ratio stood at 3.5%, a decrease of 2 basis points compared to the end of March, supported by the strong growth in activity and the good dynamics in the mortgage portfolio, which contributes to the increase in the coverage ratio by 75 basis points to 61% at the end of June 2025.

Total customer funds increased by 1.6% in the second quarter of 2025, with growth in customer deposits of 1.5% and of 1.9% in off-balance sheet funds.

Results

Spain generated a net attributable profit of €2,144m in the first half of 2025, which is 21.2% above the result achieved in the same period of 2024, driven by the evolution of all components of the gross income.

The most relevant aspects of the year-on-year changes in the area's income statement at the end of June 2025 were:

Net interest income grew 1.5%, driven by a higher contribution from the securities portfolio and a lower cost of liabilities, factors that offset the reduction in credit yields resulting from the ECB's successive interest rate cuts.

Fees and Commissions increased by 5.2% compared to the same half of the previous year, especially those generated by asset management as well as, and to a lesser extent, those related to payments and insurance.

Net Trading Income (NTI) increases its contribution by 5.9%, year-on-year, reflecting the evolution of the Global Markets unit.

The year-on-year comparison of the aggregate other operating income and expenses is conditioned by the recording in 2024 of the annual amount of the temporary tax on credit institutions and financial credit institutions for a total of €285m. Apart from the above, the performance of the insurance business is noteworthy.

Operating expenses decreased by 3.9% due to the reduction of general expenses, as the quarter includes a positive effect from the recognition of a lower Value Added Tax expense following the upward re-estimation of its applied pro-rata, offsetting the slight growth in personnel expenses. As a result of the evolution of the area's income and expenses, the gross income grew by 9.2% and, in addition, the efficiency ratio improved.

Impairment on financial asset decreased by 9.7%, mainly as a result of lower requirements in the mortgage portfolio.

Finally, the income tax line includes the accrual, for the first half of 2025, of the new tax on net interest income and fees amounting to approximately €150m, of which €65m corresponds to the second quarter of the year.

Spain generated a net attributable profit of €1,120m in the second quarter of 2025, an increase of 9.3% compared to the previous quarter. Regarding the recurring revenues, net interest income performed well, while fee income was slightly lower than in the previous quarter. On the other hand, the contribution of the other operating income and expenses line and the reduction in expenses in the quarter offset the lower income from NTI. The cumulative cost of risk at the end of June 2025 stood at 0.32%,

2 basis points higher than at the end of March as a result of the growth in impairment of financial assets.

Read legal disclaimer of this report.