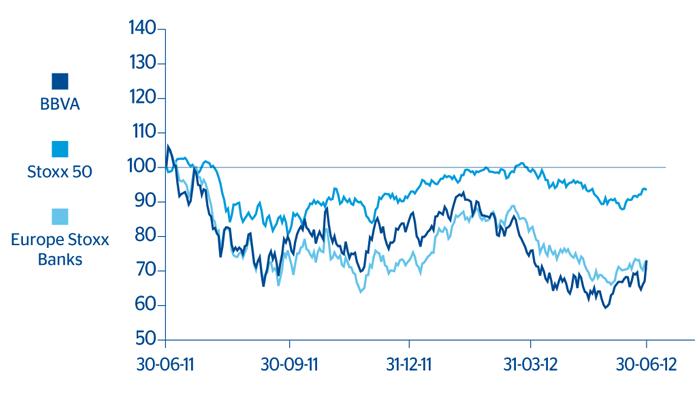

In the second quarter of 2012, events in Europe and the difficult economic situation of some countries in the euro zone continued to weigh on stock markets in general and the banking sector indices in particular. Moreover, market stabilization is being held back by the uncertainty surrounding how EU aid to the Spanish financial system will materialize, the decisions taken by some rating agencies and the stance of the European Central Bank (ECB), which is still reluctant to purchase sovereign bonds. Against this background, the risk premium for the 10-year Spanish sovereign bond reached all-time highs in the quarter and shares in the European banking sector continued to hit record price lows (Stoxx Banks down 11.1% in the quarter, compared with a fall of 3.2% for Stoxx 50), while the Spanish benchmark index was also negatively affected by its link to the Spanish sovereign bond (down 11.3% over the same period).

BBVA’s results for the first quarter of 2012 once again demonstrated its sound position and recurring revenues and were received very positively by most analysts. Better than expected revenue growth was highly valued, as was organic capital generation, confirmation of the dividend payment and the Group’s early compliance with the EBA recommendations. By business areas, in Spain the resilient credit quality, and therefore stability of the NPA ratio, continued to be positively valued, despite the country’s macroeconomic difficulties. Analysts also believe that the difficulties of this challenging environment and their impact on the development of business in Spain will be offset by revenue from other geographical areas. South America is demonstrating a higher than expected capacity to generate revenues. Mexico continues to post good results. In the United States, the improvement of its asset quality has been the best valued element in the quarter. Finally, Turkey and Asia have once again obtained better than expected results.

In this situation, it seems that the market is now beginning to differentiate between banking institutions. In fact, although the BBVA Group was punished severely by the markets due to the sovereign risk situation in 2011 and the first quarter of 2012, it outperformed the sector in the second quarter. The market has recognized its superior strength, and the BBVA share only lost 3.7% between April and June, outperforming the European banking industry indices (Stoxx Banks down 11.1% and Euro Stoxx Banks down 16.6%) and the Ibex 35 (down 11.3%). The share’s closing price as of June 29, 2012 was €5.63, equivalent to a market capitalization of €30,296m. This represents a price/ book value of 0.7, a P/E of 8.9 (calculated on the average profit for 2012 estimated by the consensus of Bloomberg analysts) and a dividend yield of 7.5% (also calculated according to the average dividend per share estimated by analysts for 2012 compared with the share price as of June 29, 2012).

With respect to shareholder remuneration, payment of an interim dividend of €0.10 per share against 2012 results was announced on June 27, and paid out July 10. The fact that the dividend amount is the same as that of the previous year has sent a clear message of confidence from the Bank’s management team, despite the difficult environment.

Finally, partial mandatory conversion of outstanding mandatory subordinated convertible bonds took place on June 30, 2012 with a 50% reduction in their nominal value (from 100 to 50 euros). The conversion was made at a price of €5.18 per share, calculated as the arithmetic mean of the closing prices of BBVA share over the five trading days prior to the conversion.