Cumulative income from fees and commissions grew by 6.6% over the last twelve months to €2,431m. This increase is significant when considering the reduced activity in Spain and the regulatory changes that have come into force in some countries in which BBVA operates, and which have had a negative impact on the year-on-year comparison. However, the expansion of activity in emerging countries, as well as the incorporation of Garanti, offset the aforementioned factors. To sum up, by business area, and as mentioned above: resilience in Spain, a decrease in the United States, and a positive contribution from Eurasia and Latin America.

NTI closed the six-month period at €829m. Two negative factors were, first, the turmoil on the markets; and second, the cuts in BBVA’s rating, all of them as a result of the successive downgrades of Spanish sovereign debt, which affected the Group’s wholesale banking activity, especially in the euro zone, and led to lower NTI. These two factors have been partially offset by the repurchase of securitization bonds in June, with the result that NTI fell year-on-year by 23.8%.

Income from dividends over the six-month period amounted to €338m, 19.6% higher than twelve months ago. This figure includes the dividends from BBVA’s stake in Telefónica.

Equity-accounted income totaled €371m between January and June 2012, with a year-on-year growth of 52.3%. Most of this income comes from BBVA’s stake in China Citic Bank (CNCB).

The heading other operating income and expenses continues to benefit from the positive performance of the insurance business in all the geographical areas, with a year-on-year increase in net revenue of 12.9%. The allocation charges to the various deposit guarantee funds in the countries where BBVA operates were up 50.0% over the same period. As a result, this heading amounted to €98m in the first half of 2012 (€141m in June 2011).

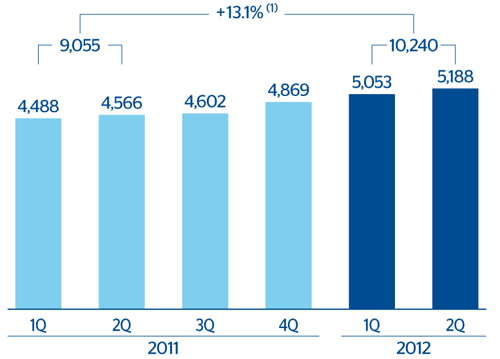

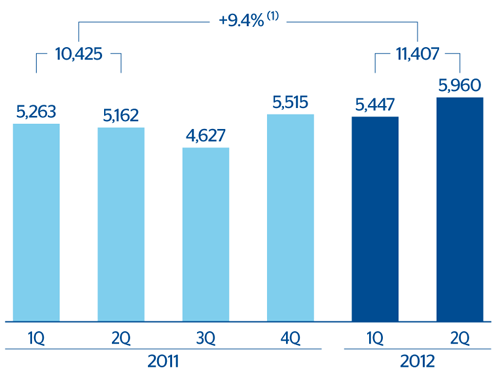

To sum up, recurring revenue, i.e. gross income excluding NTI and dividends, continued to grow quarter-by-quarter and the cumulative total for the first half of 2012 stood at €10,240m, 13.1% up on the figure reported for the same period in 2011. In addition, as a result of the performance of NTI and dividends, the quarterly gross income was up 9.4% to €11,407m.