C&IB highlights in the second quarter

- Rating downgrades have had a negative impact on activity.

- Diversified revenue.

- Resilient operating income.

Industry Trends

The second quarter of 2012 was characterized by a worsening of the debt crisis in the peripheral European countries and by downgrades in Spain’s sovereign rating. This has negatively affected wholesale business activity in general, above all in Europe.

Despite this situation, BBVA has maintained high-quality recurring earnings at CIB thanks to its differential customer-centric business model, and its portfolio diversified by products and geographical areas.

Unless indicated otherwise, all comments below on percentage changes refer to constant exchange rates, with the aim of providing a better understanding of the performance of BBVA’s wholesale business.

Income statement

(Million euros)

|

Corporate & Investment Banking |

|

1H12 |

Δ% |

Δ% (1) |

1H11 |

| Net interest income |

850 |

14.1 |

12.0 |

745 |

| Net fees and commissions |

349 |

4.1 |

1.6 |

335 |

| Net trading income |

134 |

(46.0) |

(47.6) |

249 |

| Other income/expenses |

62 |

83.5 |

88.5 |

34 |

| Gross income |

1,395 |

2.4 |

0.2 |

1,363 |

| Operating costs |

(437) |

5.6 |

3.0 |

(414) |

| Personnel expenses |

(243) |

3.1 |

0.9 |

(235) |

| General and administrative expenses |

(189) |

7.3 |

4.3 |

(176) |

| Deprecation and amortization |

(6) |

105.2 |

96.0 |

(3) |

| Operating income |

958 |

1.0 |

(1.0) |

949 |

| Impairment on financial assets (net) |

(67) |

n.m. |

n.m. |

12 |

| Provisions (net) and other gains (losses) |

(17) |

140.9 |

114.1 |

(7) |

| Income before tax |

874 |

(8.4) |

(10.0) |

954 |

| Income tax |

(262) |

(5.0) |

(6.6) |

(275) |

| Net income |

612 |

(9.8) |

(11.4) |

679 |

| Non-controlling interests |

(60) |

37.7 |

27.3 |

(43) |

| Net attributable profit |

553 |

(13.0) |

(14.2) |

635 |

(1) At constant exchange rate.

Balance sheet

(Million euros)

|

Corporate & Investment Banking |

|

30-06-12 |

Δ% |

Δ% (1) |

30-06-11 |

| Cash and balances with central banks |

6,145 |

29.7 |

12.5 |

4,739 |

| Financial assets |

83,060 |

22.7 |

22.0 |

67,670 |

| Loans and receivables |

74,391 |

6.5 |

4.2 |

69,877 |

| Loans and advances to customers |

61,010 |

6.8 |

4.1 |

57,104 |

| Loans and advances to credit institutions and other |

13,381 |

4.8 |

4.5 |

12,773 |

| Inter-area positions |

7,720 |

(45.3) |

(48.0) |

14,109 |

| Tangible assets |

32 |

40.7 |

34.9 |

23 |

| Other assets |

3,044 |

33.1 |

29.6 |

2,286 |

| Total assets/Liabilities and equity |

174,392 |

9.9 |

7.5 |

158,705 |

| Deposits from central banks and credit institutions |

69,075 |

13.3 |

11.6 |

60,952 |

| Deposits from customers |

37,256 |

(27.6) |

(30.1) |

51,440 |

| Debt certificates |

(215) |

(61.9) |

(61.9) |

(563) |

| Subordinated liabilities |

1,554 |

(25.9) |

(26.9) |

2,098 |

| Inter-area positions |

- |

- |

- |

- |

| Financial liabilities held for trading |

55,831 |

66.5 |

66.2 |

33,536 |

| Other liabilities |

5,766 |

(21.2) |

(25.3) |

7,315 |

| Economic capital allocated |

5,125 |

30.5 |

26.5 |

3,927 |

(1) At constant exchange rate.

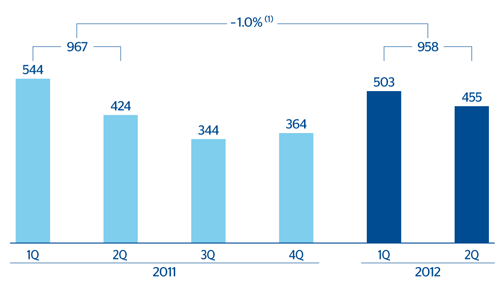

C&IB. Operating income

(Million euros at constant exchange rate)

(1) At current exchange rates: +1.0%.

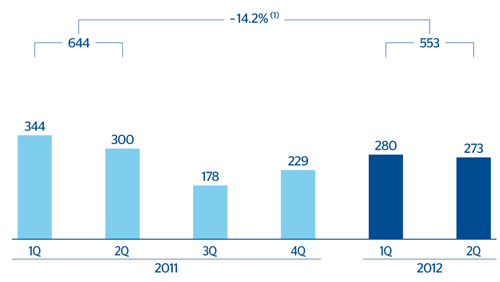

C&IB. Net attributable profit

(Million euros at constant exchange rate)

(1) At current exchange rates: – 13.0%.