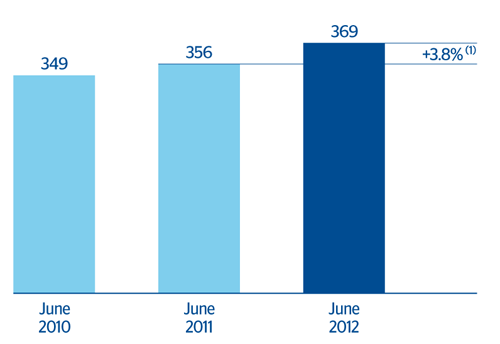

As of 30-Jun-2012, gross customer lending stood at €369 billion, increasing 3.8% year-on-year (1.4% excluding foreign-currency impact) and 2.9% quarter-on-quarter (1.8% excluding foreign currency impact).

The trends by business areas continue as commented in previous quarters:

- In South America, lending continues to grow significantly in practically all the countries in the region (up 23.1% year-on-year at constant exchange rates) where dynamism is focused on retail portfolios. In Mexico, the rise has been 12.6% (also excluding the foreign-currency effect), accelerating the year-on-year pace of growth of previous quarters. The driving force behind the rise is the positive performance of lending to small businesses, consumer loans and credit cards.

- In BBVA Compass lending is starting to grow in year-on-year terms (up 6.5% excluding the foreign-currency impact) as increases in the target portfolios (residential real estate and commercial) more than offset the continued fall in the construction real estate sector. In Eurasia there was a rise of 2.2% year-on-year, thanks to the positive contribution of Garanti.

- Finally, in Spain there was a fall of 4.5% in the same period, due to the economy’s financial deleveraging process mentioned above. However, the underwriting of the fund designed to finance payments to suppliers in the second quarter of 2012 has partly offset the deleveraging effect. There has also been a temporary increase in the balances closely related to market operations, such as repurchase agreements and guarantees.

In summary, the domestic sector has continued to fall by 3.8% over the last 12 months. Over the quarter, the balance increases 1.9% (up 1.2% in other resident sectors) for the reasons given before: increased lending to public administrations due to the underwriting of the fund to finance suppliers and the temporary rise in repos and guarantees related to market operations. In contrast, the non-domestic sector continues growing strongly (up 14.7 % year-on-year and 4.3% quarter-on-quarter). In this respect, it is worth mentioning that the loan book at the close of June 2012 does not include loans from Puerto Rico because after the sale agreement signed with Oriental Financial Group, this unit has been reclassified as a non-current asset held for sale.

Finally, non-performing loans rose year-on-year by 4.7% and by 2.3% over the quarter. This rise can be basically explained by two factors: in the domestic sector it is a result of the difficult and complex economic situation in Spain; in the non-domestic sector the key is the foreign-currency impact.