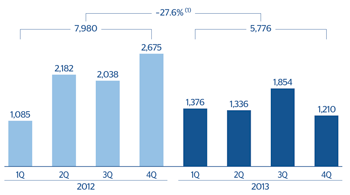

Impairment losses on financial assets in the last three months (€1,210m) were down on those recorded in the other quarters of 2013 and particularly in the third quarter, when there was a one-off increase due to the effect of classifying refinanced loans. For the year as a whole, this item amounts to €5,776m, 27.6% down on the figure for 2012, which included impairment on assets related to the real-estate sector in Spain.

Impairment losses on financial assets

(Million euros)

Provisions totaled €196m for the quarter and €630m for the year, €21m down on the figure for 2012. This heading includes, among other items, early retirement costs, provisions for contingent liabilities, contributions to pension funds and other commitments to staff.

Other gains (losses) include various items, such as the provisions made for real-estate and foreclosed or acquired assets in Spain. It totaled a negative €382m in the last quarter of 2013 and a negative €1,040m in the year as a whole.

Lastly, the new heading earnings from corporate operations includes the following items in 2013: earnings from the Group’s pension business in Latin America, including the capital gains from the sale of the different companies (Mexico in the first quarter, Colombia and Peru in the second, and Chile in the fourth); the capital gains from the sale of BBVA Panama (fourth quarter); the capital gains generated by the reinsurance operation on the individual life and accident insurance portfolio in Spain (first quarter); and the effect of the new agreement with the CITIC Group (fourth quarter), basically valuing BBVA’s stake in CNCB marked to market. The previous quarters included income by the equity method for CNCB (not including dividends). In 2012, this item includes the badwill generated in the Unnim operation, the result from the sale of BBVA Puerto Rico and the historical figures of the pension business and the income by the equity method of CNCB, as the historical series have been reconstructed to make it more homogenous and comparable.

Breakdown of results from corporate operations

|

|

|

2013 |

|

2012 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

2013 | 4Q | 3Q | 2Q | 1Q | 2012 | 4Q | 3Q | 2Q | 1Q |

| Results and net capital gains from the pensions business in Latin America | 1,866 | 466 | 7 | 570 | 823 | 392 | 138 | 83 | 75 | 96 |

| CNCB impacts (1) | (2,374) | (2,602) | 153 | 24 | 51 | 550 | 169 | 172 | 33 | 176 |

| Sale of BBVA Panama | 230 | 230 | - | - | - | - | - | - | - | - |

| Reinsurance agreement on the individual life and accident insurance portfolio in Spain |

630 | - | - | - | 630 | - | - | - | - | - |

| Unnim badwill (net) | - | - | - | - | - | 376 | 56 | 320 | - | - |

| Sale of BBVA Puerto Rico (2) | - | - | - | - | - | (15) | (15) | - | - | - |

| Income tax from corporate operations | 471 | 661 | - | - | (190) | - | - | - | - | - |

| Results from corporate operations | 823 | (1,245) | 160 | 593 | 1,315 | 1,303 | 348 | 575 | 108 | 272 |