At the close of 2013, activity in South America was once more buoyant in practically all the countries where BBVA operates, both on the side of the loan book and in on-balance sheet customer funds.

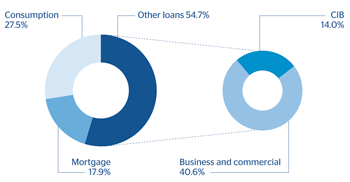

The balance of performing loans as of 31-Dec-2013 closed at €47,753m, a year-on-year growth of 21.7%. Lending to the retail segment performed outstandingly well, particularly consumer finance (up 23.6%), credit cards (up 43.5%) and to a lesser extent mortgage lending (up 14.2%). This is reflected in a year-on-year gain in market share of 16 basis points in the individual segment, according to the latest available information as of October 2013.

This rise in lending activity has been coupled with strict risk admission policies and a good management of recoveries. These lines of action, which are closely in line with those for the whole group, have improved the main risk indicators over the quarter. The NPA ratio as of 31-Dec-2013 stood at 2.1% and the coverage ratio at 141% (2.2% and 137%, respectively, at the close of September 2013).

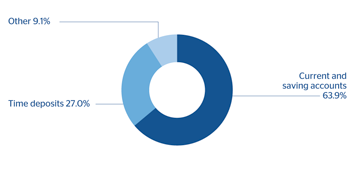

Customer deposits under management closed December at €58,881m, and have continued to increase their year-on-year rate of growth to 30.0%. Lower-cost transactional items (current and savings accounts) have driven this growth, with a rise of 42.6% over the period and a market share gain of 73 basis points from October 2012 to October 2013. Including assets under management by mutual funds, customer funds managed by the banks in South America totaled €61,833m, up 28.3% on the same date the previous year, with a rise in market share over the year of 30 basis points, again using data for October 2013. (In fact, all the figures below on market share refer to October 2013, the latest information available.)

By countries, the highlights of banking activity are as follows:

- Argentina: The loan book performed very well, with year-on-year growth of 24.6% thanks to a boost from credit cards (up 55.5%). As a result, market share increased 47 basis points for this portfolio. Customer funds grew by 27.8%, with good performance of both current and savings accounts and time deposits.

- Chile: The loan book grew by 7.3% over the quarter, strongly supported by the outstanding growth in the mortgage portfolio (up 13.4%), which gained 32 basis points in market share over the last 12 months. Customer funds have increased at a year-on-year rate of 15.5%, with an increase in the time deposit balance of 16.0% and a gain in market share of 3 basis points.

- Colombia: Lending activity has increased (up 21.1% year-on-year) more than the system as a whole, with the result of a gain of 53 basis points in market share over the year. By portfolios, there was strong performance in consumer finance and corporate lending, which increased their market share by 103 and 49 basis points, respectively. Customer funds grew by 14.7%, and market share increased by 104 basis points, focused on the good performance of more transactional items, which rose by 15.5% and gained 123 basis points in market share over the year, while time deposits increased market share by 70 basis points.

- Peru: A significant rise in lending (up 20.0%), focused on mortgage loans, which led growth at 18.1% in year-on-year terms. The 21.9% growth in customer funds reflects the boost from transactional items, which rose year-on-year by 25.4%.

- Venezuela: The strength of activity shown over the year continued into the fourth quarter, with lending up 64.5% and customer funds by 76.3%, and gains in market share of 3 and 36 basis points, respectively. In lending, there was notable growth in credit cards (up 77.4% and a gain of 165 basis points in market share) and corporate lending, which has increased almost tenfold since the close of 2012 and has gained 22 basis points in market share. In customer funds, there was a significant rise in current and savings accounts (up 90.6%, with a gain in market share of 54 basis points).

South America. Performing loans breakdown(December 2013) |

South America. Breakdown of customer depostis under management(December 2013) |

|---|---|

|

|