There has been an upturn in BBVA’s commercial activity in Mexico during 2013, despite the slower growth in GDP. Thus performing loans have risen in the latter part of the year, and at 2013 year end stood at €38,678m, 9.8% higher than at the close of 2012 and 5.0% higher than the figure at the end of the preceding quarter.

The biggest growth in the last quarter was posted by the wholesale portfolio, at 14.7% year-on-year. Outstanding in this portfolio is the increase in financing to medium-sized enterprises (up 20.2%). Corporate lending also performed well. In addition, the area has played an active role in placing its customer’ shares and fixed-income instruments. As a result, BBVA has maintained its leading position in the Mexican capital market, with a market share of 15% in local issuance, according to cumulative data through December 2013 from the Mexican Stock Exchange (BMV). As a result, it has been named the “Best Investment Bank in Mexico”, by Latin Finance magazine. Lastly, there has also been a marked recovery in lending to government bodies over the last two quarters, with growth of 5.3% year-on-year.

The retail credit segments reported growth of 6.7% over the year, with financing to small businesses particularly strong, with a year-on-year increase of 21.9%. The Bank has launched the new “Red PyME” (SME Network) in this segment, which has extended the specialized business centers to cover the whole of Mexico. This new service model includes commercial alliances to drive lending and, using the BBVA Group’s customer-centric approach, offer customers products which best fit their needs. Within the consumer portfolio, the successful pre-approved loans campaign has significantly boosted lending in the second half of the year. The year 2013 closed with a rise of 15.3% on the previous year’s balance and a rise in market share of over 150 basis points since June 2013, according to the latest information available from the CNBV as of November 2013.

The area’s asset quality indicators have also been positive, and improved in the last quarter of the year. At year end, the NPA ratio was 3.6% (4.1% at end of September 2013) and the coverage ratio increased to 110% (compared with 105% as of 30-9-2013).

Customer funds, which include demand deposits, time deposits, repos, mutual funds and other off-balance-sheet funds, totaled €60,489m at the end of 2013, with a year-on-year rise of 5.5%. The amount has been determined by the area’s policy in 2013 of increasing the profitability of liabilities. As a result, BBVA in Mexico has an adequate fund mix, with a higher relative weight of demand deposits, which have performed well with growth of 10.6% over the year.

Lastly, the insurance business has continued to perform well, with a positive impact on earnings in the area. Seguros BBVA Bancomer is still ranked as the second largest insurer in Mexico in terms of written premiums within the bancassurance market, and is ranked sixth in terms of the insurance market as a whole. Profits in this unit amounted to €291m, 6.5% up compared with the previous year.

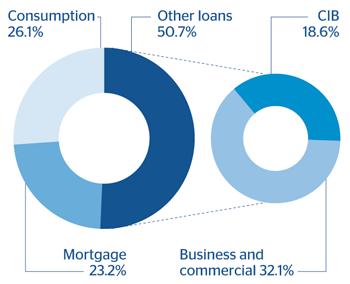

Mexico. Performing loans breakdown(December 2013) |

Mexico. Breakdown of customer deposits under management(December 2013) |

|---|---|

|

|