The key factors that affected the Group’s capital base in the fourth quarter of 2013 are as follows:

- Improvement of the core capital ratio, according to Basel II, to 11.6%, 19 basis points higher than at the close of September. Organic generation of earnings, together with the divestments in BBVA Panama and AFP Provida and a reduction in risk-weighted assets (RWA) (affected by the exchange rate) offset the negative impact on core capital of the sale of 5.1% of CNCB.

- Improvement in the Tier I and Tier II ratios by 79 and 53 basis points, respectively, during the quarter. This is mainly due to the sale of CNCB since, because the remaining stake (9.9%) does not exceed the 10% limit, it is not deducted in the capital base.

- As a result, the BIS II ratio is 14.9%, a quarterly increase of 132 basis points.

- RWA amount to €323,605m as of 31-Dec-2013, a decline of 0.6% over the last 3 months and mainly due to the exchange rate and lower activity in Spain. As the remaining stake in CNCB is not deducted, it increases the RWA and partially offsets the aforementioned reduction.

- Lastly, the new capital requirements included in the European directive CRDIV, commonly known as Basel III (BIS III) came into effect in January 2014. The Group is extremely well positioned with respect to this new regulation:

- The reduction in BBVA’s stake in CNCB to under 10% means a 71 basis points improvement in the core capital calculated under BIS III fully loaded regulation.

- Royal Decree 14/2013 of November 29, which establishes that certain deferred tax assets are to be converted into accounts receivable from the Tax Authority, implies that they do not have to be deducted from the core BIS III ratio. This new regulation is estimated to have a positive effect on the Group’s BIS III fully loaded core capital ratio of between 60 to 70 basis points.

In short, BBVA’s solvency ratios continue to be well managed, ensuring the Group’s capital adequacy position is strong.

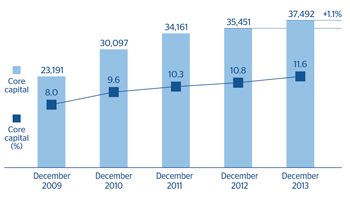

Core capital evolution (BIS II Regulation)

(Million euros and percentage)

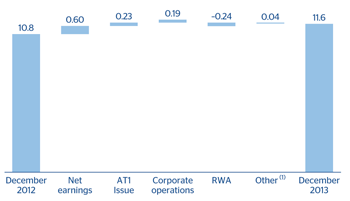

Core capital ratio evolution

(Billion euros)

Capital base (BIS II Regulation)

(Million euros)

|

|

31-12-13 | 30-09-13 | 30-06-13 | 31-03-13 | 31-12-12 |

|---|---|---|---|---|---|

| Core capital | 37,492 | 37,102 | 37,293 | 36,721 | 35,451 |

| Capital (Tier I) | 39,611 | 37,300 | 37,531 | 36,721 | 35,451 |

| Other eligible capital (Tier II) | 8,695 | 7,019 | 7,026 | 7,584 | 7,386 |

| Capital base | 48,306 | 44,319 | 44,557 | 44,305 | 42,836 |

| Risk-weighted assets | 323,605 | 325,665 | 331,098 | 328,002 | 329,033 |

| BIS ratio (%) | 14.9 | 13.6 | 13.5 | 13.5 | 13.0 |

| Core capital (%) | 11.6 | 11.4 | 11.3 | 11.2 | 10.8 |

| Tier I (%) | 12.2 | 11.5 | 11.3 | 11.2 | 10.8 |

| Tier II (%) | 2.7 | 2.2 | 2.1 | 2.3 | 2.2 |