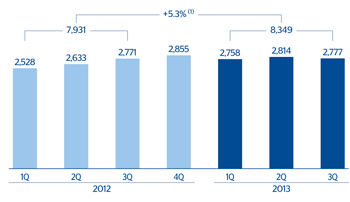

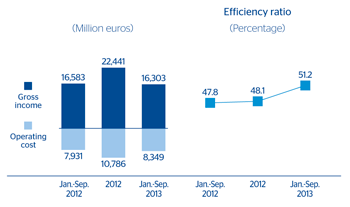

Operating expenses are down slightly over the last three months to €2,777m. The figure from January to September stands at €8,349m, up 5.3% on the same period in 2012. As mentioned in previous quarterly reports, this increase is primarily the result of the investment plans undertaken in the emerging economies, which contrasts with cost control policy applied in developed countries. During the quarter, the Group announced a new expansion plan in South America which envisages an investment of USD 2.5 billion (around €1.9 billion) until 2016, aimed basically at boosting online banking in the region.

Operating costs

(Millones de euors)

Breakdown of operating costs and efficiency calculation

(Million euros)

|

|

January-Sep. 13 | Δ % | January-Sep. 12 | 2012 |

|---|---|---|---|---|

| Personnel expenses | 4,364 | 4.2 | 4,190 | 5,662 |

| Wages and salaries | 3,301 | 2.6 | 3,218 | 4,348 |

| Employee welfare expenses | 679 | 9.1 | 622 | 819 |

| Training expenses and other | 384 | 9.6 | 350 | 495 |

| General and administrative expenses | 3,147 | 4.3 | 3,016 | 4,106 |

| Premises | 708 | 3.4 | 685 | 916 |

| IT | 597 | 8.9 | 548 | 745 |

| Communications | 228 | (7.4) | 246 | 330 |

| Advertising and publicity | 288 | 4.6 | 275 | 378 |

| Corporate expenses | 76 | 6.8 | 71 | 102 |

| Other expenses | 925 | 5.2 | 879 | 1,201 |

| Levies and taxes | 325 | 4.4 | 311 | 433 |

| Administration costs | 7,511 | 4.2 | 7,206 | 9,768 |

| Depreciation and amortization | 838 | 15.6 | 725 | 1,018 |

| Operating costs | 8,349 | 5.3 | 7,931 | 10,786 |

| Gross income | 16,303 | (1.7) | 16,583 | 22,441 |

| Efficiency ratio (Operating costs/Gross income, in %) | 51.2 |

|

47.8 | 48.1 |

Efficiency

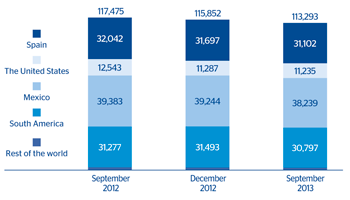

The following are worth highlighting in terms of the number of employees, branches and ATMs:

- The workforce as of 30-Sep-2013 stands at 113,293 people, i.e. 507 employees more than at the close of the first half of 2013. The increase came mainly from emerging economies. The situation in the rest of geographical regions remains stable.

Number of employees (1)

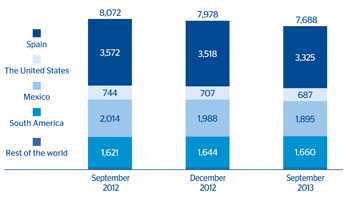

- The branch network at the end of September consists of 7,688 units and shows a new reduction in Spain, increases in South America and stability in the other geographical regions.

Number of branches (1)

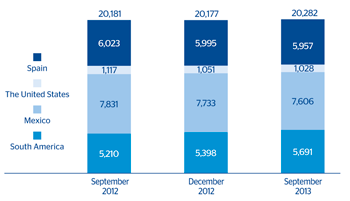

- Lastly, as of 30-Sep-2013, the number of ATMs was 20,282 units. As in the case of the branch network, the number of ATMs has decreased in Spain, increased in South America and remains practically stable in the other areas.

Number of ATMs (1)

As a result, operating income of €2,562m was generated in the third quarter, a figure slightly lower than the €2,679m reported in the second quarter of 2013. As of September, this heading stands at €7,954m, a year-on-year decline of 8.1% (compared with a 8.8% fall in the first half of 2013). The efficiency ratio for the nine months is similar to the figure for the previous quarter: 51.2%.

Operating income

(Million euros)