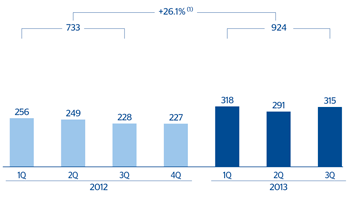

The net attributable profit of CIB through September 2013 was €924, an increase of 26.1%. This increase is based on a balanced geographical diversity, a product mix that is adapted to the environment, a focus on high-added-value customers and the prioritization of quality earnings and customer relationship rather than volume.

Gross income through September was €2,259m, 18.7% more than in the same period in 2012. By units, there was an excellent performance by Global Transactional Banking, a good year-on-year increase in Global Markets in practically all the geographical areas and a positive contribution from the Corporate Finance unit.

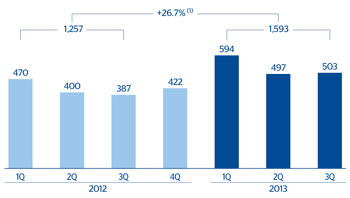

At the same time, operating expenses moderated their year-on-year increase to 3.1%, totaling €666m through September. It should be noted that this business operates in mature markets, but also in geographical areas with a high inflation rate, and that the contribution of the latter is rising. The effort to contain costs is another of the positive elements that helps improve CIB earnings, which recorded operating income of €1,593m in the first nine months of 2013, 26.7% higher than the same period in 2012. The resulting efficiency ratio of 29.5% improved 3.9 percentage points on the ratio reported for January to September 2012.

Lastly, impairment losses on financial assets through September totaled €112m, 25.4% up on the figure recorded 12 months earlier. With this level of loan-loss provisions, CIB increased its coverage ratio over the quarter from 82% to 84%. The NPA ratio remained at 1.6% as of 30-Sep-2013.

CIB. Operating income(Million euros at constant exchange rates) |

CIB. Net attributable profit(Million euros at constant exchange rates) |

|---|---|

(1) At current exchange rates: +20.5%. |

(1) At current exchange rates: +21.2%. |