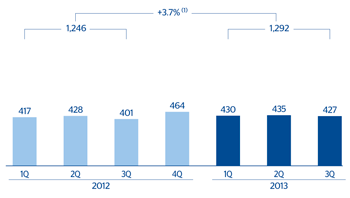

The area has generated a cumulative net attributable profit as of September of €1,292m, supported by resilient recurring revenue, strict control of operating costs and stable risk indicators.

The cumulative net interest income through September stands at €3,347m, up 6.9% compared with the same period in 2012, thanks to increasing volumes of activity and good price management. This performance puts BBVA Bancomer in the lead in the sector in terms of profitability, measured as net interest income over ATA. In fact, using harmonized local accounting data, in the first half of 2013, this ratio in BBVA Bancomer stood at 5.7%, showing a differential of around 100 basis points above the main competitors on the same date. Income from fees and commissions has increased year-on-year by 10.2% to an amount of €883m, boosted by more credit card transactions and greater income from issuance on the markets by corporate customers. NTI of 128 million compares unfavorably with the high figure 12 months earlier (down 26.9%). Lastly, the other income/expenses heading has increased by 12.9% to €242m, thanks basically to the good performance of the insurance business. As a result, gross income amounts to €4,600m to September, up 6.4% on the figure reported one year before.

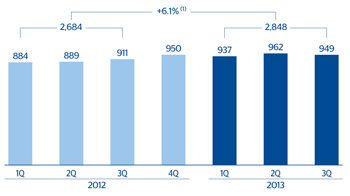

Operating expenses remain in line with previous quarters, with a similar year-on-year increase of 7.0% to €1,752m. This rise is to a large extent the result of the expansion plans implemented in the area (opening and modernization of branches, technological innovation, extension of multi-channel banking, improved service quality, construction of new corporate headquarters, sponsorship of the Mexican soccer league, etc.), since the most recurring items continue to perform in line with the country’s inflation level. BBVA Bancomer is still one of the most efficient banks in the Mexican banking sector, with an efficiency ratio as of September 2013 of 38.1%. Overall, operating income amounted to €2,848m, up 6.1% on the figure for the previous 12 months.

Impairment losses on financial assets totaled €1,101m in the first nine months of 2013 (up 12.0% year-on-year), with the cumulative risk premium to 30-Sep-2013 at 3.64%, a very similar level to that at the close of the first half of 2013.

Mexico. Operating income(Million euros at constant exchange rate) |

Mexico. Net attributable profit(Million euros at constant exchange rate) |

|---|---|

(1) At current exchange rate: +7.6%. |

(1) At current exchange rate: +5.2%. |