Performing loans managed by this area at the close of September 2013 amounted to €39,219m, an increase of 3.1% on the quarter and 5.6% over the previous 12 months. Lending growth has been balanced across all portfolios, except for loans to developers (construction real estate), which continue to decline at 1.1% since the end of June 2013 and 27.9% since 30-Sep-2012, in line with the area’s strategy explained in previous quarters. The portfolios posting the biggest growth rates are mortgages (residential real estate) and companies (including commercial real estate), which have risen by 11.7% and 6.0% respectively on the figure posted on the same date last year. Consumer finance has also performed well, with a year-on-year growth of 4.5% thanks to the positive performance of credit cards and car loans.

This growth in activity continues against a backdrop of improved asset quality indicators in the area. The NPA ratio stood at 1.5% as of 30-Sep-2013, 7 basis points below the figure at the close of June 2013. The coverage ratio increased by 2.0 percentage points over the quarter to 120%.

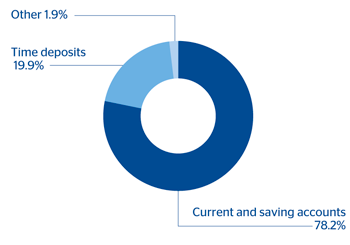

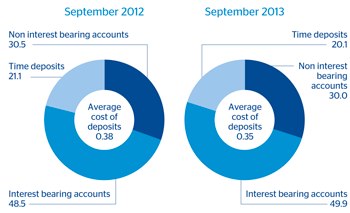

Customer deposits under management amounted to €37,626m as of 30-Sep-2013, an increase of 5.8% on the figure the previous year, but down 1.3% in the quarter due to the decline in term deposits (down 5.1% since the end of June 2013), while lower-cost deposits continue to grow (by 0.8% in the last three months), particularly compared with the figure at the close of September 2012 (up 7.4%).

Lastly, the capital ratios of BBVA Compass remain at very high levels. Specifically, at the close of September, the Tier 1 capital ratio closed at 11.8% and the total capital ratio at 14.1%, with an improvement of 17 and 21 basis points respectively on the figures for the close of the first half of 2013.

The United States. Performing loans breakdown(September 2013) |

The United States. Deposits from customers breakdown(September 2013) |

|---|---|

|

|

BBVA Compass. Loan mix(Percentage) |

BBVA Compass. Deposit mix(Percentage) |

|---|---|

|

|