The most significant aspects of the income statement are as follows:

- Net interest income performed more moderately than in previous quarters; it was hit by the negative impact of rising interest rates on the customer spread in Garanti. The rate hike has increased the cost of deposits in the third quarter, and this has not been offset by the performance of the loan book, whose repricing is expected toward the end of the year. Despite this, cumulative net interest income in the area to September amounted to €702m, a year-on-year increase of 15.9%.

- Income from fees and commissions has begun to stabilize after several months of declines, with a cumulative figure through September of €301m (down 10.5% year-on-year). This improvement is a result of the more positive performance of this heading in Garanti, particularly for fees and commissions related to its activity with customers.

- A positive level of NTI, at €177m in the first nine months of 2013. The Global Markets unit performed particularly well in the region.

- The contribution from CNCB remains in line with previous quarters. Thus, other income/expenses at €409m through September, is 30.6% down on the figure 12 months earlier. This decline is a result of the adjustment made to the loan-loss provisions by CNCB in the first quarter, when it applied the new local legislation that took effect this year.

- Operating expenses have been kept in check, despite the expansion plans underway in Garanti. In fact, since the close of 2012, the branch network has increased by 41 and the number of ATMs by 242; the costs resulting from the launch of i-Garanti before the summer should also be mentioned. Despite this, operating expenses declined by 3.6% over the last twelve months to €551m.

Garanti. Significant data 30-09-13 (1)

|

|

30-09-13 |

|---|---|

| Financial statements (million euros) |

|

| Attributable profit | 916 |

| Total assets | 69,001 |

| Loans and advances to customers | 41,056 |

| Deposits from customers | 37,762 |

| Relevant ratios (%) |

|

| Efficiency ratio (2) | 45.4 |

| NPA ratio | 2.0 |

| Other information |

|

| Number of employees | 18,928 |

| Number of branches | 977 |

| Number of ATMs | 3,750 |

Garanti. Composition of assets and lending portfolio (1)(September 2013) |

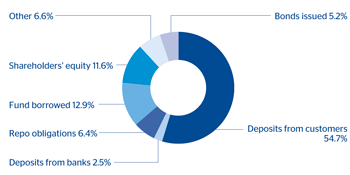

Garanti. Composition of liabilities (1)(September 2013) |

|---|---|

(1) Garanti Bank only. |

(1) Garanti Bank only. |

- Impairment losses on financial assets through September stood at €238m, 72.4% more than the amount registered in the same period in 2012. The increase is basically due to higher generic provisions resulting from Garanti’s increased activity.

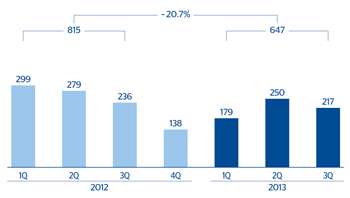

- Overall, Eurasia generated a net attributable profit of €647m as of 30-Sep-2013. Of this total, €236m (36.5%) is from Garanti, which posted earnings of €916m in the first nine months of 2013 (up 8.9% year-on-year).

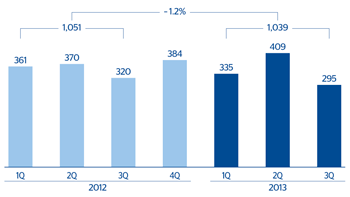

Eurasia. Operating income(Million euros) |

Eurasia. Net attributable profit(Million euros) |

|---|---|

|

|

Eurasia. Gross income breakdown by geography(30-09-2013) |

Eurasia. Net attributable profit by geography(30-09-2013) |

|---|---|

|

|