South America generated a cumulative net attributable profit to September of €885m, due to:

- An excellent performance by gross income, despite the adjustment for hyperinflation in Venezuela being more negative than in the same period last year. The strength of activity, good price management and the positive performance of income from fees and commissions and NTI have boosted gross income to €4,032m in the first nine months of 2013, 20.4% up on the amount posted in the same period in 2012.

- Growth of operating expenses as a result of the expansion plans in the area and its high rate of inflation. Between January and September 2013 this item amounted to €1,747m, a rise of 21.8% on the figure for the same period the previous year. The South American franchise has strengthened its commitment to the region with the launch of a four-year strategic plan. Its main goal is to turn BBVA into the main digital financial group in the region and the most popular with customers. To this end, the Bank has announced an investment of USD 2.5 billion (around €1.9 billion), of which 40% is allocated to technological projects and 60% to improving infrastructure and distribution networks.

- Impairment losses on financial assets have increased substantially year-on-year, as a result of the high recoveries booked in the first half of 2012. Excluding this effect, loan-loss provisions have increased in line with business activity. This item amounted to €485m in the first nine months of the year, up 35.8% on the same period in 2012. The cumulative risk premium for the area now stands at 1.39%.

This can be broken down by country as follows:

- Argentina has generated a net attributable profit between January and September 2013 of €148m (up 15.0% year-on-year), supported by the strength of more recurring revenue (boosted by the increased activity and good price management). This has offset increased expenses and loan-loss provisions.

- Chile has posted a cumulative net attributable profit of €86m, with outstanding performance by income from fees and commissions and NTI, despite the negative effect on revenue of low inflation rates.

- Colombia closed the first nine months of 2013 with a net attributable profit of €219m, which as in previous quarters reflects the positive impact of increased activity and good price management on net interest income. On the costs side, expenses have increased, as have loan-loss provisions (the latter in line with buoyant lending activity).

- Peru has posted a cumulative net attributable profit of €123m, thanks to increased net interest income, NTI and income from fees and commissions, despite the impact of the Transparency Act, which limits banks from charging certain fees.

- Venezuela has posted a very positive net attributable profit of €244m in the first nine months of the year, in line with increased activity and boosted by the positive effect of the revaluation of the bank’s US dollar positions following the devaluation announced by the Venezuelan government in February.

- Lastly, BBVA Panama reported a cumulative net attributable profit of €19m, BBVA Paraguay €16m and BBVA Uruguay €19m.

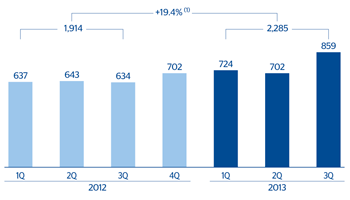

South America. Operating income(Million euros at constant exchange rates) |

South America. Net attributable profit(Million euros at constant exchange rates) |

|---|---|

(1) At current exchange rates: +1.5%. |

(1) At current exchange rates: -2.5%. |

South America. Data per country

(Million euros)

|

|

Operating income | Net attributable profit | ||||||

|---|---|---|---|---|---|---|---|---|

| Country | Jan.-Sep. 13 | Δ % | Δ % at constant exchange rates | Jan.-Sep. 12 | Jan.-Sep. 13 | Δ % | Δ % at constant exchange rates | Jan.-Sep. 12 |

| Argentina | 347 | 1.6 | 23.5 | 342 | 148 | (5.4) | 15.0 | 156 |

| Chile | 240 | 8.6 | 11.4 | 221 | 86 | (20.5) | (18.4) | 108 |

| Colombia | 394 | 1.8 | 8.3 | 387 | 219 | (2.4) | 3.8 | 224 |

| Peru | 483 | 4.3 | 8.0 | 463 | 123 | (0.3) | 3.2 | 123 |

| Venezuela | 737 | (3.5) | 38.1 | 764 | 244 | (1.1) | 41.5 | 246 |

| Other countries (1) | 84 | 13.8 | 15.3 | 74 | 66 | 33.2 | 35.3 | 50 |

| Total | 2,285 | 1.5 | 19.4 | 2,250 | 885 | (2.5) | 12.8 | 908 |