As a result, BBVA generated a net attributable profit of €195m in the quarter. This figure does not include any relevant one-off revenue. The cumulative figure for the nine first months of 2013 is €3,077m, clearly higher than the €1,656m reported in the same period last year, which included a significant part of the impairment of assets related to the real estate sector in Spain. Excluding the figure from real estate activity in Spain, the additional amount of loan-loss provisioning in the quarter as a result of the new classification of refinanced loans, the pension business in Latin America and the capital gains from the reinsurance operation completed in the first quarter of 2013, the Group’s adjusted net attributable profit through September 2013 would be €2,638m.

By business area, Spain contributed €477m to the Group’s cumulative earnings in the first nine months of the year, real estate activity in Spain generated a loss of €845m, while the United States contributed €314m, Eurasia €647m, Mexico €1,292m and South America €885m.

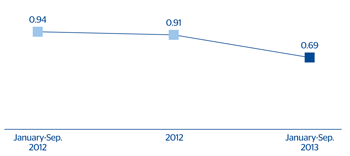

Lastly, earnings per share (EPS) generated between January and September were €0.54 (€0.47 in adjusted terms), return on total average assets (ROA) was 0.79% (0.69% adjusted), return on equity (ROE) 9.2% (7.9% adjusted), and return on tangible equity (ROTE) 11.4% (9.7% adjusted).

Earnings per share (1)

(Euros)

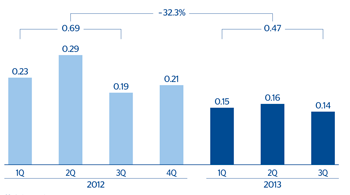

ROA (1)

(Percentage)

ROE (1) y ROTE (1)

(Percentage)