Other information: Corporate & Investment Banking

Highlights

- Lending activity increase throughout the year

- Dynamism of customer funds in the quarter

- Favorable evolution of recurring income and NTI, with double-digit growth in all business lines

- Improved efficiency

Business activity (1)

(VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO

31-12-21)

(1) Excluding repos.

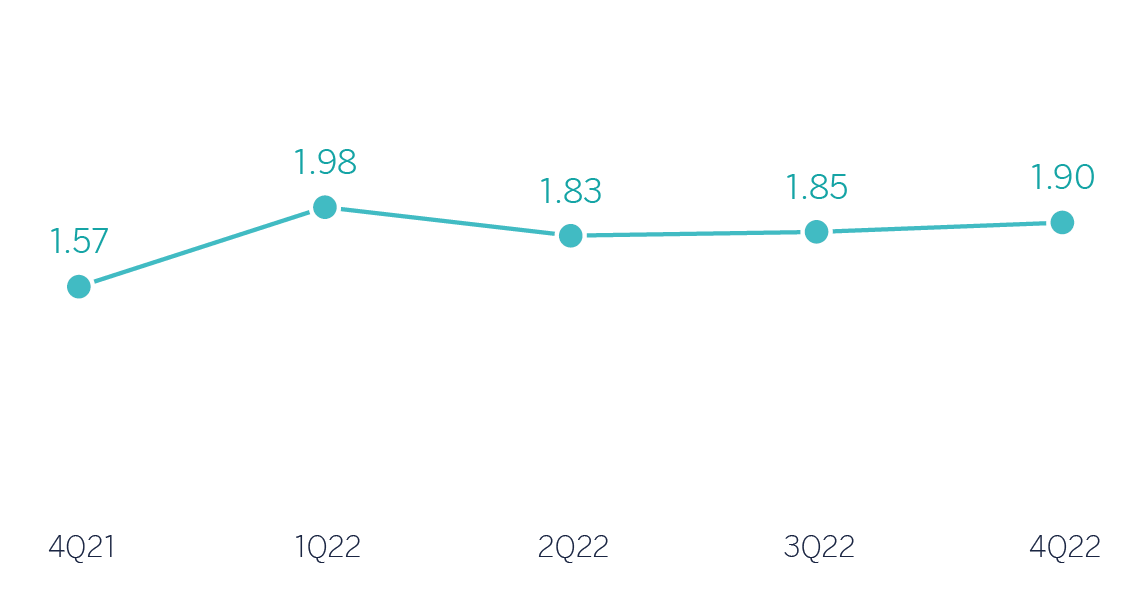

Gross income / AVERAGE TOTAL ASSETS

(Percentage. Constant exchange rates)

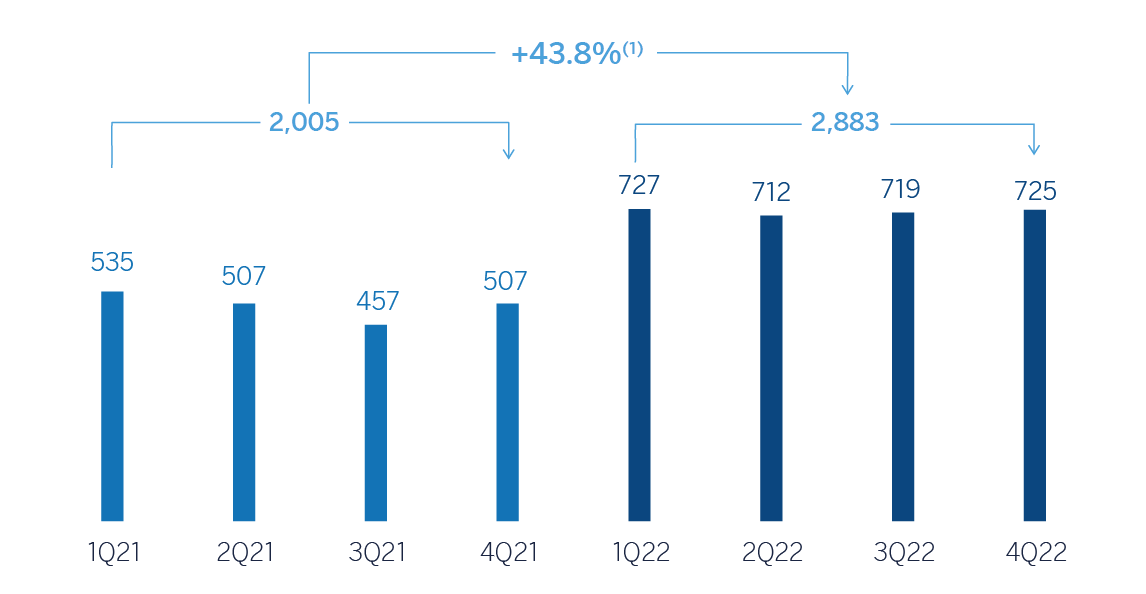

Operating income

(Millions of euros at constant exchange rates)

(1) At current exchange rates: +28.9%.

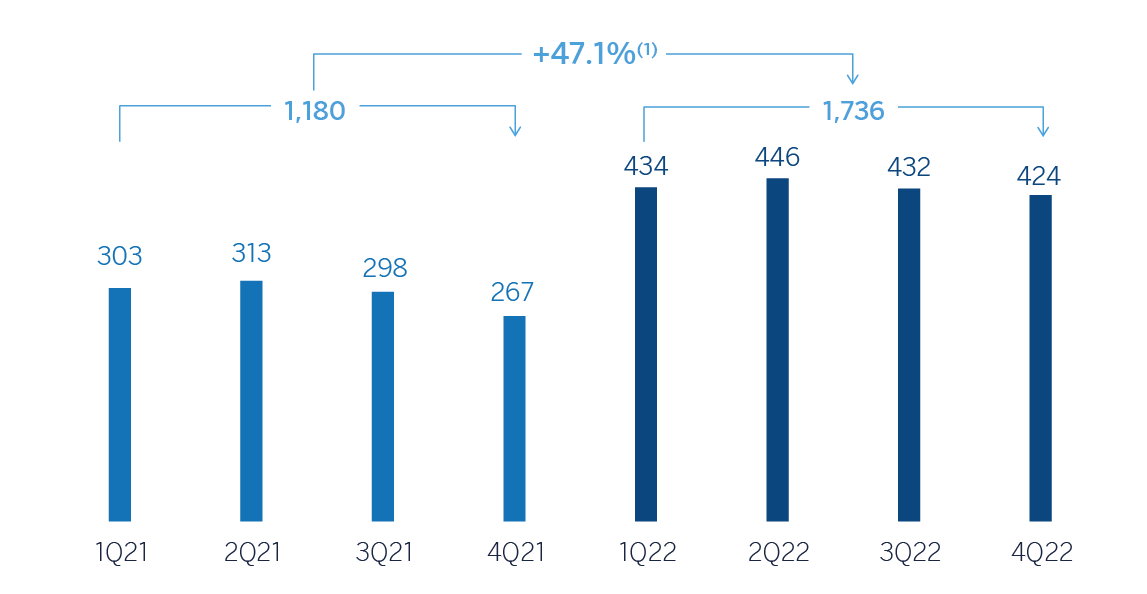

Net attributable profit (LOSS)

(Millions of euros at constant exchange rates)

(1) At current exchange rates: +40.0%.

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 2022 (1) | ∆% | ∆% (2) | 2021 (3) |

|---|---|---|---|---|

| Net interest income | 1,952 | 23.9 | 31.3 | 1,156 |

| Net fees and commissions | 917 | 15.5 | 20.0 | 794 |

| Net trading income | 1,182 | 30.6 | 50.1 | 905 |

| Other operating income and expenses | (43) | 6.9 | 4.2 | (40) |

| Gross income | 4,008 | 23.9 | 33.7 | 3,235 |

| Operating expenses | (1,125) | 12.7 | 13.4 | (999) |

| Personnel expenses | (535) | 12.9 | 12.3 | (474) |

| Other administrative expenses | (485) | 16.4 | 19.3 | (417) |

| Depreciation | (105) | (2.3) | (3.7) | (107) |

| Operating income | 2,883 | 28.9 | 43.8 | 2,236 |

| Impairment on financial assets not measured at fair value through profit or loss | (104) | 51.0 | 110.3 | (69) |

| Provisions or reversal of provisions and other results | (12) | 0.9 | (8.9) | (12) |

| Profit (loss) before tax | 2,767 | 28.4 | 42.4 | 2,156 |

| Income tax | (779) | 32.2 | 45.6 | (589) |

| Profit (loss) for the period | 1,988 | 26.9 | 41.2 | 1,567 |

| Non-controlling interests | (253) | (22.6) | 10.9 | (327) |

| Net attributable profit (loss) | 1,736 | 40.0 | 47.1 | 1,240 |

- (1) For the translation of the income statement in those countries where hyperinflation accounting is applied, the punctual exchange rate as of December 31, 2022 is used.

- (2) At constant exchange rates.

- (2) Restated balances. For more information, please refer to the “Business Areas” section.

| Balance sheets | 31-12-22 | ∆% | ∆% (1) | 31-12-21 |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 5,524 | 7.8 | 4.9 | 5,125 |

| Financial assets designated at fair value | 117,958 | (10.4) | (11.5) | 131,711 |

| Of which: Loans and advances | 45,360 | (17.9) | (18.2) | 55,232 |

| Financial assets at amortized cost | 89,440 | 23.6 | 23.6 | 72,363 |

| Of which: Loans and advances to customers | 77,208 | 24.4 | 24.5 | 62,042 |

| Inter-area positions | - | - | - | - |

| Tangible assets | 52 | 20.6 | 18.6 | 43 |

| Other assets | 862 | n.s. | n.s. | 110 |

| Total assets/liabilities and equity | 213,836 | 2.1 | 1.4 | 209,352 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 98,790 | 3.7 | 2.4 | 95,283 |

| Deposits from central banks and credit institutions | 20,987 | 62.9 | 61.7 | 12,884 |

| Deposits from customers | 48,180 | 25.6 | 25.0 | 38,360 |

| Debt certificates | 5,292 | (7.9) | (12.3) | 5,746 |

| Inter-area positions | 25,576 | (42.1) | (41.9) | 44,196 |

| Other liabilities | 4,157 | 43.3 | 45.6 | 2,901 |

| Regulatory capital allocated | 10,855 | 8.7 | 8.3 | 9,983 |

| Relevant business indicators | 31-12-22 | ∆% | ∆% (1) | 31-12-21 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (2) | 77,291 | 25.5 | 25.3 | 61,588 |

| Non-performing loans | 753 | (46.9) | (37.6) | 1,417 |

| Customer deposits under management (2) | 47,270 | 26.2 | 25.6 | 37,445 |

| Off-balance sheet funds (3) | 1,750 | 33.2 | 62.5 | 1,314 |

| Efficiency ratio (%) | 28.1 | 30.9 |

- (1) At constant exchange rates.

- (2) Excluding repos.

- (3) Includes mutual funds, customer portfolios and other off-balance sheet funds.

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. For the conversion of these figures in those countries in which accounting for hyperinflation is applied, the punctual exchange rate as of December 31, 2022 is used. These rates, together with changes at current exchange rates, can be found in the attached tables of financial statements and relevant business indicators.

Activity

The most relevant aspects related to the area's activity in the year 2022 were:

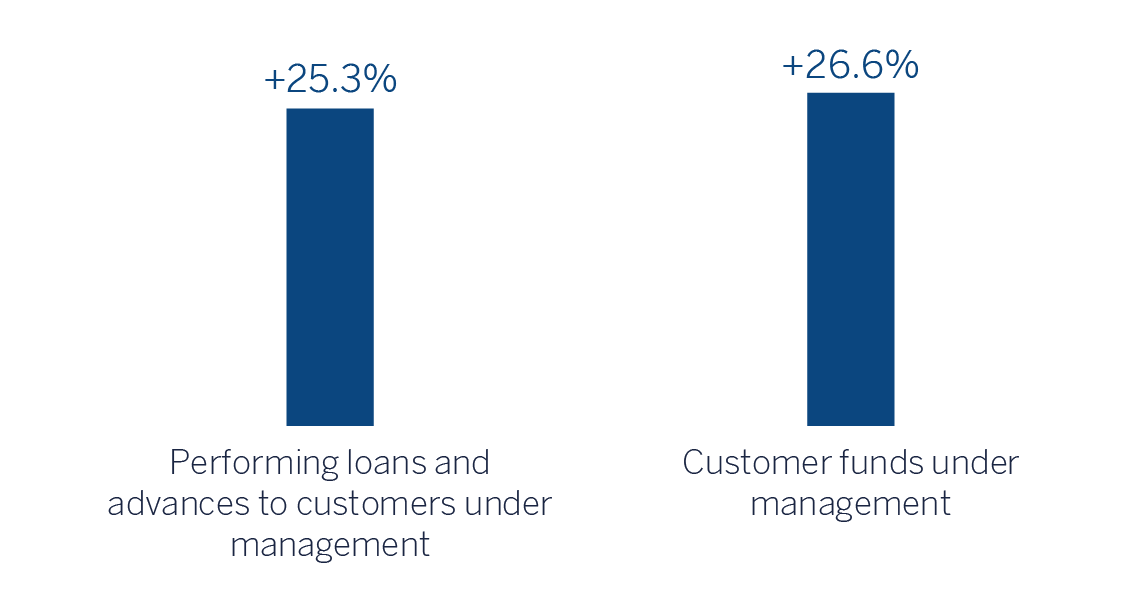

- Lending activity (performing loans under management) continued to grow at double digit rates and accumulates a growth of 25.3%, with a positive performance in all geographical areas, except for Peru. Both Investment Banking & Finance (project finance and one-off corporate operations in the United States) and Global Transactional Banking, where Factoring and Confirming business showed a very positive dynamics, stand out.

- Customer funds increased by 26.6% thanks to the active management of the area, both in demand and time deposits. The deposits from the Group’s wholesale customers continue to be a relevant lever for the BBVA’s liquidity management.

The most relevant developments in the area's activity in the fourth quarter of 2022 were:

- Lending activity (performing loans under management) increased by 1.7%, especially due to the performance of Rest of Business, with outstanding operations with corporate clients and a good evolution of Factoring.

- Customer funds increased by 11.8%, thanks to the growth in time deposits (+22.5%) and, to a lesser extent, to off-balance sheet funds (+15.6%). For its part, demand deposits grew by +5.0%.

Results

CIB generated a net attributable profit of €1,736m in 2022. These results, which do not include the application of hyperinflation accounting, represent an increase of 47.1% on a year-on-year basis, due to the growth in recurring income and NTI, which comfortably offset the higher expenses and provisions for impairment on financial assets. It should also be noted that all business lines of the CIB area recorded double-digit growth compared to the year 2021, both in revenues and net attributable profit.

The contribution by business areas, excluding the Corporate Center, to CIB's accumulated net attributable profit at the end of December 2022 was as follows: 25% Spain, 28% Mexico, 21% Turkey, 14% South America and 12% Rest of Business.

The most relevant aspects of the year-on-year evolution in the income statement of this aggregate are summarized below:

- Net interest income was 31.3% above the year 2021, with a good evolution in all business lines, highlighting the performance of Global Transactional Banking. This excellent result is due to the aforementioned good evolution of lending activity and the offer extension to our customers.

- Net fees and commissions recorded an increase of 20.0%, with positive evolution of all business lines, especially in Global Transactional Banking. Project finance operations and the good activity at guarantee scope stand out.

- NTI showed a good evolution (+50.1%), mainly due to the performance of the Global Markets unit, driven by the income from commercial activity in emerging markets and intraday trading in foreign exchange positions.

- Operating expenses increased by 13.4%, in a year-on-year comparison affected by the cost containment plans implemented by CIB in 2021, in addition to the high inflationary environment, although the area continues to focus its efforts on discretionary expenses management. Despite the aforementioned, the efficiency ratio stood at 28.1%, which is an improvement over the same period last year.

- Higher level of provisions for impairment on financial assets, with higher loan loss-provisions in Turkey.

- Finally, the provision and other results line recorded a negative result of €12m (-8.9% in year-on-year terms), highlighting in the year-on-year evolution the release of provisions for risks and contingent commitments made in the New York branch.

In the fourth quarter of 2022 and excluding the effect of the variation in exchange rates, the Group's wholesale businesses generated a net attributable profit of €424m (-2.0% compared to the previous quarter). This performance is mainly explained by the higher expenses compared to the previous quarter, as revenues and provisions showed a positive evolution.