Highlights

Results and business activity

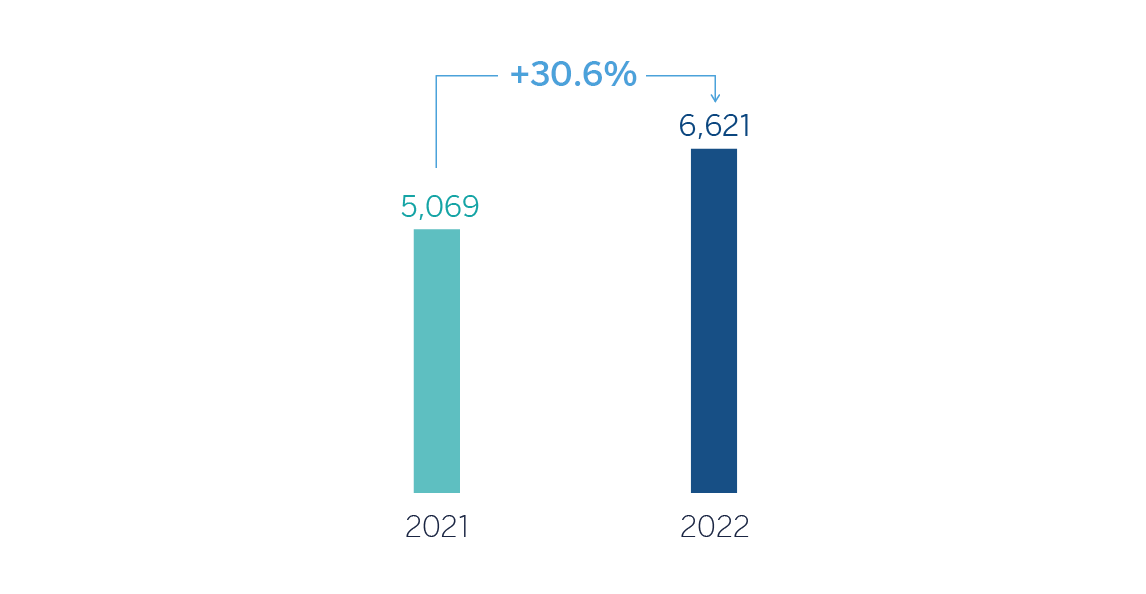

The BBVA Group generated a net attributable profit excluding non-recurring impacts of €6,621m in the year 2022, which represents an increase of 30.6% compared to the previous year, and the highest result ever. Including the non-recurring impacts, i.e. the net impact for an amount of €-201m from the purchase of offices in Spain from Merlin in June 2022 and €-416m from the results of discontinued operations corresponding to BBVA USA and the rest of the companies sold to PNC on June 1, 2021, together with the net cost related to the restructuring process of the same year, the net attributable profit increased by 38.0% in year-on-year terms to €6,420m.

Recurring income from banking activity (net interest income and commissions) continues to show an excellent performance, reflecting the good performance of activity and improvement in the customer spread, fostered by a more favorable interest rate environment.

Operating expenses increased by 12.9% at the Group level, below the average inflation rate in all countries in which BBVA operates. Notwithstanding the above, thanks to the remarkable growth in gross income, higher that the growth in expenses, the efficiency ratio stood at 43.2% as of December 31, 2022, with an improvement of 277 basis points, in constant terms, compared to the ratio as of December 31, 2021, placing BBVA, once again, in a leading position among its European peer group1.

The provisions for impairment on financial assets increased (+12.9% in year-on-year terms and at constant exchange rates), with higher provisions in South America and Turkey.

The Group's excellent performance in 2022 has also allowed it to accelerate value creation, as reflected in the growth of the tangible book value and dividends, which at year-end 2022 was 19.5% above the previous year.

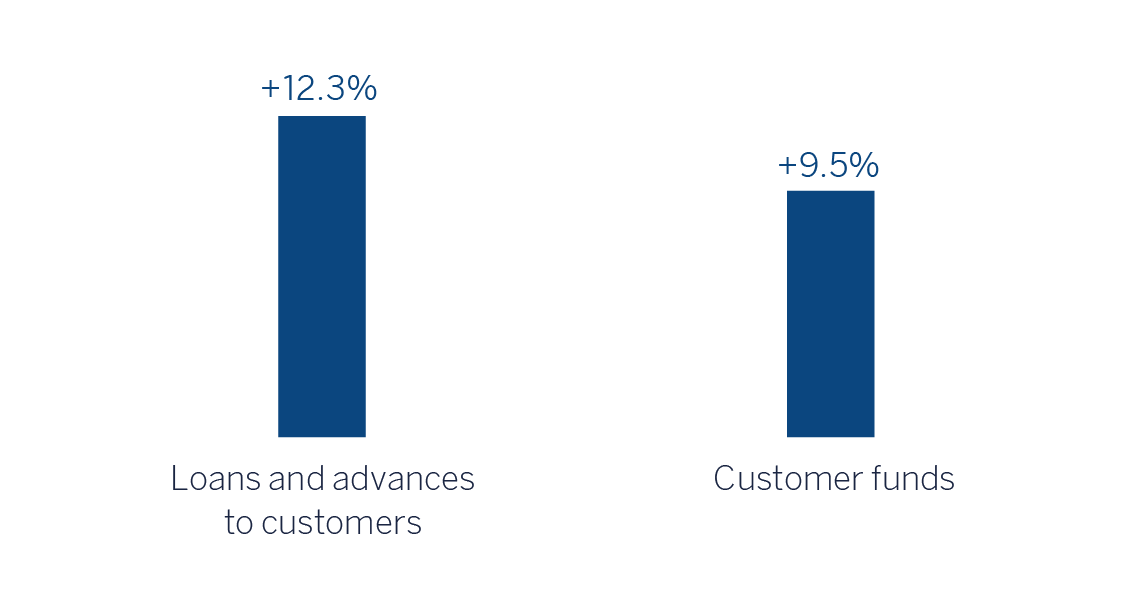

Loans and advances to customers grew by 12.3% compared to the end of December 2021, strongly favored by the evolution of business loans in all business areas and, to a lesser extent, by the performance of retail loans.

Customer funds increased by 9.5% compared to the end of December 2021 thanks to the good performance of customer deposits, which increased in all geographical areas, with increases in both demand deposits and time deposits.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2021)

Business areas

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

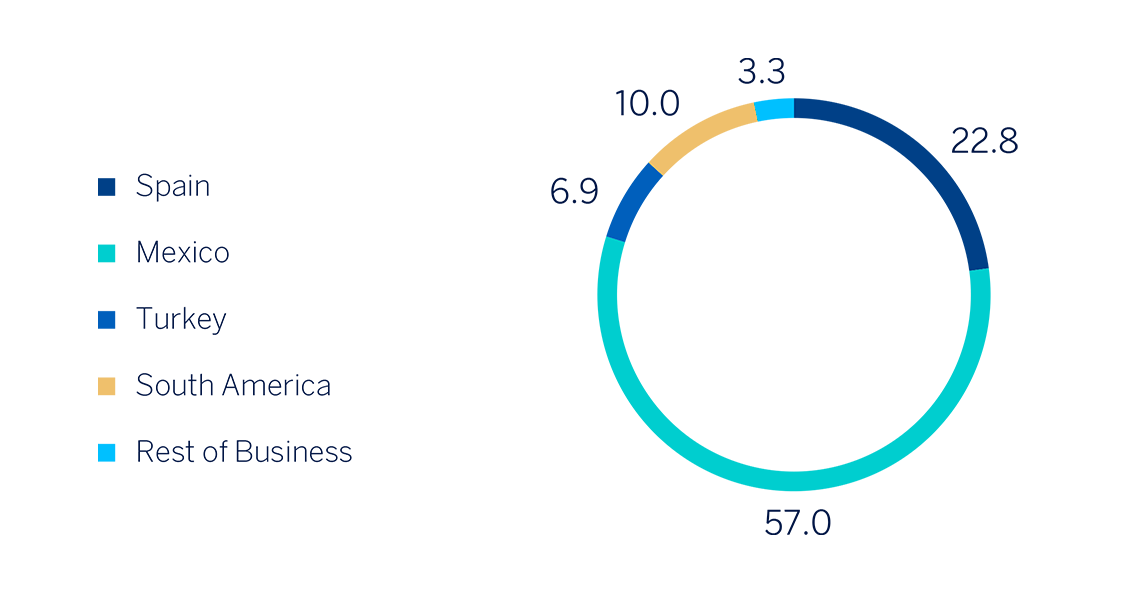

- Spain generated a net attributable profit of €1,678m in the year 2022, up 8.4% from the result achieved in the previous year, due to the dynamism of net interest income and the higher net trading income (NTI), which together with lower operating expenses and provisions, have driven the year-on-year evolution. This result includes the net impact of €-201m from the purchase of offices from Merlin, recorded in the second quarter of the year. Excluding this impact, the cumulative net attributable profit of the area at the end of the year 2022 stands at €1,879m, 21.4% above the net attributable profit of the previous year.

- In Mexico, BBVA achieved a net attributable profit of €4,182m during 2022, representing an increase of 44.8% compared to the year 2021, mainly as a result of the increase in recurring income (net interest income and commissions), due to the strong dynamism of lending activity and the continued improvement in customer spreads, which more than offset the expenses increase in a context of growth and strong activity.

- Turkey generated a net attributable profit of €509m in the year 2022, which includes the impact of hyperinflation accounting in Turkey, with effect from January 1, 2022, partially offset by good business dynamics.

- South America generated a net attributable profit of €734m in the year 2022, which represents a year-on-year variation of +80.0%, mainly due to the improved performance of recurring income (+54.3%) and NTI.

- Rest of Business achieved a net attributable profit of €240m accumulated at the end of 2022, 15.1% less than in the previous year.

The Corporate Center recorded a net attributable loss of €922m in the year 2022. This result compares to the loss of €938m recorded in the same period of the previous year, which included the net costs associated with the restructuring process in Spain carried out by the Group in 2021, in addition to the results generated by the Group's businesses in the United States until their sale to PNC on June 1, 2021.

Lastly and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €1,736m in 2022. These results, which do not include the application of hyperinflation accounting, represent an increase of 47.1% on a year-on-year basis, due to the growth in recurring income and NTI, which comfortably offset the higher expenses and provisions for impairment on financial assets. It should also be noted that all business lines of the CIB area recorded double-digit growth compared to the year 2021, both in revenues and net attributable profit.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: 2022 excludes net impact arisen from the

purchase of offices in Spain. 2021 excludes BBVA USA and the

rest of the companies in the United States sold to PNC and the

net cost related to the restructuring process.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 2022)

(1) Excludes the Corporate Center.

Solvency

The Group's CET1 Fully-loaded ratio stood at 12.61% as of December 31, 2022, maintaining a large management buffer over the Group's CET1 requirement (8.60%),2 and also above the Group's established target management range of 11.5-12.0% of CET1.

Shareholder remuneration

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.31 per share on April as final dividend of 2022 and the execution of a Share Buyback Program of BBVA for an amount of €422m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2022 will reach €3,015m, 47% of the net attributable profit, which represents €0.50 per share, and also includes the payment in cash of €0.12 per share paid on October 2022 as interim dividend of the year.

Other highlights

On December 28, 2022, the Law for the establishment of the temporary tax on credit institutions and financial credit establishments was published in the Official State Gazette.

This law establishes an obligation to pay a non-taxable equity benefit of public nature during the years 2023 and 2024 to those credit institutions that operate in Spain whose aggregated amount of interest income and fee and commission income generated, corresponding to the year 2019, equals or exceeds €800 million.

The amount of the benefit to be paid will be the result of applying the percentage of 4.8% to the sum of the net interest income and fee and commission income and expense derived from the activity carried out in Spain, as shown in the income statement of the tax consolidation group to which the credit institutions belongs, corresponding to the calendar year prior to the year in which the obligation to pay arose. The payment obligation arises on the first day of the calendar year of fiscal years 2023 and 2024.

The estimated impact for 2023 is €225 million and has been recorded on January 1, 2023 in the heading "Other operating expense" of the consolidated income statement of the Consolidated Financial Statements.

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, comparable peer data as of the end of September 2022.

2 From 1st January 2023, BBVA’s SREP requirement is 8.72% at the consolidated level.