5.2.1. Scope of application

For the purposes of calculating own funds, the scope of application of the internal model for market risk extends to BBVA S.A. and BBVA Bancomer Trading Floors.

5.2.2. Features of the models used

The basic measurement model used is that of value-at-risk (VaR), which provides a forecast of the maximum loss that can be incurred by trading portfolios in a one-day horizon, with a 99% probability, stemming from market fluctuations of the aforementioned factors. It uses a historical period of 2 years of observations of the risk factors.

The Bank of Spain has authorized the use of the internal model to calculate the capital risk positions of the trading portfolios of BBVA S.A. (since 2004) and BBVA Bancomer (since 2007). Together, the two account for around 80-90% of market risk in the Group's trading portfolio. Furthermore, and following guidelines established by Spanish and European regulators, BBVA includes additional metrics to comply with the regulatory requirements issued by the Bank of Spain. The new market risk measures for the trading portfolio include the calculation of the stressed VaR (to quantify the risk level in extreme historical conditions), the quantification of non-performing risks, and of downgrade risks in the rating of some positions held in the portfolio, such as bonds and credit derivatives; they also quantify securitization and correlation portfolio charges, using the standard model.

The market-risk limits model currently in force consists of a system of VaR (Value at Risk) and economic capital limits and VaR sub-limits, as well as stop-loss limits for each of the Group’s business units. The global limits are proposed by the Corporate GRM area and approved by the Executive Committee on an annual basis, after they have been submitted to the Board’s Risk Committee.

This limits structure is developed by identifying specific risks by type, trading activity and trading desk. The market risk units maintain consistency between the limits. This system of limits is supplemented by measures of the impact of extreme market movements on risk positions. Currently the stress analysis is carried out on the basis of historical crisis scenarios. The benchmark historical scenario is the Lehman bankruptcy in 2008. The economic crisis scenario is updated monthly and is carried out ad hoc for each of the BBVA Group's treasuries. The most significant market risk positions are identified in this scenario and an evaluation is made of the impact that movements in market variables may have on the positions.

BBVA continues its work to improve and enrich the information provided by stress exercises. It prepares scenarios that aim to detect what possible combinations of impacts in terms of market variables may significantly affect the result of trading portfolios. It complements the information provided by VaR and the historical scenarios and works as an alert indicator that complements the normal risk measurement and control policies.

In order to assess business unit performance over the year, the accrual of negative earnings is linked to the reduction of the VaR limits that have been set. The control structure in place is supplemented by limits on loss and a system of alert signals to anticipate the effects of adverse situations in terms of risk and/or result. All the tasks associated with stress testing, methodologies, scenarios of market variables and reports are coordinated between the Group’s various Risk Areas.

Finally, the market risk measurement model includes backtesting, or ex-post comparison, which helps to refine the accuracy of the risk measurements by comparing day-on-day results with their corresponding VaR measurements.

Value at Risk (VaR) is the basic variable for managing and controlling the Group’s market risk. This risk metric estimates the maximum loss that may occur in a portfolio’s market positions for a particular time horizon and given confidence level. VaR is calculated in the Group at a 99% confidence level and a one-day time horizon.

BBVA, S.A. market risk

BBVA Bancomer market risk

As mentioned before, both BBVA S.A. and BBVA Bancomer have received approval from the Bank of Spain to use an internal model developed by the BBVA Group to calculate bank capital requirements for market risk. This model estimates the VaR in accordance with the "historical simulation" methodology, which consists of estimating the losses and gains that would have been produced in the current portfolio if the changing market conditions that occurred over a determined period of time were repeated. Based on this information, it infers the maximum foreseeable loss in the current portfolio with a given level of confidence. The model has the advantage of accurately reflecting the historical distribution of the market variables and of not requiring any specific distribution assumption. The historical period used in this model is two years.

In addition, and for the purposes of calculating the capital requirements for financial instruments held for trading, the Group has since 2011 incorporated the new Basel 2.5 requirements, which has had an impact in terms of an increase in capital charges. Specifically, these new charges include:

1. Incremental Risk Charge (IRC): Calculates the risk not captured by the VaR model, specifically migration and default events.

2. VaR Stress: Gives a VaR figure using parameters calculated in a period of stress conditions.

3. Charge on securitization portfolio: The specific risk will be calculated according to the standard method rules, i.e. the same capital charge as a position in the banking book.

4. Capital charge on correlation portfolio: The risk is calculated by the standard method and supervisory formula. The perimeter of this charge is referred to Nth-to-default market positions and/or market tranches, and only for positions with an active market and hedging capacity.

Below is the breakdown of capital requirements for BBVA S.A and BBVA Bancomer models:

2012

(Million euros)

|

|

Capital requirement by market risk | |||

|---|---|---|---|---|

| Advanced Model | CR (VaR) | CR (sVaR) | IRC | Total |

| Spain | 160 | 165 | 124 | 449 |

| Mexico | 54 | 150 | 39 | 243 |

| Total | 214 | 315 | 163 | 693 |

2011

(Million euros)

|

|

Capital requirement by market risk | |||

|---|---|---|---|---|

| Advanced Model | CR (VaR) | Advanced Model |

CR (VaR) | Advanced Model |

| Spain | 155 | 193 | 93 | 441 |

| Mexico | 48 | 142 | 57 | 247 |

| Total | 202 | 336 | 150 | 688 |

By type of market risk on the trading book, the main risk in BBVA S.A. is interest-rate and spread risk, at 77% of the total at the end of 2012; equity risk accounts for 2%, exchange-rate risk 3% and volatility risk 18%.

The following tables show VaR by risk factor for BBVA S.A. and BBVA Bancomer:

BBVA, S.A. market risk

(Million euros)

| Risk | 31-12-12 |

|---|---|

| Interest + Spread | 26.3 |

| Exchange rate | 1.2 |

| Equity | 0.7 |

| Volatility and correlation | 6.2 |

| Diversification effect | (15.2) |

| TOTAL | 19.2 |

| 2012 AVERAGE | 13.8 |

| 2012 MAXIMUM | 21.7 |

| 2012 MINIMUM | 8.1 |

BBVA Bancomer market risk

(Million euros)

| Risk | 31-12-12 |

|---|---|

| Interest + Spread | 5.7 |

| Exchange rate | 1.1 |

| Equity | 1.8 |

| Volatility and correlation | 2.7 |

| Diversification effect | (4.1) |

| TOTAL | 7.3 |

| 2012 AVERAGE | 5.1 |

| 2012 MAXIMUM | 9.1 |

| 2012 MINIMUM | 3.4 |

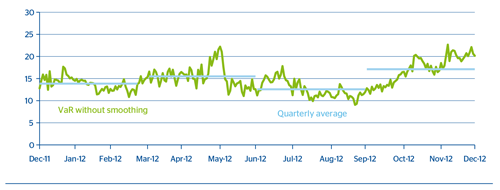

VaR figures are estimated following two methodologies:

- VaR without smoothing, which awards equal weight to the daily information for the previous two years. This is currently the official methodology for measuring market risks vis-à-vis limits compliance.

- VaR with smoothing, which weighs more recent market information more heavily. This metric is supplementary to the one above.

VaR with smoothing adapts itself more swiftly to the changes in financial market conditions, whereas VaR without smoothing is, in general, a more stable metric that will tend to exceed VaR with smoothing when the markets show less volatile trends, but be lower when they present upturns in uncertainty.

5.2.3. Stress testing

All the tasks associated with stress, methodologies, scenarios of market variables or reports are undertaken in coordination with the Group’s Risk Areas.

Currently the stress analysis is carried out on the basis of historical crisis scenarios. The benchmark historical scenario is the bankruptcy of Lehman in 2008. Once the critical period to be used has been defined, the behavior of risk factors is applied to revaluate the current portfolio in order to estimate the loss that would be incurred if this market situation were to be repeated.

Impact on earnings in Lehman scenario

(Million euros)

|

|

31-12-2012 | 31-12-2011 |

|---|---|---|

| GM Europe | -9 | -42 |

| GM Bancomer | -82 | -21 |

| GM Argentina | -1 | -2 |

| GM Chile | -8 | -4 |

| GM Colombia | -2 | -1 |

| GM Peru | -8 | -6 |

| GM Venezuela | -4 | -3 |

A new methodology for calculating stress scenarios: The historical stress exercises are supplemented with the use of a simulation process to design stress scenarios that can significantly impact the current portfolio at any time. Unlike the historical scenarios, which are fixed and thus do not adapt to the composition of portfolio risks at any given time, these scenarios are dynamic and are recalculated regularly according to what the principal risks in the trading portfolios are. The exercise therefore starts with the most relevant sensitivities in the portfolio and takes a historical view of the risk factors beginning in 2008, selecting the 500 consecutive days that were the greatest stress for this portfolio. A simulation exercise is then carried out in this stress window by the re-sampling of historical observations. This generates a 20-day distribution of gains and losses that allows an analysis of extreme events. The advantage of this methodology is that the stress period is not pre-established, but rather a function of the portfolio; and the large number of simulations mean that the expected shortfall analysis can be include richer information than that available in scenarios included in the VaR calculation. This methodology is in place at BBVA, S.A. and Bancomer, and will be gradually transferred to the remaining geographical areas.

5.2.4. Backtesting

The Group’s market risk measurement model needs to have a backtesting or self-validation program that assures that the risk measurements being made are appropriate.

The Global Markets Risk unit periodically approves the risk valuation models used to estimate the maximum loss that could be incurred in the positions assessed with a certain level of probability. If it is noticed that the model does not match the real results of the positions in question, checks would need to be run to offset possible errors, or changes made to improve the accuracy of the estimate.

The approval of the VaR measurement system is performed by comparing the ex-ante risk levels provided daily by the model with the real, ex-post management results calculated by the Financial Division from the business units’ management systems. Consistency between the results obtained and resulting risk level is verified.

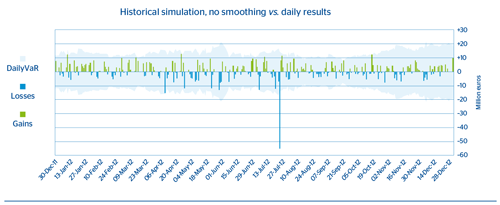

Validation of the market risk measurement model for BBVA S.A. with management results

(EUR Base)

In 2012, portfolio losses at BBVA S.A. were only greater than the daily VaR on one occasion, thus validating the correct operation of the model over the period, in line with the Basel criteria:

- July 24: This was a global trading desk exception generated exclusively due to a negative result produced on the equity trading desk. On that day, Telefónica announced it would not pay a dividend in 2012 and cut the shareholder payout in 2013 and subsequent years by 50%.

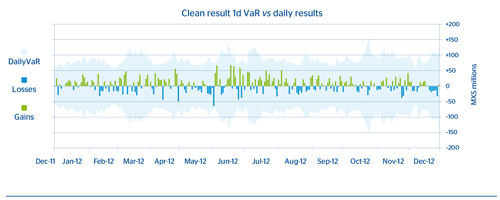

BBVA Bancomer. Backtesting

(December 2012)

No exception to the model occurred at BBVA Bancomer in 2012.

5.2.5. Characteristics of the risk management system

The Group has a risk management system that is appropriate for the volume of risks managed, in compliance with the conditions laid out in Rule Ninety-three:

- Integration of the daily risk calculations into the Group’s risk management.

- A Risk unit that is independent of the business units.

- Active participation of management bodies in the risk control process.

- Sufficient human resources to employ the model.

- Existence of written procedures that assure the global precision of the internal model used for calculating VaR.

- Accreditation of the degree of accuracy of the internal model used for calculated VaR.

- Existence of a stress program.

- Periodic internal audits performed on the risk measurement system.

The Group employs a backtesting program that ensures that the risk measurements carried out are appropriate.

The Group uses internal validation procedures for the model that are independent of the model development process.

VaR is calculated at a 99% confidence level and a 1-day time horizon. In order to extrapolate to the regulatory 10-day horizon, the figures are multiplied by the square root of 10. A historical period of 2 years is used for risk factor observation.

The market risks model has a sufficiently large number of risk factors, according to the business volume in the various financial markets.