Risk management

Credit risk

The global economy is currently facing a number of extraordinary challenges. The war in Ukraine and the related sanctions imposed against and by Russia have led to significant disruption, instability and volatility in global markets, as well as rising inflation and lower economic growth. The increase in interest rates during the last year could negatively affect the Group by reducing the demand for credit, limiting its capacity to generate credit for its customers and causing a strain on the payment capacity of individuals.

The Group has been offering COVID-19 support measures to its clients in all the geographical areas in which it is present, which have consisted of both current loan moratoriums and new financing with a public guarantee. The measures in force in 2022 and maintained in 2023 related to new financing with a public guarantee are limited to Spain and Peru. For the latter, the possibility of taking advantage of the Reactiva program which initially ended on June 30, 2023, has been extended until September 30, 2023. In addition, in Spain, in March 2022, the Council of Ministers (RDL 6/2022) approved a line of financing with public guarantees of 70% and 80% of the principal amount for self-employed and enterprises in order to alleviate the liquidity tensions due to increases in energy prices and raw materials, available until December 2023.

Finally, on November 23, 2022, the Royal Decree-Law 19/2022, of November 22, was published. It amends the Code of Good Practices, establishes a new Code of Good Practices, regulated by Royal Decree Law 6/2012, easing the impact of interest rates hikes on mortgage loans agreements related to primary residences and provides for other structural measures aiming to ease access to lending. In November 30, 2022, the BBVA Board of Directors agreed the adherence to the new Code of Good Practices with effect from January 1, 2023The number and amount of the transactions granted to clients in accordance with the new Code of Good Practices have been low.

Regarding the direct exposure of the Group to Russia and Ukraine, this is limited for BBVA, although the Group has taken different measures aimed at reducing its impact, among which are the initial lowering of limits followed by the suspension of operations with Russia, the lowering of internal ratings and the inclusion of the country and its borrowers as impaired for subjective reasons. However, the indirect risk is greater due to the activity of customers in the affected area or sectors. The economic effects are mainly shown through higher commodity prices, mainly energy, despite the moderation observed in recent months.

Calculation of expected losses due to credit risk

For the estimation of expected losses, the models include individual and collective estimates, taking into account the macroeconomic forecasts in accordance with IFRS 9. Thus, the estimate at the end of the quarter includes the effect on expected losses of updating macroeconomic forecasts, which take into account the current global environment, which has been affected by the war in Ukraine, the evolution of interest rates, inflation rates and commodity prices.

Additionally, the Group can supplement the expected losses either by the consideration of additional risk drivers, the incorporation of sectorial particularities or that may affect a set of operations or borrowers, following a formal internal process established for the purpose.

Thus, in Spain, during 2021 and 2022, the Loss Given Default (LGD) of certain specific operations considered unlikely to pay was reviewed upwards, with a remaining adjustment as of June 30, 2023 of €388 million, without significant variation since the end of the year 2022. In addition, due to the earthquakes that affected an area in the south of Turkey, during the month of February 2023 the classification of the credit exposure recorded in the five most affected cities was reviewed, which led to its reclassification to Stage 2. As of June 30, 2023 the amounts recorded in Stage 2 were €472 million on-balance sheet and €478 million of off-balance sheet, with allowances for losses of approximately €56 million at contract level.

On the other hand, the complementary adjustments pending allocation to specific operations or customers that are in force as of June 30, 2023 total €158m, of which €54m correspond to Spain, €85 million to Mexico, €2 million to Peru, €8 million to Colombia, €2 million to Chile and €6m to Rest of Business of the Group. Compared to December 31, 2022, the complementary adjustments pending allocation to specific operations or customers totaled €302 million, of which €163m corresponded to Spain, €92 million to Mexico, €25 million to Peru, €11 million to Colombia, €5 million to Chile. and €6m to Rest of Business of the Group. The change in the first half is due to the utilization made during this period in Spain, Mexico, Peru, Colombia and Chile, with no additional provisions in the first months of the year.

BBVA Group's credit risk indicators

The evolution of the Group’s main credit risk indicators is summarized below:

- Credit risk increased in the second quarter of the year by 1.8% (+2.8% at constant exchange rates), with generalized growth at constant exchange rates in all geographic areas except Peru, where it remained practically stable.

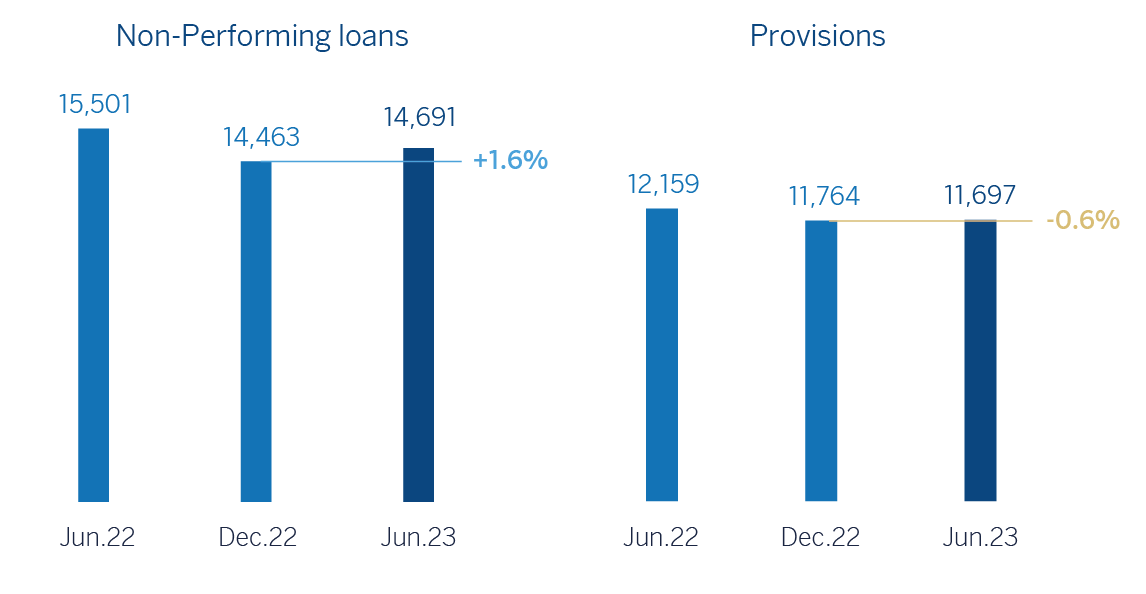

- Increase in the balance of non-performing loans at the Group level between April and June 2023 (+3.9% in current terms and +4.8% at constant rates), due to higher NPL inflows in retail portfolios, offset by the positive dynamics in wholesale portfolios (repayments and recoveries). Compared to the end of the previous year, the balance of non-performing loans increased by 1.6% (+2.1% at constant exchange rates).

NON-PERFORMING LOANS AND PROVISIONS (MILLIONS OF EUROS)

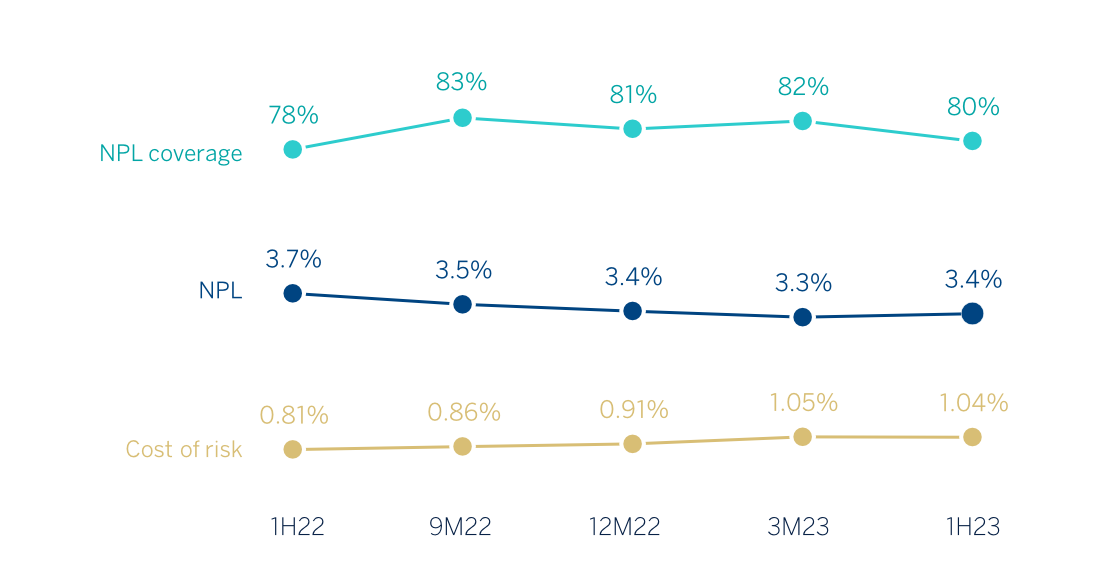

- The NPL ratio continued to show stability and stood at 3.4% as of June 30, 2023, 7 basis points above the figure recorded in the previous quarter (5 basis points below that of the end of 2022) due to the aforementioned increase in the non-performing loans balance.

- Loan-loss provisions remained almost stable compared to the figure at the end of the previous quarter (+0.3 and -0.6% with respect to December 2022).

- The NPL coverage ratio ended the quarter at 80%, 284 basis points lower than the figure at the end of the previous quarter (172 basis points lower than the end of 2022 and at a higher rate compared to the first half of 2022), mainly due to the increase in the balance of non-performing loans and, to a lesser extent, to improvements in the credit quality of some wholesale customers.

- The cumulative cost of risk as of June 30, 2023 stood at 1.04% practically stable compared to the previous quarter.

NPL AND NPL COVERAGE RATIOS AND COST OF RISK (PERCENTAGE)

CREDIT RISK(1) (MILLIONS OF EUROS)

| 30-06-23 | 31-03-23 | 31-12-22 | 30-09-22 | 30-06-22 | |

|---|---|---|---|---|---|

| Credit risk | 436,174 | 428,423 | 423,669 | 428,064 | 413,638 |

| Non-performing loans | 14,691 | 14,141 | 14,463 | 15,162 | 15,501 |

| Provisions | 11,697 | 11,661 | 11,764 | 12,570 | 12,159 |

| NPL ratio (%) | 3.4 | 3.3 | 3.4 | 3.5 | 3.7 |

| NPL coverage ratio (%)(2) | 80 | 82 | 81 | 83 | 78 |

(1) Includes gross loans and advances to customers plus contingent liabilities.

(2) The NPL coverage ratio includes the valuation adjustments for credit risk throughout the expected residual life in those financial instruments that have been acquired (mainly originating from the acquisition of Catalunya Banc, S.A.). If these valuation corrections had not been taken into account, the NPL coverage ratio would have stood at 79% as of June 30, 2023, 80% as of December 31, 2022 and 77% as of June 30, 2022.

NON-PERFORMING LOANS EVOLUTION (MILLIONS OF EUROS)

| 2Q23 (1) | 1Q23 | 4Q22 | 3Q22 | 2Q22 | |

|---|---|---|---|---|---|

| Beginning balance | 14,141 | 14,463 | 15,162 | 15,501 | 15,612 |

| Entries | 2,877 | 2,256 | 2,332 | 1,871 | 2,085 |

| Recoveries | (1,394) | (1,489) | (1,180) | (1,595) | (1,697) |

| Net variation | 1,483 | 767 | 1,152 | 276 | 388 |

| Write-offs | (877) | (1,081) | (928) | (683) | (579) |

| Exchange rate differences and other | (56) | (8) | (923) | 67 | 80 |

| Period-end balance | 14,691 | 14,141 | 14,463 | 15,162 | 15,501 |

| Memorandum item: | |||||

| Non-performing loans | 13,787 | 13,215 | 13,493 | 14,256 | 14,597 |

| Non performing guarantees given | 905 | 926 | 970 | 906 | 904 |

(1) Preliminary data.

Structural risks

Liquidity and funding

Liquidity and funding management at BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs using a wide range of instruments that provide access to a large number of alternative sources of financing. BBVA's business model, risk appetite framework and funding strategy are designed to reach a solid funding structure based on stable customer deposits, mainly retail (granular). As a result of this model, deposits have a high degree of assurance in each geographical area, close to 60% in Spain and Mexico. In this regard, it is important to note that, given the nature of BBVA's business, lending is mainly financed through stable customer funds.

One of the key elements in the BBVA Group's liquidity and funding management is the maintenance of large high-quality liquidity buffers in all geographical areas. In this respect, the Group has maintained during the last 12 months an average volume of high quality liquid assets (HQLA) of €138.1 billion, of which 96% corresponds to maximum quality assets (level 1 in the liquidity coverage ratio, LCR).

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolution strategy: the parent company sets the liquidity policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity and funding (taking deposits or accessing the market with their own rating). This strategy limits the spread of a liquidity crisis among the Group's different areas and ensures that the cost of liquidity and financing is correctly reflected in the price formation process.

The BBVA Group maintains a solid liquidity position in every geographical area in which it operates, with ratios well above the minimum required:

- LCR requires banks to maintain a volume of high-quality liquid assets sufficient to withstand liquidity stress for 30 days. BBVA Group's consolidated LCR remained comfortably above 100% during 2022 and stood at 148% as of June 30, 2023. It should be noted that, given the MPE nature of BBVA, this ratio limits the numerator of the LCR for subsidiaries other than BBVA S.A. to 100% of its net outflows. Therefore, the resulting ratio is below that of the individual units (the LCR of the main components reaches 174% in BBVA, S.A., 180% in Mexico and 228% in Turkey). If this restriction was eliminated, the Group's LCR ratio would reach 189%.

- The net stable funding ratio (NSFR) requires banks to maintain a stable funding profile in relation to the composition of their assets and off-balance sheet activities. The BBVA Group's NSFR ratio, stood at 132% as of June 30, 2023.

The breakdown of these ratios in the main geographical areas in which the Group operates is shown below:

LCR AND NSFR RATIOS (PERCETANGE. 30-06-23)

| BBVA, S.A. | Mexico | Turkey | South America | |

|---|---|---|---|---|

| LCR | 174 % | 180 % | 228 % | All the countries >100 |

| NSFR | 123 % | 136 % | 175 % | All the countries >100 |

In addition to the above, the most relevant aspects related to the main geographical areas are the following:

- BBVA, S.A. has maintained a strong position with a large high-quality liquidity buffer, having repaid almost the entire TLTRO III program. During the first half of 2023, commercial activity has not had a significant impact on the Bank's liquidity with a slight decline in lending, in line with customer deposits. The latter fell in the first quarter, influenced by the seasonal component and by the transfer to off-balance sheet funds, and it has recovered in the second quarter. In addition, in December 2022 the Bank started the repayment of the TLTRO III program for an amount of €12 billion, plus an additional repayment of €12 billion between February and March 2023 and another one of €11 billion in June 2023, which together represent more than the 90% of the original amount, maintaining at all times regulatory liquidity metrics well above the established minimums.

- BBVA Mexico continues to present a comfortable liquidity situation, which has contributed to an efficient management of the cost of funds in an environment of rising interest rates. During the first half of the year, however, commercial activity has drained liquidity to a large extent due to seasonal outflows of funds in the first months of the year, but also due to sustained loan growth.

- In Turkey, in the first half of 2023, the lending gap in local currency has been reduced, due to a greater growth in deposits than in loans. The lending gap in foreign currency has increased due to reductions in deposits as a result of the mechanism established to encourage Turkish lira deposits, and an increase in foreign currency loans. Garanti BBVA continues to maintain a stable liquidity position with comfortable ratios. For its part, the Central Bank of Turkey has begun to gradually ease the measures in order to reduce the dollarization of the economy.

- In South America, the liquidity situation remains adequate throughout the region. In Argentina, liquidity continues to increase in the system, and in BBVA due to a higher growth in deposits than in loans in local currency. In BBVA Colombia, the credit gap widened slightly due to higher growth in lending in contrast to deposits in the second quarter of the year. BBVA Peru maintains solid liquidity levels, showing a reduction in the credit gap in the first half of the year thanks to the positive performance of deposits in contrast to a reduction in lending, affected by the expiration of loans covered by COVID-19 programs.

The main wholesale financing transactions carried out by the BBVA Group during the first half of 2023 are listed below:

| Type of issue | Date of issue | Nominal (millions) | Currency | Coupon | Early redemption | Maturity date |

|---|---|---|---|---|---|---|

| Senior non-preferred | Jan-23 | 1,000 | EUR | 4.625 % | Jan-30 | Jan-31 |

| Covered bonds | Jan-23 | 1,500 | EUR | 3.125 % | - | Jul-27 |

| Senior preferred | May-23 | 1,000 | EUR | 4.125 % | May-25 | May-26 |

| Tier 2 | Jun-23 | 750 | EUR | Midswap + 280 basis points | Jun-Sep 28 | Sep-33 |

| AT1 | Jun-23 | 1,000 | EUR | 8.375 % | Dec-28 | Perpetual |

Additionally, in June 2023 BBVA, S.A. completed a securitization of a portfolio of car loans for an amount of €800m.

BBVA Mexico, for its part, carried out two senior issues in the first quarter of the year and a subordinated issue in the second quarter. The first of the senior issues consists of a green bond for 8,689 million Mexican pesos (approximately €468m) with a maturity of 4 years, using the TIIE (Balanced Interbank Interest Rate used in Mexico) rate as a benchmark, at one day +32 basis points; and the second one involved the issue of a senior bond for 6,131 million Mexican pesos (approximately €330m) at a fixed rate of 9.54% and a term of 7 years. Regarding the subordinated issue carried out in June, it was a USD 1 billion Tier 2 issue for a term of 15 years with an early redemption option after 10 years and at a fixed rate of 8.45%. The main objective of this issue is to achieve a comfortable loss-absorbing capital buffer to comply with TLAC (Total Loss-Absorbing Capacity) requirements, with full implementation in Mexico in 2025.

BBVA Colombia together with the International Finance Corporation (IFC) announced the launch of the first blue bond in the country of USD50m. For further information, please refer to the Sustainability section at the beginning of this report.

In Turkey, Garanti BBVA renewed in June a syndicated loan associated with environmental, social and corporate governance (ESG) criteria, consisting of two separate tranches of USD199m and €218.5m, both maturing in one year.

Foreign exchange

Foreign exchange risk management aims to reduce both the sensitivity of the capital ratios and the net attributable profit variability to currency fluctuations.

The performance of the Group's main currencies during the first half of 2023 has been very disparate. On the positive side, due to its relevance for the Group, the strength of the Mexican peso, which has appreciated 12.4% against the euro, stands out. Other Latin American currencies have also performed well in the first six months of the year: the Colombian peso (+12.7%), the Chilean peso (+5.1%) and the Peruvian sol (+3.0%). On the negative side, the Turkish lira (-29.5%) and the Argentine peso (-32.3%) depreciation stands out; both currencies are from countries with very high inflation rates. Finally, the U.S. dollar fell 1.8% against the euro, although it moved in a relatively narrow range.

EXCHANGE RATES (EXPRESSED IN CURRENCY/EURO)

| Period-end exchange rates | Average exchange rates | ||||

|---|---|---|---|---|---|

30-06-23 |

∆% on 30-06-22 |

∆% on 31-12-22 |

1H23 |

∆% on 1H22 |

|

| U.S. dollar | 1.0866 | (4.4) | (1.8) | 1.0809 | 1.2 |

| Mexican peso | 18.5614 | 12.9 | 12.4 | 19.6495 | 12.8 |

| Turkish lira (1) | 28.3193 | (38.8) | (29.5) | - | - |

| Peruvian sol | 3.9402 | (0.4) | 3.0 | 4.0564 | 1.7 |

| Argentine peso (1) | 278.43 | (53.4) | (32.3) | - | - |

| Chilean peso | 872.19 | 9.6 | 5.1 | 871.72 | 3.5 |

| Colombian peso | 4,554.24 | (5.9) | 12.7 | 4,963.93 | (13.8) |

(1) According to IAS 21 "The effects of changes in foreign exchange rates", the year-end exchange rate is used for the conversion of the Turkey and Argentina income statement.

In relation to the hedging of the capital ratios, BBVA covers, in aggregate, 70% of its subsidiaries' capital excess. The sensitivity of the Group's CET1 fully-loaded ratio to 10% depreciations in major currencies is estimated at: +18 basis points for the U.S. dollar, -9 basis points for the Mexican peso and -3 basis points for the Turkish lira10. With regard to the hedging of results, BBVA hedges between 40% and 50% of the aggregate net attributable profit it expects to generate in the next 12 months. For each currency, the final amount hedged depends on its expected future evolution, the costs and the relevance of the incomes related to the Group's results as a whole.

Interest rate

Interest rate risk management seeks to limit the impact that BBVA may suffer, both in terms of net interest income (short-term) and economic value (long-term), from adverse movements in the interest rate curves in the various currencies in which the Group operates. BBVA carries out this work through an internal procedure, pursuant to the guidelines established by the European Banking Authority (EBA), with the aim of analyzing the potential impact that could derive from a range of scenarios on the Group's different balance sheets.

The model is based on assumptions intended to realistically mimic the behavior of the balance sheet. Of particular relevance are assumptions regarding the behavior of accounts with no explicit maturity and prepayment estimates. These assumptions are reviewed and adapted at least once a year, to take into account any changes in observed behavior.

At the aggregate level, BBVA continues to have a positive sensitivity toward interest rate increases in the net interest income.

The first half of 2023 was characterized by persistent inflation in most of the countries where the Group operates. Although headline inflation continued to show signs of slowing down, core inflation remains at high levels. Following the episode of high volatility observed in March with the crisis involving certain regional banks in the United States and another Swiss bank, interest rates fell somewhat, anticipating a possible relaxation of contractionary monetary policies. However, in the following months, the central banks took up the hawkish message again, leading the markets to delay expectations of rate cuts, despite the pause in the Fed's bullish strategy. The effect of these movements on sovereign debt translated into strong rises in short tranches in both Europe and the United States. For its part, the peripheral curves continued to be well supported. In the case of Mexico, the cycle of increases of rates is considered to have ended and the markets discount that it could be one of the first to initiate cuts, even in 2023. The central bank of Turkey, has made a 180 degrees turn in its monetary policy with a significant rate hike in June, which is expected to continue in the coming months, following a 250 basis point increase in July. In South America, Colombia seems to have reached its terminal rate and Peru remains at the same levels as in the first quarter, after six consecutive meetings without changes.

By area, the main features are:

-

Spain has a balance sheet characterized by a high proportion of variable-rate loans (mortgages and corporate lending) and liabilities composed mainly by customer demand deposits. The ALCO portfolio acts as a management lever and hedging for the balance sheet, mitigating its sensitivity to interest rate fluctuations. In an environment of higher rates, currently close to their market-predicted terminal values, the interest rate risk profile of the balance sheet has been reduced during the year.

On the other hand, the ECB raised interest rates by 25 basis points at each of its meetings in May and June, bringing the benchmark interest rate to 4.00%, the marginal deposit facility rate at 3.5% and the marginal loan facility rate at 4.25% at the end of the quarter. In this environment, Euribor reference rates continued to rise in the second quarter of 2023, although at a slower pace than in the first quarter of the year. Thus, the customer spread is benefiting from the interest rate hikes and the containment in the cost of deposits. - Mexico continues to show a balance between fixed and variable interest rates balances, which results in a limited sensitivity to interest rates fluctuations. In terms of assets that are most sensitive to interest rate movements, the commercial portfolio stands out, while consumer loans and mortgages are mostly at a fixed rate. With regard to the customer funds, the high proportion of non-interest bearing deposits should be highlighted, which are insensitive to interest rate movements. The ALCO portfolio is invested primarily in fixed-rate sovereign bonds with limited maturities. The monetary policy rate stands at 11.25%, 75 basis points above the end-of-year level of 2022, but stable in the quarter. Regarding customer spread, there has been improvement so far in the first half of 2023, favored by both the containment of the cost of deposits and the positive evolution of the loan yield.

- In Turkey, the sensitivity of loans, which are mostly fixed-rate but with relatively short maturities, and the ALCO portfolio balance the sensitivity of deposits on the liability side. Thus, the sensitivity of net interest income remains limited, both in Turkish lira and in foreign currencies. The CBRT increased the monetary policy rates in June from 8.5% to 15.0% and to 17.5% at its July meeting. The customer spread worsened in the first half of 2023 due to the higher cost of the deposits and the caps on lending rates.

- In South America, the interest rate risk profile remains low as most countries in the area have a fixed/variable composition and maturities that are very similar for assets and liabilities, with limited net interest income sensitivity. In addition, the balance sheets with several currencies, interest rate risk is managed for each of the currencies, showing a very low level of risk. Regarding benchmark rates, in Peru it remained unchanged at 7.75%, Colombia, after the last increase of 25 basis points in April, stood at 13.25% and Argentina 97.00% after increasing 1,900 basis points between April and May. The customer spread worsened in the first half of the year in Colombia, impacted by a higher cost of deposits, which does not apply in the same way to loan yields, while in Peru it shows a slight improvement in the year thanks to the containment of the cost of deposits.

INTEREST RATES (PERCENTAGE)

| 30-06-23 | 31-03-23 | 31-12-22 | 30-09-22 | 30-06-22 | 31-03-22 | |

|---|---|---|---|---|---|---|

| Official ECB rate | 4.00 | 3.50 | 2.50 | 1.25 | 0.00 | 0.00 |

| Euribor 3 months (1) | 3.54 | 2.91 | 2.06 | 1.01 | (0.24) | (0.50) |

| Euribor 1 year (1) | 4.01 | 3.65 | 3.02 | 2.23 | 0.85 | (0.24) |

| USA Federal rates | 5.25 | 5.00 | 4.50 | 3.25 | 1.75 | 0.50 |

| TIIE (Mexico) | 11.25 | 11.25 | 10.50 | 9.25 | 7.75 | 6.50 |

| CBRT (Turkey) | 15.00 | 8.50 | 9.00 | 12.00 | 14.00 | 14.00 |

(1) Calculated as the month average.

10 This sensitivity does not include the cost of capital hedges, which are currently estimated at 1 basis points per month for Mexican peso and 1 basis points per month for Turkish lira.