Highlights

Results and business activity

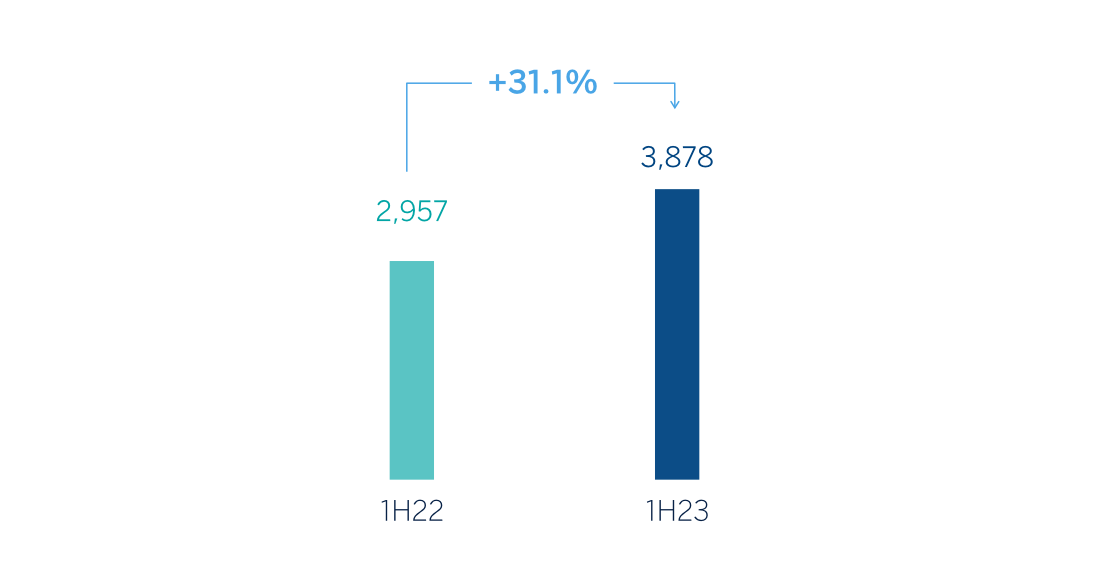

The BBVA Group generated a net attributable profit of €3,878m in the first half of 2023, which represents an increase of 31.1% compared to the same period of the previous year, driven by the performance of recurring income from the banking business, mainly the net interest income.

These results include the recording for the estimated total annual amount of the temporary tax on credit institutions and financial credit institutions for €225m, included in the other operating income and expenses line of the income statement.

Operating expenses increased by 18.2% at Group level, largely impacted by the inflation rates observed in the countries in which the Group operates. Notwithstanding the above, thanks to the remarkable growth in gross income, higher than the growth in expenses, the efficiency ratio stood at 42.0% as of June 30, 2023, with an improvement of 468 basis points, in constant terms, compared to the ratio recorded 12 months earlier.

The provisions for impairment on financial assets increased (+38.2% in year-on-year terms and at constant exchange rates), with lower requirements in Turkey, which were offset by higher provisioning needs, mainly in Mexico and South America, in a context of growth in activity.

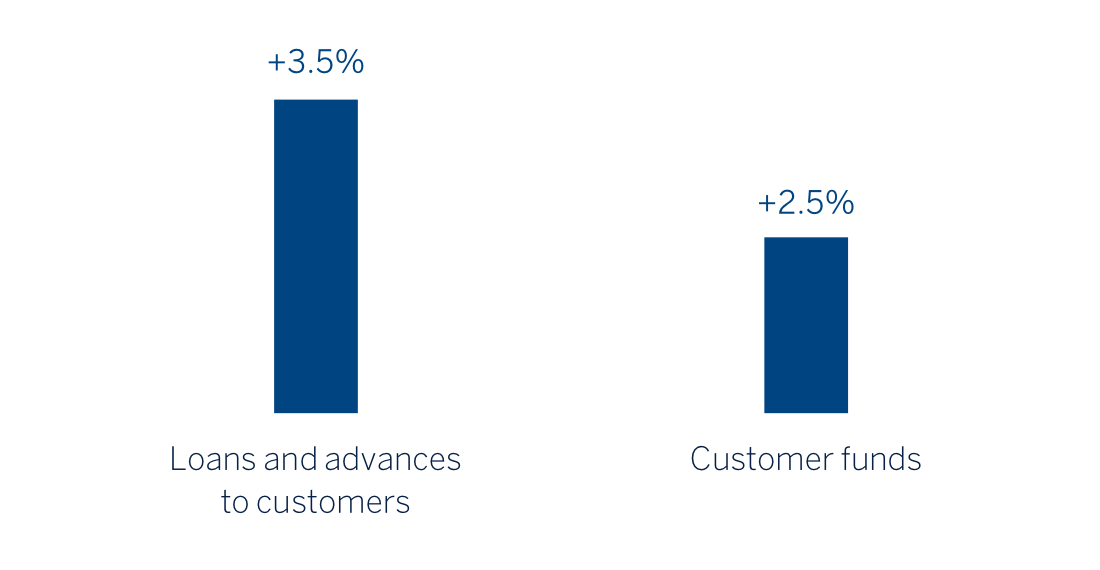

Loans and advances to customers recorded an increase of 3.5% compared to the end of December 2022, strongly favored by the evolution of retail loans (+5.6% at Group level).

Customer funds increased 2.5% compared to the end of December 2022 thanks both to the growth in deposits from customers which increased by 2.0%, and to the increase in off-balance sheet funds (+3.7%).

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2022)

Business areas

As for the business areas evolution, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

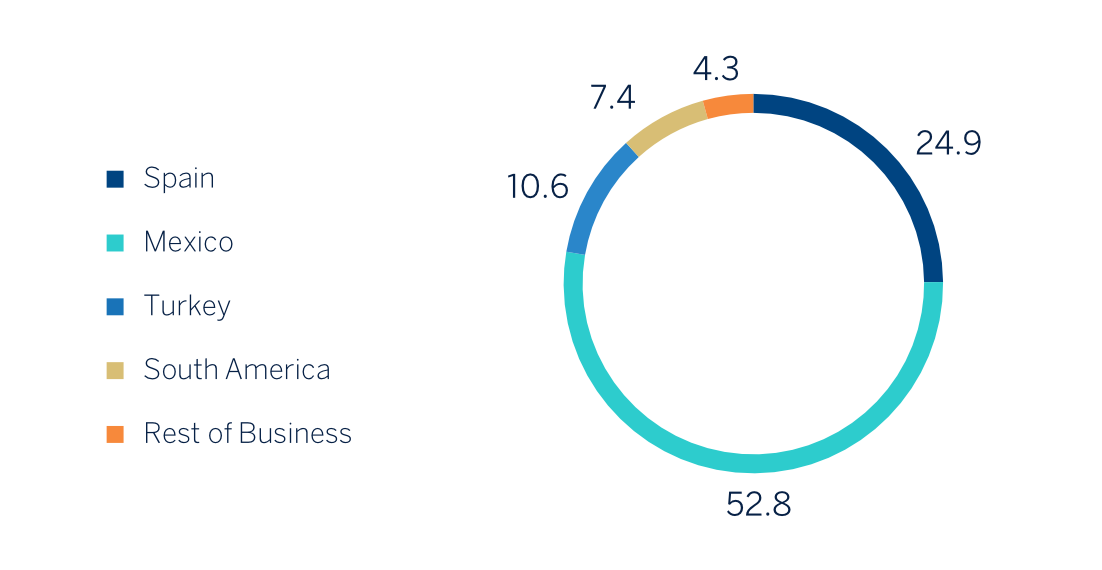

- Spain generated a net attributable profit of €1,231m in the first half of 2023, 53.6% higher than in the same period of the previous year, thanks to the dynamism of the net interest income, which boosted gross income growth.

- In Mexico, BBVA achieved a net attributable profit of €2,614m by the end of the first half of 2023, representing an increase of 30.1% compared to the same period in 2022, mainly as a result of the notable growth in net interest income, thanks to the strong boost of the activity and the improvement in the customer spread.

- Turkey generated a net attributable profit of €525m during the first half of 2023, which compares very positively with the result reached in the first half of 2022, both periods reflecting the impact of the application of hyperinflation accounting. The accumulated result at the end of June 2023 reflects the positive impact of the revaluation for tax purposes of the real estate and other depreciable assets of Garanti BBVA AS which has generated a credit in corporate income tax expense, due to the higher tax base of the assets, amounting to approximately €205m.

- South America generated a cumulative net attributable profit of €367m at the end of the first half of the year 2023, which represents a year-on-year increase of +22.6%, thanks to the good performance of recurring income (+65.7%) and the area's NTI, which offset the increase in expenses, in a highly inflationary environment throughout the region, and the higher provisioning requirements for impairment on financial assets.

- Rest of Business achieved a net attributable profit of €212m accumulated at the end of the first half of 2023, 68.3% higher than in the same period of the previous year, thanks to a favorable performance of recurring income, especially the net interest income, and NTI, which offset the increase in expenses in a context of higher inflation and normalization of loan-loss provisions.

The Corporate Center recorded in the first half of the year 2023 a net attributable profit of €-1,072m, compared with €-230m recorded in the same period of the previous year, mainly due to a negative contribution in the NTI line from exchange rate hedges as a result of better than expected currency performance, in particular the Mexican peso.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €1,233m in the first half of 2023. These results, which do not include the application of hyperinflation accounting, represent an increase of 47.9% on a year-on-year basis and reflects the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 1H23)

(1) Excludes the Corporate Center.

Solvency

The Group's CET1 fully-loaded ratio stood at 12.99% as of June 30, 2023, which allows to maintain a large management buffer over the Group's CET1 requirement (8.76% at the date of release of this report)1, and also above the Group's established target management range of 11.5-12.0% of CET1.

New Share Buyback Program

BBVA requested on July 27, 2023 to the European Central Bank the correspondent supervisory authorization in order to carry out a buyback program of BBVA shares up to €1,000 million. Its execution, if the authorization requested is finally granted, would be subject to the adoption of the correspondent corporate resolutions and to the communication of the specific terms and conditions of the share buyback program before its execution. This share buyback program would be considered to be an extraordinary shareholder distribution and is therefore not included in the scope of the ordinary distribution policy.

Sustainability

Channeling sustainable business2

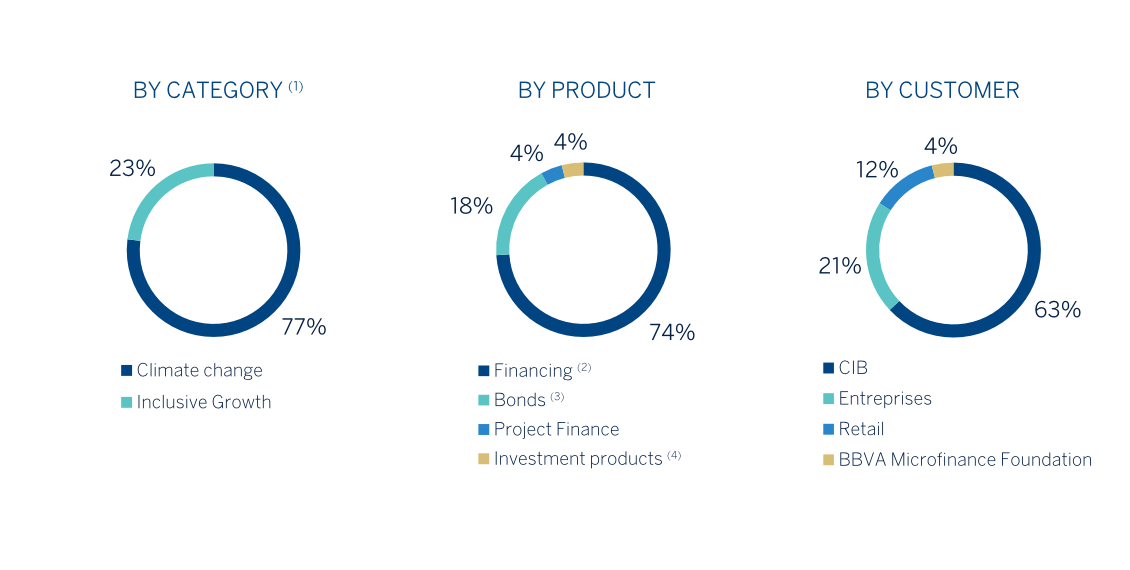

SUSTAINABLE BUSINESS BREAKDOWN (PERCENTAGE. TOTAL AMOUNT CHANNELED 2018-JUNE 2023)

(1) In those cases where it is not feasible or there is not enough information available to allow an exact distribution between the categories of climate change and inclusive growth, internal estimates are made based on the information available.

(2) Non-Project Finance and transactional banking activity.

(3) Bonds in which BBVA acts as bookrunner.

(4) Investment products art. 8 or 9 under Sustainable Finance Disclosure Regulation (SFDR) or similar criteria outside the European Union, managed, intermediated or marketed by BBVA. Includes, in Retail: structured deposits, insurance policies for electric vehicles and self-renting of electric vehicles, mainly; and in CIB and Enterprise: structured deposits, mainly.

BBVA Group has mobilized a total of approximately €169 billion in sustainable business between 2018 and June 2023, of which approximately 77% correspond to the area of promoting the fight against climate change, and the remaining 23% to promote inclusive growth. The channeled amount includes financing, intermediation, investment, off-balance sheet or insurance operations. These operations have contractual maturity or amortization dates, so the mentioned accumulated amount does not represent the amount recognized in the balance sheet.

During the first half of 2023, around €33 billion was mobilized, of which around €19 billion correspond to the second quarter of 2023. This channeling during the second quarter of 2023 represents an increase of about 30% compared to the same quarter of 2022 and a new quarterly record in sustainable business mobilization for the Group.

In this second quarter, the retail business has mobilized around €1.3 billion. The good behavior related to financial and social inclusion stands out, among which are worth mentioning the financing and the access to the financial system for vulnerable segments of the population, which grows by 85% in relation to the same period of the previous year. During this quarter, in the area of financial and social inclusion, €156m have been mobilized, the contribution of Mexico being relevant, which has channeled more than a third of this amount.

Between April and June 2023, the commercial business (enterprises) mobilized around €6.5 billion. The financing destined to promote or improve the energy efficiency of buildings stands out with €1,246m channeled in the quarter, which represents an increase of 114% compared to the same period of the previous year. In this section, the contribution of Spain is fundamental, advancing by 125%.

The corporate business has channeled during this quarter around €10.8 billion. The dynamism of the brokered bond market in which BBVA acts as bookrunner stands out, contributing €3,560m this quarter (25% more than in the same period of the previous year). Of this amount, €2,634m correspond to green bonds, which have experienced an increase of 91% compared to the same quarter of the previous year, offsetting the lower growth of other types. However, there have been signs of a slowdown in the field of sustainable corporate financing since the beginning of 2023, both in the long and short term.

Lastly, this quarter the BBVA Microfinance Foundation (FMBBVA), which is not part of the consolidated Group, has channeled around €400m to support vulnerable entrepreneurs with microcredits, experiencing an increase of 5% compared to the same quarter of the previous year.

Other actions carried out and awards received in sustainability matters

- Issuance of the first blue bond in Colombia

BBVA, together with the International Finance Corporation (IFC), announced this quarter the issuance of the first blue bond in Colombia. This blue bond consists of a first tranche of USD50m, which will be destined to support initiatives related to the protection of the country's water resources and, thus, preserve and protect aquatic biodiversity, conserving the sustainable use, management and protection of marine resources.

- Advances in energy efficient products

During this quarter, BBVA has continued to promote energy efficiency solutions in order to accompany its customers in the transition to a more sustainable future, with the aim of reducing energy costs and carbon dioxide (CO2) emissions into the atmosphere.

Thus, in Spain, BBVA and the General Council of Property Administrators have agreed on collaborating to improve the energy efficiency of Spain's housing stock. Thanks to this initiative, communities of owners of residential buildings built before 2007, and managed by property administrators registered in the General Council of Property Administrators, will be able to learn about financing solutions through BBVA, including loans with a maturity of up to 10 years.

Likewise, in Colombia, BBVA, in alliance with a brand of household appliances, has announced a new line of financing that promotes savings in energy consumption in Colombian households.

- Investment in Just Climate

During this quarter, BBVA invested USD20m in Just Climate's decarbonization fund (Just Climate CAF I), established by Generation Investment Management. Just Climate CAF I is a fund that invests in developing new large-scale technologies to reduce or eliminate emissions from industries that are difficult to decarbonize, such as cement and steel.

- BBVA renews as a member of the NZBA steering committee.

BBVA has renewed its membership as the only Spanish bank on the steering committee of the Zero Net Emissions Banking Alliance (NZBA). This alliance, of which BBVA is a founding member since 2021, is the forum promoted by the United Nations that defines the reference framework for the decarbonization of the banking sector: a robust, science-based framework that supports the credibility of the voluntary commitments.

- Global Finance Awards

This quarter BBVA has won several awards in different categories related to sustainability in the Global Finance magazine's Sustainable Finance Awards 2023, including "Outstanding Financial Leadership in Sustaining Communities in 2023", which highlights the Group's commitment to contribute to a more inclusive future.

It has also been recognized by Global Finance as:

- Outstanding bank in green bonds in Western Europe.

- Outstanding Financial Leadership in Sustaining Communities in Latin America.

- Leadership in ESG-related Loans in Latin America.

1 Includes the update of the countercyclical capital buffer calculated on the basis of exposure at end June 2023.

2 Channeling sustainable business is considered to be any mobilization of financial flows, cumulatively, towards activities or clients considered sustainable in accordance with existing regulations, both internal and market standards and best practices. The foregoing is understood without prejudice to the fact that such mobilization, both initially and at a later time, may not be recorded on the balance sheet. To determine the amounts of channeled sustainable business, internal criteria based on both internal and external information are used.