Turkey

Highlights

- Solid growth in lending.

- Good performance of deposits, both in Turkish lira and foreign currency, strongly focused on current and savings accounts.

- Very good performance of more recurring revenues, cost discipline and reduction of loan-loss provisions.

- Improvement of the asset quality indicators, which have performed better than in the rest of the sector.

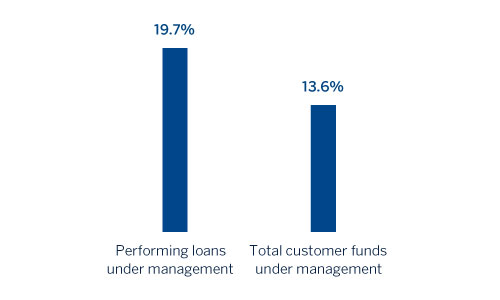

Business activity (1)

(Year-on-year change at constant exchange rate. Data as of 30-06-2017)

(1) Excluding repos.

Net interest income/ATA

(Percentage. Constant exchange rate)

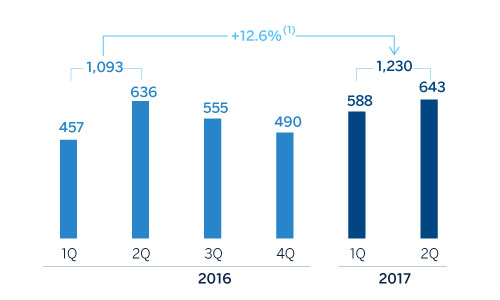

Operating income

(Million euros at constant exchange rate)

(1) At current exchange rate: -6.9%.

Net attributable profit

(Million euros at constant exchange rate)

(1) At current exchange rate: +15.3%.

Breakdown of performing loans under management (1)

(30-06-2017)

(1) Excluding repos.

Breakdown of customer funds under management (1)

(30-06-2017)

(1) Excluding repos.

Macro and industry trends

According to the most recent figures from the Turkish Statistical Institute, Turkey's economic growth is accelerating significantly, now standing at 5% in year-on-year terms in the first quarter of 2017, strongly influenced by the fiscal stimulus and solid growth of exports. This acceleration could continue into the second quarter, supported by increased orders, imports of intermediate goods, robust exports, the delayed effects of the significant increase in credit thanks to the Credit Guarantee Fund (CGF), the extension of tax cuts on durable goods, and fiscal expansion. Higher than expected growth in the first quarter, together with signs of stronger private demand, could lead to overall economic growth for 2017 of around 5%, according to BBVA Research estimates.

Despite being still high, inflation has fallen to 10.9% (June 2017 data) as a result of movements in food and energy prices. Core inflation has moderated slightly, but given inflationary pressure and possible second-round effects, headline inflation is likely to remain in double-digits until the end of the year.

Against this backdrop, the Central Bank of Turkey (CBRT) has been tightening monetary policy since the end of last year, with an increase of around 367 basis points in the average funding rate (from 8.31% to 11.98%) year-to-date. Moreover, the CBRT has declared that this restrictive stance would be maintained until the prospects for inflation show a significant improvement.

The Turkish financial sector has again increased the trend in year-on-year credit growth at the end of the first half of 2017, according to CBRT data. Adjusted for the effect of the depreciation of the lira, this rise is 17.6% to June 30, due basically to commercial lending fostered by the Government's CGF. Deposit gathering has been fairly strong (also according to CBRT information), with a year-on-year growth of 12.1%, according to data at the close of June, and also adjusted for the exchange-rate effect. Turkish-lira deposits grew by 5% and foreign-currency deposits by 16%. As a result of the rapid expansion of credit, interest rates on deposits have grown by around 180 basis points in the second quarter. Finally, the NPL ratio in the system remains at 3.05%, according to the latest available information from the CBRT as of June 30.

Activity

In March 2017, BBVA completed the acquisition of an additional 9.95% stake in the share capital of Garanti, increasing BBVA's total stake in this entity to 49.85%, which continues to be incorporated into the Group's financial statements by the full integration method.

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and earnings, will be given at constant exchange rate. These rates, together with changes at current exchange rate, can be seen in the attached tables of financial statements and relevant business indicators.

The solid growth of lending activity (performing loans under management) in the area in the first quarter of 2017 has continued into the second quarter. The total portfolio has accelerated its growth rate so far this year to 8.0%, boosted once more by the Turkish lira loans. The trend in foreign-currency loans continues to be muted. By segments, business banking loans and consumer loans continue to perform favorably. The CGF program, backed by the Turkish Treasury to boost business loans, continues to contribute positively to the increase in lending, above all in Turkish lira. In addition, favorable trend in mortgage loan and general purpose loan portfolios remain positive but with price discipline at the same time. It is worth noting that Garanti is strengthening its market position in the credit card segment, mainly due to the increase in commercial credit cards. Overall, the bank is maintaining its leading position in consumer lending, mortgages, auto loans and company credit cards.

In asset quality, the NPL ratio fell to 2.5%, well below the sector average, and the NPL coverage ratio climbs to 135%.

Customer deposits remain the main source of funding for the balance sheet in the area, with their proportion growing to 56% of total liabilities and growth of 7.6% in the last six months. Deposits in both Turkish lira and foreign currency are growing. There was a good performance of current and savings accounts, which grew by 9.5% over the first-half. In this regard, is worth of note that the average balance of low cost deposits (current and savings accounts) in the area as of 30-Jun-2017 represents 26.2% of total balance-sheet deposits (current and savings accounts plus time deposits), well above the sector average (around 21%). The above has a bigger positive effect in Garanti’s cost of financing than the sector.

Results

Turkey has generated a cumulative net attributable profit through June 2017 of €374m, up 39.3% on the figure in the same period in 2016. The most significant aspects of the year-on-year changes of the income statement are as follows:

- Positive performance of net interest income (up 21.3%) due to an increase in activity and good management of customer spreads against a backdrop of high interest rates (adequate liability mix with higher weighting of low cost products and rising of loan yields). In addition, the upward revision of inflation expectations from 7% to 9% used for the valuation of CPI linker bonds has had a positive contribution of €24m in this line.

- Income from fees and commissions continues to perform well (up 8.4%), thanks to good diversification (payment systems, money transfers, loans, insurance, etc.). This positive performance is achieved despite the lower generation of fees for account maintenance due to the suspension of charges in the retail segment implemented by the Turkish Council of State, and the high revenues generated in the same period of 2016 by the Miles & Smiles program.

- Reduction of NTI (down 91.6%) due mainly to the capital gains generated in the first half of 2016 derived from the VISA deal.

- Overall, gross income was 12.1% higher than in the first six months of 2016.

- Operating expenses continue under control, which have reduced the efficiency ratio to 38.4% (39.8% in the first quarter of 2017 and 40.8% in 2016). Over the quarter this heading fell by 2.4%. However, in the cumulative figure for the half-year there was a year-on-year increase of 11.4%, basically due to the high level of inflation and the impact of the depreciation of the Turkish lira on the cost items denominated in foreign currency.

- A decrease in impairment losses on financial assets (down 4.2% year-on-year). As a result, the cost of risk in the area closed the half-year at 0.84%.

- Finally, BBVA Group’s additional stake of 9.95% in Garanti’s capital has had a positive effect of approximately €54m of less non-controlling interests heading.

Financial statements and relevant business indicators (Million euros and percentage)

| Income statement | 1H17 | ∆% | ∆%(1) | 1H16 |

|---|---|---|---|---|

| Net interest income | 1,611 | 0.3 | 21.3 | 1,606 |

| Net fees and commissions | 352 | (10.3) | 8.4 | 392 |

| Net trading income | 9 | (93.0) | (91.6) | 128 |

| Other income/expenses | 26 | (7.0) | 12.3 | 28 |

| Gross income | 1,998 | (7.2) | 12.1 | 2,154 |

| Operating expenses | (768) | (7.8) | 11.4 | (833) |

| Personnel expenses | (407) | (7.0) | 12.4 | (438) |

| Other administrative expenses | (267) | (12.8) | 5.4 | (307) |

| Depreciation | (93) | 5.5 | 27.5 | (88) |

| Operating income | 1,230 | (6.9) | 12.6 | 1,321 |

| Impairment on financial assets (net) | (239) | (20.7) | (4.2) | (301) |

| Provisions (net) and other gains (losses) | 18 | n.s. | n.s. | 1 |

| Profit/(loss) before tax | 1,010 | (1.1) | 19.5 | 1,022 |

| Income tax | (201) | (1.0) | 19.7 | (203) |

| Profit/(loss) for the year | 809 | (1.2) | 19.4 | 819 |

| Non-controlling interests | (436) | (11.9) | 6.4 | (495) |

| Net attributable profit | 374 | 15.3 | 39.3 | 324 |

| Balance sheets | 30-06-17 | ∆% | ∆%(1) | 31-12-16 |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 1,917 | (29.6) | (23.8) | 2,724 |

| Financial assets | 12,264 | (10.3) | (2.9) | 13,670 |

| Loans and receivables | 66,420 | 2.5 | 10.9 | 64,814 |

| of which loans and advances to customers | 55,248 | (0.7) | 7.6 | 55,612 |

| Tangible assets | 1,385 | (3.1) | 4.9 | 1,430 |

| Other assets | 1,909 | (14.3) | (7.3) | 2,229 |

| Total assets/liabilities and equity | 83,895 | (1.1) | 7.0 | 84,866 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 615 | (39.0) | (33.9) | 1,009 |

| Deposits from central banks and credit institutions | 13,210 | (2.1) | 6.0 | 13,490 |

| Deposits from customers | 46,780 | (1.0) | 7.2 | 47,244 |

| Debt certificates | 8,649 | 9.4 | 18.4 | 7,907 |

| Other liabilities | 11,896 | (7.7) | (0.1) | 12,887 |

| Economic capital allocated | 2,745 | 17.8 | 27.6 | 2,330 |

| Relevant business indicators | 30-06-17 | ∆% | ∆%(1) | 31-12-16 |

|---|---|---|---|---|

| Loans and advances to customers (gross) (2) | 57,527 | (0.7) | 7.5 | 57,941 |

| Non-performing loans and guarantees given | 1,766 | (10.9) | (3.6) | 1,982 |

| Customer deposits under management (2) | 47,196 | (0.6) | 7.6 | 47,489 |

| Off-balance sheet funds (3) | 3,913 | 4.3 | 12.9 | 3,753 |

| Risk-weighted assets | 67,270 | (4.4) | 3.5 | 70,337 |

| Efficiency ratio (%) | 38.4 | 40.8 | ||

| NPL ratio (%) | 2.5 | 2.7 | ||

| NPL coverage ratio (%) | 135 | 124 | ||

| Cost of risk (%) | 0.84 | 0.87 |

(1) Figures at constant exchange rate.

(2) Excluding repos.

(3) Includes mutual funds, pension funds and other off-balance sheet funds.