Relevant events

Results

- General growth of more recurring revenues in practically all geographic areas.

- Lower contribution from net trading income (NTI).

- Operating expenses under control and improvement in the efficiency ratio in comparison with the same period the previous year.

- Impairment losses on financial assets below the figure for the first half of 2016.

- Provisions (net) and Other gains (losses) higher than in the same period last year due to allocation for restructuring costs.

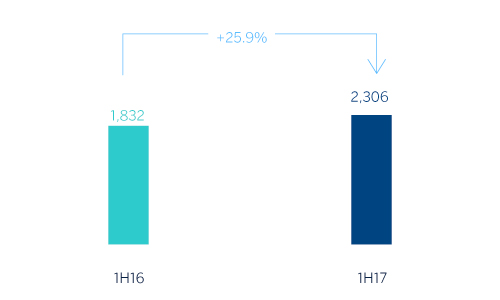

- As a result, the net attributable profit in the first half of 2017 is €2,306m, 25.9% up on the first six months of 2016.

Net attributable profit (Million euros)

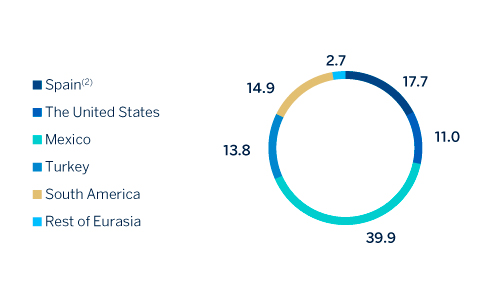

Net attributable profit breakdown (1) (Percentage. 1H 2017)

(1) Excludes the Corporate Center.

(2) Includes the areas Banking activity in Spain and Non Core Real Estate.

Balance sheet and business activity

- Loans and advances to customers (gross) continue to increase in emerging economies but decline in Spain (albeit less than in previous periods) and the United States.

- Non-performing loans continue to improve, particularly in Spain, the United States and Turkey.

- Deposits from customers have again performed well in the more liquid and lower-cost items.

- In off-balance sheet customer funds, the trend in mutual funds continues to be positive.

Solvency

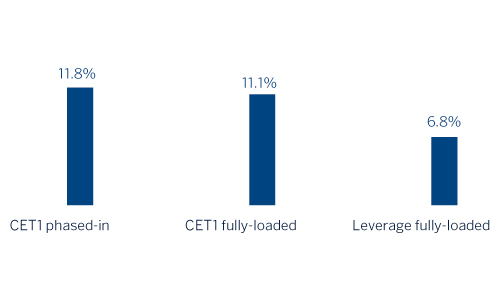

- The capital position is above regulatory requirements, with a fully-loaded CET1 ratio of 11.1% as of 30-Jun-2017 above the established target of 11%. Year-to-date, this ratio has increased by 20 basis points primarily due to organic generation of earnings and a reduction of risk-weighted assets (RWAs).

- One issue of instruments that are eligible as additional Tier 1 capital for €500m with a coupon of 5.875%, and a number of issues that are eligible as Tier 2.

Capital and leverage ratios (Percentage as of 30-06-17)

Risk management

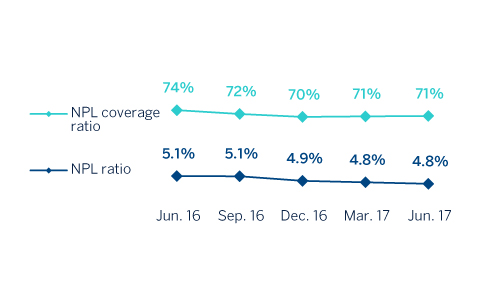

- Positive trend in the metrics related to the credit-risk management in the first six months of the year (stability in the second quarter): as of 30-Jun-2017, the NPL ratio closed at 4.8%, the NPL coverage ratio at 71% and the cumulative cost of risk at 0.92%.

NPL and coverage ratios (Percentage)

Transformation

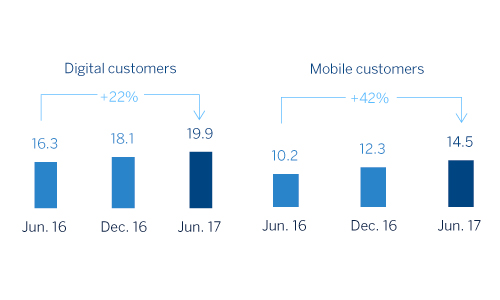

- The Group's digital and mobile customer base (up 22% and 42% year-on-year, respectively, according to latest available data) continues to increase, as do digital sales in all the geographic areas where BBVA operates.

Digital and mobile costumers (1)(Millions)

(1) Figures in Spain and the United States have been restated.