Risk management

Credit risk

Since the beginning of the year, persistent inflation, Central Banks rate increases and the uncertainty surrounding economic growth have been the main factors that have impacted the markets, affecting to a greater or lesser extent depending on the region, reducing credit demand and causing a strain on the payment capacity of families and companies.

Uncertainty continues to be high, and the geopolitical turbulence at the time of drafting of this report could contribute to a rebound in oil prices, and therefore, increase the biases towards more negative scenarios, with downward growth and upward inflation.

By region, the evolution during the year is uneven. In Spain, although an environment of high inflation and higher interest rates continues, the level of household debt is far from its historical highs, and the labor market is expected to remain strong. In Mexico, the improvements in the growth outlook due to the dynamism of private consumption, and the effect of the relocation of industrial production (nearshoring), is positively impacting the labor market. The uncertainty in Turkey continues, although growth remains solid. Despite changes in economic policy, system quality indicators remain at low levels. Finally, in general, growth has been less dynamic in South America, in a context of high inflation and interest rates, negative effects related to the slowdown in China, as well as adverse climatic factors and social conflicts, affecting the economic situation of families and companies.

Calculation of expected losses due to credit risk

For the estimation of expected losses, the models include individual and collective estimates, taking into account the macroeconomic forecasts in accordance with IFRS 9. Thus, the estimate at the end of the quarter includes the effect on expected losses of updating macroeconomic forecasts, which take into account the current global environment.

Additionally, the Group may supplement the expected losses either by the consideration of additional risk drivers, the incorporation of sectorial particularities or that may affect a set of operations or borrowers, following a formal internal process established for the purpose.

Thus, in Spain, during 2021 and 2022, the Loss Given Default (LGD) of certain specific operations considered unlikely to pay was reviewed upwards, with a remaining adjustment as of September 30, 2023 of €407 million without significant variation since the end of the year 2022. In addition, due to the earthquakes that affected an area in the south of Turkey, during the month of February 2023 the classification of the credit exposure recorded in the five most affected cities was reviewed, which led to its reclassification to Stage 2. As of September 30, 2023 the amounts recorded in Stage 2 were €337 million on the balance sheet and €441 million off- balance sheet, with allowances for losses of approximately €38 million at contract level.

On the other hand, the complementary adjustments pending allocation to specific operations or customers as of September 30, 2023 totaled €71m of which €33m correspond to Spain, €30m to Mexico, €2m to Colombia, and €6m to Rest of Business of the Group. As of December 31, 2022, the complementary adjustments pending allocation to specific operations or customers totaled €302m, of which €163m corresponded to Spain, €92m to Mexico, €25m to Peru, €11m to Colombia, €5m to Chile and €6m to Rest of Business of the Group. The change during the nine months ended September 30, 2023 is mainly due to use of provisions and partial releases.

BBVA Group's credit risk indicators

The evolution of the Group’s main credit risk indicators is summarized below:

- Credit risk increased in the third quarter of the year by 2.0% (in current and constant terms), with generalized growth at constant exchange rates in all geographic areas except in Peru, where cancellations in both wholesale and "Plan Reactiva" portfolios continue, both with a practically stable evolution.

- Non-performing loans presented a slight increase at the Group level between June and September 2023 (+1.2% in current and constant terms), with decline in Spain and Turkey, which offset the increases in the rest of the geographical areas. Compared to the end of the previous year, the balance of non-performing loans increased by 2.8% (+3.2% at constant exchange rates), focused on retail portfolio in South America and Mexico, and to a lesser extent, in Rest of Business, affected by three singular customers inflows.

NON-PERFORMING LOANS AND PROVISIONS (MILLIONS OF EUROS)

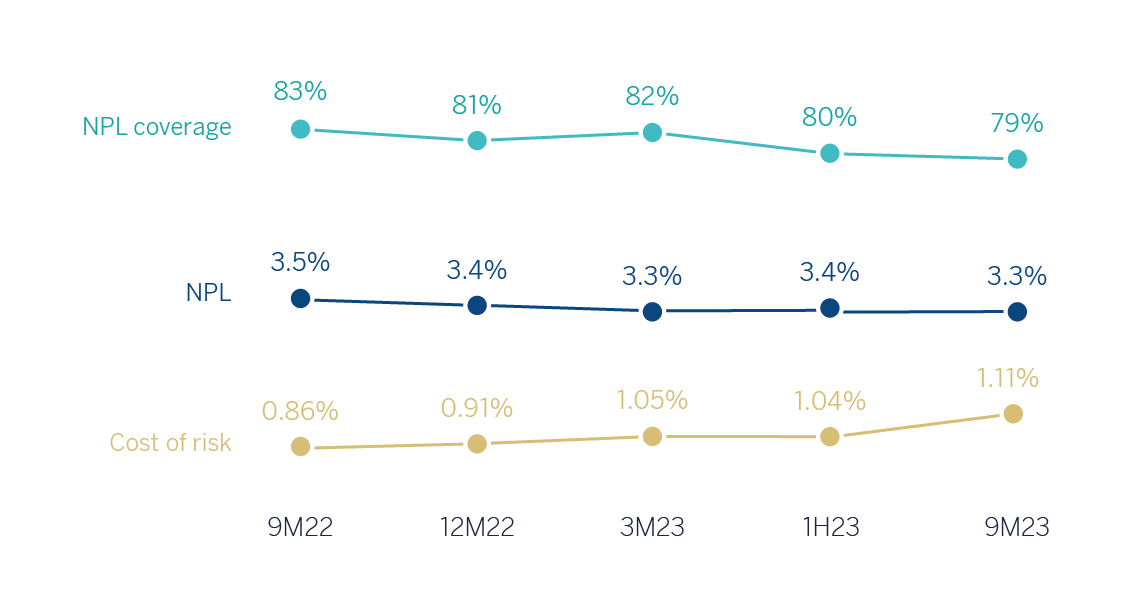

- The NPL ratio declined slightly to 3.3% as of September 30, 2023, which represents an improvement of 3 basis points compared to the previous quarter (7 basis points below that of the end of 2022).

- Loan-loss provisions remained practically stable compared to the figure at the end of the previous quarter (+0.5% and -0.1% with respect to December 2022), affected by the sale of a default loan portfolio without collateral in Spain.

- The NPL coverage ratio ended the quarter at 79% (57 basis points below the previous quarter and 228 basis points lower than the end of 2022).

- The cumulative cost of risk as of September 30, 2023 stood at 1.11%, which is above the previous quarter due to the higher requirements in the retail portfolio in the main geographical areas, offset by the positive dynamics of the wholesale portfolio.

NPL AND NPL COVERAGE RATIOS AND COST OF RISK (PERCENTAGE)

CREDIT RISK (1) (MILLIONS OF EUROS)

| 30-09-23 | 30-06-23 | 31-03-23 | 31-12-22 | 30-09-22 | |

|---|---|---|---|---|---|

| Credit risk | 444,984 | 436,174 | 428,423 | 423,669 | 428,064 |

| Stage 1 | 394,329 | 386,711 | 377,908 | 371,930 | 374,509 |

| Stage 2 | 35,791 | 34,772 | 36,373 | 37,277 | 38,394 |

| Stage 3 (non-performing loans) | 14,864 | 14,691 | 14,141 | 14,463 | 15,162 |

| Provisions | 11,751 | 11,697 | 11,661 | 11,764 | 12,570 |

| Stage 1 | 2,143 | 2,107 | 2,062 | 2,067 | 2,203 |

| Stage 2 | 2,198 | 2,181 | 2,243 | 2,111 | 2,247 |

| Stage 3 (non-performing loans) | 7,410 | 7,409 | 7,357 | 7,586 | 8,120 |

| NPL ratio (%) | 3.3 | 3.4 | 3.3 | 3.4 | 3.5 |

| NPL coverage ratio (%) (2) | 79 | 80 | 82 | 81 | 83 |

(1) Includes gross loans and advances to customers plus guarantees given.

(2) The NPL coverage ratio includes the valuation adjustments for credit risk throughout the expected residual life in those financial instruments that have been acquired (mainly originating from the acquisition of Catalunya Banc, S.A.). If these valuation corrections had not been taken into account, the NPL coverage ratio would have stood at 78% as of September 30, 2023, 80% as of December 31, 2022, and 82% as of September 30, 2022.

NON-PERFORMING LOANS EVOLUTION (MILLIONS OF EUROS)

| 3Q23 (1) | 2Q23 | 1Q23 | 4Q22 | 3Q22 | ||

|---|---|---|---|---|---|---|

| Beginning balance | 14,691 | 14,141 | 14,463 | 15,162 | 15,501 | |

| Entries | 2,896 | 2,875 | 2,256 | 2,332 | 1,871 | |

| Recoveries | (1,537) | (1,394) | (1,489) | (1,180) | (1,595) | |

| Net variation | 1,360 | 1,481 | 767 | 1,152 | 276 | |

| Write-offs | (830) | (877) | (1,081) | (928) | (683) | |

| Exchange rate differences and other | (357) | (54) | (8) | (923) | 67 | |

| Period-end balance | 14,864 | 14,691 | 14,141 | 14,463 | 15,162 | |

| Memorandum item: | ||||||

| Non-performing loans | 13,947 | 13,787 | 13,215 | 13,493 | 14,256 | |

| Non performing guarantees given | 918 | 905 | 926 | 970 | 906 |

(1) Preliminary data.

Structural risks

Liquidity and funding

Liquidity and funding management at BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs using a wide range of instruments that provide access to a large number of alternative sources of financing. BBVA's business model, risk appetite framework and funding strategy are designed to reach a solid funding structure based on stable customer deposits, mainly retail (granular). As a result of this model, deposits have a high degree of assurance in each geographical area, close to 60% in Spain and Mexico. In this regard, it is important to note that, given the nature of BBVA's business, lending is mainly financed through stable customer funds.

One of the key elements in the BBVA Group's liquidity and funding management is the maintenance of large high-quality liquidity buffers in all geographical areas. In this respect, the Group has maintained during the last 12 months an average volume of high quality liquid assets (HQLA) of €134.29 billion, of which 97% corresponds to maximum quality assets (level 1 in the liquidity coverage ratio, LCR).

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolution strategy: the parent company sets the liquidity policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity and funding (taking deposits or accessing the market with their own rating). This strategy limits the spread of a liquidity crisis among the Group's different areas and ensures that the cost of liquidity and financing is correctly reflected in the price formation process.

The BBVA Group maintains a solid liquidity position in every geographical area in which it operates, with ratios well above the minimum required:

- LCR requires banks to maintain a volume of high-quality liquid assets sufficient to withstand liquidity stress for 30 days. BBVA Group's consolidated LCR remained comfortably above 100% during 2022 and stood at 143% as of September 30, 2023. It should be noted that, given the MPE nature of BBVA, this ratio limits the numerator of the LCR for subsidiaries other than BBVA S.A. to 100% of its net outflows. Therefore, the resulting ratio is below that of the individual units (the LCR of the main components reaches 166% in BBVA, S.A., 163% in Mexico and 230% in Turkey). If this restriction was eliminated, the Group's LCR ratio would reach 181%.

- The net stable funding ratio (NSFR) requires banks to maintain a stable funding profile in relation to the composition of their assets and off-balance sheet activities. The BBVA Group's NSFR ratio stood at 130% as of September 30, 2023.

The breakdown of these ratios in the main geographical areas in which the Group operates is shown below:

LCR AND NSFR RATIOS (PERCETANGE. 30-09-23)

| BBVA, S.A. | Mexico | Turkey | South America | |

|---|---|---|---|---|

| LCR | 166% | 163% | 230% | All the countries >100 |

| NSFR | 120% | 133% | 182% | All the countries >100 |

In addition to the above, the most relevant aspects related to the main geographical areas are the following:

- BBVA, S.A. has maintained a strong position with a large high-quality liquidity buffer, having repaid almost the entire TLTRO III program. During the first nine months of 2023, commercial activity has not had a significant impact on the Bank's liquidity with a relatively flat evolution in lending, in line with customer deposits. The latter fell in the first quarter, influenced by the seasonal component and by the transfer to off-balance sheet funds, it recovered during the second quarter and it remained stable in the third quarter. On the other hand, in December 2022 the Bank started the repayment of the TLTRO III program for an amount of €12 billion, plus an additional repayment of €12 billion between February and March 2023 and another one of €11 billion in June 2023, which together represent more than the 90% of the original amount, maintaining at all times the regulatory liquidity metrics well above the established minimums.

- BBVA Mexico continues to present a solid liquidity situation, which has contributed to an efficient management of the cost of funds in an environment of rising interest rates. During the first nine months of the year, however, commercial activity has drained liquidity due to a sustained loan growth, together with outflows of funds in the first months of the year (seasonal effect after relevant inflows at the end of the year), which are not able to recover because of transfers to off-balance sheet funds with higher remuneration.

- In Turkey, during the first nine months of 2023, the lending gap in local currency has been reduced, due to a greater growth in deposits than in loans. The lending gap in foreign currency has increased due to higher reductions in deposits. Garanti BBVA continues to maintain a stable liquidity position with comfortable ratios. On the other hand, the Central Bank of Turkey has begun to promote a gradual change of FX protected scheme to standard deposits in Turkish lira as an additional step on the economy dedollarization process.

- In South America, the liquidity situation remains adequate throughout the region. In Argentina, liquidity in the system continues to increase, and so does in BBVA due to a higher growth in deposits than in loans in local currency, without significant variations in foreign currency. In BBVA Colombia, the credit gap declined due to a higher volume of deposits and a slowdown in lending growth. BBVA Peru maintains solid liquidity levels, showing a reduction in the credit gap since the beginning of the year thanks to the positive performance of deposits in contrast to a lower dynamism in lending activity, affected by the expiration of loans covered by COVID-19 programs.

The main wholesale financing transactions carried out by the BBVA Group during the first nine months of 2023 are listed below:

| Type of issue | Date of issue | Nominal (millions) | Currency | Coupon | Early redemption | Maturity date |

|---|---|---|---|---|---|---|

| Senior non-preferred | Jan-23 | 1,000 | EUR | 4.625% | Jan-30 | Jan-31 |

| Covered bonds | Jan-23 | 1,500 | EUR | 3.125% | - | Jul-27 |

| Senior preferred | May-23 | 1,000 | EUR | 4.125% | May-25 | May-26 |

| Tier 2 | Jun-23 | 750 | EUR | Midswap + 280 basis points | Jun-Sep 28 | Sep-33 |

| AT1 | Jun-23 | 1,000 | EUR | 8.375% | Dec-28 | Perpetual |

| Tier 2 | Aug-23 | 300 | GBP | 8.250% | Aug-Nov 28 | Nov-33 |

| AT1 | Sep-23 | 1,000 | USD | 9.375% | Sep-29 | Perpetual |

Additionally, in June 2023 BBVA, S.A. completed a securitization of a portfolio of car loans for an amount of €800m.

BBVA Mexico, for its part, carried out two senior issues in the first quarter of the year and a subordinated issue in the second quarter. The first of the senior issues consists of a green bond for 8,689 million Mexican pesos (approximately €470m) with a maturity of 4 years, using the TIIE (Balanced Interbank Interest Rate used in Mexico) rate as a benchmark, at one day +32 basis points; and the second one involves the issuance of a senior bond for 6,131 million Mexican pesos (approximately €331m) at a fixed rate of 9.54% and a term of 7 years. Regarding the subordinated issue carried out in June, it was a USD 1 billion Tier 2 issue for a term of 15 years with an early redemption option after 10 years and at a fixed rate of 8.45%. The main objective of this issue is to achieve a comfortable loss- absorbing capital buffer to comply with TLAC (Total Loss-Absorbing Capacity) requirements, with full implementation in Mexico in 2025.

In Turkey, Garanti BBVA renewed in June a syndicated loan associated with environmental, social and corporate governance (ESG) criteria, consisting of two separate tranches of USD199m and €218.5m, both maturing in one year.

BBVA Colombia announced the launch of the first blue bond in Colombia, together with the International Finance Corporation (IFC), for an amount of USD50m.

Foreign exchange

Foreign exchange risk management aims to reduce both the sensitivity of the capital ratios and the net attributable profit variability to currency fluctuations.

The performance of the Group's main currencies during the first nine months of 2023 has been very uneven. Due to its relevance for the Group, it should be noted the strength of the Mexican peso, which has appreciated 12.7% against the euro. The other currency which stands out was the Colombian peso (+18.5%). On the negative side, the depreciation of both the Turkish lira (-31.3%), mainly focused on June after the elections, and the Argentine peso (-49.2%), stands out. In both cases, the currencies have been pressured by the negative dynamism of inflation. The rest of currencies evolved moderately during the first nine months of the year: the Peruvian sol (+1.5%), the U.S. dollar (+0.7%) and the Chilean peso (-4.6%).

EXCHANGE RATES (EXPRESSED IN CURRENCY/EURO)

| Year-end exchange rates | Average exchange rates | ||||

|---|---|---|---|---|---|

30-09-23 |

∆% on 30-09-22 |

∆% on 31-12-22 |

Jan.-Sep. 23 |

∆% on Jan.-Sep. 22 |

|

| U.S. dollar | 1.0594 | (8.0) | 0.7 | 1.0834 | (1.8) |

| Mexican peso | 18.5030 | 6.1 | 12.7 | 19.2867 | 11.8 |

| Turkish lira (1) | 29.0514 | (37.8) | (31.3) | - | - |

| Peruvian sol | 3.9965 | (3.2) | 1.5 | 4.0332 | 0.5 |

| Argentine peso (1) | 370.82 | (61.3) | (49.2) | - | - |

| Chilean peso | 960.71 | (2.0) | (4.6) | 890.01 | 2.5 |

| Colombian peso | 4,328.25 | 2.1 | 18.5 | 4,777.63 | (9.5) |

(1) According to IAS 21 "The effects of changes in foreign exchange rates", the year-end exchange rate is used for the conversion of the Turkey and Argentina income statement.

In relation to the hedging of the capital ratios, BBVA covers, in aggregate, 70% of its subsidiaries' capital excess. The sensitivity of the Group's CET1 fully-loaded ratio to 10% depreciations in major currencies is estimated at: +18 basis points for the U.S. dollar, -9 basis points for the Mexican peso and -5 basis points for the Turkish lira10. With regard to the hedging of results, BBVA hedges between 40% and 50% of the aggregate net attributable profit it expects to generate in the next 12 months. For each currency, the final amount hedged depends on its expected future evolution, the costs and the relevance of the incomes related to the Group's results as a whole.

Interest rate

Interest rate risk management seeks to limit the impact that BBVA may suffer, both in terms of net interest income (short-term) and economic value (long-term), from adverse movements in the interest rate curves in the various currencies in which the Group operates. BBVA carries out this work through an internal procedure, pursuant to the guidelines established by the European Banking Authority (EBA), with the aim of analyzing the potential impact that could derive from a range of scenarios on the Group's different balance sheets.

The model is based on assumptions intended to realistically mimic the behavior of the balance sheet. Of particular relevance are assumptions regarding the behavior of accounts with no explicit maturity and prepayment estimates. These assumptions are reviewed and adapted at least once a year, to take into account any changes in observed behavior.

At the aggregate level, BBVA continues to have a positive sensitivity toward interest rate increases in the net interest income.

The first nine months of 2023 were characterized by persistent inflation in most of the countries where the Group operates. Although headline inflation continued to show signs of slowing down, core inflation remains at high levels, which together with the growth indicators strength, served as reason for both the ECB and the Fed to consolidate their hawkish messages of high interest rates for a longer time. This positioning from monetary authorities has contributed the sovereign curves to certain rises, particularly in both intermediate and long tranches, and has delayed the expectation of starting a rates cut cycle in the main occidental economies. On the other hand, the peripheral curves spreads started to rise after having been well supported during the year, particularly in Italy. In the case of Mexico, the cycle of rate increases is considered to have ended, but the rates cut expectation is delayed until the first semester of 2024. The central bank of Turkey delves into the tighten of its monetary policy, with significant rate hikes in the third quarter of the year. In South America, after Uruguay, Brazil and Chile, Peru started its rate cut cycle with 25 basis points on September (25 additional basis points on October), and Colombia to follow it is expected before the end of the year. Argentina remains within an uncertainty environment because of the general elections on November.

By area, the main features are:

-

Spain has a balance sheet characterized by a high proportion of

variable-rate loans (mortgages and corporate lending) and

liabilities composed mainly by customer demand deposits. The ALCO

portfolio acts as a management lever and hedging for the balance

sheet, mitigating its sensitivity to interest rate fluctuations.

In an environment of higher rates, currently close to their

market-predicted terminal values, the interest rate risk profile

of the balance sheet has been reduced during the year.

On the other hand, the ECB raised interest rates by 25 basis points at each of its meetings in July and September, bringing the benchmark interest rate to 4.5%, the marginal deposit facility rate at 4.0% and the marginal loan facility rate at 4.75% at the end of the quarter. In this environment, Euribor reference rates continued to rise in the third quarter of 2023, although at a slower pace than in the first six months of the year. Thus, the customer spread is benefiting from the interest rate hikes and the containment in the cost of deposits. - Mexico continues to show a balance between fixed and variable interest rates balances, which results in a limited sensitivity to interest rates fluctuations. In terms of assets that are most sensitive to interest rate movements, the commercial portfolio stands out, while consumer loans and mortgages are mostly at a fixed rate. With regard to the customer funds, the high proportion of non-interest bearing deposits, which are insensitive to interest rate movements, should be highlighted. The ALCO portfolio is invested primarily in fixed-rate sovereign bonds with limited maturities. The monetary policy rate stands at 11.25%, 75 basis points above the end-of-year level of 2022, but stable in the quarter. Regarding customer spread, there has been improvement so far between January and September of 2023, favored by both the containment of the cost of deposits and the positive evolution of the loan yield.

- In Turkey, the sensitivity of loans, which are mostly fixed-rate but with relatively short maturities, and the ALCO portfolio balance the sensitivity of deposits on the liability side. Thus, the sensitivity of net interest income remains limited, both in Turkish lira and in foreign currencies. The CBRT increased the monetary policy rates, with two hikes each of 500 basis points on September and October from the 25% rate established on its August meeting. The customer spread improved in the third quarter due to the loan yield increases as a result of a positioning strategy against interest rates rises.

- In South America, the interest rate risk profile remains low as most countries in the area have a fixed/variable composition and maturities that are very similar for assets and liabilities, with limited net interest income sensitivity. In addition, the balance sheets with several currencies, interest rate risk is managed for each of the currencies, showing a very low level of risk. Regarding benchmark rates, in Peru it stood at 7.25% at the end of October after the two cut rates of 25 basis points made by the Peru's central bank in September and October. In Colombia, with no changes from April, interest rates stand at 13.25%. In Argentina, after the presidential elections in August, interest rates increased significantly by 2,100 basis points to 118%, and has continued to increase to 133%% after the last decision of the central bank on October. The customer spread in Colombia continues to recover as seen in the previous quarter, as well as in Peru, which maintains a constant improvement in the year.

INTEREST RATES (PERCENTAGE)

| 30-09-23 | 30-06-23 | 31-03-23 | 31-12-22 | 30-09-22 | 30-06-22 | 31-03-22 | |

|---|---|---|---|---|---|---|---|

| Official ECB rate | 4.50 | 4.00 | 3.50 | 2.50 | 1.25 | 0.00 | 0.00 |

| Euribor 3 months (1) | 3.88 | 3.54 | 2.91 | 2.06 | 1.01 | (0.24) | (0.50) |

| Euribor 1 year (1) | 4.15 | 4.01 | 3.65 | 3.02 | 2.23 | 0.85 | (0.24) |

| USA Federal rates | 5.50 | 5.25 | 5.00 | 4.50 | 3.25 | 1.75 | 0.50 |

| TIIE (Mexico) | 11.25 | 11.25 | 11.25 | 10.50 | 9.25 | 7.75 | 6.50 |

| CBRT (Turkey) | 30.00 | 15.00 | 8.50 | 9.00 | 12.00 | 14.00 | 14.00 |

(1) Calculated as the month average.

10 This sensitivity does not include the cost of capital hedges, which are currently estimated at 3 basis points per quarter for Mexican peso and 4 basis points per quarter for Turkish lira.