Highlights

Results and business activity

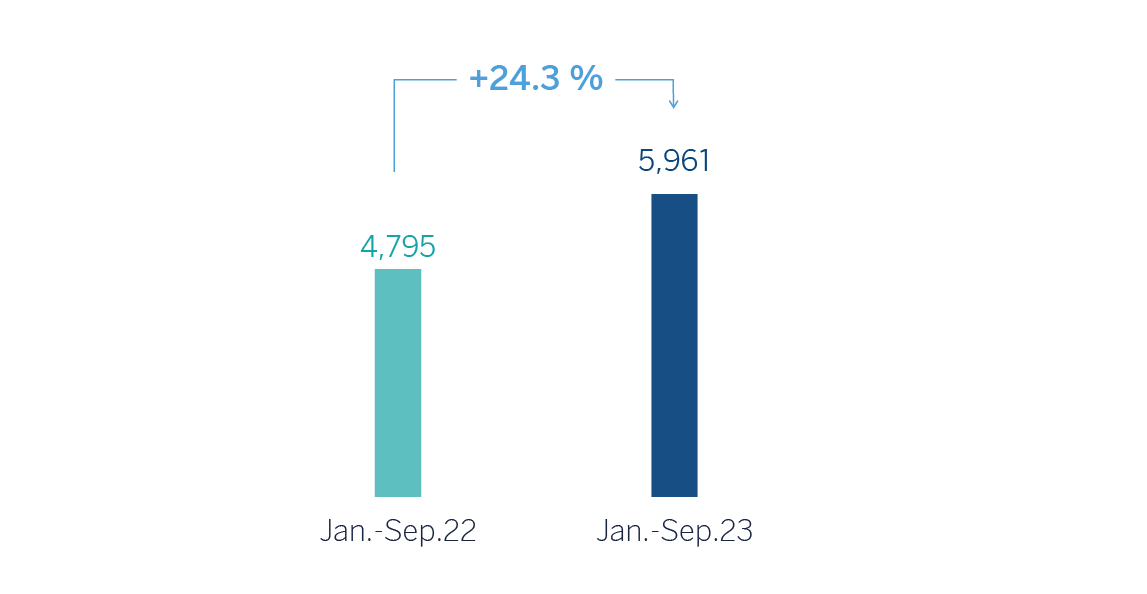

The BBVA Group generated a net attributable profit of €5,961m between January and September of 2023, which represents an increase of 24.3% compared to the same period of the previous year, driven by the performance of recurring income from the banking business, mainly the net interest income, which grew at a rate of 29.4%.

These results include the recording for the total annual amount paid for the temporary tax on credit institutions and financial credit institutions for €215m, included in the other operating income and expenses line of the income statement.

Operating expenses increased by 18.1% at Group level, largely impacted by the inflation rates observed in the countries in which the Group operates. Notwithstanding the above, thanks to the remarkable growth in gross income, higher than the growth in expenses, the efficiency ratio stood at 41.8% as of September 30, 2023, with an improvement of 328 basis points, in constant terms, compared to the ratio recorded 12 months earlier.

The provisions for impairment on financial assets increased (+35.5% in year-on-year terms and at constant exchange rates), with lower requirements in Turkey, which were offset by higher provisioning needs, mainly in South America and Mexico, in a context of rising interest rates and growth in the most profitable segments, in line with the Group's strategy.

Loans and advances to customers recorded an increase of 5.3% compared to the end of December 2022, strongly favored by the evolution of retail loans (+6.9% at Group level).

Customer funds increased by 3.6% compared to the end of December 2022 thanks both to the growth in deposits from customers which increased by 2.4% and to the increase in off-balance sheet funds, which grew by +6.9%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2022)

Business areas

As for the business areas evolution, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

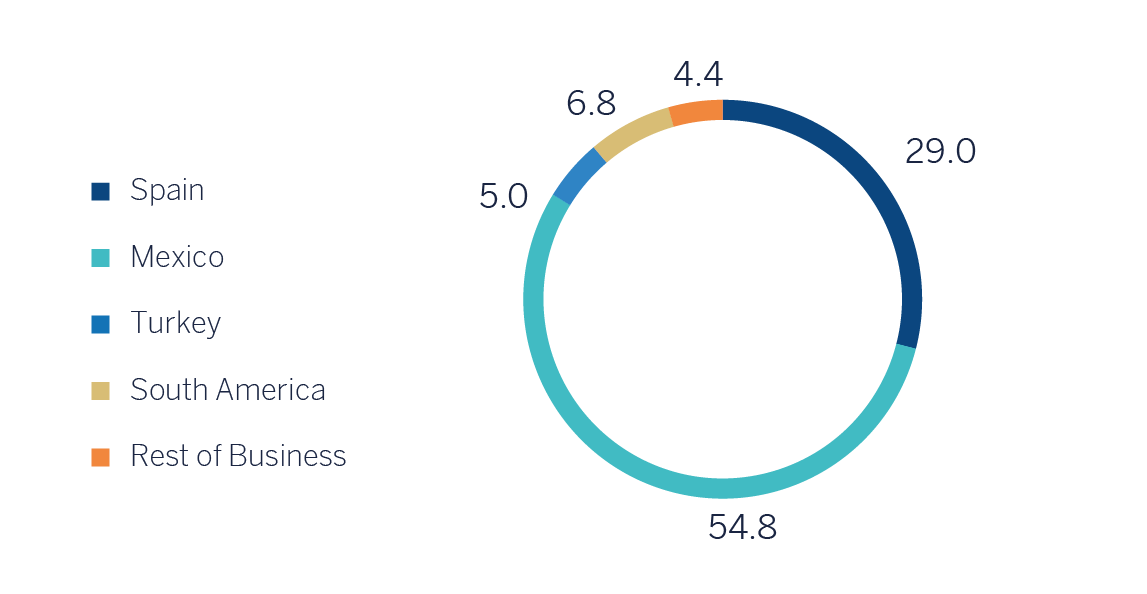

- Spain generated a net attributable profit of €2,110m in the first nine months of 2023, 61.9% higher than in the same period of the previous year, thanks again to the strength of the net interest income, which boosted gross income growth.

- In Mexico, BBVA achieved a cumulative net attributable profit of €3,987m by the end of September 2023, representing an increase of 22.3% compared to the same period in 2022, mainly as a result of the significant growth in net interest income, thanks to the strong boost of the activity and the improvement in the customer spread.

- Turkey generated a net attributable profit of €367m during the first nine months of 2023, which compares positively with the accumulated result reached at the end of September 2022, both periods reflecting the impact of the application of hyperinflation accounting.

- South America generated a cumulative net attributable profit of €496m at the end of the first nine months of the year 2023, which represents a year-on-year increase of +20.5%, driven again by the good performance of recurring income (+59.1%) and the area's NTI, which offset the increase in expenses and higher provisioning needs for impairment on financial assets.

- Rest of Business achieved an accumulated net attributable profit of €322m at the end of the first nine months of 2023, 80.8% higher than in the same period of the previous year, thanks to a favorable performance of recurring income, especially the net interest income, and the NTI.

The Corporate Center recorded, between January and September of 2023 a net attributable profit of €-1,321m, compared with €-566m recorded in the same period of the previous year, mainly due to a negative contribution in the NTI line from exchange rate hedges as a result of a better than expected currency performance, in particular the Mexican peso.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €1,763m between January and September of 2023. These results, which do not include the application of hyperinflation accounting, represent an increase of 43.8% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. JAN.-SEP. 2023)

(1) Excludes the Corporate Center.

Solvency

The Group's CET1 fully-loaded ratio stood at 12.73% as of September 30, 2023, including the effect of the share buyback program launched on October 2, 2023 for a total amount of €1,000m (-32 basis points), which allows to keep maintaining a large management buffer over the Group's CET1 requirement (8.77%)1 and above the Group's established target management range of 11.5-12.0% of CET1.

Dividend

The Board of Directors of BBVA resolved on its meeting hold on September 27, 2023, the payment of a cash interim dividend of €0.16 gross per share on account of the 2023 dividend, which was paid on October 11, 2023. This dividend is already considered in the Group's capital adequacy ratios and represents an increase of 33.3% compared to the gross amount paid in October 2022 (€0.12 per share).

Share buyback program

On October 2, and having received the required authorization from the European Central Bank, the Group started the execution of a new share buyback program for a total amount of €1,000m. This share buyback program is considered to be an extraordinary shareholder distribution and is therefore not included in the scope of the shareholder ordinary distribution policy. For more information on this, see "Solvency" chapter within this report.

Sustainability

Channeling sustainable business2

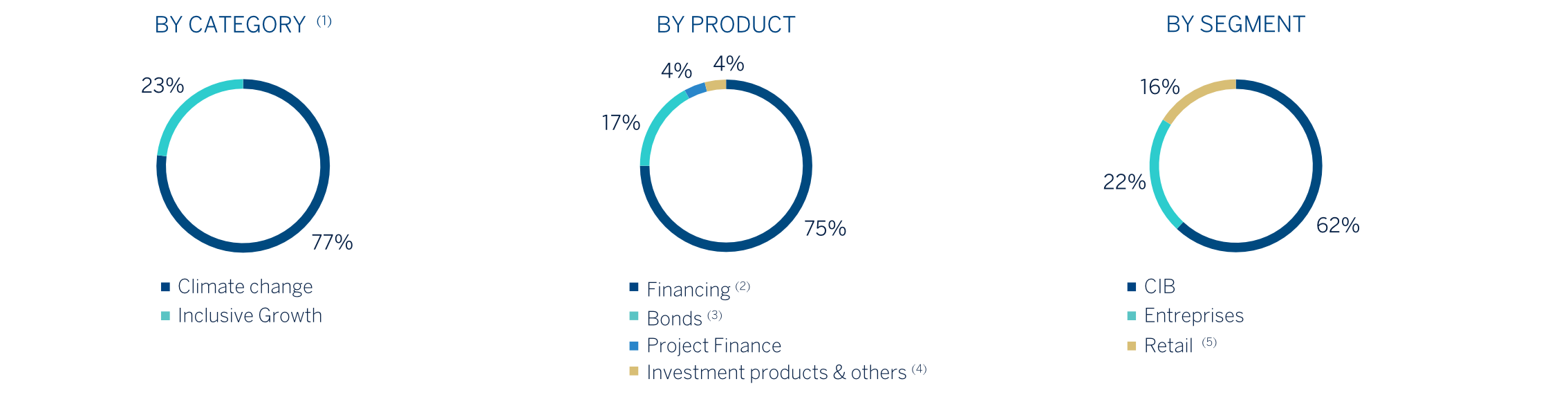

SUSTAINABLE BUSINESS BREAKDOWN (PERCENTAGE. TOTAL AMOUNT CHANNELED 2018-SEPTEMBER 2023)

(1) In those cases where it is not feasible or

there is not enough information available to allow an exact

distribution between the categories of climate change and

inclusive growth, internal estimates are made based on the

information available.

(2) Non-Project Finance and transactional banking activity.

(3) Bonds in which BBVA acts as bookrunner.

(4) Investment products art. 8 or 9 under Sustainable Finance Disclosure Regulation (SFDR) or similar criteria outside the European Union, managed, intermediated or marketed by BBVA. Others includes, in Retail: structured deposits, insurance policies for electric vehicles and self-renting of electric vehicles, mainly; and in CIB and Enterprise: structured deposits, mainly.

(5) Includes the activity of the BBVA Microfinance Foundation (FMBBVA), which is not part of the consolidated Group and has channeled during the third quarter around €400m to support vulnerable entrepreneurs through microloans. This represents a 7% decrease compared to the same quarter of the previous year, while it remains stable for the first nine months of 2023 compared to the previous year.

Regarding the objective of channeling €300 billion between 2018 and 2025 as part of the sustainability strategy, the BBVA Group has mobilized an approximate total of €185 billion in sustainable business between 2018 and September 2023, of which approximately 77% is allocated toward the fight against climate change, while the remaining 23% is dedicated to promoting inclusive growth. The channeled amount includes financing, intermediation, investment, off-balance sheet, or insurance operations. These operations have contractual maturity or amortization dates, so the above mentioned accumulated figure does not represent the amount reflected on the balance sheet.

During the first nine months of 2023, around €49 billion was mobilized (+25% compared to the same period of the previous year), of which around €16 billion correspond to the third quarter of 2023. This channeling during the third quarter of 2023 represents an increase of about 13% compared to the same quarter of 2022 and is the second best quarter in sustainable business channeling for the Group, following the quarterly record achieved in the second quarter of this year.

In this third quarter, the retail business has mobilized around €1.700m, to reach a cumulative amount of around €7,300m since January 2023 (+69% compared to the same period last year). The good behavior of the channeling related to the acquisition of hybrid or electric vehicles stands out with €87m representing a growth of 78% compared to the same period of the previous year (+35% compared to the accumulated amount of the first 9 months of 2023 on a year-on-year basis). The contribution from Spain, which has channeled over half of this amount, is the most relevant.

Between July and September 2023, the commercial business (enterprises) has mobilized around €5.400m. In cumulative terms, mobilization in the first 9 months of the 2023 financial year has reached nearly €15,600m (+95% year-on-year). As in the previous quarter, the funding allocated to promote or improve the energy efficiency of buildings stands out with €1.088m, representing a 21% year-on-year increase (+55% when comparing the accumulated amount for the first 9 months of 2023 with the same period last year). In this area, Mexico's contribution of Mexico is fundamental, with a 37% increase.

CIB has channeled approximately €8,100m during this quarter, and during the first 9 months of this year, around €26,200m (-3% year-on-year). During this quarter, the positive development of short-term financing or sustainable transactional banking activity stands out, wich contributed approximately €4,400m, more than half the amount channeled by the corporate segment, representing a 34% year-on-year growth (and 10% if considering the accumulated amount from January 2023 compared to the same period last year). Since the beginning of 2023, signs of slowdown have been noted in the field of sustainable corporate financing, especially in long-term financing, as well as a revitalization of the sustainable bond market in which BBVA acts as bookrunner.

1 This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end June 2023.

2 Channeling sustainable business is considered to be any mobilization of financial flows, cumulatively, towards activities or clients considered sustainable in accordance with existing regulations, both internal and market standards and best practices. The foregoing is understood without prejudice to the fact that such mobilization, both initially and at a later time, may not be recorded on the balance sheet. To determine the amounts of channeled sustainable business, internal criteria based on both internal and external information are used.