South America

Highlights

- Growth in lending activity

- Excellent evolution of the net interest income

- Favorable NTI evolution

- Higher adjustment for hyperinflation in Argentina

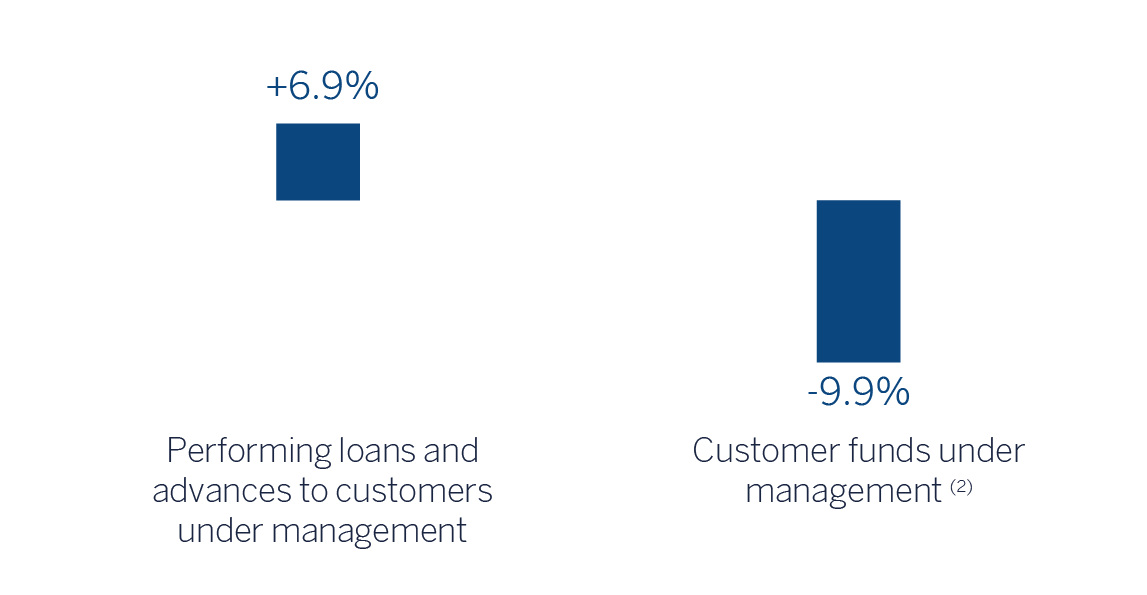

Business activity (1)

(VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO

31-12-22)

(1) Excluding repos.

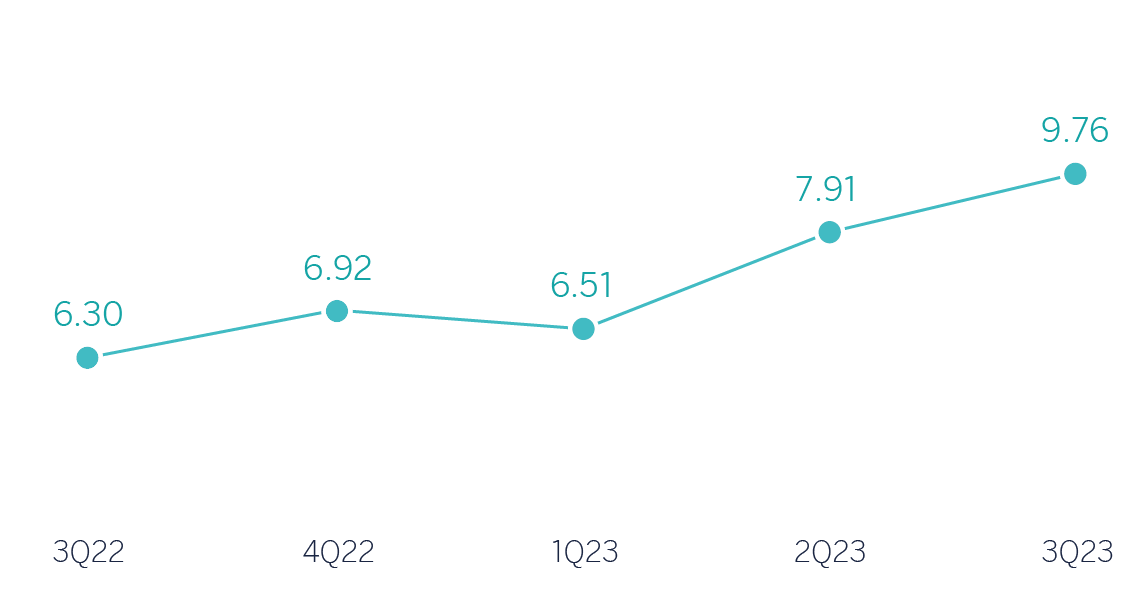

Net interest income / AVERAGE TOTAL ASSETS

(PERCENTAGE AT CONSTANT EXCHANGE RATES)

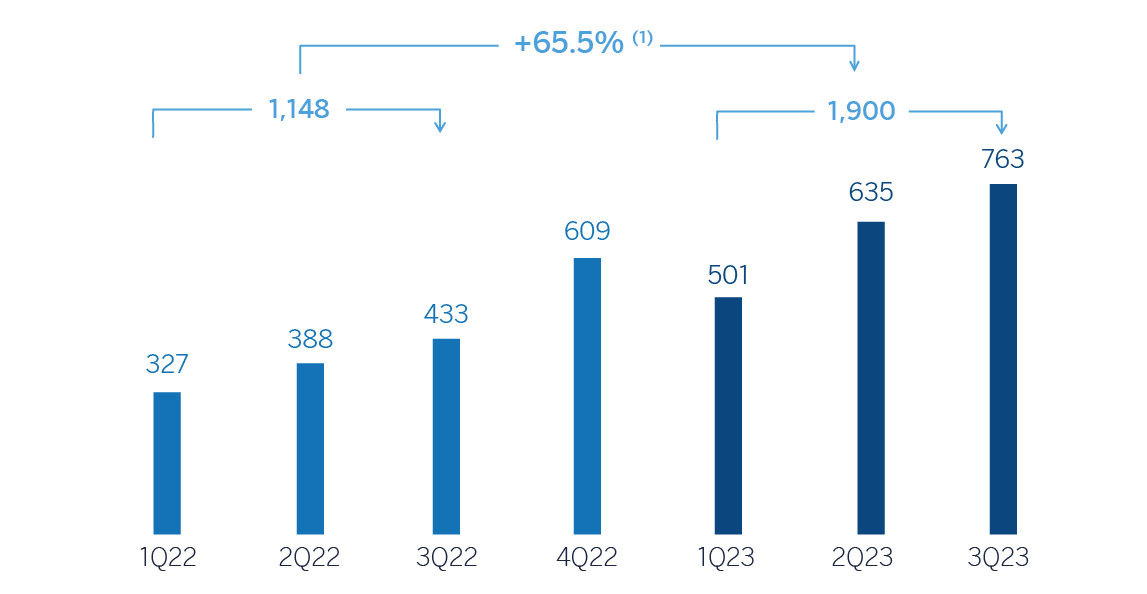

Operating income

(Millions of euros at constant exchange rates)

(1) At current exchange rates: +12.2%.

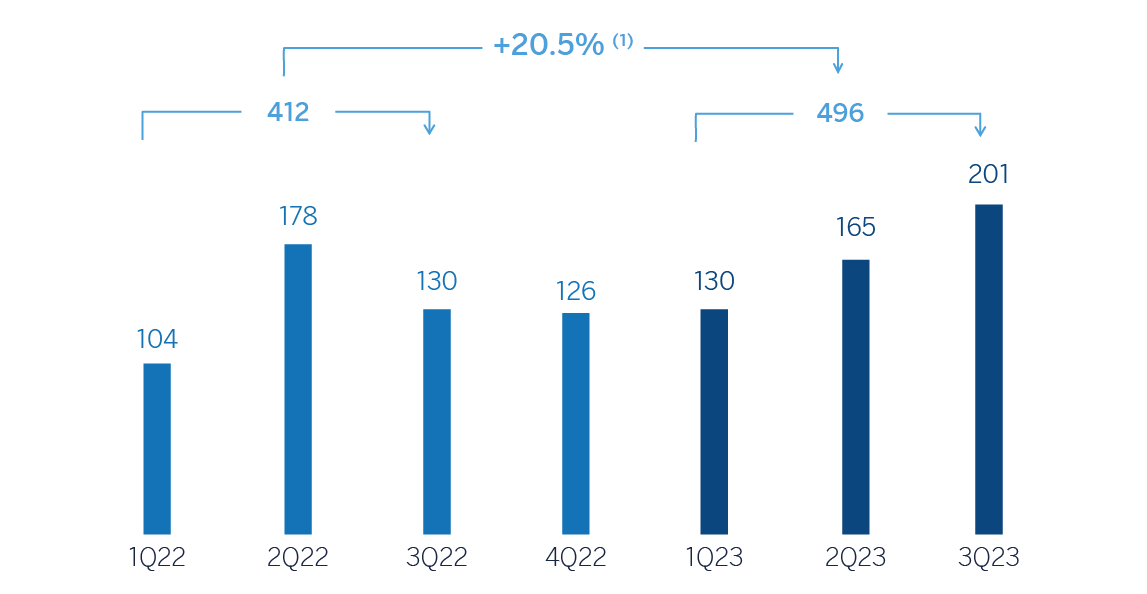

Net attributable profit (LOSS)

(Millions of euros at constant exchange rates)

(1) At current exchange rates: -20.6%.

(2) The variation in customer funds under management is affected by the transfer of the pension funds managed by the Pension Fund Administrator that the BBVA Group maintains in Bolivia to the Public Long-Term Social Security Manager of Bolivia.

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | Jan.-Sep. 23 | ∆% | ∆% (1) | Jan.-Sep. 22 (2) |

|---|---|---|---|---|

| Net interest income | 3,892 | 26.6 | 67.6 | 3,074 |

| Net fees and commissions | 584 | (4.1) | 18.9 | 608 |

| Net trading income | 386 | 8.7 | 33.6 | 355 |

| Other operating income and expenses | (1,285) | 51.0 | 68.5 | (851) |

| Gross income | 3,577 | 12.3 | 52.9 | 3,186 |

| Operating expenses | (1,677) | 12.3 | 40.8 | (1,493) |

| Personnel expenses | (779) | 9.1 | 39.4 | (714) |

| Other administrative expenses | (762) | 17.3 | 48.8 | (650) |

| Depreciation | (136) | 4.7 | 13.0 | (130) |

| Operating income | 1,900 | 12.2 | 65.5 | 1,693 |

| Impairment on financial assets not measured at fair value through profit or loss | (864) | 79.2 | 110.0 | (482) |

| Provisions or reversal of provisions and other results | (15) | (75.9) | (70.7) | (63) |

| Profit (loss) before tax | 1,021 | (11.0) | 49.1 | 1,148 |

| Income tax | (265) | 9.8 | 215.8 | (241) |

| Profit (loss) for the period | 756 | (16.6) | 25.8 | 906 |

| Non-controlling interests | (260) | (7.6) | 37.5 | (281) |

| Net attributable profit (loss) | 496 | (20.6) | 20.5 | 625 |

| Balance sheets | 30-09-23 | ∆% | ∆% (1) | 31-12-22 (2) |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 7,228 | (6.1) | (1.3) | 7,695 |

| Financial assets designated at fair value | 11,519 | 7.3 | 18.9 | 10,739 |

| Of which: Loans and advances | 224 | 47.9 | 24.8 | 152 |

| Financial assets at amortized cost | 45,000 | 11.3 | 9.5 | 40,448 |

| Of which: Loans and advances to customers | 42,119 | 9.6 | 7.3 | 38,437 |

| Tangible assets | 1,115 | 2.5 | 8.5 | 1,088 |

| Other assets | 2,274 | 14.8 | 15.7 | 1,981 |

| Total assets/liabilities and equity | 67,136 | 8.4 | 9.9 | 61,951 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 3,209 | 14.1 | (1.9) | 2,813 |

| Deposits from central banks and credit institutions | 5,121 | (8.7) | (11.7) | 5,610 |

| Deposits from customers | 44,535 | 11.2 | 13.1 | 40,042 |

| Debt certificates | 3,055 | 3.3 | 3.0 | 2,956 |

| Other liabilities | 5,189 | 11.5 | 33.9 | 4,655 |

| Regulatory capital allocated | 6,028 | 2.6 | 4.1 | 5,874 |

| Relevant business indicators | 30-09-23 | ∆% | ∆% (1) | 31-12-22 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (3) | 42,014 | 9.2 | 6.9 | 38,484 |

| Non-performing loans | 2,253 | 22.8 | 16.9 | 1,835 |

| Customer deposits under management (4) | 44,535 | 11.2 | 13.1 | 40,042 |

| Off-balance sheet funds (5) | 6,345 | (64.3) | (62.9) | 17,760 |

| Risk-weighted assets | 50,255 | 7.3 | 8.5 | 46,834 |

| Efficiency ratio (%) | 46.9 | 46.3 | ||

| NPL ratio (%) | 4.6 | 4.1 | ||

| NPL coverage ratio (%) | 93 | 101 | ||

| Cost of risk (%) | 2.50 | 1.69 |

(1) At constant exchange rates.

(2) Balances restated according to IFRS 17 - Insurance contracts.

(3) Excluding repos.

(4) Excluding repos and including specific marketable debt securities.

(5) Includes mutual funds, customer portfolios in Colombia and Peru and pension funds in Bolivia as of 31-12-2022.

South America. Data per country (Millions of euros)

| Operating income | Net attributable profit (loss) | |||||||

|---|---|---|---|---|---|---|---|---|

| Country | Jan.-Sep. 23 | ∆% | ∆% (1) | Jan.-Sep. 22 (2) | Jan.-Sep. 23 | ∆% | ∆% (1) | Jan.-Sep. 22 (2) |

| Argentina | 487 | 51.9 | n.s. | 321 | 138 | (11.9) | n.s. | 156 |

| Colombia | 356 | (31.7) | (24.6) | 522 | 115 | (47.5) | (41.9) | 218 |

| Peru | 817 | 20.2 | 19.6 | 680 | 155 | (8.0) | (8.4) | 168 |

| Other countries (3) | 240 | 40.4 | 36.8 | 171 | 89 | 8.2 | 5.2 | 83 |

| Total | 1,900 | 12.2 | 65.5 | 1,693 | 496 | (20.6) | 20.5 | 625 |

(1) Figures at constant exchange rates.

(2) Balances restated according to IFRS 17 - Insurance contracts.

(3) Bolivia, Chile (Forum), Uruguay and Venezuela. Additionally, it includes eliminations and other charges.

South America. Relevant business indicators per country (Millions of euros)

| Argentina | Colombia | Peru | ||||

|---|---|---|---|---|---|---|

| 30-09-23 | 31-12-22 | 30-09-23 | 31-12-22 | 30-09-23 | 31-12-22 | |

| Performing loans and advances to customers under management (1) (2) | 3,752 | 1,947 | 16,444 | 15,743 | 17,285 | 17,198 |

| Non-performing loans (1) | 74 | 32 | 848 | 712 | 1,175 | 1,070 |

| Customer deposits under management (1) (3) | 6,974 | 3,540 | 16,958 | 15,471 | 16,758 | 16,467 |

| Off-balance sheet funds (1) (4) | 2,399 | 1,171 | 2,189 | 2,425 | 1,755 | 1,475 |

| Risk-weighted assets | 6,678 | 8,089 | 18,616 | 15,279 | 19,436 | 17,936 |

| Efficiency ratio (%) | 57.6 | 61.3 | 48.0 | 40.4 | 36.6 | 37.2 |

| NPL ratio (%) | 1.8 | 1.6 | 4.7 | 4.2 | 5.4 | 4.9 |

| NPL coverage ratio (%) | 144 | 173 | 92 | 106 | 88 | 91 |

| Cost of risk (%) | 3.60 | 2.61 | 1.97 | 1.56 | 2.79 | 1.58 |

(1) Figures at constant exchange rates.

(2) Excluding repos.

(3) Excluding repos and including specific marketable debt securities.

(4) Includes mutual funds and customer portfolios (in Colombia and Peru).

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. These rates, together with the changes at current exchange rates, can be found in the attached tables of the financial statements and relevant business indicators.

Activity and results

The most relevant aspects related to the area's activity during the first nine months of the year 2023 were:

- Lending activity (performing loans under management) increased by 6.9%, with growth focused on the retail portfolio, which grew more than the wholesale portfolio (+11.2% versus +3.1%), mainly favored by the evolution of consumer loans (+11.2%), and credit cards (+36.9%). On the other hand, corporate loans also increased (+3.2%).

- Customer funds under management decreased (-9.9%) compared to the closing balances at the end of 2022, with an increase in time deposits (+29.7%) and a reduction of off-balance sheet funds (-62.9%) due to the transfer of pension funds managed by the Pension Fund Administrator that the BBVA Group maintains in Bolivia to the Public Long-Term Social Security Management Company of this country.

The most relevant aspects related to the area's activity during the third quarter of the year 2023 were:

- Lending activity (performing loans under management) increased by +2.8%, also boosted by consumer loans (+3.4%), credit cards (+11.5%) and corporate loans (+1.5%).

- With regard to asset quality, the NPL ratio stood at 4.6%, with an increase of 28 basis points in the quarter at the regional level, generalized in all countries, except Argentina which was positively affected by activity growth. On the other hand, the area's NPL coverage ratio decreased to 93%.

- Customer funds under management increased (+7.6%) compared to the previous quarter thanks to both good evolution of customer deposits (+6.5%) and off-balance sheet funds (+16.3%).

South America generated a cumulative net attributable profit of €496m at the end of the first nine months of the year 2023, which represents a year-on-year increase of +20.5%, driven again by the good performance of recurring income (+59.1%) and the area's NTI, which offset the increase in expenses, in a highly inflationary environment throughout the region and higher provisioning needs for impairment on financial assets.

The heading "Other operating income and expenses" mainly includes the impact of the adjustment for hyperinflation in Argentina, whose net monetary loss stood at €953m in the period January-September 2023, which is higher than the €670m registered in the period January-September 2022.

More detailed information on the most representative countries of the business area is provided below:

Argentina

Macro and industry trends

The macroeconomic environment has continued to deteriorate. Risk of economic and financial turbulence has increased, in a context of high uncertainty related to the presidential elections in the fourth quarter of 2023. BBVA Research estimates that GDP will fall by around 3.5% this year, the same forecast as three months ago, largely due to the impact of the adverse weather shock on the production and export of agricultural goods. Despite high uncertainty about the future economic policy, an eventual tightening of fiscal and monetary conditions will most likely help bring inflation (which reached 138.3% in September and could converge to around 200% by the end of 2023) under control, despite an expected further depreciation of the Argentine peso. Given this environment, GDP could decline by around 2.5% in 2024, 50 basis points more than previously expected.

The banking sector continues to grow at a stable pace but feels the burden of high inflation. At the end of September 2023, total credit grew by 108% compared to the same month in 2022, favored by both consumer and corporate portfolios, which reached year-on-year growth rates of 96% and 131%, respectively. Deposits slowed slightly compared to the previous month, growing by 113% in September. Finally, the NPL ratio remained stable at 3.1% in July 2023 (7 basis points lower than in the same month of 2022).

Activity and results

- Between January and September of 2023, performing loans under management increased by 92.7%, with growth in both the business portfolio (+107.3%) and the retail portfolio (+78.6%), highlighting in the latter credit cards (+78.4%) and consumer loans (+72.0%). The NPL ratio stood at 1.8%, which represents a decrease of 9 basis points compared to the previous quarter, positively affected by activity growth, which offset higher entries in NPLs in mainly credit cards and consumer loans. On the other hand, the NPL coverage ratio stood at 144%, with decline compared to the previous quarter due to a non-recurring item.

- Balance sheet funds grew by 97.0% between January and September of 2023, with time deposits increasing at a faster rate than demand deposits (+112.2% versus +75.3%). On the other hand, mutual funds also increased (+104.9%).

- The cumulative net attributable profit at the end of September 2023 stood at €138m, well above the figure achieved in the same period of 2022, which is mainly explained by the favorable evolution of the net interest income, driven by both volume and price effect, mainly in credit cards and business portfolio, as well as a higher profitability of the securities portfolios. This evolution was partially offset by a more negative adjustment for hyperinflation (mainly collected in the other operating income and expenses line), higher expenses -both in personnel due to salary revisions, as well as general expenses-, and provisions, due to both the credit and the fixed income securities portfolio. In the quarterly evolution, the net interest income and NTI growth was partially offset by a higher negative adjustment for hyperinflation within the other operating income and expenses line as well as by the operating expenses increase.

Colombia

Macro and industry trends

Economic activity lost momentum throughout 2023, in line with the expectations of BBVA Research, which maintains unchanged GDP growth forecasts of 1.2% in 2023 and 1.5% in 2024. Lower growth in domestic demand is expected to favor a gradual moderation of inflation from 11.0% in September to around 7.1%, on average, in 2024. This will probably allow interest rates, which at the date of drafting of this report are at 11.25%, to be gradually cut from the fourth quarter of 2023 onwards.

Total credit growth in the banking system stood at 8.9% year-on-year in June 2023, and continues to be driven by corporate lending at 10.9% and mortgages at 10.8%. Consumer credit deceleration stands out, as it slowed from a year-on-year growth rate of 20% throughout the full year 2022 to 5.1% in June 2023. Total deposits showed a year-on-year growth rate of 9.8% in June 2023, with a strong increase in time deposits (up 50.5% year-on-year) and a fall in demand deposits (down 9.6% year-on-year). The NPL ratio of the system has climbed in recent months to 4.7% in June 2023, 101 basis points higher than in the same month of 2022.

Activity and results

- Lending activity registered a growth of 4.4% compared to the end of 2022. Both the retail and wholesale portfolio increased (+5.9% and +2.5%, respectively) thanks to the performance of consumer loans, credit cards and business loans, although the latter showed deleveraging in the third quarter (-1.7%). In terms of asset quality, the NPL ratio increased in the third quarter of the year (+24 basis points) to 4.7%, originating from retail portfolios, mainly consumer and credit cards portfolios. On the other hand, the NPL coverage ratio declined in the quarter to 92% due to the lower average provisions of balances with NPL inflows during the quarter.

- In the first nine months of 2023, customer deposits increased by 9.6% thanks to the positive evolution of time deposits (+24.7%).

- The cumulative net attributable profit at the end of the first nine months of 2023 stood at €115m, that is 41.9% lower than at the end of the same period of the previous year. The lower contribution from net interest income was affected by the high cost of funds and was partially offset by the net fees and commissions evolution. On the lower part of the income statement, higher operating expenses and increase in provisions for impairment of financial assets due to higher requirements in the retail portfolio within a more complex macroeconomic environment. In the third quarter of 2023, net interest income evolved favorably, although a lower income from commissions and particularly a worse NTI performance (negative in the quarter due to the Global Markets results) were registered. On the other hand, a higher operating expenses and loan-loss provisions was observed. As a result of the above, the quarterly net attributable profit closed 71.9% below the previous quarter.

Peru

Macro and industry trends

Economic activity has shown weakness in recent months in a setting marked by adverse weather shocks. BBVA Research has therefore revised its forecast for GDP growth in 2023 from 1.6% to 0.4%. In addition, the easing of inflation (which reached 5.0% in September and will average around 3.5% in 2024) and the process of cutting interest rates (which will probably fall from the October level of 7.25%, reached after two cuts of 25 basis points in recent months, to around 5.25% at the end of next year) will presumably support a recovery in activity and GDP growth of 2.3% in 2024 (30 basis points below the previous forecast).

Total credit in the Peruvian banking system fell in August 2023 (-3.6% year-on-year). Performance by portfolio is uneven, with the biggest slowdown continuing to be seen in corporate lending, with a year-on-year contraction in the balance of -10.3%. However, consumer finance remained buoyant, growing by 13.2% year-on-year in August 2023, while the mortgage portfolio maintained a stable growth rate of around 4.6% year-on-year. Total deposits in the system dropped in August (-1.2% year-on-year), with a continued shift towards time deposits (+26.1% year-on-year) to the detriment of demand deposits (-12.8% year-on-year). The NPL ratio across the banking system rose very slightly to 4.3% in August 2023 (36 basis points above the same month in 2022).

Activity and results

- Lending activity remained flat compared to the close of December 2022 (+0.5%) mainly due to the deleveraging of the corporate portfolio (-4.3%), principally due to the maturities of the "Reactiva Perú" program and some CIB operations, offset by a favorable evolution of consumer loans (+15.9%), credit cards (+18.2%) and mortgage portfolios (+3.0%). In terms of credit quality indicators, the NPL ratio increased by 41 basis points to stand at 5.4%, with entries mainly in retail portfolio, which were affected by the current environment. On the other hand, the NPL coverage ratio increased to 88% in the quarter.

- Customers funds under management increased during the first nine months of 2023 (+3.2%) due to the good performance of time deposits (+29.0%), favored by high rates environment by the central bank and, to a lesser extent, by the off-balance sheet funds (+19.0%), which offset the lower balances in demand deposits (-9.2%).

- BBVA Peru's net attributable profit stood at €155m at the end of September 2023, 8.4% below the figure achieved at the end of the same period of the previous year, favored by the good performance of net income and NTI. On the lower part of the income statement, there was an increase in operating expenses (+18.0%) and provisions for impairment of financial assets (+130.1%), with higher requirements due to the worsening of the macroeconomic environment. In the third quarter of 2023, net interest income increased, favored by the growth of corporates portfolio rates, but it was offset by a lower level of fees and commissions, higher operating expenses and particularly by higher loan-loss provisions, mainly due to the macroeconomic scenario update and higher loan-loss provisions in retail portfolios. Thus, and excluding the effect of exchange rate fluctuations, BBVA Peru's net attributable profit at the end of the third quarter stood at €43m, 19.8% lower than in the second quarter.