Turkey

Highlights

- Significant de-dollarization of the balance sheet

- Improved risk indicators compared to year-end 2022

- Net attributable profit positively affected by lower income tax

Business activity (1)

(VARIATION AT CONSTANT EXCHANGE RATE COMPARED TO

31-12-22)

(1) Excluding repos.

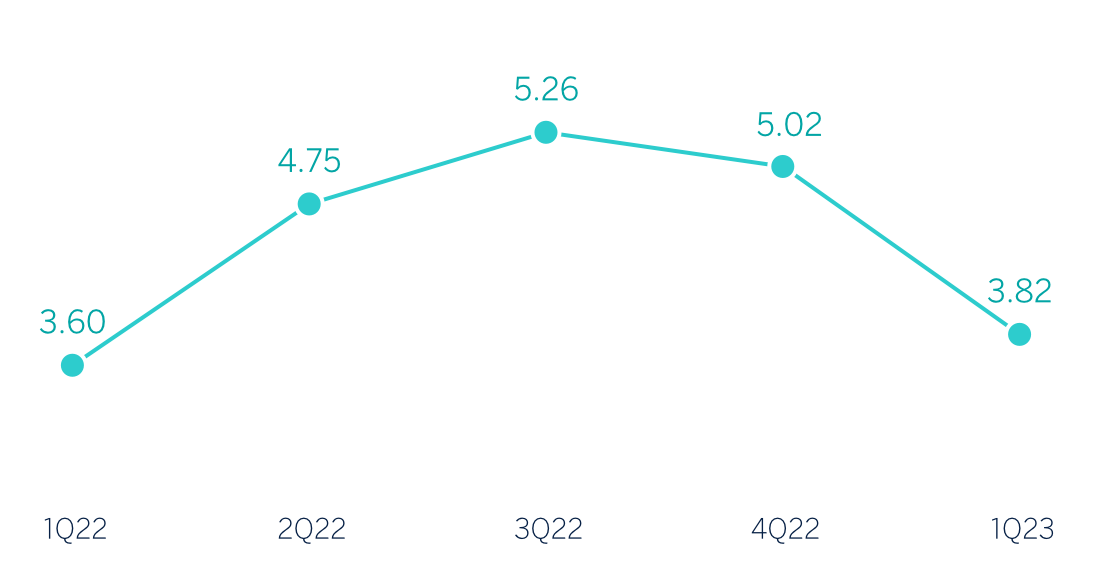

Net interest income / AVERAGE TOTAL ASSETS

(Percentage at Constant exchange rate)

Operating income

(Millions of euros at constant exchange rate)

(1) At current exchange rate: +53.8%.

Net attributable profit (LOSS)

(Millions of euros at constant exchange rate)

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 1Q23 | ∆% | ∆% (1) | 1Q22 (2) |

|---|---|---|---|---|

| Net interest income | 626 | 27.4 | 63.0 | 492 |

| Net fees and commissions | 172 | 25.9 | 61.0 | 137 |

| Net trading income | 224 | 27.9 | 64.0 | 175 |

| Other operating income and expenses | (220) | (27.3) | (48.7) | (303) |

| Gross income | 802 | 60.4 | n.s. | 500 |

| Operating expenses | (399) | 67.7 | 112.7 | (238) |

| Personnel expenses | (209) | 58.7 | 103.1 | (132) |

| Other administrative expenses | (154) | 99.6 | 154.5 | (77) |

| Depreciation | (36) | 24.2 | 49.6 | (29) |

| Operating income | 403 | 53.8 | n.s. | 262 |

| Impairment on financial assets not measured at fair value through profit or loss | (59) | (38.0) | (20.3) | (96) |

| Provisions or reversal of provisions and other results | (16) | 48.9 | 63.6 | (11) |

| Profit (loss) before tax | 327 | 110.7 | n.s. | 155 |

| Income tax | (5) | (98.4) | (98.0) | (308) |

| Profit (loss) for the period | 323 | n.s. | n.s. | (153) |

| Non-controlling interests | (45) | n.s. | n.s. | 77 |

| Net attributable profit (loss) | 277 | n.s. | n.s. | (76) |

| Balance sheets | 31-03-23 | ∆% | ∆% (1) | 31-12-22 (2) |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 8,479 | 39.9 | 46.2 | 6,061 |

| Financial assets designated at fair value | 5,109 | (1.8) | 2.6 | 5,203 |

| Of which: Loans and advances | 1 | (50.8) | (48.6) | 3 |

| Financial assets at amortized cost | 54,240 | 5.1 | 9.8 | 51,621 |

| Of which: Loans and advances to customers | 38,995 | 4.1 | 8.8 | 37,443 |

| Tangible assets | 1,368 | 12.8 | 17.2 | 1,213 |

| Other assets | 2,025 | 4.5 | 9.0 | 1,938 |

| Total assets/liabilities and equity | 71,222 | 7.9 | 12.7 | 66,036 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 2,079 | (2.7) | 1.6 | 2,138 |

| Deposits from central banks and credit institutions | 2,756 | (4.0) | 0.3 | 2,872 |

| Deposits from customers | 51,234 | 10.6 | 15.5 | 46,339 |

| Debt certificates | 2,904 | (10.2) | (6.2) | 3,236 |

| Other liabilities | 5,087 | 7.3 | 11.9 | 4,741 |

| Regulatory capital allocated | 7,161 | 6.7 | 11.5 | 6,711 |

| Relevant business indicators | 31-03-23 | ∆% | ∆% (1) | 31-12-22 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (3) | 38,958 | 4.8 | 9.5 | 37,191 |

| Non-performing loans | 2,333 | (10.2) | (6.1) | 2,597 |

| Customer deposits under management (3) | 49,806 | 9.2 | 14.2 | 45,592 |

| Off-balance sheet funds (4) | 7,491 | 8.0 | 12.9 | 6,936 |

| Risk-weighted assets | 58,683 | 4.3 | 8.9 | 56,275 |

| Efficiency ratio (%) | 49.7 | 33.5 | ||

| NPL ratio (%) | 4.3 | 5.1 | ||

| NPL coverage ratio (%) | 99 | 90 | ||

| Cost of risk (%) | 0.52 | 0.94 |

(1) At constant exchange rate.

(2) Restated balances according to IFRS17 - Insurance contracts.

(3) Excluding repos.

(3) Includes mutual funds and pension funds.

Macro and industry trends

After growing by 5.6% in 2022, one tenth of a percentage point above BBVA Research's forecast, GDP is expected to grow by around 3.0% in 2023 (unchanged from the previous forecast). The negative impact on growth from the strong earthquakes recorded at the beginning of the year is expected to be offset by the impact of construction work and the greater fiscal stimulus. Despite the recent moderation, inflation remains excessively high (50.5% in March), largely due to relatively strong demand, the depreciation of the Turkish lira and the high inertia of the price revision process. The future evolution of inflation, in particular, and of the economy, in general, will depend, among other factors, on the policies implemented after the general elections announced for May. Moreover, the economic environment is highly volatile, given the combination of high inflation, very negative real interest rates, economic policy uncertainty, pressure on the Turkish lira, high external financing needs and the current global and regional background.

Regarding the Turkish banking system, with data as of February 2023, where the effect of inflation remains clear, the total volume of credit in the system increased by 55.8% year-on-year, in line with the growth of previous months. The credit stock continues to be driven by the acceleration in consumer and credit card lending (+75.8% year-on-year) while corporate lending grew less (+49.8% year-on-year). Total deposits grew strongly (+70.4% year-on-year as of February 2023). Growth in Turkish lira deposits accelerated (+138.0%) while dollar deposits grew much more slowly (+23.1%), reducing dollarization to 29% at the end of February 2023 (vs. 49% a year earlier, driven by regulatory measures announced throughout the year to encourage the growth of Turkish lira deposits). As for the system's NPL ratio, it improved substantially to 1.93% as of February 2023 (109 basis points lower than the same month of 2022).

Unless expressly stated otherwise, all comments below on rates of changes for both activity and results, will be presented at constant exchange rates. For the conversion of these figures, the exchange rate as of March 31, 2023 is used. These rates, together with changes at current exchange rates, can be observed in the attached tables of the financial statements and relevant business indicators.

Activity

The most relevant aspects related to the area’s activity in the first quarter of 2023 were:

- Lending activity (performing loans under management) increased by 9.5% between January and March 2023, mainly driven by the growth in Turkish lira loans (+10.4%). This growth was mainly supported by the performance of credit cards and, to a lesser extent, consumer loans. Foreign currency loans (in U.S. dollars) increased by 6.6%, boosted by the increase in activity with customers focused on foreign trade (with natural hedging of exchange rate risk).

- In terms of asset quality, the NPL ratio decreased 77 basis points from that at the end of December 2022 to 4.3% and 239 basis points below the figure for the first quarter of 2022 due to the good performance in the wholesale portfolio, mainly in recoveries and repayments. Improvement in the NPL coverage ratio in the quarter to 99% as of March 31, 2023 due to the decrease in the non-performing loans balance.

- Customer deposits (72% of the area's total liabilities as of March 31, 2023) remained the main source of funding for the balance sheet and increased by 14.2%. Noteworthy is the positive performance of Turkish lira time deposits (+40.3%), which represent a 77.3% of total customer deposits in local currency, as well as demand deposits (+10.7%). Balances deposited in foreign currency (in U.S. dollars) continued their downward path and decreased by 8.1%, with transfers from foreign currency time deposits to Turkish lira time deposits observed under a foreign exchange protection scheme. Thus, as of March 31, 2023, Turkish lira deposits accounted for 62% of total customer deposits in the area. For its part, off-balance sheet funds grew by 12.9%.

Results

Turkey generated a net attributable profit of €277m in the first quarter of 2023, which compares very positively with the negative result of €76m in the same quarter of 2022, both periods reflecting the impact of the application of hyperinflation accounting. The accumulated result at the end of March 2023 reflects, in addition to the good business dynamics, the positive impact of the revaluation for tax purposes of the real estate and other depreciable assets of Garanti BBVA AS which has generated a credit in corporate income tax expense, due to the higher tax base of the assets, amounting to approximately €260m.

The most significant aspects of the year-on-year evolution in the area's income statement at the end of March 2023 are summarized below:

- Net interest income recorded a year-on-year growth of 63.0%, reflecting growth in Turkish lira loan, improved foreign currency spread, as well as lower funding costs and higher income from the securities portfolio.

- Net fees and commissions increased by 61.0%, favored by the performance in payment systems fees, money transfers, brokerage activity and guarantees and asset management.

- NTI showed an excellent performance (+64.0%) thanks to the increase in the results of the Global Markets unit as well as gains from foreign exchange positions, derivatives and securities.

- The other operating income and expenses line showed a balance of €-220m, which compares favorably with the negative balance of the previous year. This line includes among others, the loss in the value of the net monetary position due to the country's inflation rate, which stood below the loss recorded in the first quarter of 2022, partially offset by the income derived from inflation-linked bonds (CPI linkers), which were slightly lower in relation to those obtained in the first quarter of 2022. It is also worth highlighting the improved performance of Garanti BBVA's subsidiaries, also included in this line.

- Operating expenses increased by 112.7%, with growth both in personnel, as a result of salary improvements to compensate for the loss of purchasing power of the workforce, and in general expenses, mainly due to the institutional donation of approximately €32m made by the BBVA Group to help those affected by the earthquake that struck an area in the south of the country last February.

- Impairment on financial assets decreased by 20.3%, mainly due to strong recoveries in the wholesale segments and good dynamics of non-performing entries. For its part, the accumulated cost of risk at the end of March 2023 recorded a significant improvement to reach 0.52% from the 0.94% at the end of the previous year.

- The provisions and other results line closed March 2023 with a higher loss than in the same quarter of the previous year, mainly due to lower results related to real estate assets.