Results

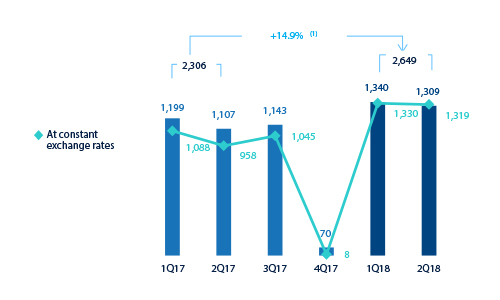

BBVA generated a net attributable profit of €2,649m in the first half of 2018, which represents a year-on-year increase of 14.9% (29.5% at constant exchange rates). Once more, it is important to highlight the good performance of recurring revenue, containment of operating expenses and lower loan-loss impairments and provisions, which offset the lower contribution from net trading income (NTI) compared to the same period the previous year.

Consolidated income statement: quarterly evolution (Million euros)

| IFRS 9 | IAS 39 | |||||

|---|---|---|---|---|---|---|

| 2018 | 2017 | |||||

| 2Q | 1Q | 4Q | 3Q | 2Q | 1Q | |

| Net interest income | 4,355 | 4,288 | 4,557 | 4,399 | 4,481 | 4,322 |

| Net fees and commissions | 1,256 | 1,236 | 1,215 | 1,249 | 1,233 | 1,223 |

| Net trading income | 297 | 410 | 552 | 347 | 378 | 691 |

| Dividend income | 72 | 12 | 86 | 35 | 169 | 43 |

| Share of profit or loss of entities accounted for using the equity method | 6 | 8 | 5 | 6 | (2) | (5) |

| Other operating income and expenses | (10) | 142 | (54) | 154 | 77 | 108 |

| Gross income | 5,977 | 6,096 | 6,362 | 6,189 | 6,336 | 6,383 |

| Operating expenses | (2,963) | (2,979) | (3,114) | (3,075) | (3,175) | (3,137) |

| Personnel expenses | (1,560) | (1,566) | (1,640) | (1,607) | (1,677) | (1,647) |

| Other administrative expenses | (1,105) | (1,106) | (1,143) | (1,123) | (1,139) | (1,136) |

| Depreciation | (299) | (307) | (331) | (344) | (359) | (354) |

| Operating income | 3,014 | 3,117 | 3,248 | 3,115 | 3,161 | 3,246 |

| Impairment on financial assets not measured at fair value through profit or loss | (788) | (823) | (1,885) | (976) | (997) | (945) |

| Provisions or reversal of provisions | (86) | (99) | (180) | (201) | (193) | (170) |

| Other gains (losses) | 67 | 41 | (267) | 44 | (3) | (66) |

| Profit/(loss) before tax | 2,207 | 2,237 | 916 | 1,982 | 1,969 | 2,065 |

| Income tax | (602) | (611) | (499) | (550) | (546) | (573) |

| Profit/(loss) for the year | 1,604 | 1,626 | 417 | 1,431 | 1,422 | 1,492 |

| Non-controlling interests | (295) | (286) | (347) | (288) | (315) | (293) |

| Net attributable profit | 1,309 | 1,340 | 70 | 1,143 | 1,107 | 1,199 |

| Net attributable profit excluding results from corporate operations | 1,309 | 1,340 | 70 | 1,143 | 1,107 | 1,199 |

| Earning per share (euros) (1) | 0.18 | 0.19 | (0.00) | 0.16 | 0.16 | 0.17 |

- (1) Adjusted by additional Tier 1 instrument remuneration.

Consolidated income statement (Million euros)

| IFRS 9 | IAS 39 | |||

|---|---|---|---|---|

| 1H 18 | ∆% | ∆% at constant exchange rates | 1H 17 | |

| Net interest income | 8,643 | (1.8) | 9.4 | 8,803 |

| Net fees and commissions | 2,492 | 1.5 | 11.3 | 2,456 |

| Net trading income | 708 | (33.8) | (30.4) | 1,069 |

| Dividend income | 84 | (60.6) | (59.7) | 212 |

| Share of profit or loss of entities accounted for using the equity method | 14 | n.s. | n.s. | (8) |

| Other operating income and expenses | 133 | (28.4) | (17.8) | 185 |

| Gross income | 12,074 | (5.1) | 4.8 | 12,718 |

| Operating expenses | (5,942) | (5.8) | 2.9 | (6,311) |

| Personnel expenses | (3,125) | (6.0) | 2.7 | (3,324) |

| Other administrative expenses | (2,211) | (2.8) | 6.8 | (2,275) |

| Depreciation | (606) | (14.9) | (8.4) | (712) |

| Operating income | 6,131 | (4.3) | 6.8 | 6,407 |

| Impairment on financial assets not measured at fair value through profit or loss | (1,611) | (17.0) | (9.0) | (1,941) |

| Provisions or reversal of provisions | (185) | (49.0) | (48.3) | (364) |

| Other gains (losses) | 108 | n.s. | n.s. | (69) |

| Profit/(loss) before tax | 4,443 | 10.2 | 25.5 | 4,033 |

| Income tax | (1,213) | 8.3 | 21.5 | (1,120) |

| Profit/(loss) for the year | 3,230 | 10.9 | 27.0 | 2,914 |

| Non-controlling interests | (581) | (4.3) | 17.0 | (607) |

| Net attributable profit | 2,649 | 14.9 | 29.5 | 2,306 |

| Net attributable profit excluding results from corporate operations | 2,649 | 14.9 | 29.5 | 2,306 |

| Earning per share (euros) (1) | 0.37 | 0.33 | ||

- (1) Adjusted by additional Tier 1 instrument remuneration.

Unless expressly indicated otherwise, to better understand the changes in the main headings of the Group's income statement, the year-on-year percentage changes given below refer to constant exchange rates.

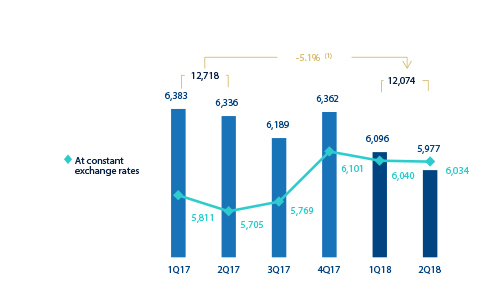

Gross income

Gross income in the first half of 2018 grew by 4.8% year-on-year, once more strongly supported by the positive performance of the more recurring items.

Gross income (Million euros)

(1) At constant exchange rates: 4.8%.

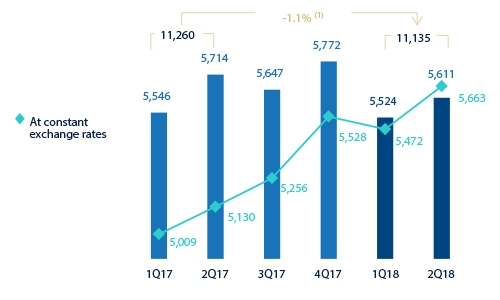

Net interest income grew by 9.4% year-on-year. There was a general increase in all business areas, mainly in the United States, Mexico, Turkey and South America. This positive trend can once again be explained by growth of activity in emerging economies and in the United States, and good management of customer spreads. During the quarter, net interest income grew by 3.5%.

Net interest income/ATAs (Percentage)

Cumulative net fees and commissions performed very well in all the Group's areas (up 11.3% year-on-year), driven by good diversification. The quarterly figure was also good (up 3.3% in the last three months).

As a result, more recurring revenues items (net interest income plus net fees and commissions) increased by 9.8% year-on-year (up 3.5% over the second quarter).

Net interest income plus fees and commissions (Million euros)

(1) At constant exchange rates: 9.8%.

NTI during the first half of 2018 moderated in comparison with the same period of 2017, when it was exceptionally high, largely due to the registration of the capital gains of €204m before tax from the sale on the market of 1.7% of China Citic Bank (CNCB) in the first quarter of 2017. There have also been lower sales of ALCO portfolios in Spain in the first half of 2018 compared to the same period of the previous year. By business areas, NTI had a good performance in Mexico and South America.

Other operating income and expenses totaled €133m; 17.8% less in year-on-year terms, mainly due to higher contribution to the Single Resolution Fund -SRF- (€124m in Spain, compared to €98m the same period of 2017), and lower insurance income from Mexico.

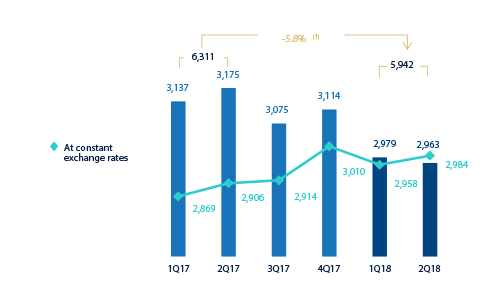

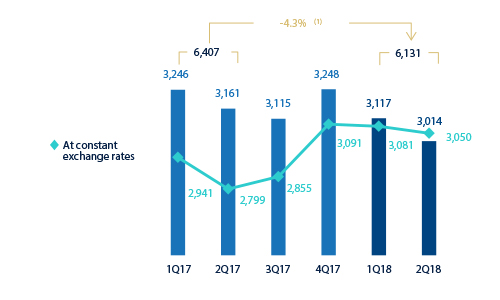

Operating income

Operating expenses for the first half of 2018 increased 2.9%, year-on-year, affected by the exchange rates (down 5.8% at current exchange rates). Cost discipline has been maintained in all the Group's areas through various efficiency plans. By business area the biggest reductions were in Spain and the Rest of Eurasia. In the other geographies, the growth of expenses was lower than the growth of gross income.

Operating expenses (Million euros)

(1) At constant exchange rates: 2.9%.

Breakdown of operating expenses and efficiency calculation (Million euros)

| 1H 18 | ∆% | 1H 17 | |

|---|---|---|---|

| Personnel expenses | 3,125 | (6.0) | 3,324 |

| Wages and salaries | 2,448 | (5.5) | 2,590 |

| Employee welfare expenses | 453 | (5.1) | 478 |

| Training expenses and other | 224 | (12.6) | 256 |

| Other administrative expenses | 2,211 | (2.8) | 2,275 |

| Property, fixtures and materials | 495 | (6.3) | 528 |

| IT | 558 | 12.0 | 499 |

| Communications | 120 | (19.4) | 149 |

| Advertising and publicity | 175 | (6.2) | 186 |

| Corporate expenses | 50 | (3.4) | 51 |

| Other expenses | 594 | (5.0) | 625 |

| Levies and taxes | 220 | (7.5) | 237 |

| Administration costs | 5,336 | (4.7) | 5,599 |

| Depreciation | 606 | (14.9) | 712 |

| Operating expenses | 5,942 | (5.8) | 6,311 |

| Gross income | 12,074 | (5.1) | 12,718 |

| Efficiency ratio (operating expenses/gross income; %) | 49.2 | 49.6 |

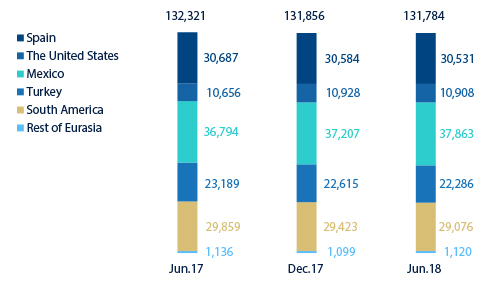

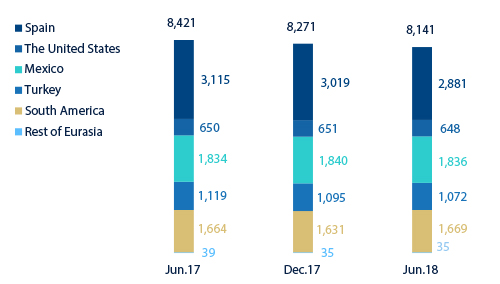

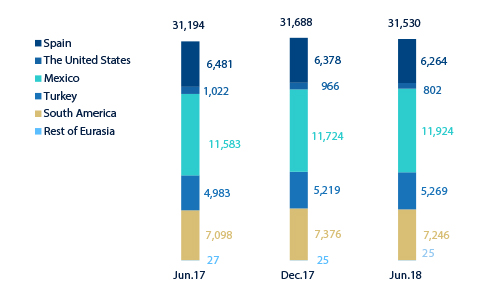

Number of employees

Number of branches

Number of ATMs

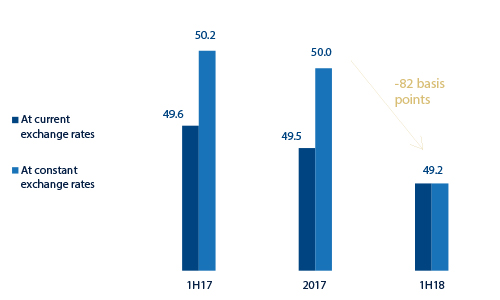

The efficiency ratio improved to 49.2% in the first half of 2018, compared to 49.6% in the same period the previous year. Operating income increased by 6.8% over the last twelve months.

Efficiency ratio (Percentage)

Operating Income (Million euros)

(1) At constant exchange rates: 6.8%.

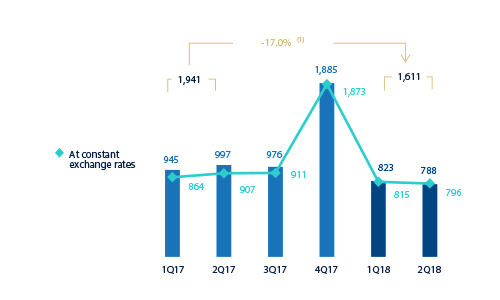

Provisions and other

Impairment losses on financial assets in the first half of the year were 9.0% below the figure for the same period in 2017. By business area, they continued to fall in Spain, due to lower loan-loss provisioning requirements for large customers. They also fell in the United States, due to the lower provisioning requirements in the portfolios affected by the 2017 hurricanes. They also fell in Mexico and, to a lesser extent, in South America. In contrast, they increased in Turkey, concentrated in wholesale customer portfolios.

Impairment on financial assests (net) (Million euros)

(1) At constant exchange rates: -9.0%.

Provisions or reversal of provisions (hereinafter, provisions) fell by 48.3% compared to the figure for the same period of 2017 (which included a charge of €177m for restructuring costs). The line other gains (losses) showed a positive balance rather than the negative of the first half of 2017, and incorporated capital gains from the sale of certain portfolios in Mexico, Turkey and Non Core Real Estate. The first half of the previous year presented a negative balance due to certain operations with an unfavorable effect from the Non Core Real Estate area.

Results

As a result of the above, the Group's net attributable profit for the first half of 2018 continued to be very positive (up 29.5% year-on-year at constant exchange rates, up 14.9% at current exchange rates).

By business area, Banking activity in Spain generated a profit of €793m, Non Core Real Estate a loss of only €36m, the United States contributed a profit of €387m, Mexico registered €1,208m, Turkey contributed a profit of €373m, South America €452m and the Rest of Eurasia €58m.

Net attributable profit (Million euros)

(1) At constant exchange rates: 29.5%.

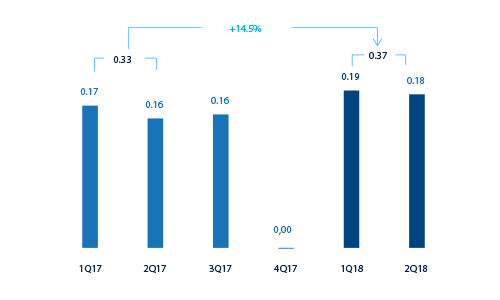

Earning per share (1) (Euros)

(1) Adjusted by additional Tier 1 instrument remuneration.

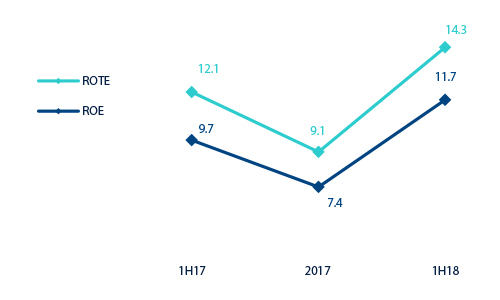

ROE and ROTE (1) (Percentage)

(1) The ROE and ROTE ratios include, in the denominator, the Group’s average shareholders’ funds and take into account the item called “Accumulated other comprehensive income”, which forms part of the equity. Excluding this item, the ROE would stand at 8.6% in the first half 2017, 6.4% in 2017 and 9.7% in the first half 2018; and the ROTE on 10.5%, 7.7% and 11.5%, respectively.

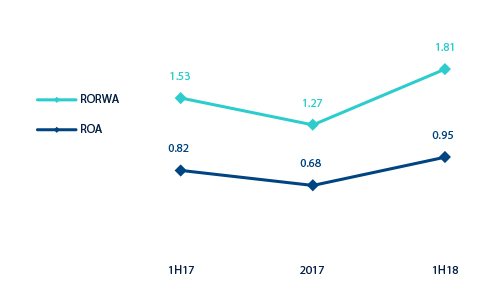

ROA and RORWA (Percentage)