Risk management

Credit risk

At the close of the first half of 2018 BBVA Group's risk metrics continued to perform well:

- Growth of credit risk i in the quarter (up 2.1% both, at current and constant exchange rates) in all areas, except Non Core Real Estate. Compared to the close of December 2017 the increase in credit risk stood at 0.3% at current exchange rates and 1.2% in constant terms.

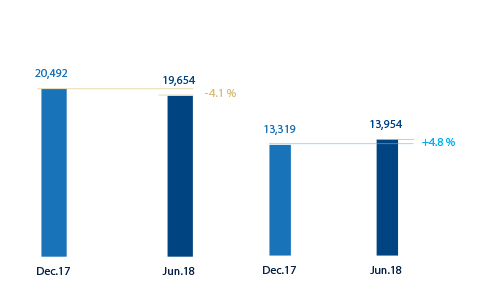

- The balance of non-performing loans increased slightly in the quarter (up 0.7% at current exchange rates and up 1.3% at constant exchange rates), although over the last six months they fell by 4.1% (down 2.9% in constant terms). Over the first six months of the year, Banking Activity in Spain, Non Core Real Estate and Mexico performed well. South America was negatively impacted by some retail portfolios and specific customers, and Turkey deteriorated to some extent, especially in the wholesale-customers segment. The balance of non-performing loans in the United States remained stable in the first half (up 0.3% at constant exchange rates).

- As a result, the Group's NPL ratio stood at 4.4% as of 30-June-2018, a reduction of six basis points with respect to March of 2018.

- Provisions decreased by 1.6% over the quarter (down 0.5% at constant exchange rates) and grew by 4.8% over the last six months (up 6.8% at constant exchange rates), so the NPL coverage ratio closed at 71%.

- Finally, the cumulative cost of risk through June 2018 was 0.82%, seven basis points lower than the figure for 2017.

Non-performing loans and provisions (Million euros)

Credit risk (1) (Million euros)

| 30-06-18(2) | 31-03-18(2) | 31-12-17(2) | |

|---|---|---|---|

| Credit risk | 451,587 | 442,446 | 450,045 |

| Non-performing loans | 19,654 | 19,516 | 20,492 |

| Provisions | 13,954 | 14,180 | 13,319 |

| NPL ratio (%) | 4.4 | 4.4 | 4.6 |

| NPL coverage ratio (%) | 71 | 73 | 65 |

- (1) IInclude gross loans and advances to customers plus guarantees given.

- (2) Figures without considering the classification of non-current assets held for sale.

Non-performing loans evolution (Million euros)

| 2Q18 (1-2) | 1Q18 (2) | 4Q17 (2) | 3Q17 | 2Q17 | |

|---|---|---|---|---|---|

| Beginning balance | 19,516 | 20,492 | 20,932 | 22,422 | 23,236 |

| Additions | 2,596 | 2,065 | 3,757 | 2,268 | 2,525 |

| Recoveries | (1,655) | (1,748) | (2,142) | (2,001) | (1,930) |

| Net variation | 942 | 317 | 1,616 | 267 | 595 |

| Write-offs | (826) | (913) | (1,980) | (1,575) | (1,070) |

| Exchange rate differences and other | 23 | (380) | (75) | (181) | (340) |

| Period-end balance | 19,654 | 19,516 | 20,492 | 20,932 | 22,422 |

| Memorandum item: | |||||

| Non-performing loans | 18,627 | 18,569 | 19,753 | 20,222 | 21,730 |

| Non performing guarantees given | 1,027 | 947 | 739 | 710 | 691 |

- (1) Preliminary data.

- (2) Figures without considering the reclassification of non-current assets held for sale.

Structural risks

Liquidity and funding

Management of liquidity and funding in BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of financing, always in compliance with current regulatory requirements.

A core principle n BBVA's management of the Group's liquidity and funding is the financial independence of its banking subsidiaries abroad. This principle prevents the propagation of a liquidity crisis among the Group's different areas and ensures that the cost of liquidity is correctly reflected in the price formation process.

The financial soundness of the Group's banks continues to be based on the funding of lending activity, fundamentally through the use of stable customer funds. During the first half of 2018, liquidity conditions remained comfortable across BBVA Group's global footprint:

- In the Eurozone, the liquidity situation is still comfortable and the credit gap stable.

- In the United States, the liquidity situation is adequate. The credit gap increased over the first six months of the year due to the cost-containment strategy for deposits, in a context of competition in prices and rising rates.

- In Mexico, the liquidity position is sound, despite the uncertainty derived from the electoral process. The credit gap has widened year-to-date due to deposits growing less than lending.

- The liquidity situation in Turkey is comfortable and commercial dynamics are good. There was a reduction in the credit gap as a result of deposits growing faster than lending.

- In South America, the liquidity situation remains comfortable in all geographies. There has not been any material change in the liquidity situation of Argentina, despite the volatility of the markets.

On the funding side, the long-term wholesale funding markets in the geographic areas where the Group operates continued to be stable. The performance of short-term funding remained positive, in a highly liquid environment.

During the first six months of 2018, the companies that form part of BBVA Group carried out the following operations:

- BBVA S.A. completed an issuance of senior non-preferred debt for €1.5 billion, with a floating coupon at 3-month Euribor plus 60 basis points and a maturity of five years. It also carried out the largest issuance made by a financial institution in the Eurozone of the so-called “green bonds" (€1 billion). It was a 7-year senior non-preferred debt issuance, which has made BBVA the first Spanish bank to carry out this type of issuance. The high demand allowed the price to be lowered to mid-swap plus 80 basis points. Additionally, it closed a private issuance of Tier 2 subordinated debt for US$300m, with a maturity of 15 years, with a coupon of 5.25%.

- In the United States, BBVA Compass issued a senior debt bond for US$1.15 billion in two tranches, both at three years: US$700m at a fixed rate with a reoffer yield of 3.605%, and US$450m at a floating rate of 3-month Libor plus 73 basis points.

- In Mexico, BBVA Bancomer completed an international issuance of subordinated Tier 2 debt of US$1 billion. The instrument was issued at a price equivalent to Treasury bonds plus 265 basis points at a maturity of 15 years, with a ten-year call (BBVA Bancomer 15NC10).

- In Turkey, Garanti issued the first private bond in emerging markets for US$75m over six years, to support women's entrepreneurship.

- In South America, BBVA Chile issued senior debt on the local market for an equivalent of €288m, in a variety of issuances with maturities ranging from four to six years. Also in Chile, Forum issued an amount equivalent to €108m. And BBVA Peru issued a three-year senior debt in the local market for an aggregate amount of €53m.

The liquidity coverage ratio (LCR) in BBVA Group remained comfortably above 100% in the first half of 2018, without including any transfers between subsidiaries; in other words, no kind of excess liquidity levels in the subsidiaries abroad are considered in the calculation of the consolidated ratio. As of June 30, 2018, the LCR stood at 127%. Although this requirement is only established at Group level, the minimum level is easily exceeded in all the subsidiaries (Eurozone, 153%; Mexico, 136%; Turkey, 133%; and the United States, 142%).

Foreign exchange

Foreign-exchange risk management of BBVA’s long-term investments, basically stemming from its franchises abroad, aims to preserve the Group's capital adequacy ratios and ensure the stability of its income statement.

The first half of 2018 was notable for the depreciation against the euro of the Turkish lira (down 14.8%) and the Argentine peso (down 30.3%). In contrast, the Mexican peso (up 3.4%) and the U.S. dollar (up 2.9%) appreciated over the first six months of the year. BBVA has maintained its policy of actively hedging its main investments in emerging countries, covering on average between 30% and 50% of the earnings for the year and around 70% of the excess of CET1 capital ratio (which is not naturally covered by the ratio itself). In accordance with this policy, the sensitivity of the CET1 ratio to a depreciation of 10% of the main emerging currencies (Mexican peso or Turkish lira) against the euro remains at around a negative two basis points for each of these currencies. In the case of the dollar, the sensitivity is approximately a positive ten basis points to a depreciation of 10% of the dollar against the euro, as a result of RWAs generated outside the United States. Given the geopolitical context, the coverage level of the expected earnings for 2018 has been maintained at around 70% for Mexico and 50% for Turkey.

Interest rates

The aim of managing interest-rate risk is to maintain a sustained growth of net interest income in the short and medium-term, irrespective of interest-rate fluctuations, while controlling the impact on capital through the valuation of the portfolio of financial assets at fair value with changes reflected in other accumulated comprehensive income.

The Group's banks have fixed-income portfolios to manage their balance-sheet structure. In the first half of 2018, the results of this management were satisfactory, with limited risk strategies in all the Group's banks. Their capacity of resilience to market events has allowed them to face the cases of Italy and Turkey without any relevant impact.

The uncertainty regarding the formation of the government in Italy in May generated tensions in the peripheral debt markets, with the consequent effect on the valuation of sovereign portfolios. As a result of the limited risk management of these positions and subsequent market performance, the effect of this event on the capital ratio has been limited to around a negative 2.9 basis points over the quarter.

In Turkey, the presidential and parliamentary elections, together with a higher than expected inflation, generated some volatility in the markets, leading the Turkish Central Bank (CBRT) to raise interest rates to contain the depreciation of the lira. Risk management, together with a portfolio mix with a high proportion of inflation-linked bonds, have contained the impact on the capital ratio to around a negative 1.9 basis points over the quarter.

Finally, it is worth noting the following monetary policies pursued by the different central banks in the main geographical areas where BBVA operates:

- No relevant changes in the Eurozone, where interest rates remain at 0% and the deposit facility rate at -0.40%.

- In the United States the upward trend in interest rates continues. The increases of 25 basis points each in March and June left the rate at 2.0%.

- In Mexico, Banxico made two interest rate hikes in 2018, leaving the monetary policy level at 7.75%.

- In Turkey, following on from the rises in 2017, there were three further increases in the second quarter of 2018, of a total of five percentage points. As a result, the average funding rate of the CBRT now stands at 17.75%.

- In South America, the monetary authorities continued their expansive policies, lowering rates in Peru (by 50 basis points) and Colombia (by 50 basis points). However, in Argentina, the Central Bank raised rates to curb the volatility of the exchange rate, increasing its reference rate to 40%.

Economic capital

Consumption of economic risk capital (ERC) at the close of May 2018, in consolidated terms, was €32,758m, equivalent to a decline over the last three months of 2.0% (down 0.1% at constant exchange rates) and a decrease of 4.8% year-to-date (down 2.6% at constant exchange rates). The reduction was mainly observed in equity, trading and fixed-income spread risk, and was partially offset by the increase in credit risk due to higher activity levels.

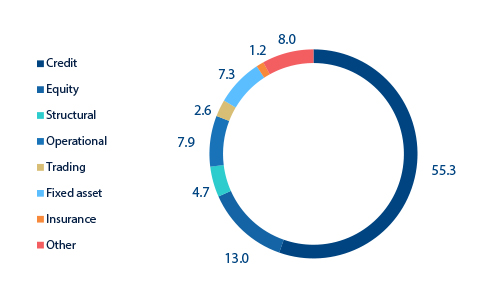

Consolidated economic risk capital breakdown

(Percentage as of May 2018)