The Group’s net attributable profit for the quarter is €20m, while the cumulative figure to December stands at €1,676m. Excluding the charge for the impairment of assets related to the real-estate sector in Spain and the badwill generated by the Unnim operation, the adjusted net attributable profit amounts to €1,061m over the quarter, with a cumulative figure of €4,406m. To sum up, the BBVA Group continues to generate sound earnings despite the difficult environment.

By business areas, Spain posted a €1,267m loss. Excluding the charge for the impairment of real estate assets, the area generated adjusted earnings of €1,211m. Eurasia contributed €950m, Mexico €1,821m, South America €1,347m and the United States €475m.

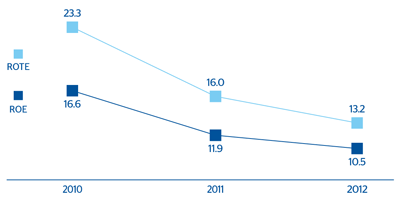

Lastly, earnings per share (EPS) from January to December 2012 stand at €0.32 (€0.82 in terms of adjusted EPS), return on total average assets (ROA) is 0.37% (0.81% adjusted), return on equity (ROE) totals 4.0% (10.5% adjusted) and return on tangible equity excluding goodwill (ROTE) amounts 5.0% (13.2% adjusted).