As explained in section 2.3 of this Document, BBVA Group has a General Risk Management and Control model that is adapted to its business model, organization and the geographical areas in which it operates.

This Model is applied comprehensively in the Group and is made up of the basic elements set out below:

The Group promotes the development of a risk culture that ensures the consistent application of the Risk Management and Control Model within the Group and guarantees that the risk function is understood and permeates throughout all the levels of the organization.

The risk governance model in BBVA is characterized by the strong involvement of its corporate bodies, both in establishing the risk strategy and in the continuous monitoring and supervising of its implementation.

Thus, as explained below, it is the corporate bodies that approve the risk strategy and the corporate policies for the different types of risks. The risk function is responsible within the scope of its management for implementing and developing the risk strategy, being answerable for it to the corporate bodies.

The responsibility for the day-to-day management of risks corresponds to the businesses, which engage in their business following the policies, rules, procedures, infrastructures and controls that are based on the framework set by the company bodies and defined by the risk function.

To carry out this work adequately, the risk function in the BBVA Group has been set up as a single, global function that is independent of the commercial areas.

The Board of Directors (hereinafter “the Board”) approves the risk strategy and supervises the internal control and management systems. Specifically, in relation to the risk strategy, the Board approves the Group’s Risk Appetite statement, the core metrics and the main metrics by type of risk, as well as the General Risk Management and Control Model.

The Board of Directors is also responsible for approving and monitoring the strategic and business plan, the annual budgets and management goals, as well as the investment and funding policy, in a consistent way and in line with the approved Risk Appetite Framework. For this reason, the processes for defining the Risk Appetite Framework proposals and strategic and budgetary planning at Group level are coordinated by the executive area for submission to the Board.

To ensure the integration of the Risk Appetite Framework into management, on the basis established by the Board of Directors, the Executive Committee (EC) approves the metrics by type of risk in relation to concentration, profitability and reputational and the Group’s basic structure of limits at geographical area, risk type, asset type and portfolio level. This Committee also approves specific corporate policies for each type of risk.

Lastly, the Board of Directors comprises a committee specializing in risks, the Risks Committee (RC), that assists the Board and the Executive Committee in determining the Group’s risk strategy and the risk limits and policies, respectively, analyzing and assessing beforehand the proposals submitted to those bodies. In 2016, the Risks Committee held 38 meetings.

The amendment of the Group’s risk strategy and of its elements is the exclusive power of the BBVA Board of Directors, while the Executive Committee is responsible for amending the metrics by type of risk within its scope of decision and the Group’s basic structure of limits, when applicable. In both cases, the amendments follow the same decision-making process described above, so the proposals for amendment are submitted by the executive area (CRO) and later analyzed, first by the Risks Committee, for later submission to the Board of Directors or to the Executive Committee, as appropriate.

Moreover, the Risks Committee, the Executive Committee and the Board itself conduct proper monitoring of the risk strategy implementation and of the Group’s risk profile. The risks function regularly reports on the development of the Group’s Risk Appetite Framework metrics to the Board and to the Executive Committee, after their analysis by the Risks Committee, whose role in this monitoring and control work is particularly relevant. In addition to ongoing supervision and control which performs the risk function and reports to the governing bodies, in the event of deviation from the maximum appetite levels (or maximum capacity) set for the core metrics or by type of risk, or in the event of an overlimit in the basic structure, as approved by the governing bodies, the Risks Committee is informed of the situation, following analysis by the executive areas in the relevant top-level committees. Following the Risks Committee report, the situation is reported to the governing bodies that approved the exceeded metric. Whatever the case, reports will be given on the pertinent corrective measures, as appropriate, and which must be agreed by the governing bodies and, in the executive sphere, by the corresponding area.

The head of the risk function in the executive line, the Corporate Risk Officer (CRO) carries out his work with the independence, authority, rank, experience, knowledge and resources required. He is appointed by the Bank’s Board of Directors, as a member of its senior management, and has direct access to its corporate bodies (the Board of Directors, the Executive Committee and the Risks Committee), to which he reports regularly on the risk situation in the Group.

To perform his functions better, the CRO is supported by a structure made up of crosscutting risk units in the corporate area and specific risk units in the Group’s geographical and/or business areas. Each of these units, within their field of competence, carries out risk management and control functions and ensures the implementation of the corporate policies and rules approved at the Group level in a consistent manner, adapting them if necessary to the local requirements and reporting to the local governing bodies.

The Risk Managers of these geographical and/or business areas answer to both the Group Risk Director and the head of the geographical and/or business area. This system of co-dependence aims to ensure the interdependence of the local risk function from the operational functions, and allows them to be aligned with the Group’s corporate policies and objectives with respect to risks.

As mentioned above, the risk function comprises the corporate area risk units, which carry out cross-cutting functions, and the risk units of the geographical and/or business areas.

The corporate area risk units develop and submit to the Corporate Risk Officer (CRO) the proposal for the Group’s Risk Appetite Framework, the corporate policies, rules, procedures and global infrastructures within the framework of action approved by the corporate bodies; they ensure their correct application and report directly or through the CRO to the Bank’s corporate bodies. Among their functions are:

Management of the different types of risks at Group level, in accordance with the strategy defined by the corporate bodies.

Planning of risks in line with the Risk Appetite Framework principles defined by the Group.

Monitoring and control of the Group’s risk profile in relation to the Risk Appetite Framework approved by the Bank’s corporate bodies, providing precise and reliable information with the frequency and in the format required.

Carrying out prospective analyses that can evaluate compliance with the Risk Appetite Framework in stress scenarios and analyze the mechanisms for mitigating the effect.

Management of the technological and methodological developments required for development of the Model in the Group.

Articulating Group’s Internal Risk Control model and defining the methodology, corporate criteria and procedures to identify and prioritize the risk inherent to each unit’s activities and processes.

Validation of the models used and the results obtained by them to verify whether they are appropriate to the different uses to which they are applied.

The risk units in the business units develop and submit to the Chief Risk Officer of the geographical and/or business area the Risk Appetite Framework proposal applicable in each geographical and/or business area, independently and always within the Group’s strategy/Risk Appetite Framework.

Moreover, they ensure that the approved corporate policies and rules are applied consistently at Group level, adapting them where appropriate to local requirements; they are provided with the adequate infrastructures for the management and control of their risks, within the global risk infrastructure framework defined by the corporate areas, and report, where appropriate, to the corporate bodies and senior management.

Thus the local risk units work with the corporate risk units with the aim of adapting to the risk strategy at Group level and pooling all the information necessary to monitor changes in risks.

The risk function’s decision-making process is based on a committee structure. The Global Risk Management Committee (GRMC) is the main committee in the risk function. It proposes, checks, and approves, where appropriate, items such as the internal regulatory framework for risks, the procedures and infrastructures needed to identify, evaluate, measure and manage the risks faced by the Group in carrying out its business, approves the risk limits by portfolio or counterparty, and the admission of the operations with the most relevant risks.

The members of this Committee are the CRO and the heads of the risk units of the corporate area and the most representative geographical and/or business areas.

The GRMC operates through various support committees, including the following:

Global Technical Operations Committee: Its aim is to take decisions related to wholesale credit risk admission from certain customer segments.

Information, Monitoring & Reporting Committee: Guarantees the existence and proper development of the aspects relating to information management, risk tracking and reporting with a comprehensive and cross-cutting approach.

Asset Allocation Committee: An executive body for analysis and decision-making on all those issues related to credit risks that are linked to the processes designed to obtain a balance between risk and profitability in accordance with the Group’s Risk Appetite Framework.

Technology and Methodologies Committee: Its aim is to determine the need for new models and infrastructures, and to guarantee decision-making related to the development and implementation of the tools required to manage all the risks to which the Group is exposed.

Corporate Technological Risks and Operational Control Committee: The aim is to approve the Technological Risk Management and Operational Control Frameworks, in accordance with the General Risk Model, and monitor the metrics, risk profiles and operational loss events.

Global Markets Risk Unit Committee: The aim is to formalize, supervise and communicate the monitoring of trading risk in all the Global Markets business units.

Corporate Operational Risk Admission and Outsourcing Committee: its purpose entails the identification, evaluation and analysis of the operational risks of new businesses, new products and services and outsourcing initiatives.

Each geographical and/or business area has its own risk management committee (or committees), with objectives and content similar to those of the corporate area, which develop their functions consistently and in line with the corporate policies and regulations on risks.

Under this organizational scheme, the risks function ensures the integration and application throughout the Group of the risk strategy, the regulatory framework, the infrastructures and standardized risk and controls. It also benefits from the knowledge and proximity to customers in each geographical and/or business area, and conveys the corporate risk culture to the Group’s different levels. Moreover, this organization enables the risks function to conduct and report to the corporate bodies integrated monitoring and control of the entire Group’s risks.

The Group has a specific Internal Risk Control unit. Its main function is to ensure there is a sufficient internal regulatory framework, a process and measures defined for each type of risk identified in the Group (and for those other types of risk for which the Group may be potentially affected). It controls their application and operation, as well as ensuring the integration of the risk strategy into the Group’s management.

The Internal Risk Control unit checks the functional operation of the units that develop the risk models, manage processes and execute controls. Its scope of action is global, from the geographical point of view and the type of risks.

The Group’s Internal Risk Control Director is responsible for the function; he reports its activities and informs the CRO and the Board’s Risks Committee of its work plans, as well as assisting the Board on such matters as it requires.

For this purpose, Internal Risk Control includes a Technical Secretary to provide the necessary technical support for the Committee to improve its performance.

The unit has a structure of teams at both corporate level and in the most relevant geographical areas in which the Group operates.

As in the case of the Corporate Area, local units are independent of the business areas that execute the processes, and of the units that execute the controls, and report functionally to the Internal Risk Control unit. This unit’s lines of action are established at Group level, and it is responsible for adapting and executing them locally, as well as for reporting the most relevant aspects.

In addition, the Group has an Internal Validation unit, which checks the functional development of the units that develop the risk models and of those that use them in management. Its functions include revision and independent validation at internal level of the models used for the control and management of risks in the Group.

The Group’s Risk Appetite Framework as approved by the Board of Directors determines the risks and their level that the Group is prepared to assume to achieve its business objectives, taking into account the organic business performance. These are expressed in terms of solvency, profitability, liquidity and funding, or other metrics, which are reviewed periodically or if there are any substantial changes in the entity’s business or relevant corporate operations. The determination of the Risk Appetite Framework has the following objectives:

Make explicit the Group’s risk strategy and the maximum levels of risk that the Group is prepared to assume, both at Group level and at geographical and/or business level.

Establish guidelines for action and a management framework for the medium-long term that prevents actions (both at Group and geographical and/or business level) that may compromise the Group’s future viability.

Establish a framework for relating with the geographical and/or business areas, that preserves their decision-making autonomy while ensuring their consistent performance and preventing divergent behavior.

Establish a common language across the whole organization and develop a risk culture geared toward compliance with it.

Alignment with the new regulatory requirements, making communication with regulators, investors and other stakeholders easier, thanks to an integrated and stable risk management framework.

The Risk Appetite Framework is expressed through the following elements:

Risk Appetite Statement: it includes the general principles of the Group’s risk strategy and the target risk profile. The Group’s Risk Appetite Statement is:

BBVA Group’s risk policy is designed to achieve a moderate risk profile for the Bank through: prudent management and a universal responsible banking business model aimed at generating value, return adjusted to principles and recurring earnings, diversified by geographical area, class of assets, portfolios and customers, with a presence in emerging and developed countries, keeping a medium/low risk profile in each country and supported by long-term relationships with customers.

Core metrics: based on the Risk Appetite Statement, statements are made that specify the general principles of risk management in terms of solvency, liquidity, funding, recurring revenue and profitability.

Moreover, the core metrics reflect, in quantitative terms, the principles and the target risk profile set out in the Risk Appetite statement and are aligned with the Group’s strategy. Each core metric has three thresholds (the traffic-light approach), ranging from usual management of the businesses to higher levels of impairment: Management reference, maximum appetite and maximum capacity. BBVA Group’s core metrics are those specified in the following chart:

Metrics by type of risk: based on the core metrics for each type of risk, statements are made that set out the general management principles for the risk and a number of metrics are calibrated, whose observance enables compliance with the core metrics and the Group’s statement. The metrics by type of risk define the strategic positioning by type of risk and have a maximum appetite level.

Basic limits structure (core limits): they shape the Risk Appetite Framework at geographical area, risk type, asset type and portfolio level, ensuring that management is within the metrics by type of risk.

In addition to this Framework, there is a level of management limits that is defined and managed by the risks area when developing the core limits, with the aim of ensuring that proactive management of risks by risk subcategory within each type or by subportfolio respects these core limits, and in general the established Risk Appetite Framework.

The basic scheme of BBVA’s Risk Appetite Framework is outlined in the following chart:

The corporate risks area works together with the various geographical and/or business areas to define their Risk Appetite Framework, so that it is coordinated with, and integrated into the Group’s Risk Appetite Framework, making sure that its profile is in line with the one defined.

The Risk Appetite Framework defined by BBVA expresses the levels and types of risk that the Bank is prepared to assume to carry out its strategic plan without significant deviations, even in situations of tension. The Risk Appetite Framework is integrated into management and determines the basic lines of the Group’s activity, as it establishes the framework within which the budgeting process is developed.

During 2016, Risk Appetite metrics trended consistently with the profile established according to the operating limits set or marked by the different areas in the organization.

The transfer of the Risk Appetite Framework to ordinary management is underpinned by three basic aspects:

The corporate GRM area is responsible for defining and developing corporate policies, specific regulations, procedures and schemes for delegation according to which the risk decisions have to be adopted within the Group.

This process aims for the following objectives:

The approval of corporate policies for all kinds of risks corresponds to the Bank’s corporate bodies, while the corporate risk area approves the rest of the regulations.

The risk units of the geographical and/or business areas comply with this body of regulations and, where necessary, adapt it to local requirements, in order to have a decision-making process that is appropriate to the local level and in line with the Group’s policies.

If such adaptation is necessary, the local risks area must inform the corporate GRM area, which has to ensure consistency in the body of regulations at Group level. Where appropriate, it must thus give its prior approval to the modifications proposed by the local risk areas.

Risk planning ensures integration in the Risk Appetite Framework through a cascade process of establishing limits and return adjusted to the target risk, where the function of the corporate area and of the geographical and/or business area risk units is to guarantee that this process is aligned with the Group’s Risk Appetite Framework in terms of solvency, profitability, liquidity and funding.

This process is equipped with tools for aligning and tracking the Risk Appetite Framework defined at the aggregated level by business areas, legal entities, risk types, concentrations and any other level considered necessary.

The process of risk planning is present within the rest of the Group’s planning framework to ensure the coherence of all the other processes.

All risks must be managed in an integrated fashion during their life cycle, based on differentiated treatment according to their type.

The risk management cycle is made up of 5 elements:

Evaluation, monitoring and reporting is a cross-cutting element that has to ensure that the Model has a dynamic and anticipatory vision, making possible compliance with the Risk Appetite Framework approved by the corporate bodies, even under unfavorable scenarios. This process is carried out with the following aims:

To carry out this process, which is integrated into the activity of the corporate and geographical and/or business risk units, the following phases must be developed:

Infrastructure constitutes the element that must ensure that the Group has the human and technological resources required for effective management and supervision of risks, performance of the functions included in the Group’s risk model, and achievement of its objectives.

With respect to human resources, the Group’s risk function has an adequate workforce in terms of number, skills, knowledge and experience.

With respect to technology, the Group ensures the integrity of the management information systems and the provision of the infrastructure required to support risk management, including the tools appropriate to the needs derived from the different types of risks in their admission, management, valuation and monitoring.

The principles according to which the Group’s risk technology is governed are:

Through the Risk Analytics function, the Group has a corporate framework that develops measurement techniques and models, covering all the types of risk and the different purposes, and involves a uniform language for all the activities and geographical/business areas.

The execution is decentralized, allowing the Group’s global scope to be used to the full. The idea is to develop the existing risk models continuously and generate others that cover the new range of businesses that are being deployed, with the aim of strengthening anticipation and proactiveness that characterize the risk function in the Group.

Equally, the risk units of the geographical and/or business areas must ensure they have sufficient means from the point of view of resources, structures and tools to develop risk management in accordance with the corporate model.

BBVA considers risk culture as an essential element for the consolidation and integration of the other components of the Model.

The culture transfers to all the levels of the organization the implications involved in the Group’s activities and businesses from the perspective of risk. The risk culture is based on a number of levers, including:

Communication: Promotes the spread of the Model, and particularly the principles that should govern risk management in the Group consistently and comprehensively across the organization, through the most appropriate channels.

GRM has a variety of channels for communication that facilitate the transfer of information and knowledge between the different teams in the function and the Group, adapting the frequency, formats and recipients according to the objective set, making it easier to establish the basic principles of the risk function. Thus the culture of risks and the prudent management model begin with the corporate bodies and the Group’s management and are transmitted across the whole organization.

Training: The main aim is to spread and consolidate the prudent risk management model across the organization, ensuring standards in skills and knowledge in those involved in the risk management processes.

A well-defined and implemented system of training ensures the continuous improvement of the skills and knowledge of the Group’s professionals, and in particular those in the GRM area. It is organized into four vectors that aim to develop each of the requirements of the GRM group by providing in-depth knowledge and skills in various subjects, such as: finance and risks, tools and technology, management and expertise, and languages.

Motivation: An area where the aim is for the incentives of the teams in the risk function to support the risk management strategy, values and culture of the function at all levels. It includes remuneration and all the other elements associated with motivation, such as the working environment, etc. that contribute to achieving the Model’s objectives.

Credit risk arises from the probability that one party to a financial instrument will fail to meet its contractual obligations for reasons of insolvency or inability to pay and cause a financial loss for the other party.

It is the most important risk for the Group and includes counterparty credit risk, issuer risk, settlement risk and country risk management.

For managing risks and capital, BBVA quantifies its credit risk using two main metrics: expected loss (“EL”) and economic capital (“EC”). The expected loss reflects the average value of losses and is considered a business cost; economic capital is the amount of capital necessary to cover unexpected losses that arise if actual losses are higher than expected losses, which could even endanger the continuity of the entity’s activity.

These risk metrics are combined with information on profitability in value-based management, thus building the profitability-risk binomial into decision-making, from the definition of business strategy to approval of individual loans, price setting, assessment of non-performing portfolios, incentives to areas in the Group, etc.

There are three essential parameters in the process of calculating the EL and EC measurements: the probability of default (“PD”), loss given default (“LGD”) and exposure at default (“EAD”), mainly based on the estimate of credit conversion factors (“CCF”). They are generally estimated using the available historical information and are assigned to operations and customers according to their particular characteristics.

In this context, the credit rating tools (ratings and scorings) assess the risk in each customer/transaction according to their credit quality by assigning them a score, which is used to assign risk metrics together with other additional information: transaction seasoning, loan to value ratio, customer segment, etc.

Section 3.2.5.1 of this document details the definitions, methods and data used by the Group to determine the capital requirements for estimating and validating the parameters of probability of default (PD), loss given default (LGD) and exposure at default (EAD).

The credit risk for BBVA Group’s global portfolio is measured through a Portfolio Model that includes the effects of concentration and diversification. The aim is to study the loan portfolio as a whole, and to analyze and capture the effect of the interrelations between the different portfolios.

In addition to enabling a more comprehensive calculation of economic capital needs, this model is a key tool for credit risk management, as it establishes loan limits based on the contribution of each unit to the total risk in a global, diversified setting.

The Portfolio Model considers that risk comes from various sources (it is a multi-factor model). This feature implies that economic capital is sensitive to geographic diversification, a crucial aspect in a global entity like BBVA.

These effects have been made more apparent against the current backdrop in which, despite the stress undergone by some economies, BBVA Group’s presence in different geographical areas, subject to different shocks and different moments in the cycle, have contributed to bolster the bank’s solvency. In addition, the tool is sensitive to concentration in certain credit exposures of the entity’s large clients.

Lastly, the results of the Portfolio Model are integrated into management within the framework of the Asset Allocation project, where business concentrations are analyzed in order to establish the entity’s risk appetite profile.

A financial asset is considered impaired for accounting purposes when there is objective evidence that events have occurred which have a negative impact on the future cash flows that were estimated at the time the transaction was arranged.

Objective evidence of impairment of a financial asset or group of financial assets includes observable data about the following aspects:

Significant financial difficulties on the part of the obligor.

Continued delays in payment of interest or principal.

Refinancing or restructuring of debt caused by the financial difficulties of the counterparty.

Bankruptcy and other types of reorganization/winding-up are considered likely.

Disappearance of a financial asset from an active market due to financial difficulties.

Observable data that indicate a reduction in future flows from initial recognition such as adverse changes in the status of counterparty payments (payment delays, drawing credit on cards up to the limit, etc.).

Domestic or local economic conditions are correlated with default in financial assets (increase in the unemployment rate, fall in property prices, etc.).

The classification of financial assets impaired for reasons of customer default is done in an objective way and on an individual basis according to the following criterion:

The total amount of debt instruments, irrespective of the holder and the guarantee involved, with an amount past due for more than ninety days for principal, interest or contractually agreed expenses, unless they should be classified directly as write-offs.

Contingent liabilities in which the guaranteed party has incurred default.

Debt instruments classified as impaired through the accumulation of balances in default for an amount exceeding 20% of the overall amounts pending collection will also be included.

Financial assets impaired for reasons other than customer default, which are those for which there is a reasonable doubt about their total reimbursement under the terms and conditions agreed by contract, are classified individually for all risks whose individual amount is significant.

Write-off risks are those debt instruments whose recovery is deemed remote and should be classified as final write-offs.

The impairment on financial assets is calculated by type of instrument and other circumstances that may affect them, taking into account the guarantees received by the holders of the instruments to assure (fully or partially) the performance of the transactions. BBVA Group recognizes impairment charges directly against the impaired asset when the likelihood of recovery is deemed remote, and uses an offsetting or allowance account when it records provisions made to cover estimated losses on their full value.

The amount of the deterioration of debt instruments valued at their amortized cost is determined differently according to whether the impairment losses are calculated individually or collectively. First, it is determined whether there is objective evidence of individual impairment of individually significant assets, and as a group for financial assets that are not individually significant. If there is no objective evidence of deterioration in a financial asset evaluated individually, the asset will be included in a group of financial assets with similar credit risk characteristics and its deterioration will be evaluated as a group.

The amount of impairment losses recorded by these instruments coincides with the positive difference between their respective book values and the present values of future cash flows. These cash flows are discounted at the instrument’s original effective interest rate. If a financial instrument has a variable interest rate, the discount rate for measuring any impairment loss is the current effective rate determined under the contract.

As an exception to the rule described above, the market value of quoted debt instruments is deemed to be a fair estimate of the present value of their future cash flows.

The estimation of future cash flows for debt instruments considers the following:

All sums expected to be recovered during the remaining life of the instrument, including those that may arise from collateral and credit enhancements, if any (once deduction has been made of the costs required for their foreclosure and subsequent sale). Impairment losses include an estimate of the possibility of collecting of the accrued, past-due and uncollected interest.

The various types of risk to which each instrument is subject.

The circumstances under which the collections will foreseeably take place

For group analysis of impairment, the financial assets are grouped by similar risk characteristics indicating the debtor’s ability to make its payments under the contractual terms. Based on this analysis the impairment of loans not individually significant are estimated, distinguishing between those that present objective evidence of impairment from those that do not present objective evidence of impairment, as well as the impairment of significant loans for which the Group has determined that there is no objective evidence of impairment.

With respect to financial assets that do not show any objective evidence of impairment, the Group applies statistical procedures using its historical experience and other specific information to estimate incurred losses incurred by the Group resulting from events that have occurred as of the date of preparation of the consolidated financial statements, but that are not known and are only identified individually after the presentation of the statements. This calculation is a temporary step until the losses are identified specifically at individual level, when these financial instruments will be separated from the group of financial assets without objective evidence of impairment.

Quantification of losses incurred takes into account three basic factors: exposure at default, probability of default and loss given default.

Exposure at default (EAD) is the amount of risk exposure at the date of default by the counterparty.

Probability of default (PD)1 is the probability of the counterparty failing to meet its principal and/or interest payment obligations. This probability reflects the current conditions of the portfolio at each date of preparation of the financial statements and is estimated taking into account the main characteristics of the credit quality of the counterparty/transaction.

Loss given default (LGD3 is the estimate of the loss arising in the event of default. It depends mainly on the characteristics of the transaction and the valuation of the related guarantees or collateral.

The calculation of LGD at each date of the balance sheet estimates the current value of the cash flows expected to be obtained during the remaining life of the financial asset. The recoverable amount of effective collateral will be estimated based on the valuation of the property, discounting the adjustments needed to capture adequately the uncertainty the potential fall in value up to the time of foreclosure and sale, plus foreclosure costs, maintenance costs and sale costs.

1 The PD and LGD is calculated from a Point-in-time (“PIT”) focus for solvency purposes

Non-performing contingent exposures and commitments, except for letters of credit and other guarantees, are to be provisioned for an amount equal to the estimation of the sums expected to be disbursed that are deemed to be non-recoverable, applying criteria of valuation prudence. When calculating the provisions, criteria similar to those established for non-performing assets for reasons other than customer default are applied.

In any event, letters of credit and other guarantees provided which are classified as non-performing will be covered by applying similar criteria to those set out in the preceding section on value adjustments for impairment of assets.

Likewise, the inherent loss associated with letters of credit and other guarantees provided that are in force and not impaired is covered by applying similar criteria to those set out in the preceding section on impairment losses determined collectively.

As set out in the Group’s Annual Consolidated Financial Statements (Note 7.3.6), a restructured transaction is understood to be one that for economic or legal reasons related to the holder’s (or holders’) current or foreseeable financial difficulties, the financial conditions are modified to facilitate payment of the debt (principal and interest) because the holder cannot, or is considered will not be able to, comply with these conditions on time and in full, even when such modification is included in the contract.

In any event, restructured transactions are considered to be those where a haircut is applied or assets are received to reduce the debt, or whose conditions are modified to extend its maturity, change the repayment schedule to reduce the amount of payments in the short term or their frequency, or establish or extend the initial grace period of the principal, interest or both; except where it can be provide that the conditions are modified for reasons other than the financial difficulties of the holder and are similar to those applied in the market at the time of modification to transactions granted to customers with a similar risk profile.

Pursuant to article 5 of the CRR, with respect to the bank capital requirements for credit risk, exposure is understood to be any asset item and all items included in the Group’s memorandum accounts involving credit risk and not deducted from the Group’s bank capital. Accordingly, mainly customer lending items are included, with their corresponding undrawn balances, letters of credit and guarantees, debt securities and capital instruments, cash and deposits in central banks and credit institutions, assets purchased or sold under a repurchase agreement (asset and liability repos), financial derivatives (nominal) and fixed assets.

The credit risk exposure specified in the following sections of this document is broken down into the standardized credit risk approach (section 3.2.4), advanced credit risk approach (section 3.2.5) and counterparty credit risk (section 3.2.6) and securitization credit risk (section 3.2.7).

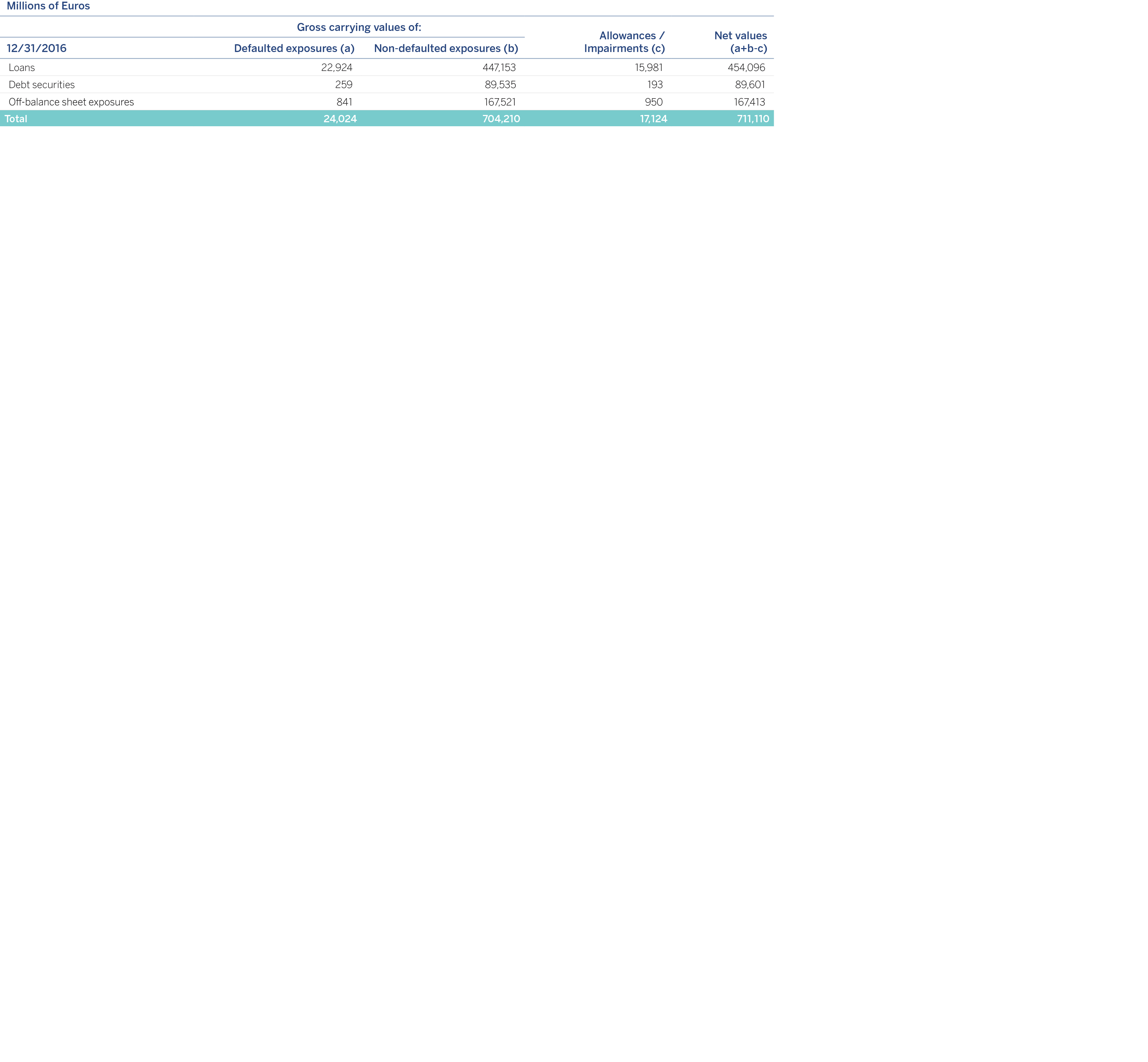

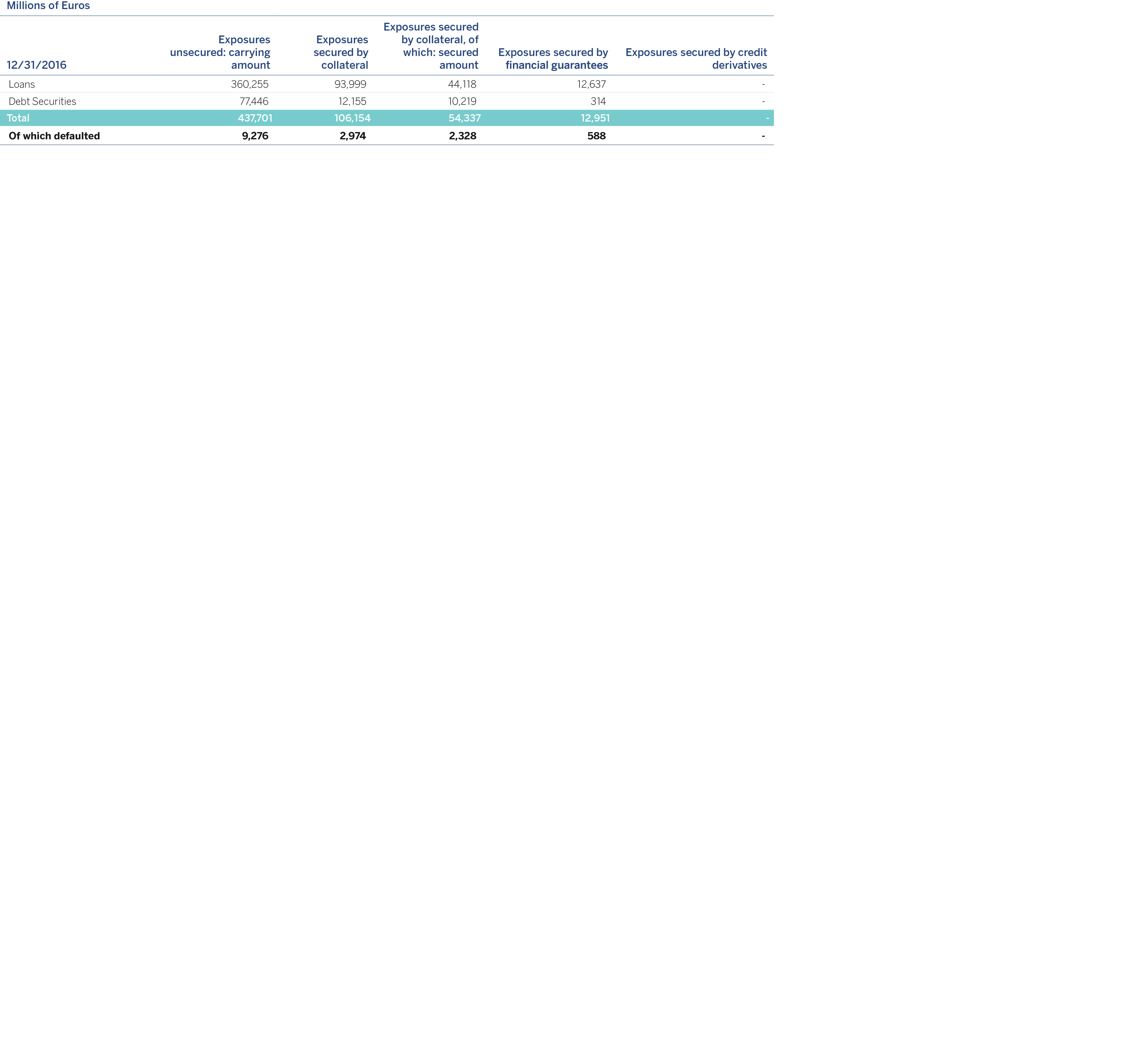

The book value of loans, debt securities and off-balance sheet exposures, broken down into defaulted and non-defaulted exposures, as well as the provisions and value adjustments linked to the defaulted exposures, are shown below. This breakdown provides a comprehensive picture of the credit quality of the Group’s on and off balance sheet assets as of December 31, 2016:

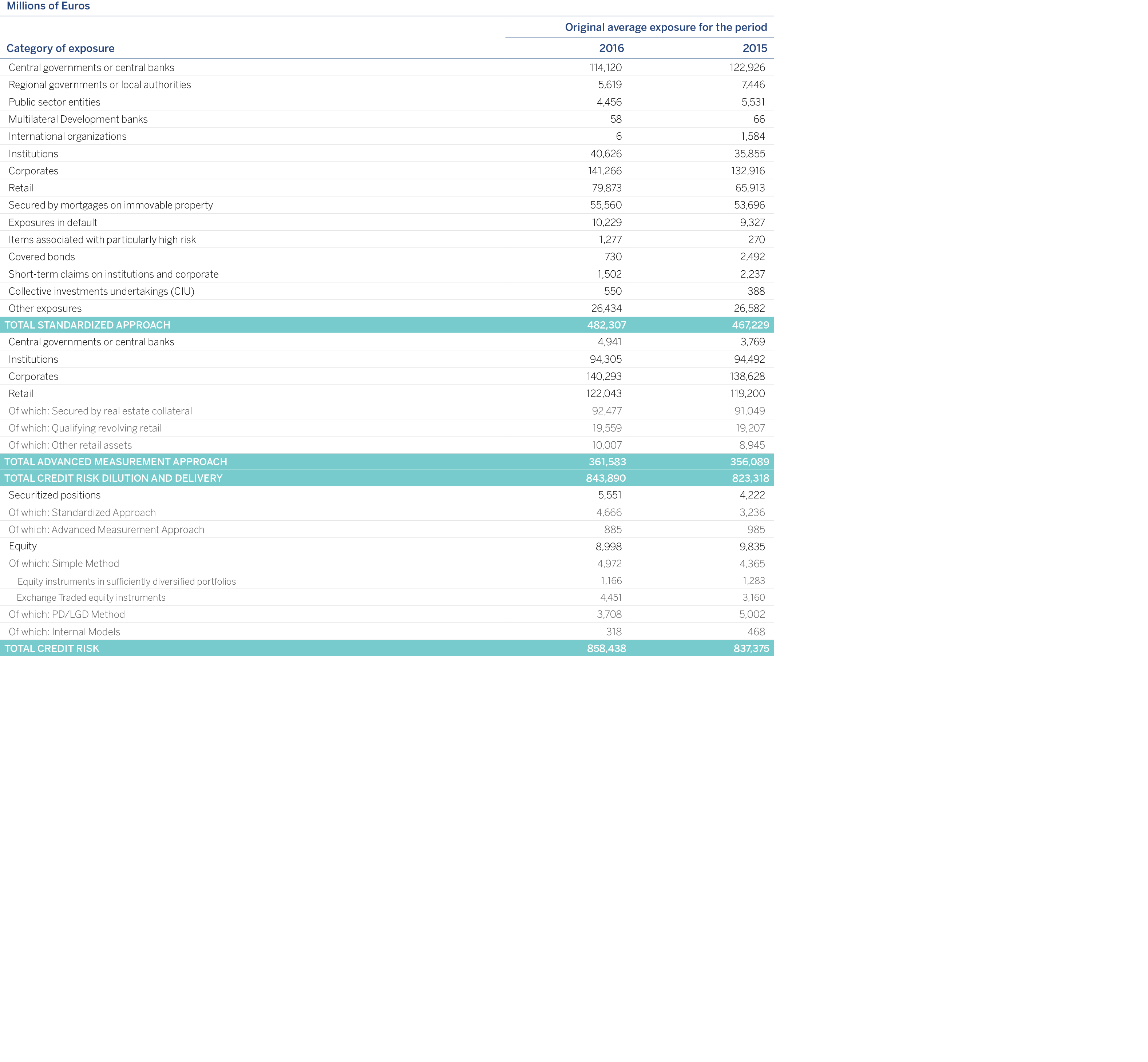

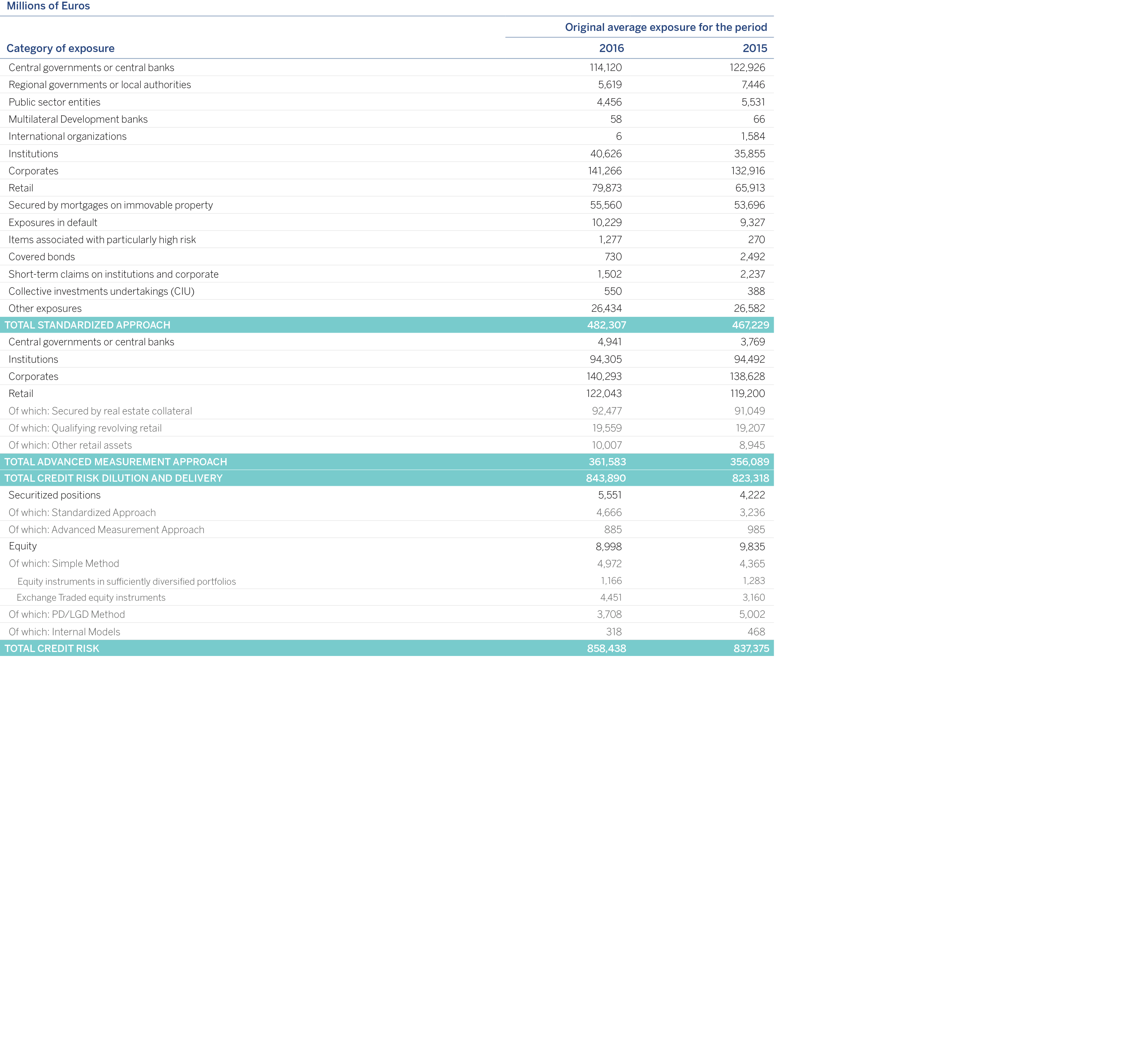

The table below shows the average value of exposure to credit risk (including counterparty credit risk) in 2016 and 2015, for both the advanced measurement and standardized approaches by exposure categories:

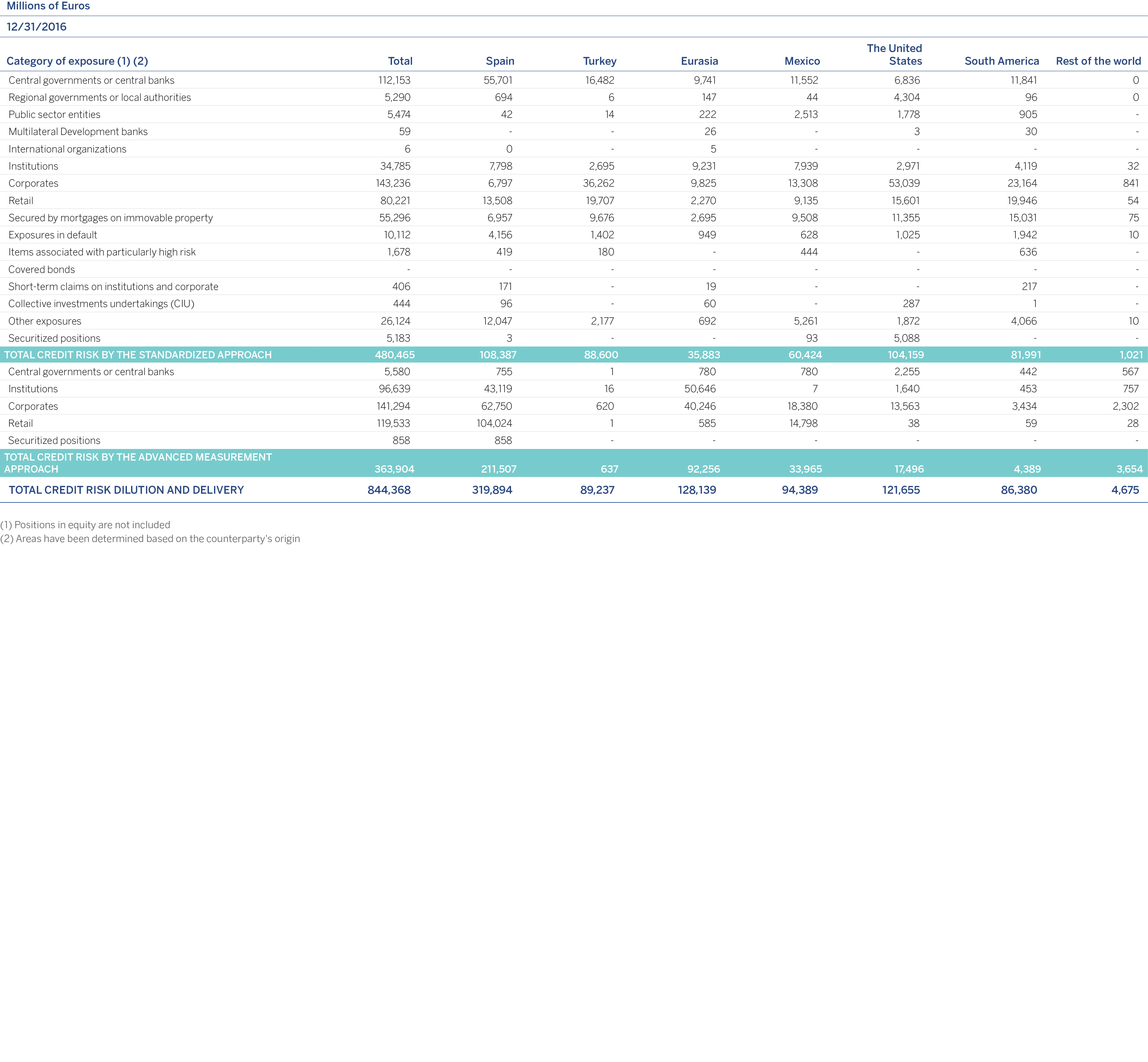

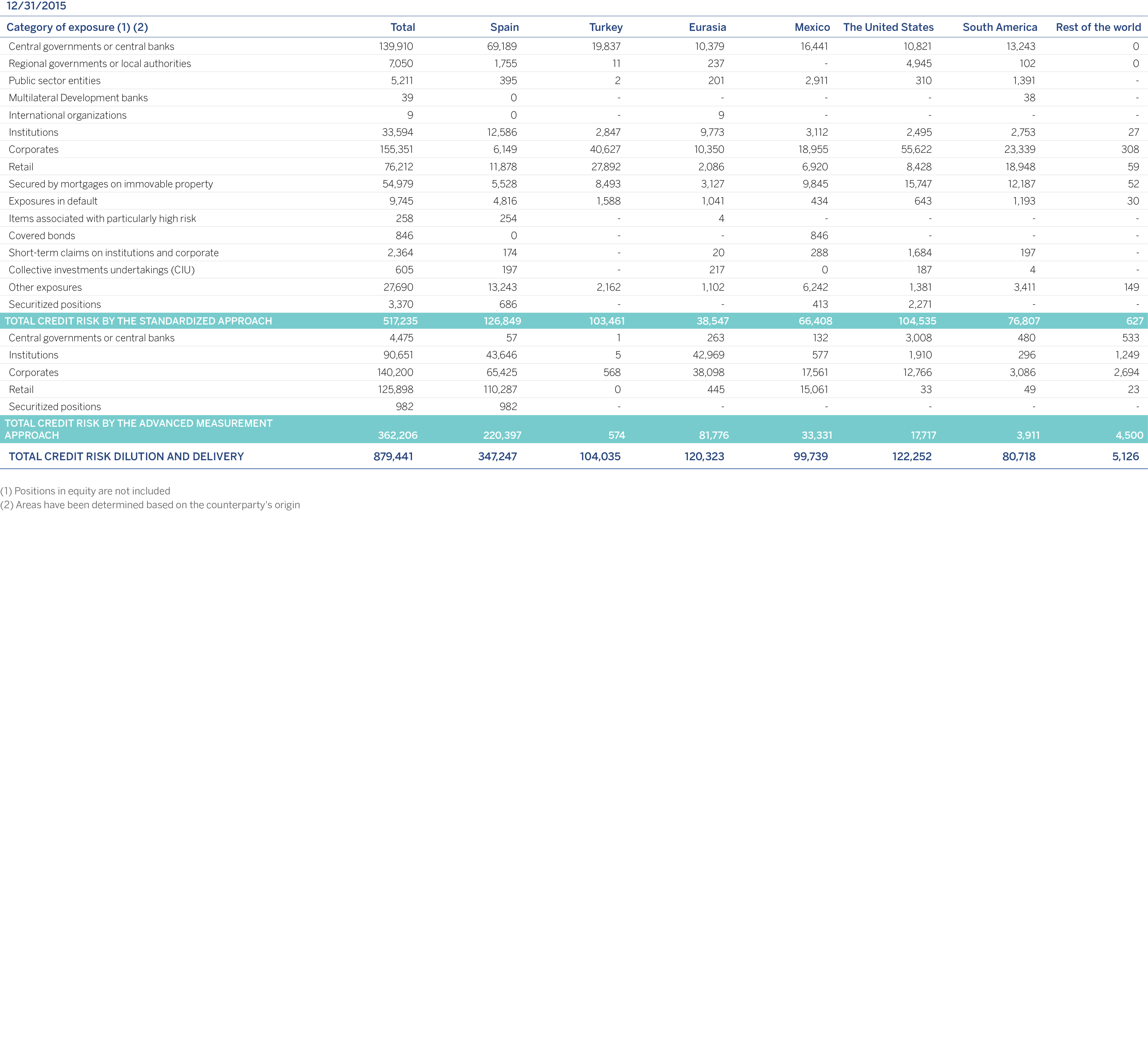

The following chart presents the distribution by geographic areas of the original exposure gross of provisions by obligor’s country. The distribution includes exposure under the standardized and advanced measurement approaches, as well as counterparty credit risk, but not including equity exposures.

It also shows graphically the distribution of original exposure by geographical area, revealing the Group’s high level of geographical diversification, which constitutes one of the key levers for its strategic growth.

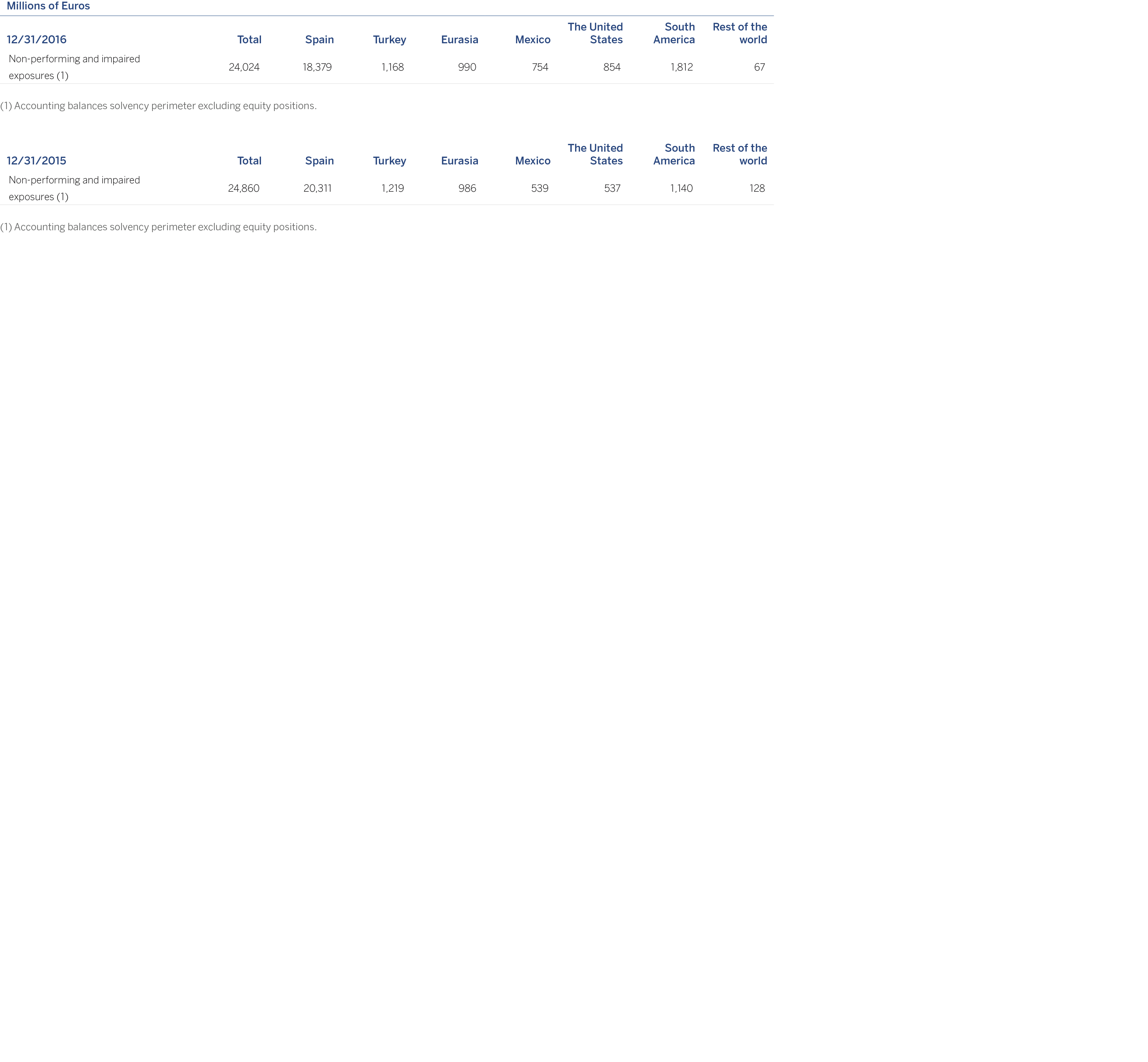

Below is the distribution by geographical area of the accounting balances of defaulted and impaired exposure of the financial assets and contingent risks, taking into account that the impaired and defaulted exposures referred to have been determined based on the accounting definition but with a prudential perimeter:

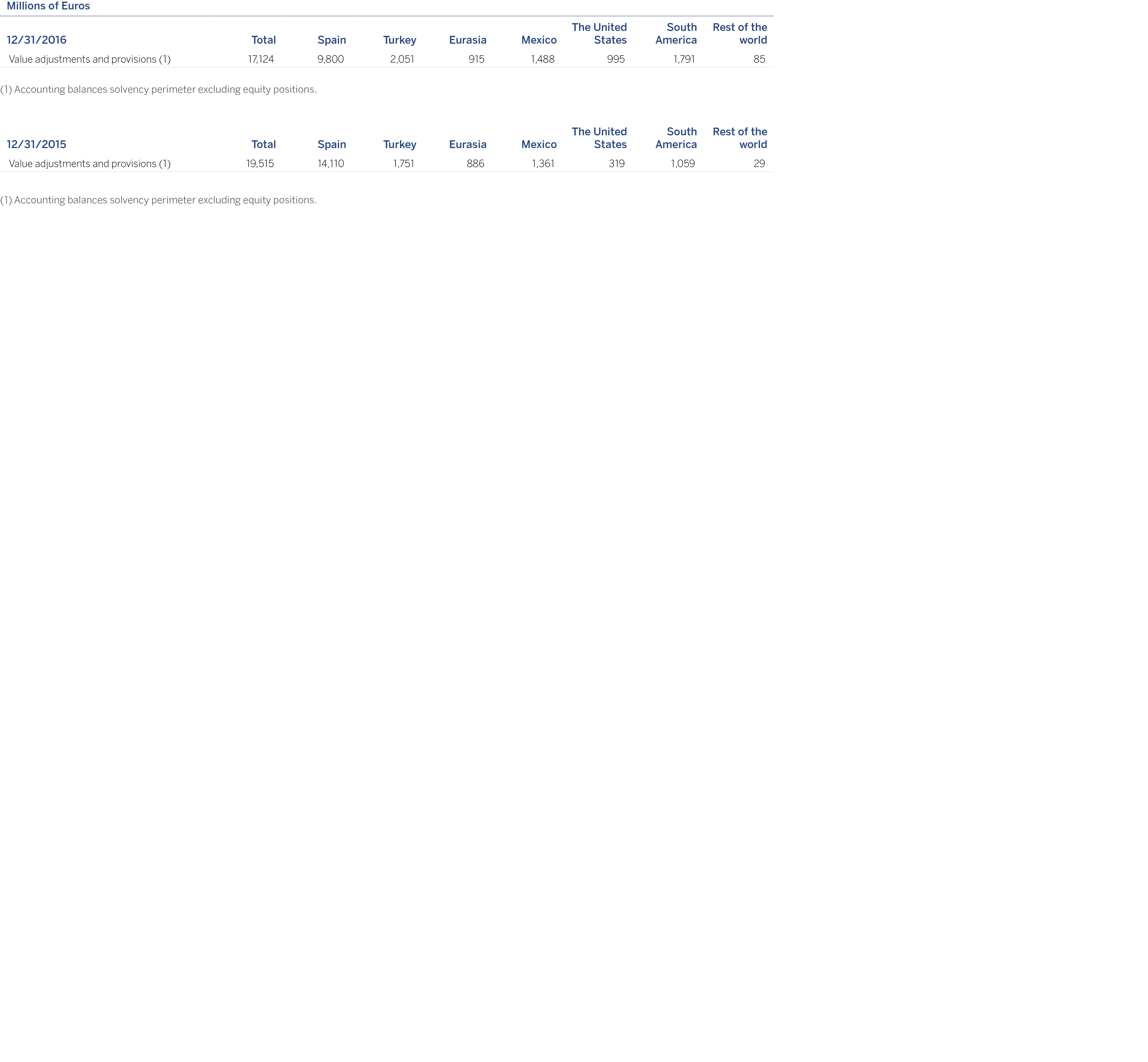

The next table shows the distribution by geographical area of the account balances of the allowances for financial asset losses and for contingent liabilities.

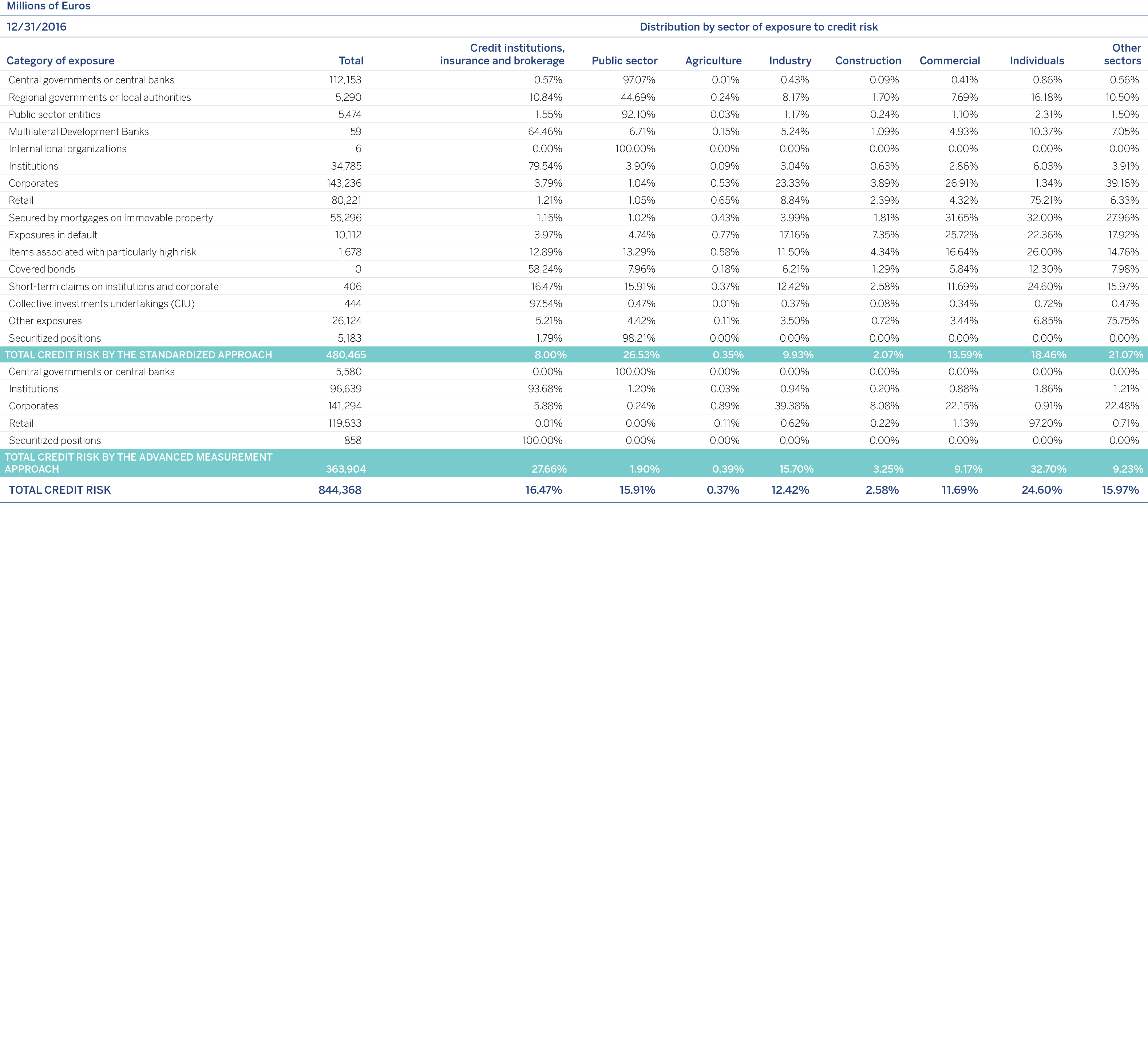

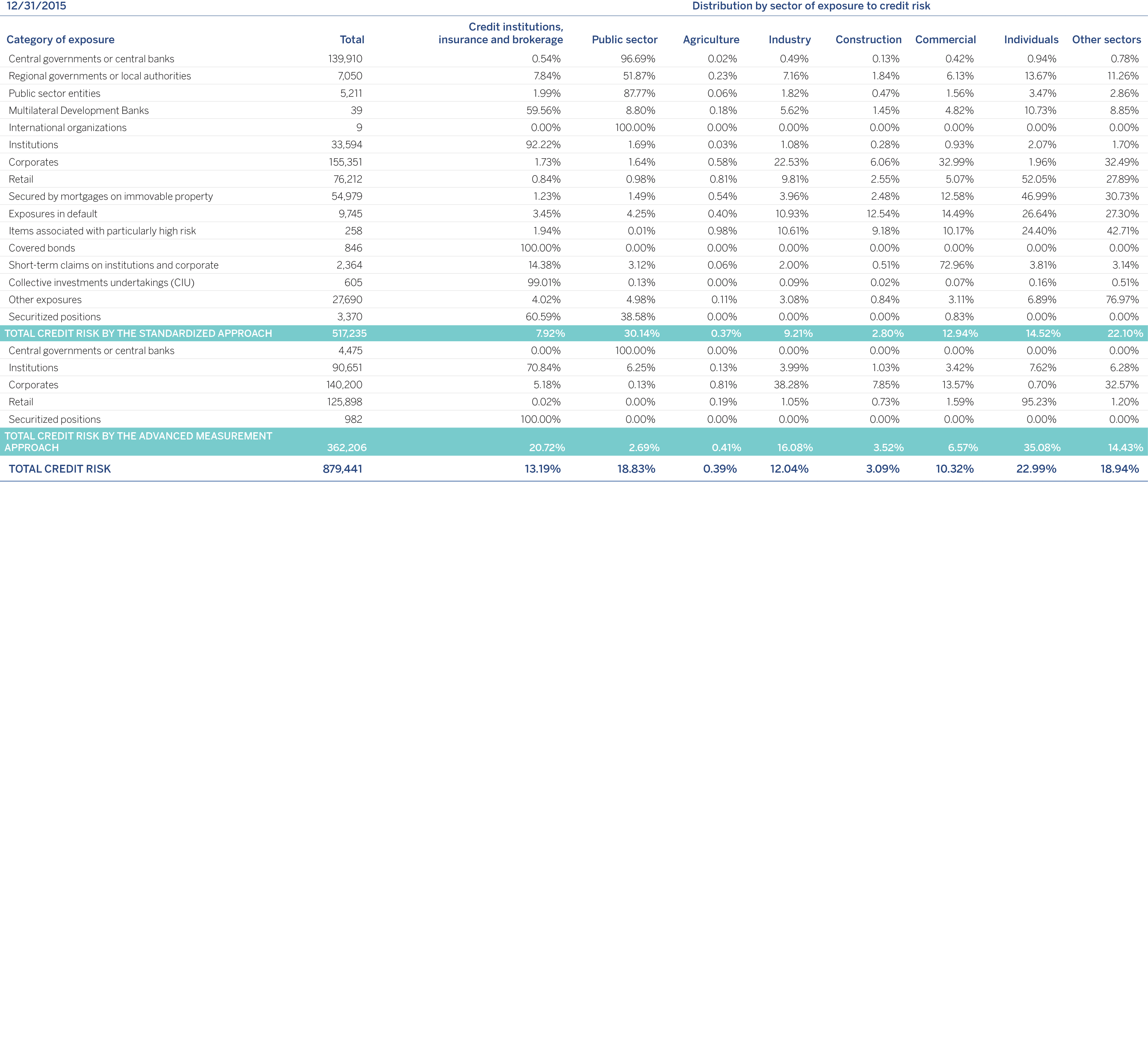

Below is the distribution by economic sector (standardized and advanced measurement approaches and counterparty credit risk) of the original exposure, excluding holding in equities:

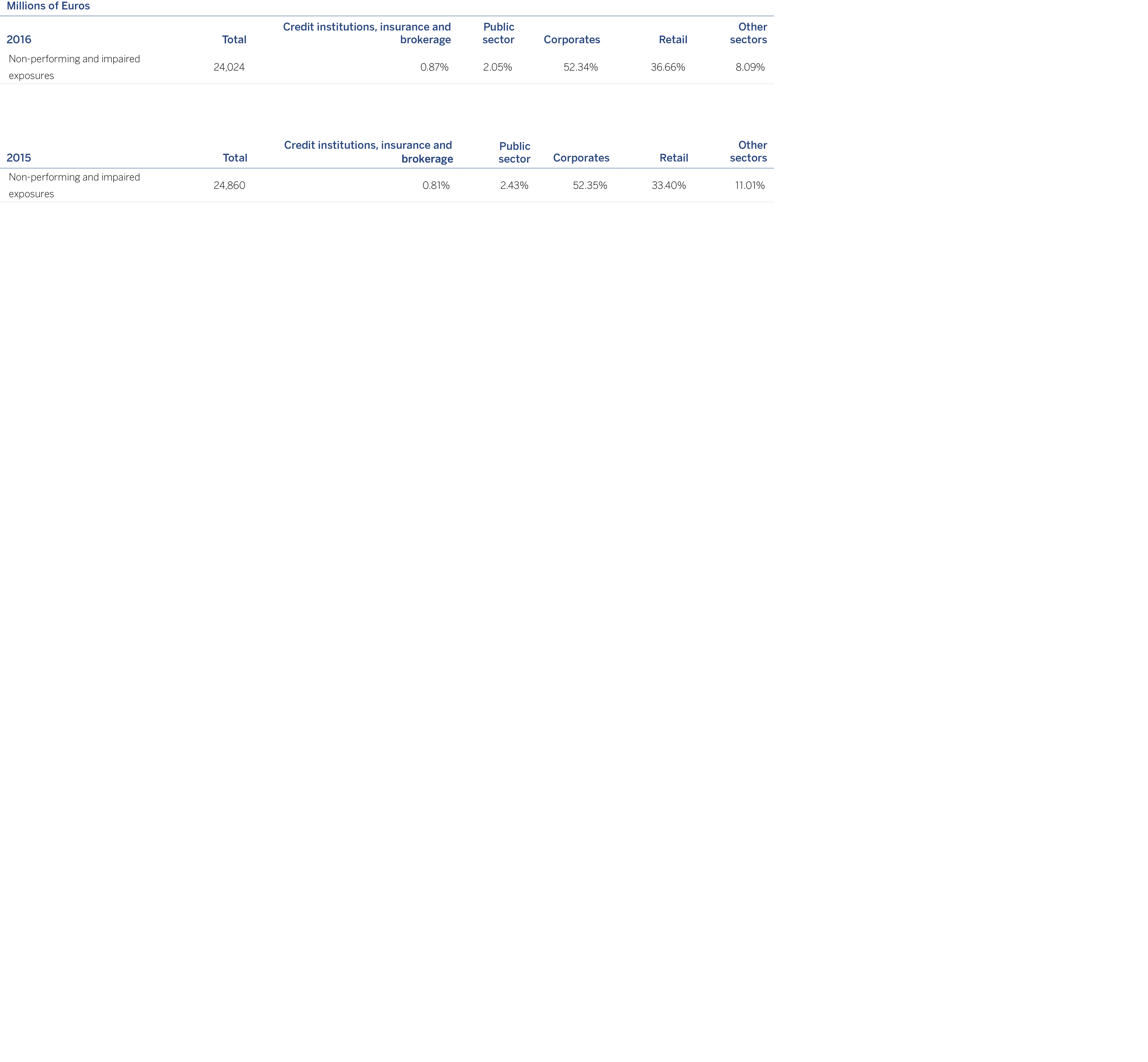

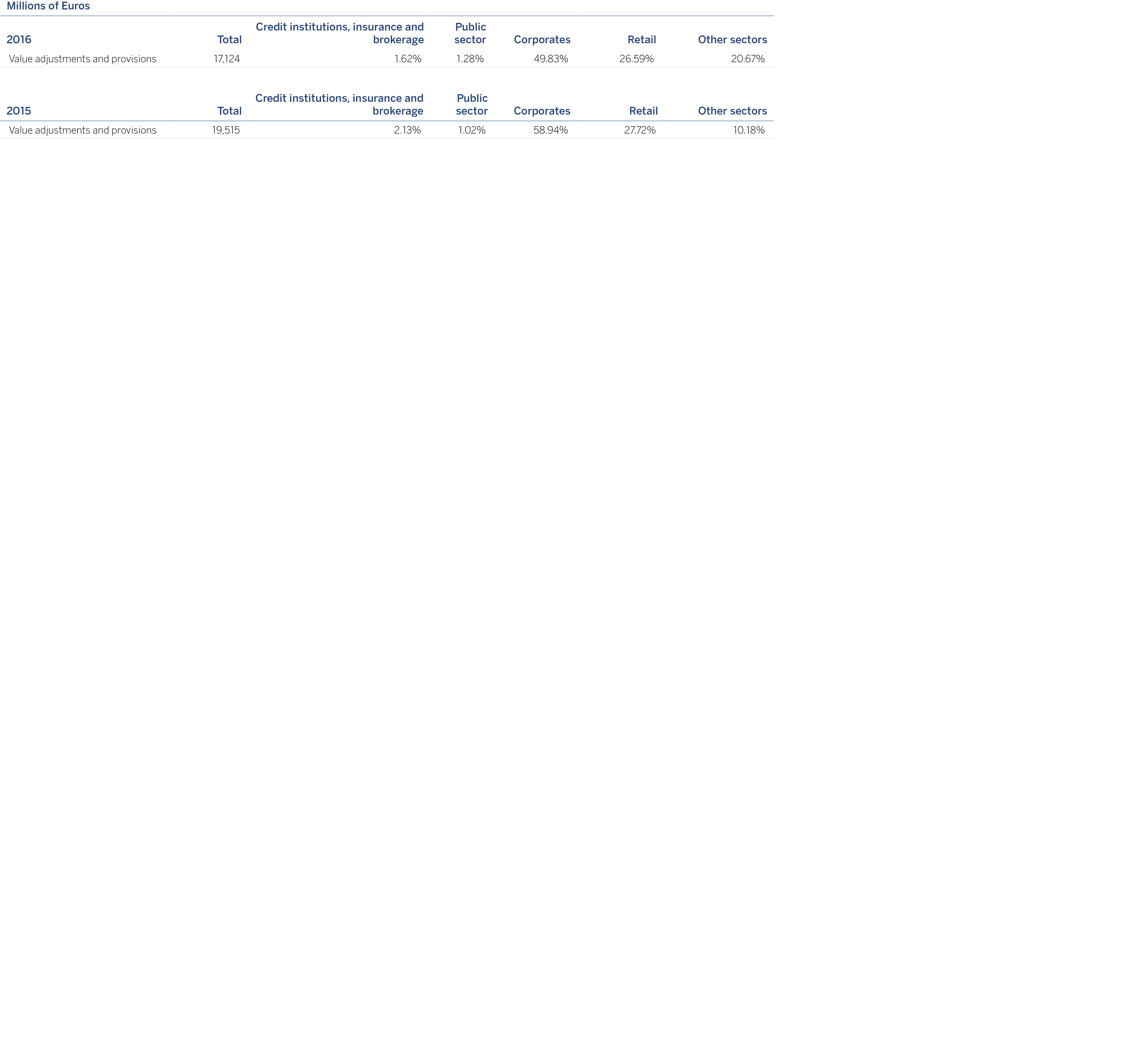

The following table shows the distribution by counterparty of the account balances of the non-performing and impaired exposures of financial assets and contingent liabilities:

The next table shows the distribution by counterparty of the account balances of allowances for financial asset losses and for contingent exposures:

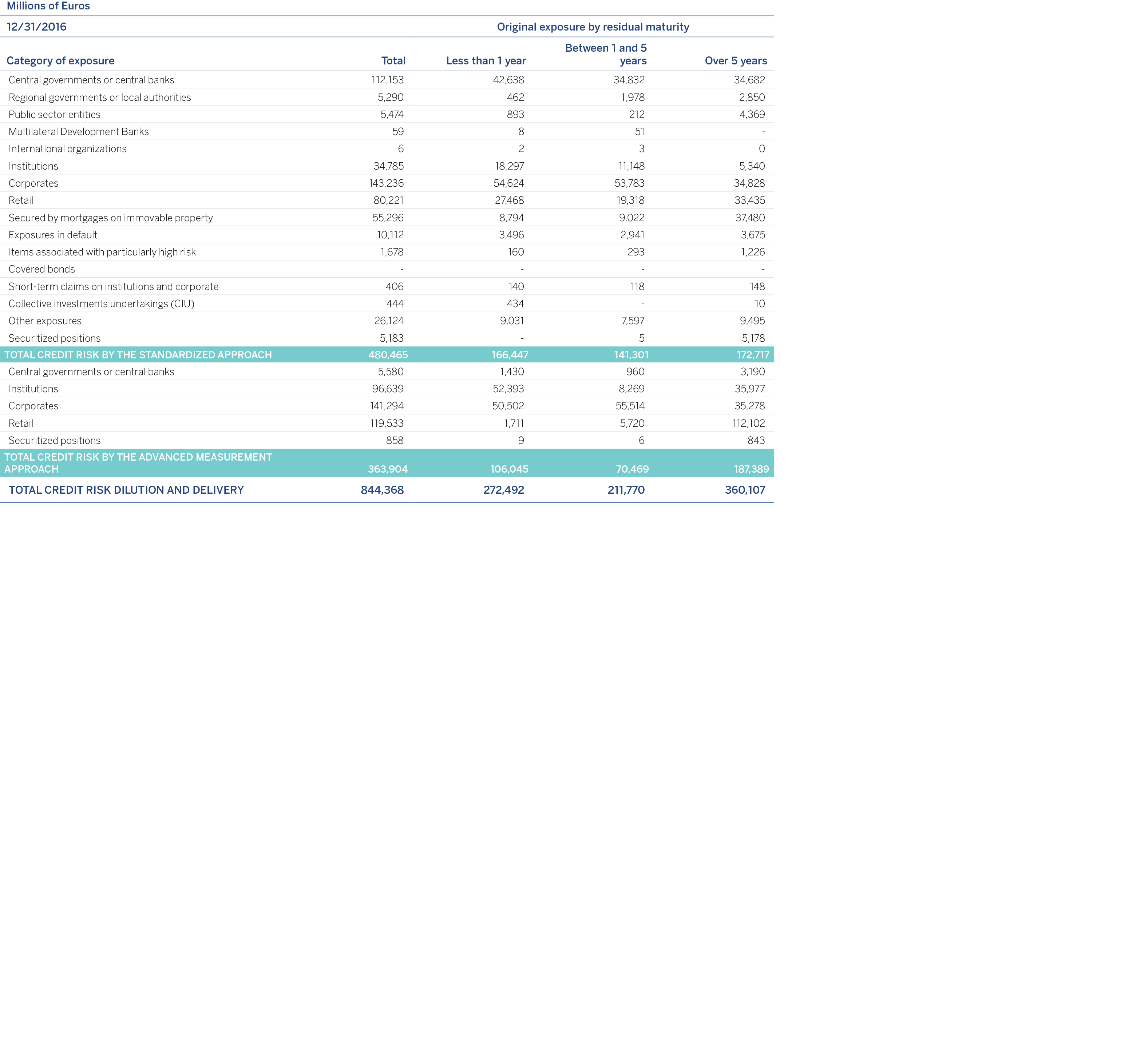

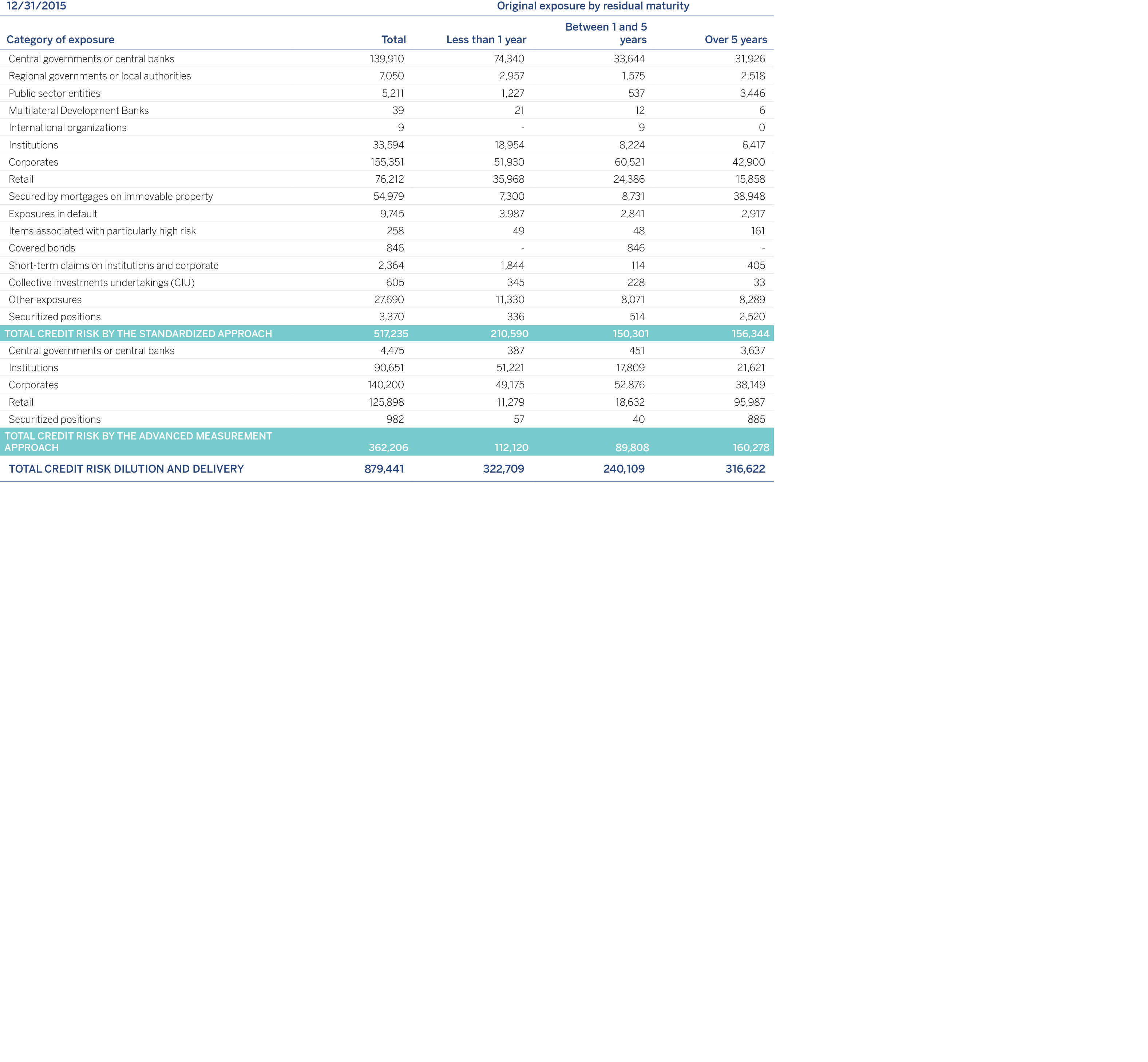

The following table shows the distribution of original exposure by residual maturity, broken down by category of exposure under the standardized and advanced measurement approaches and counterparty credit risk, excluding equity exposures:

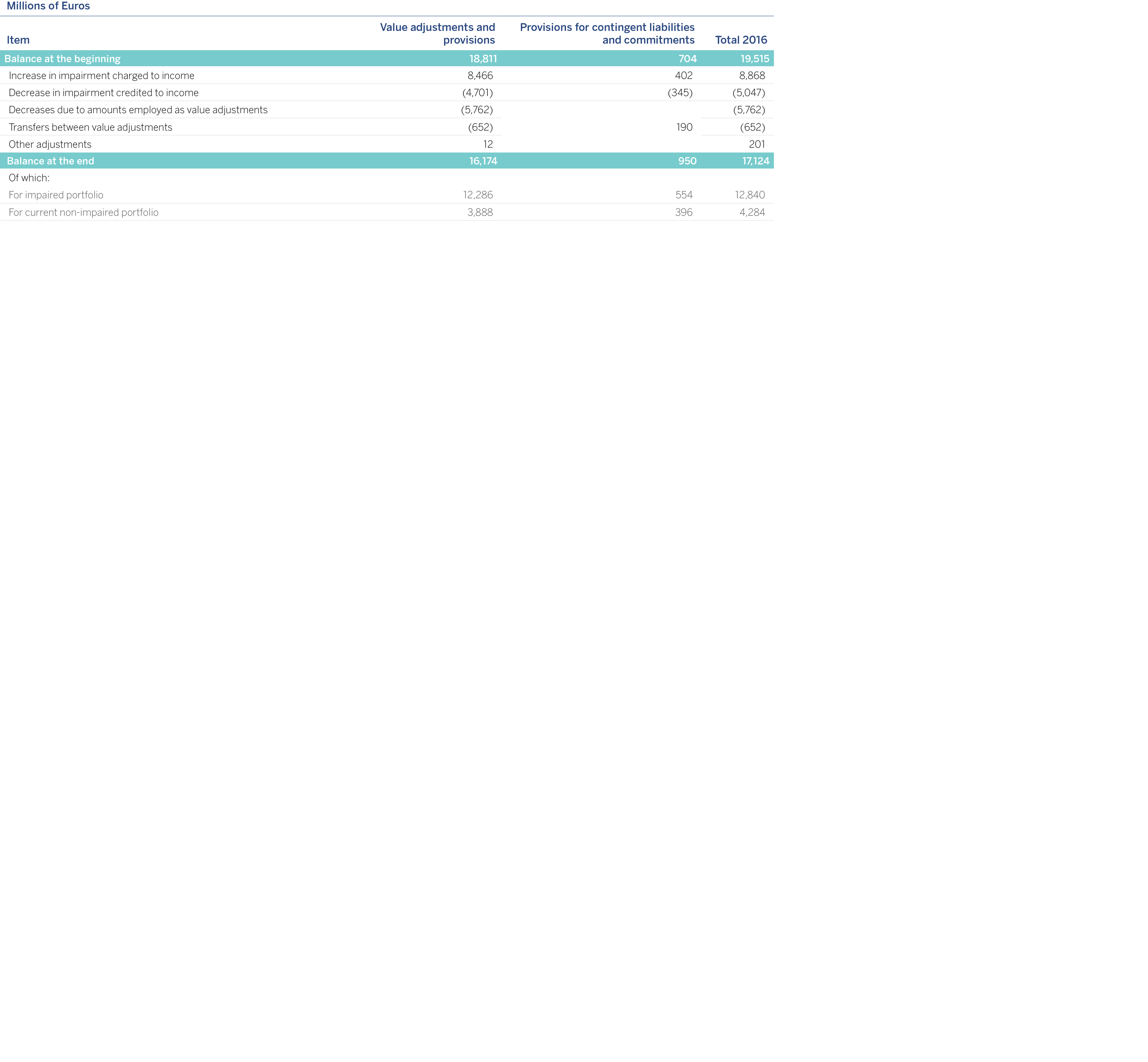

The following table presents the movement recorded in 2016 in the value adjustments for allowances and impairment losses of financial assets on the balance sheet; and for contingent risks and commitments.

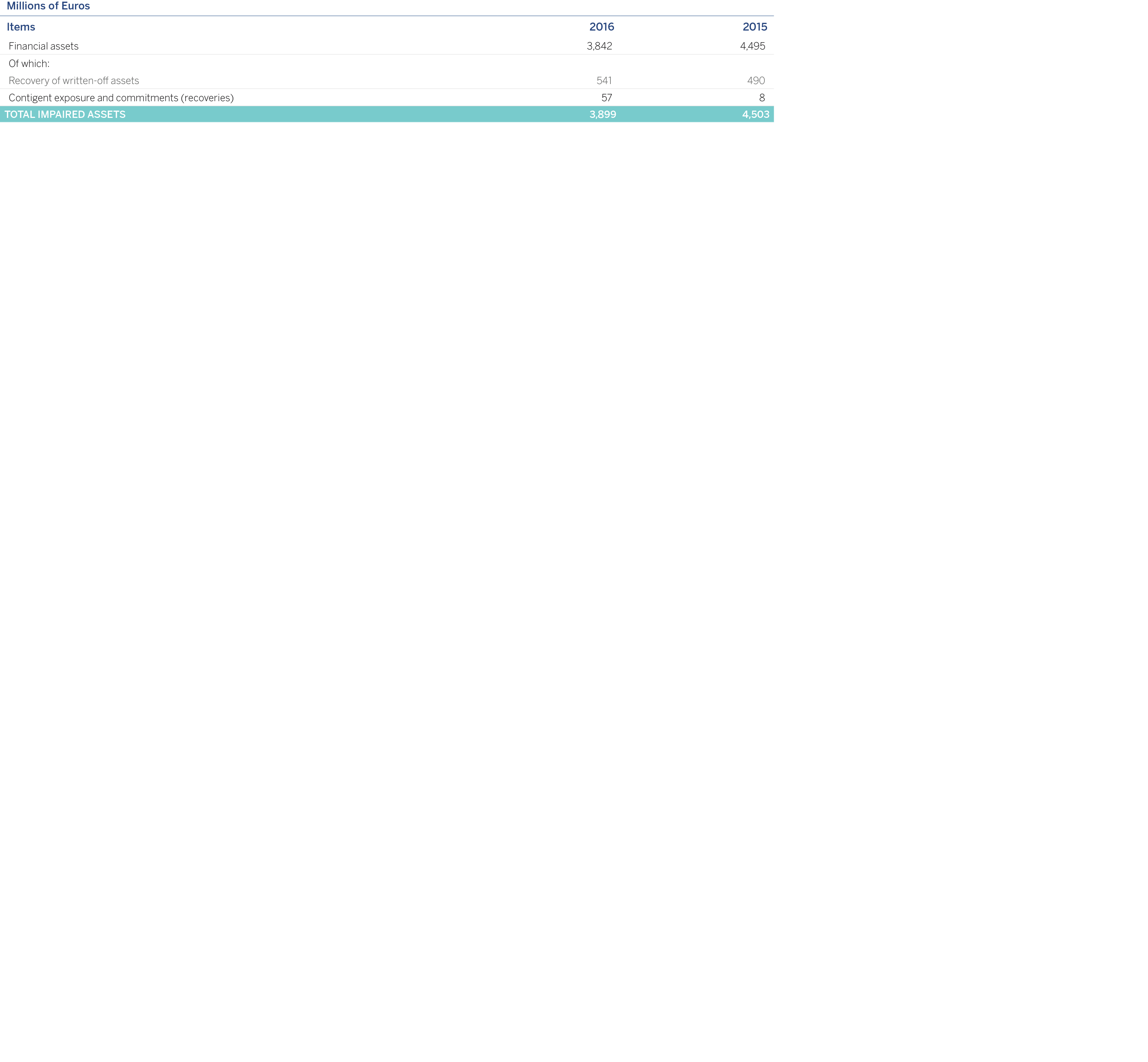

The following table shows details of impairment losses and allowances on financial assets and contingent risks and commitments, as well as derecognition of losses recognized previously in asset write-offs recorded directly in the income statement in 2016 and 2015.

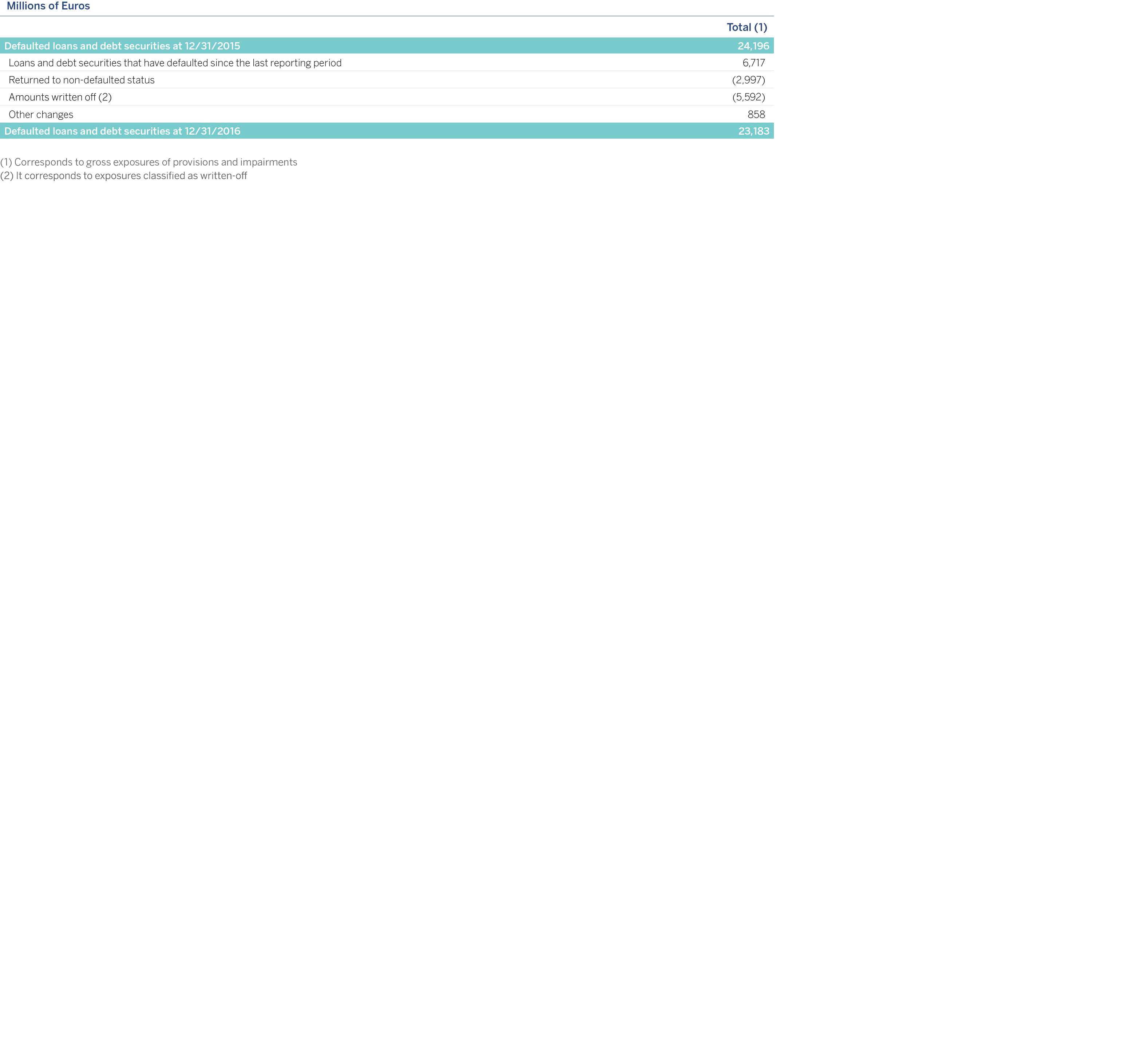

In addition, a movement in the stock of defaulted exposures in the balance sheet between December 31, 2016 and December 31, 2015 is shown below:

The external credit assessment institutions (ECAIs) appointed by the Group to determine the risk weightings applicable to its exposures are the following: Standard&Poor’s, Moody’s, Fitch and DBRS.

The exposures for which the ratings of each ECAI are used are those corresponding to the wholesale portfolios, basically involving “Sovereigns or central banks” in developed countries, and “Financial Institutions”.

In cases where a counterparty has ratings by different ECAIs, the Group follows the procedure laid down in Article 261 of the Solvency Regulations, which specifies the order of priority to be used in the assignment of ratings.

When two different credit ratings made by designated ECAIs are available for a rated exposure, the higher risk weighting will be applied. However, when there are more than two credit ratings for the same rated exposure, use is to be made of the two credit ratings that provide the lowest risk weightings. If the two lowest risk weightings coincide, then that weighting will be applied; if they do not coincide, the higher of the two will be applied.

The correspondence between the alphanumeric scale of each agency used and the risk categories used by the Group are defined in the final draft Implementing Technical Standards on the mapping of the credit assessments of the ECAI under Article 136(1) and (3) of Regulation (EU) No. 575/2013; complying with the provisions of Article 136 of the CRR.

The number of cases and the amount of these assignments is not relevant for the Group in terms of admission and management of issuer credit risk.

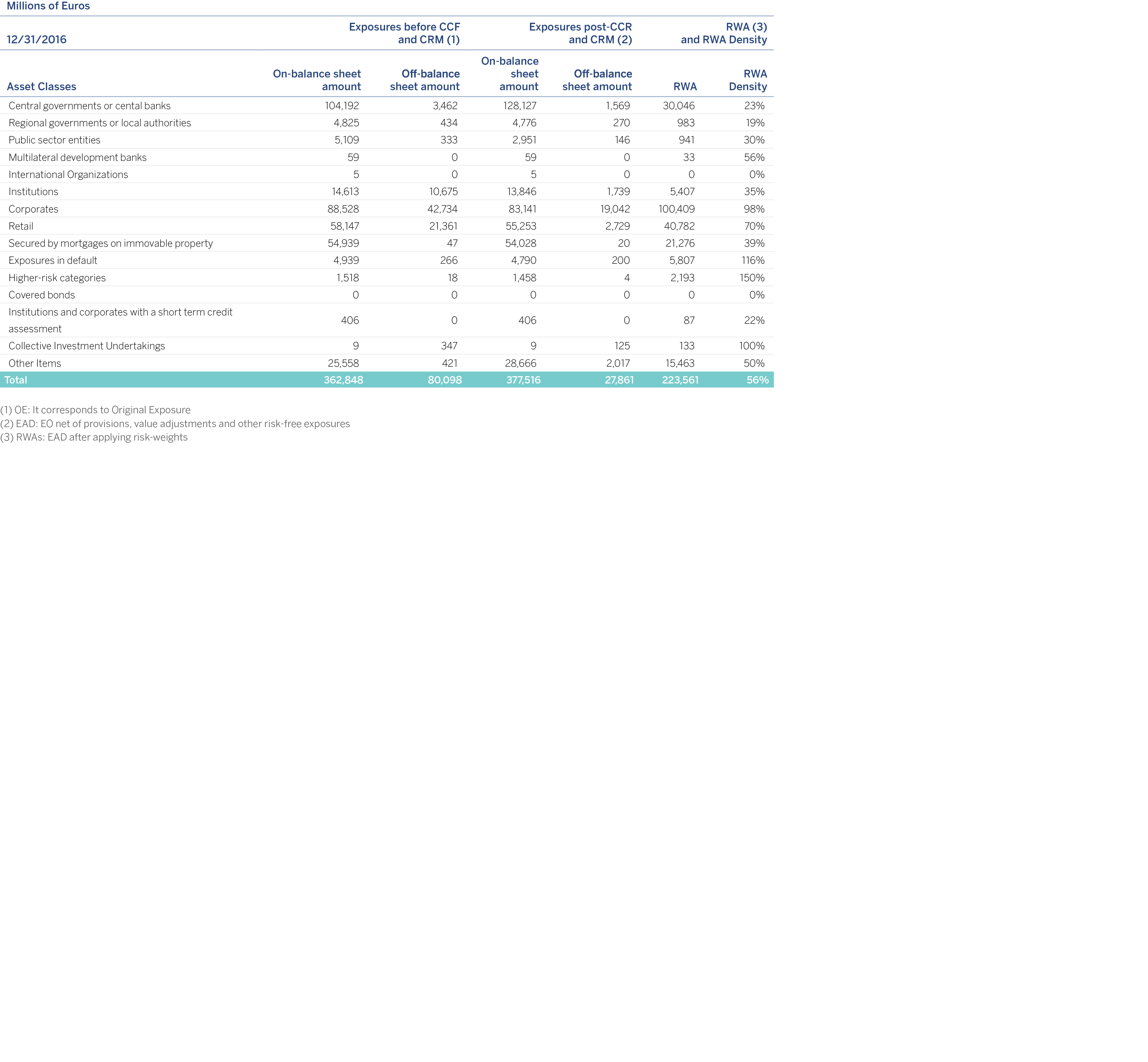

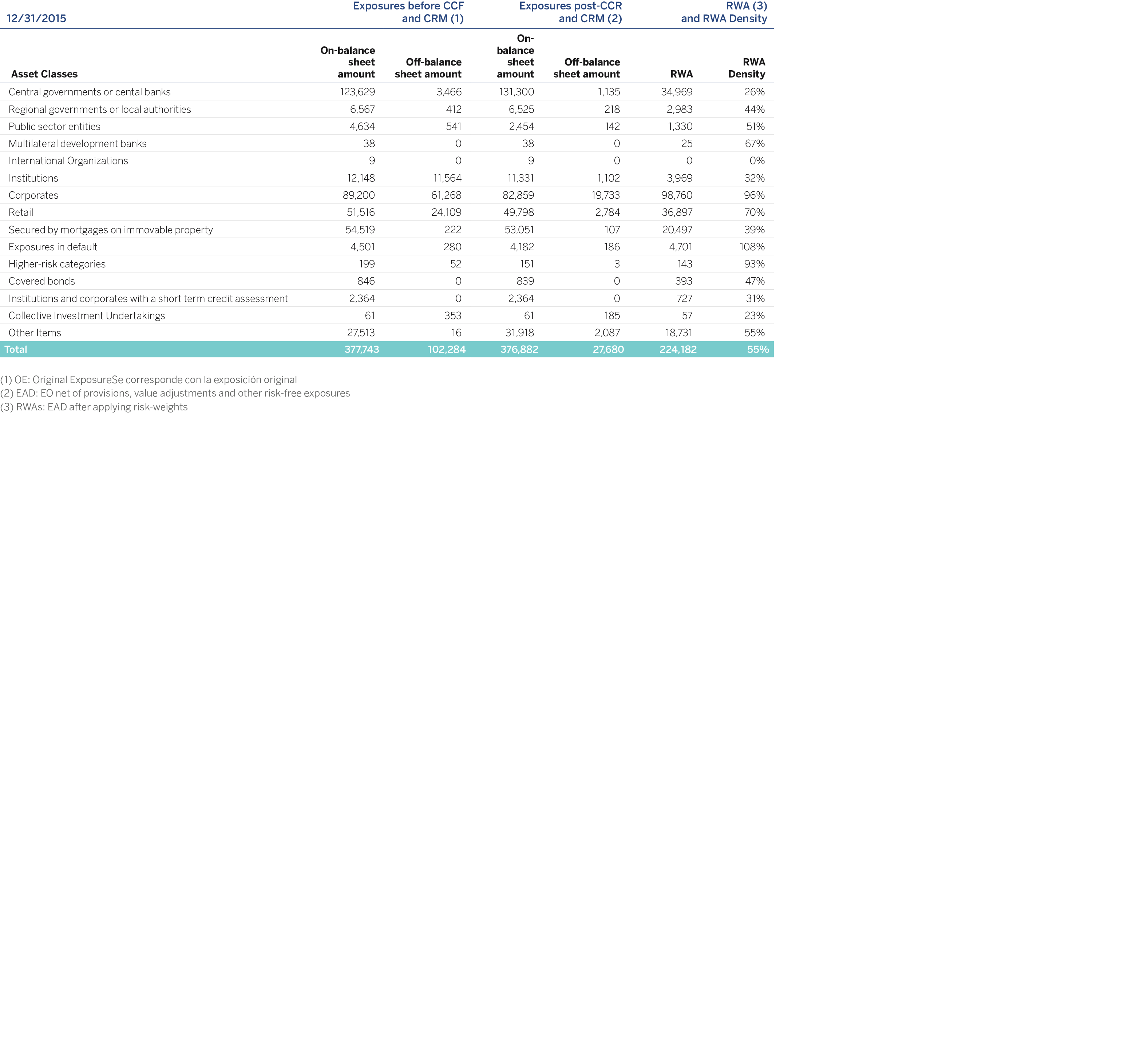

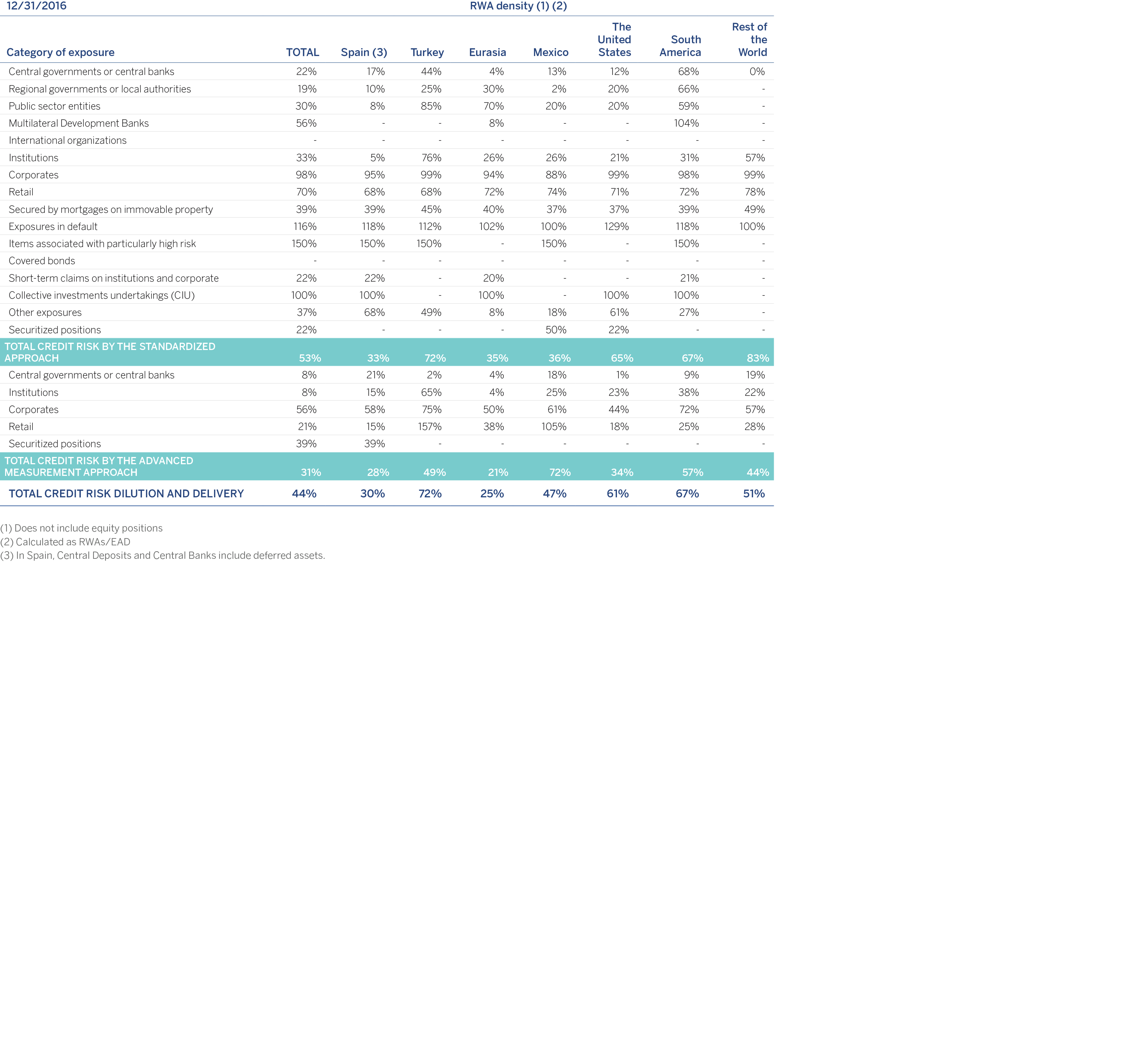

The original net exposure amounts for provisions and value adjustments, the exposure after risk mitigation techniques and RWA density for each exposure category by the standardized approach are shown below, excluding securitization and counterparty credit risk exposure which is presented in section 3.2 of this Report.

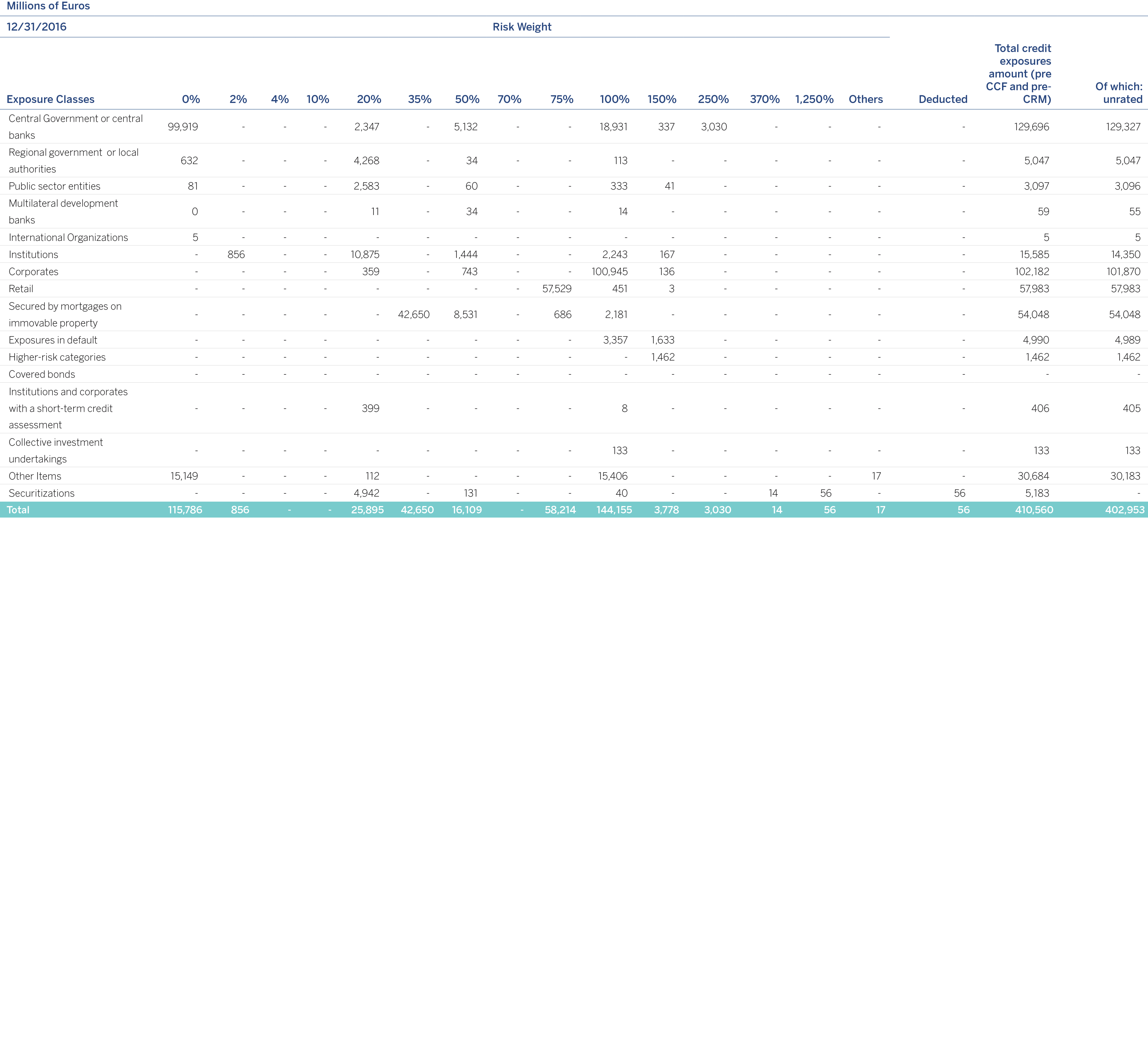

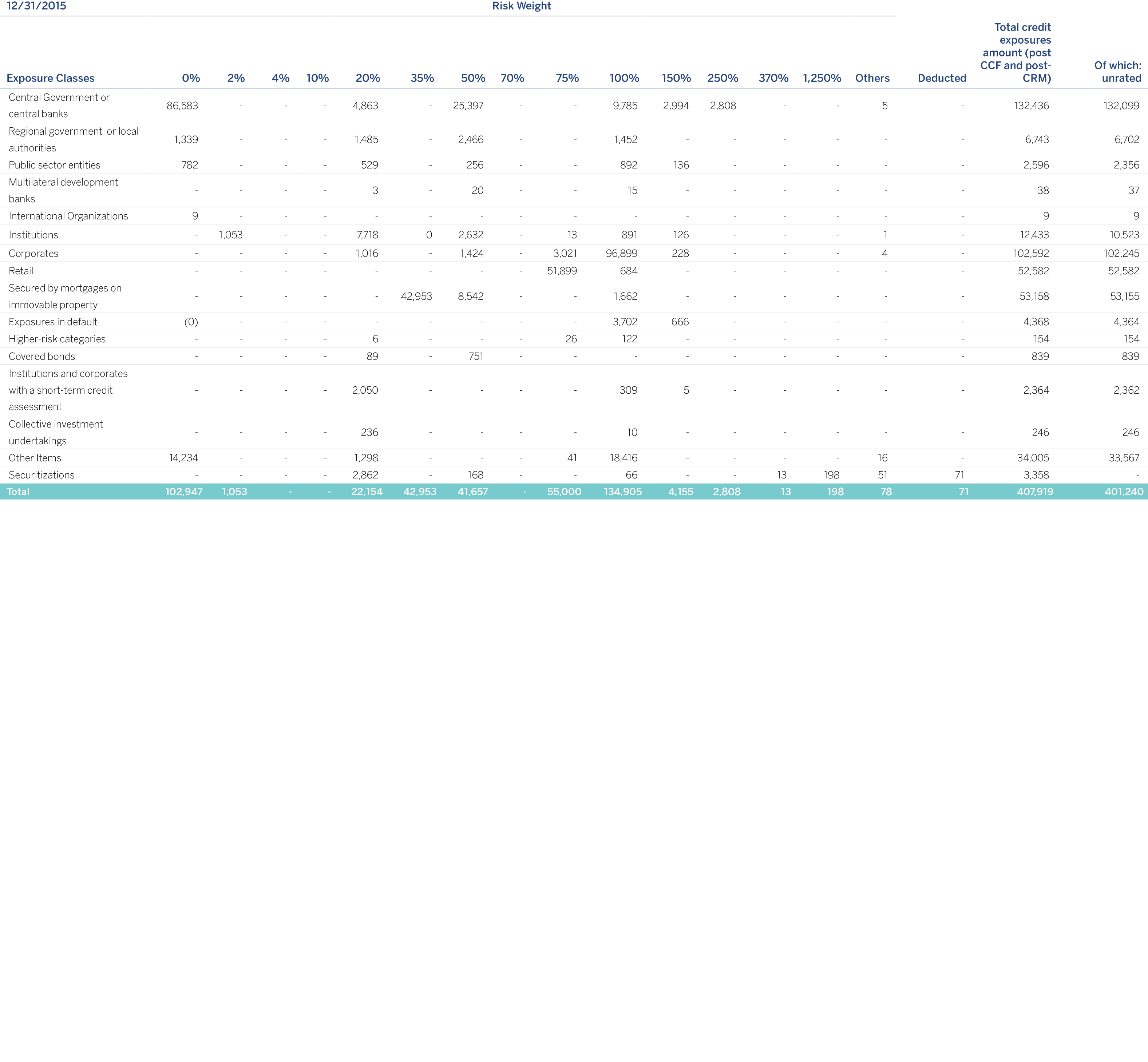

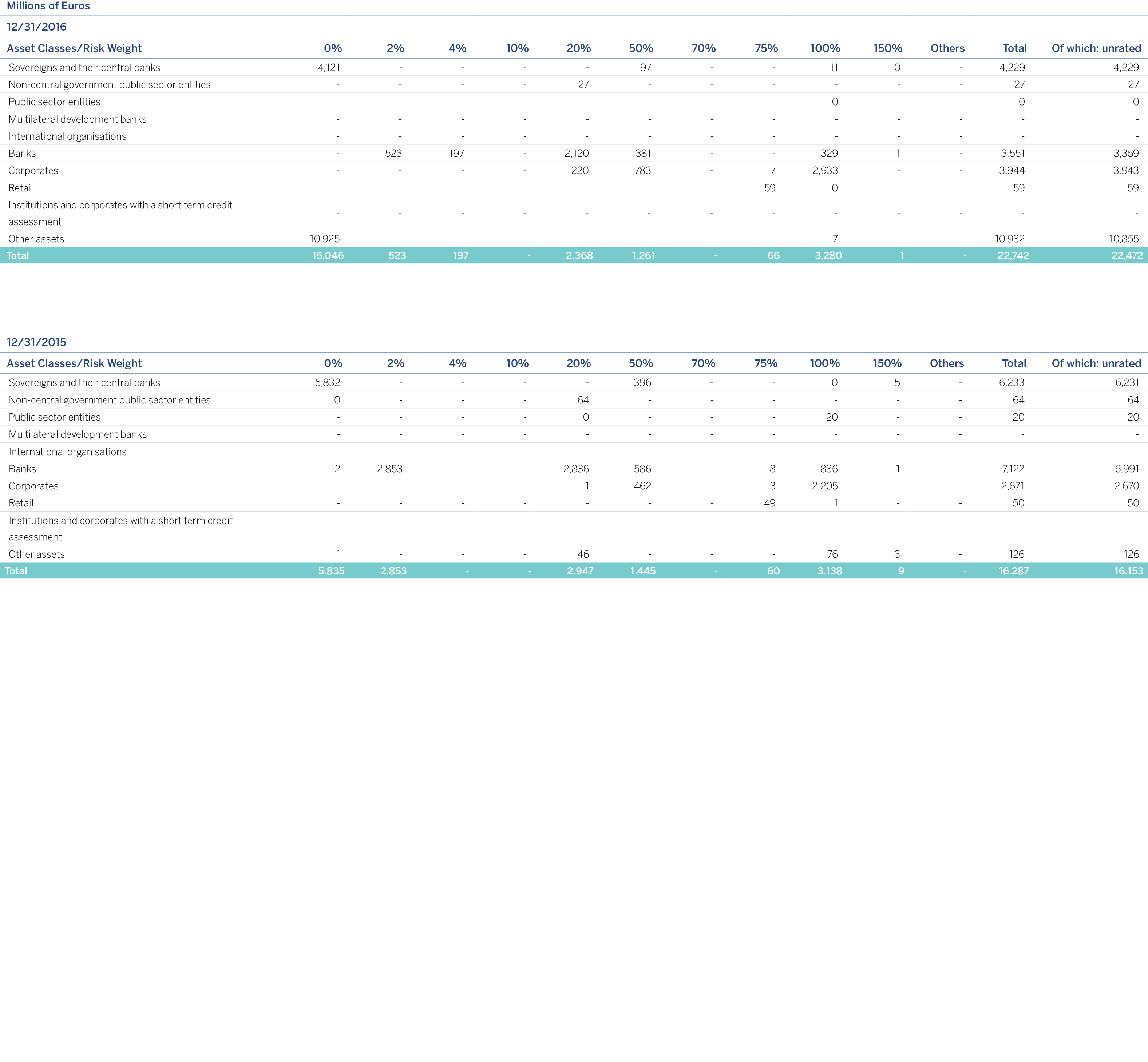

Moreover, the following tables present the amounts of exposures net of provisions, before and after the application of credit risk mitigation techniques by risk weightings and by exposure categories that correspond to the standardized method, not including securitization positions and counterparty credit risk exposure, in accordance with the EBA EU-CR5 (GRPDR) format.

Counterparty credit risk exposures net of provisions and after applying CCF and CRM are shown in table EU-CCR3 of section 3.2.6 of this report.

The following table presents the main variations in the period in terms of RWAs for the Credit Risk standardized approach.

The increase in RWAs for credit risk in the standardized model is due mainly to:

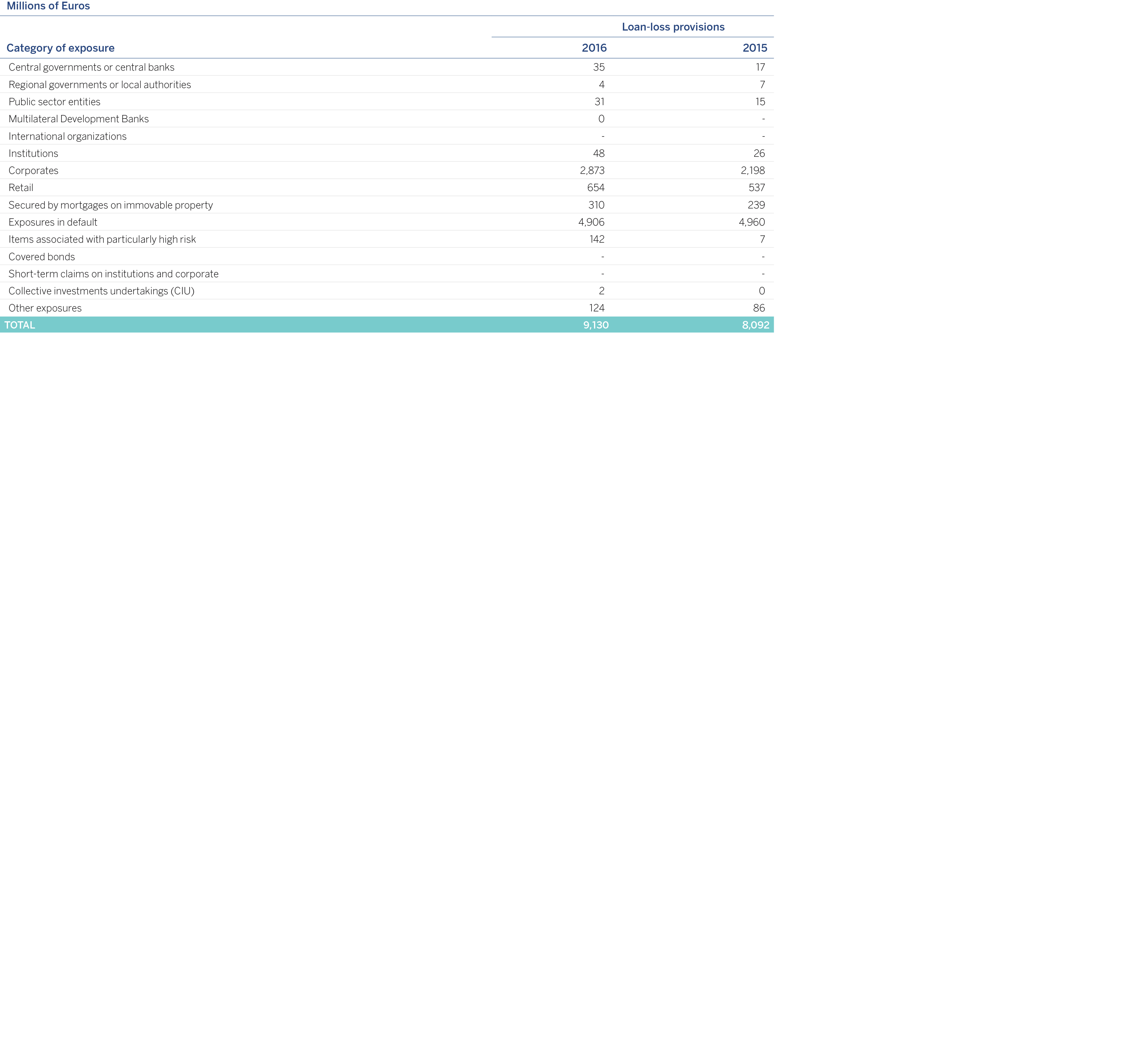

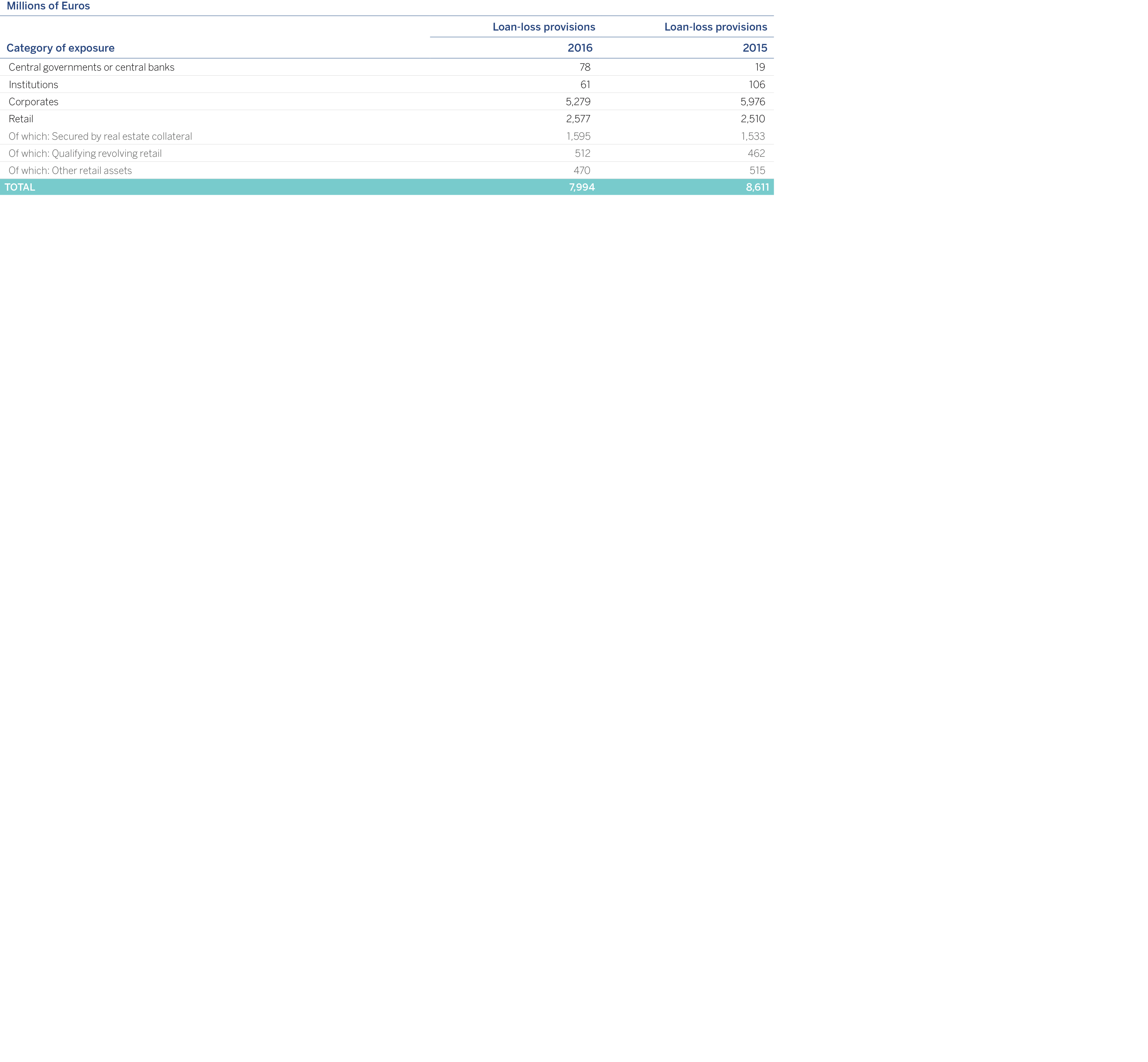

The table below shows the balances of credit risk and counterparty credit risk provisions by exposure categories, as of December 31, 2016 and 2015:

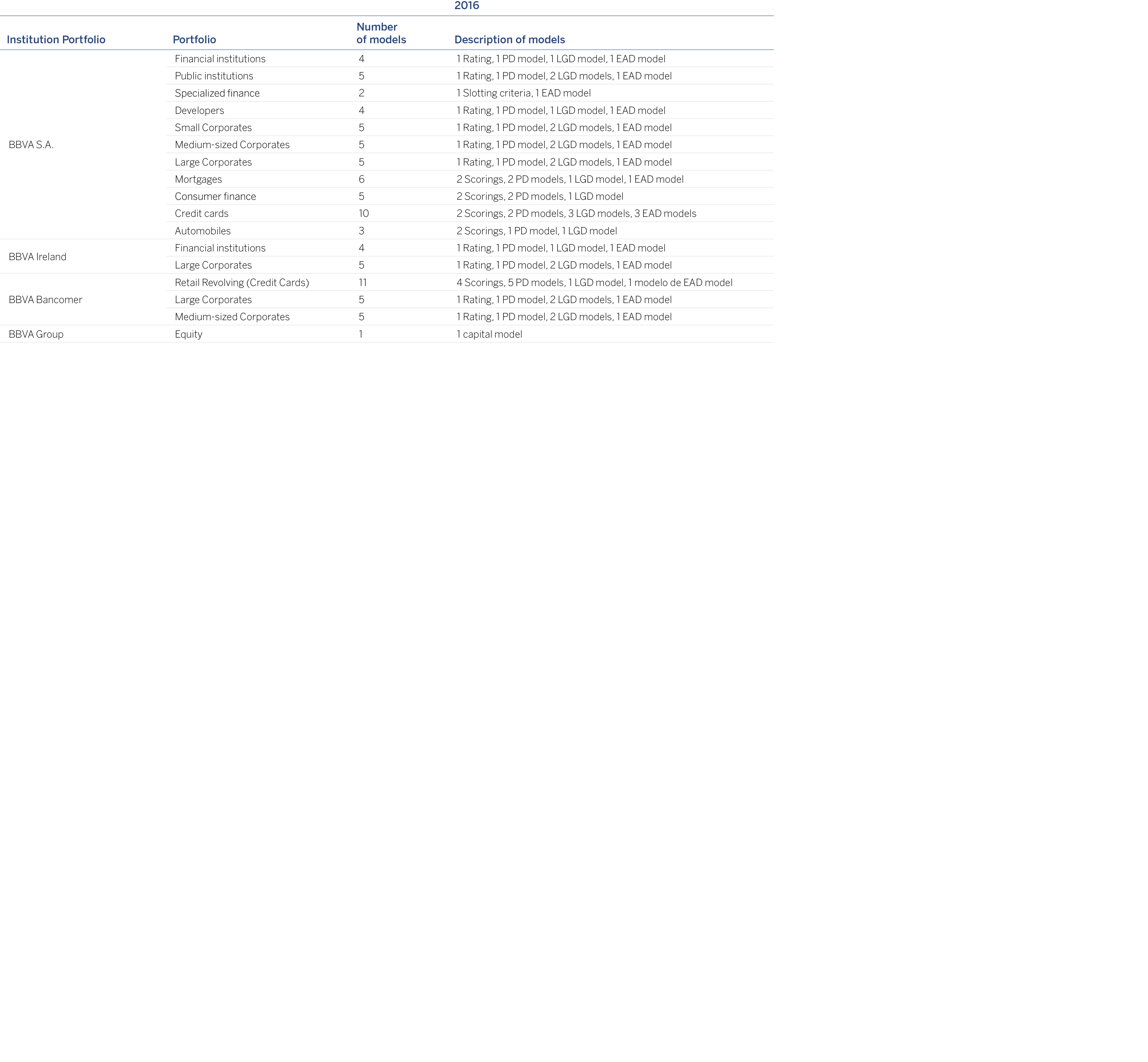

The following is a list of the models authorized by the supervisor to be used on the calculation of capital requirements.

The main types of rating models used in the IRB portfolios are ratings for wholesale portfolios and proactive and reactive scorings in the case of retail portfolios.

The rating models give contracts/customers a score that orders customers according to their credit quality.

This score is determined by the characteristics of the transactions, economic and financial conditions of the customer, information on payment behavior, credit bureau, etc.

Based on this score a probability of default (PD) can be assigned at contract or customer level.

If the data used in these calculations do not cover a complete economic cycle, the additions to NPL and probability of default depend on the phase of the cycle used. As a result, an adjustment has to be made to the cycle to consider this question. It will vary depending on the economic situation and will allow an average PD to be determined over the cycle.

In the case of low default portfolios, the Group uses a variety of techniques to estimate the PDs, such as the use of external default data, or ECAI references.

The method used to estimate the loss given default is the “Workout LGD”, based on the discount of the cash flows of defaulted exposure, recovered at different points of time.

According to the quantitative requirements, to calculate the RWAs a LGD has to be estimated that includes the slowdowns in the economic cycle, called the “DLGD” (the LGD at the bottom of the cycle).

In the case of low default portfolios the Group uses a variety of techniques to estimate the LGDs, such as the use of LGD data from external studies or empirical estimates, either of groupings of low default portfolios (“LDPs”), or extrapolations of non-LDP portfolios.

Finally, the conversion factors or CCF are defined as the percentage of the undrawn balance that is expected to be used before the default. It tends to be estimated under a cohort approach based on the historically observed defaults.

A cohort is a 12-month window that has a reference date (close of each month) and contains all the non-performing transactions whose default date is within the cohort. All the transactions will need a contracting date before the reference date. A CCF is calculated in each cohort considering all the defaults included in it.

The approval of the models by the supervisor includes both own estimations of the probability of default (PD), loss given default (LGD) and the internal estimation of credit conversion factors (CCFs).

The Group maintains its calendar established for receiving approval for additional Advanced Internal Models in different risk classes and geographical areas.

The Group has rating tools for each one of the exposure categories listed in the Basel Accord.

The retail portfolio has scoring tools for determining the credit quality of transactions on the basis of information on the transaction itself and on the customer. The scoring models are algorithms estimated using statistical methods that score each transaction. This score reflects the transaction’s level of risk and is in direct relation to its probability of default (PD).

These decision models are the basic tool for deciding who should receive a loan and the amount to be granted, thereby contributing to both the arrangement and management of retail type loans.

For the wholesale portfolio, the Group has rating tools that, as opposed to scorings, do not assess transactions but rather, customers. The Group has different tools for rating the various customer segments: small companies, corporates, government and other government agencies, etc. In those wholesale portfolios where the number of defaults is very low (sovereign risks, corporates, financial institutions) the internal information is supplemented by the benchmarks of external rating agencies.

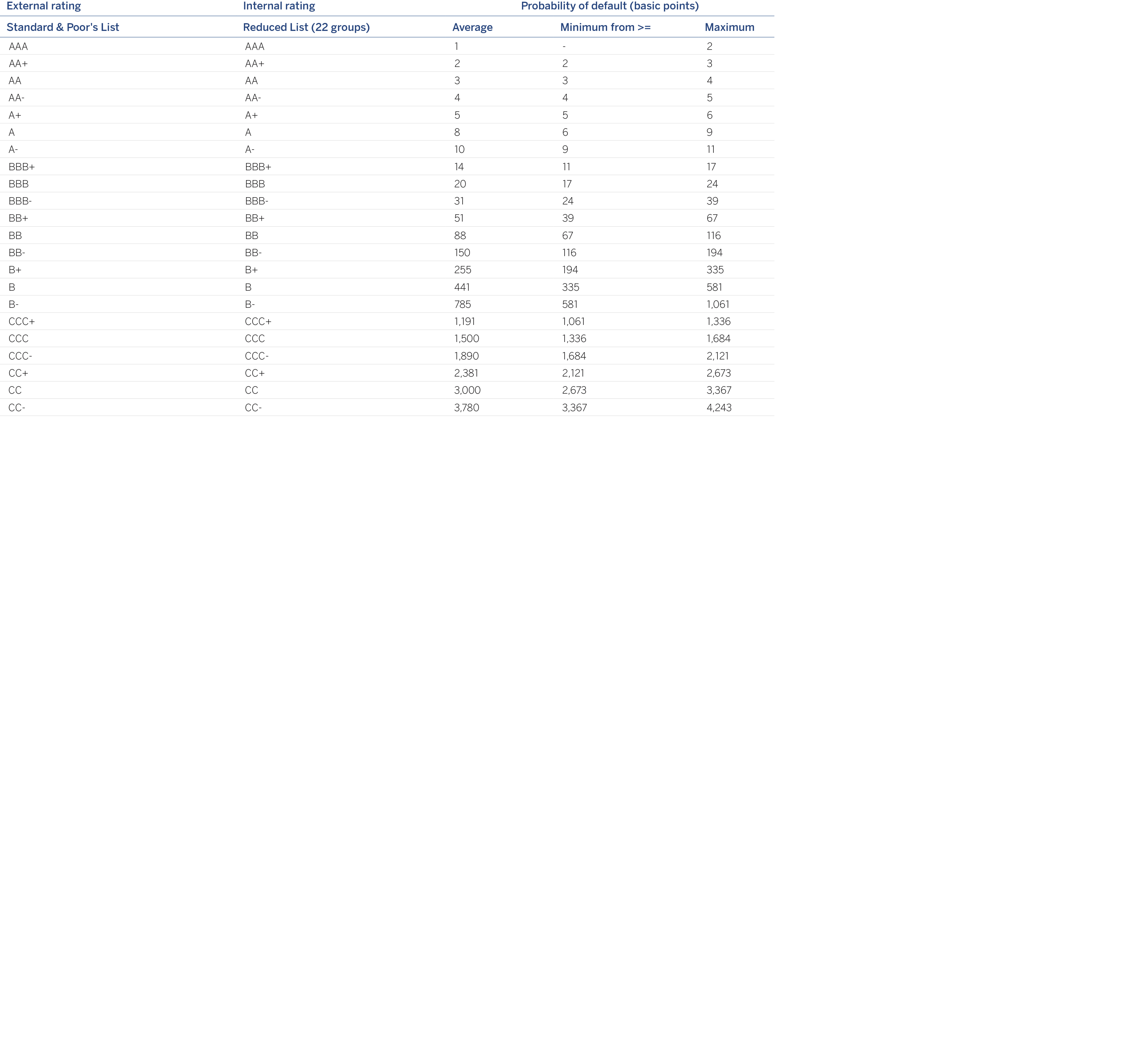

The PD estimates made by the Group are transferred to the Master Scale, enabling a comparison to be made with the scales used by external agencies. This is shown below.

The Group’s internal estimations are a vital component of management based on value creation, giving rise to criteria for assessing the risk-return trade-off.

These measures have a broad range of uses, from the adoption of strategic business decisions through to the individual admission of transactions.

Specifically, internal estimates are used in everyday business in support of credit risk management through their inclusion in admission and monitoring processes, as well as in the pricing of transactions.

The management use of performance metrics that consider expected loss, economic capital and risk-adjusted return enables the monitoring of portfolios and the assessment of non-performing positions, among others.

Mitigation is an iterative process whose purpose is to recognize the benefits of the existence of collateral and guarantees, ordering them from the highest to the lowest credit quality.

The Group uses risk mitigation techniques for exposures pertaining to the wholesale portfolio by replacing the obligor’s PD with that of the guarantor, in those cases in which the latter is eligible and their PD is lower than the obligor’s. Regarding processes of retail admission, the scoring contains the effect of the guarantor, and the recovery flows that are forthcoming throughout the cycle reflect the recoveries related to the guarantees associated with the contracts. This means that the effect of the guarantees is taken into account in the actual estimation of the loss given default for retail portfolios.

The entity carries out the control and monitoring of the rating systems and metrics for risk management for private individuals, SMEs and the self-employed, corporates and institutions. The activities are carried out, within certain analytical and qualitative fields, by carrying out periodic 360º monitoring of all impacts of the tools as well as their internal function in terms of efficiency and effectiveness.

Global understanding of the systems allows action plans to be established, with a follow-up to ensure their proper execution. The weaknesses of the rating tools are thus identified and managed. The monitoring function is the main driving force of new developments and evolving maintenance, which allow the business interests of the entity to be aligned with regulatory requirements and management needs within a framework of analytical, technical and technological capacities.

In general, there is a series of corporate management programs that establish the main lines and minimum contents determining the management and/or supervision of the different credit risk models, as well as defining the metrics for their correct control.

More specifically, these corporate management programs will be adjusted to each of the rating tools of a business area within a time horizon adapted to the nature of the tool.

Periodically, an overall monitoring and review of compliance with the thresholds agreed under the management program will be carried out to detect situations that could potentially require an adjustment to the models and/or credit policies and to take early corrective actions to minimize the impact of such situations.

Analysis, in the methodological sphere, is defined as the monitoring of the predictive capabilities of the models, backtesting calibration of the parameters, proper granularity and concentration, sample stability of input, as well as traceability, integrity and consistency.

The use of rating systems by the different areas is overseen from the context of integration in management. This context defines parameter sensitivity tests, stress-tests of estimates, proper use of the parameters in the portfolio management to facilitate decision-making, control of exposure without rating, risk policies and the framework for delegating tasks, structures of decision-making committees, implementation risk evaluation, proper technological environment, evaluation of the inclusion of the parameters in corporate applications, proper follow-up of the training of users to guarantee its proper implementation and full comprehension, follow-up of the correct structure and quality of documentation, as well as all other activities that ensure the proper use of management metrics.

Apart from the corporate management programs mentioned above, access to the internal rating systems is based on IT system-authorized profiles that ensure only the customer loan management supervisors can see the scoring and rating.

Control of the capital process is performed by risk units that are independent of the units that calculate the scoring and rating and which, therefore, are users of the internal rating system. These control mechanisms are established at different levels of the process, such as at input, execution and final outputs, and involve both the integrity of the data and their accuracy and correctness.

There follows a description of the internal classification processes according to each customer category:

Central banks and central governments: For this segment, the assignment of ratings is made by the Risk units appointed for this purpose, which periodically analyze this type of customers, rating them according to the parameters included in the corresponding rating model. There are 3 different methods currently in use for assigning country ratings: (i) ratings from external agencies, used for developed nations, emerging countries with elevated incomes and emerging countries where the Group has little risk, (ii) internal rating based on a proprietary tool used for emerging countries where the Group has an appreciable risk, and lastly (iii) the country risk ratings published by the Belgian export credit agency (which manages the quantitative model used by the OECD to assign its country risk ratings) for countries of marginal importance for the Group that have no external qualifications. Sovereign ratings are generated in local and foreign currency for all the tools, as well as a transfer rating, which evaluates the risk of inconvertibility/transfer restrictions.

In the case of emerging countries with presence of BBVA subsidiaries or branches, the rating in local currency is adjusted to that obtained by the emerging countries’ tool under the authorization of the Risk Committee assigned for this purpose.

Institutions: The rating of Public Institutions is generally provided by the risk units responsible for their approval, on a yearly basis, coinciding with the review of customer risk or with the reporting of their accounts.

In the case of Financial Institutions, the Risk unit responsible makes a regular assessment of this type of customer, continuously monitoring their evolution on domestic and international markets. External ratings are a key factor in assigning ratings for financial institutions.

Large Companies: Includes the rating of exposures with corporate business groups. The result is affected both by indicators of business risk (evaluation of the competitive environment, business positioning, regulation, etc.) and financial risk indicators (size of the group by sales, cash generation, levels of debt, financial flexibility, etc.).

In accordance with the characteristics of the large companies segment, the rating model is global in nature with specific algorithms by sector of activity and geographical adaptations. The rating of these customers is generally calculated within the framework of the annual risk review process, or the admission of new operations.

The responsibility for the assessment lies with the units originating the risk, while those approving it validate it when the decision is taken.

Medium-sized companies: This segment also takes into account quantitative factors derived from economic and financial information, and qualitative factors that are related to the age of the company, the sector, management quality, etc. and alert factors derived from risk monitoring.

As in the Corporate segment, the rating tends to run parallel to the admission process, so the responsibility for rating lies with the unit proposing the risk, while the decisionmaking level is in charge of validating it.

Small Businesses: As in the case of medium-sized companies, this segment also takes into account quantitative factors derived from economic and financial information, and qualitative factors that are related to the age of the company, the sector, management quality, etc. and alert factors derived from risk monitoring. Similarly, the rating tends run parallel with the admission process, so the responsibility for rating is with the unit proposing the risk, while the decision-making level is in charge of validating it.

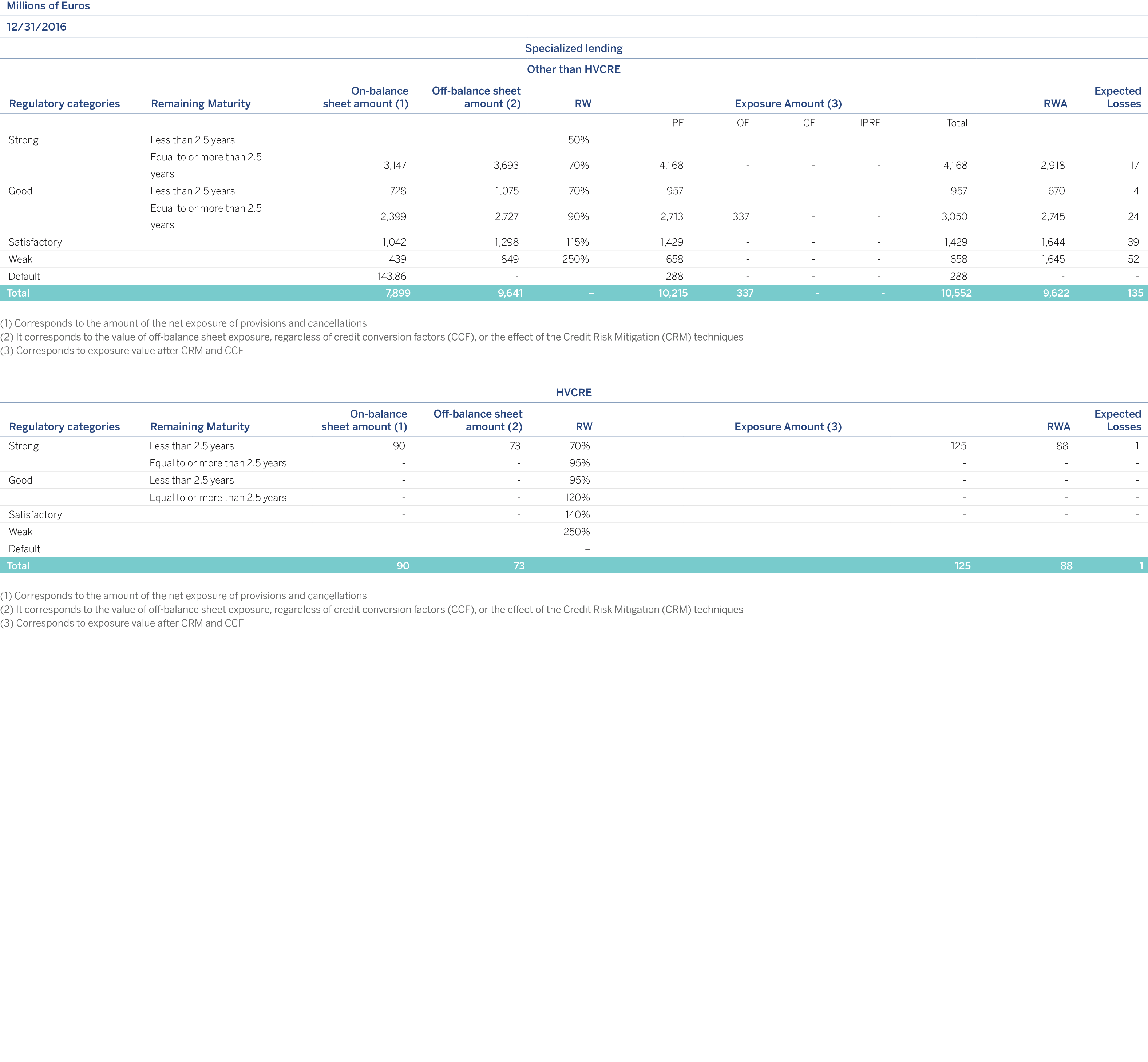

Specialist Lending: For classifying this segment, the Group has chosen to apply the supervisory slotting criteria approach, as included in the Basel Accord of June 2004 and in the Solvency Regulations (CRR article 153.5).

Developers: The rating of real-estate developers allows the rating of both the customers who are developers and the individual real-estate projects. Its use makes it easier to monitor and rate projects during their execution phase, as well as enriching the admission processes.

BBVA Bancomer companies: This segment also takes into account quantitative factors derived from economic and financial information and bureau information, as well as qualitative factors related to the age of the company, the sector, the quality of its management, etc. The rating tends to run parallel to the admission process, so that responsibility for the rating is with the unit originating the risk, while the decisionmaking body validates it.

In general in the wholesale area, the rating of customers is not limited to admission, as the ratings are updated according to new information available at any time (economic and financial data, changes in the company, external factors, etc.)

Retail: This has been broken down into each one of the exposure categories referred to by the correlations provided for in the sections defined in the Solvency Regulations.

One of the most important processes in which scoring is fully integrated at the highest level and in all decision-making areas is the Group’s process for approving retail transactions. Scoring is an important factor for the analysis and resolution of transactions and it is a mandatory requirement to include it in decision-making on risk in those segments for which it has been designed. In the process of marketing and approving retail transactions, the manager is responsible for marketing management, the credit quality and the profitability, in other words, the customer’s comprehensive management, attending to the processes of admission, monitoring and control.

The rating process is as follows for each specific category of retail exposure:

Mortgages, consumer finance and retail credit cards - Spain: The manager collects data on the customer (personal, financial, banking relationship information) and on the operation (LTV, amount, maturity, destination etc.) and calculates the rating of the transaction with the scoring. The decision of whether it is approved is made based on the results issued by the model.

Consumer Finance Autos Spain: The financing application may enter through the call center or be directly recorded in web application by our authorized dealers. The necessary information on the customer (personal, financial information, authorization of the consult from the external bureau of credit) and on the transaction (maturity, amount, etc.) is recorded to rate the transaction with the scoring. Once the validity of the information provided is obtained, the decision of whether to approve it is made based on the results issued by the model.

Retail Revolving (BBVA Bancomer credit cards): The manager or specialist party gathers the necessary information on the customer (personal, financial information and authorization of the consult from the external bureau of credit) and on the transaction (limit requested) to rate the transaction with the scoring. There are additional processes for validating and checking this information through the back office or operational support areas. The decision of whether it is approved is made based on the results issued by the model.

Behavioral: Every month all the active cards are rated according to their transactional behavior and payment status.

Proactive: Each month all the customers who have asset positions in credit cards, consumer finance or mortgages and liabilities positions are rated, based on information on internal behavior and flows.

Proactive - Spain: Each month all the customers who have asset positions in credit cards, consumer finance or mortgages and liabilities positions in credit cards and consumer finance, are rated according to information on their behavior.

Equity: For its portfolio position registered as equity, the Group is applying the rating obtained for the customer as a result of their classification in the lending process.

The estimation of the parameters is based on the uniform definition of default established at Group level. Specifically, for a contract or customer to be considered in a situation of default, the provisions of current regulations must be met.

Specifically, there are two approaches within the Group for considering default and estimating parameters:

The contract-level approach is applied within the sphere of retail risk. Each customer transaction is dealt with as an independent unit in terms of credit risk. Therefore, non-compliance with credit obligations to the bank is handled at the transaction level, regardless of the behavior of the customer with respect to other obligations.

The customer-level approach is applied to the remainder of the portfolio. The significant unit for defining default is the customer’s sum of contracts, which enter a situation of default en masse when the customer defaults.

In addition, to avoid including defaults for small amounts in the estimations, defaulted volumes are to pass through a materiality filter that depends on the type of customer and transaction.

Estimating parameters

In the case of Spain and Mexico, the Group has a RAR information system that reflects exposure to credit risk in the Group’s different portfolios included in advanced internal models.

This information system guarantees the availability of historical data recorded by the Group, which are used to estimate the parameters of Probability of Default (PD), Loss Given Default (LGD) and Credit Conversion Factors (CCF). These are then used to calculate the regulatory capital using the advanced measurement approach, economic capital and expected loss by credit risk.

Other sources of information for the Bank may be used in addition, depending on any new needs detected in the estimation process. Internal estimations of the PD, LGD and CCF parameters are made for all the Group’s portfolios.

In the case of low default portfolios (LDP), in which the number of defaults tends to be insufficient for obtaining empirical estimates, use is made of data from external agencies that are merged with the internal information available and expert criteria.

The following shows the estimation methodologies used for the PD, LGD and CCF risk parameters, for the purpose of calculating the capital requirements.

The methodology used for estimating the PD in those cases that have a mass of internal data of sufficient size is based on the creation of pools of exposures. The groups proposed with a view to calibration are defined by pooling contracts together seeking to achieve intragroup uniformity in terms of credit quality and differentiation with all the other risk groups. The largest possible number of pools is defined in order to allow a suitable discrimination of risk.

The basic metric used for making these groupings is the score, being supplemented by other metrics relevant to PD that are proven to be sufficiently discriminating depending on the portfolio.

Once the pools of exposures have been defined, the average empirical PD recorded for each one is obtained and adjusted to the cycle. This metric provides stable estimates over the course of the economic cycle, referred to as PD-TTC (Through the Cycle). This calculation considers the portfolio’s track record and provides long-term levels of PD.

In low default portfolios (LDPs) the empirical PDs observed by external credit assessment institutions are used to obtain the PD of internal risk groups.

Finally, in customer-focused portfolios there is a Master Scale, which is simply a standard and uniform rule for credit levels that makes it possible to make comparisons of credit quality in the Group’s different portfolios.

As a general rule, the method used to estimate the severity in portfolios with a sufficient number of defaults is Workout LGD Here, the LGD of a contract is obtained as a quotient of the sum of all the financial flows recorded during the recovery process that takes place when a transaction defaults, and the transaction’s exposure at the time of the default.

This estimate is made by considering all the historical data recorded in internal systems. When making the estimates, there are transactions that have already defaulted but for which the recovery process is still ongoing. The loss given default recorded at the time of the estimate is therefore higher than it will ultimately be. The necessary adjustments are made in these cases so as not to distort the estimate.

These estimates are made by defining uniform risk groups in terms of the nature of the operations that determine loss given default. They are made in such a way that there are enough groups for each one to be distinguishable and receive a different estimate.

In keeping with the guidelines set out by the rules, the estimates are made by distinguishing between wholesale and retail type exposures.

There is insufficient historical experience to make a robust estimation in low default portfolios (LDP) using the Workout LGD method, so external sources of information are used, combined with internal data to provide the portfolio with a representative rate of loss given default.

The loss given default rates estimated according to the internal databases the Group holds are conditioned to the moment of the cycle of the data window used, since loss given default varies over the economic cycle. Hence, two concepts can be defined: long-term loss given default, referred to as Long-Run LGD (LRLGD), and loss given default in a period of stress in the cycle, called Downturn LGD (DLGD).

LRLGD is calculated by making an adjustment to capture the difference between the loss given default obtained empirically with the available sample and the average loss given default observed throughout the economic cycle if the observation is complete.

In addition, the LGD observed in a period of stress in the economic cycle (DLGD) is determined.

These estimates are made for those portfolios whose loss given default is noticeably sensitive to the cycle. The different ways in which the recovery cycles can conclude are determined for each portfolio where this LGD in conditions of stress has not yet been observed, and the level these parameters would have in a downturn situation are estimated.

As with the two preceding parameters, the exposure at the moment of default is another of the necessary inputs for calculating expected loss and regulatory capital. A contract’s exposure usually coincides with its balance. However, this does not hold true in all cases.

For example, for those products with explicit limits, such as credit cards or credit lines, the exposure should incorporate the potential increase in the balance that may be recorded up to the time of default.

In observance of regulatory requirements, exposure is calculated as the drawn balance, which is the real risk at any specific moment, plus a percentage (CCF) of the undrawn balance, which is the part that the customer can still use until the available limit is reached. Therefore, the CCF is defined as the percentage of the undrawn balance that is expected to be used before default occurs.

CCF is estimated by using the cohort approach, analyzing how the exposure varies from a pre-established reference date through to the moment of default, obtaining the average performance according to the relevant metrics.

Different approaches are used for wholesale and retail type exposures. The contract approach analyzes the exposure’s evolution until the contract’s moment of breach of contract, whereas the customer approach analyzes the exposure’s evolution through to the moment of breach by the customer.

Once again, in low default portfolios (LDP) there is insufficient historical experience to make a reliable calculation with the Workout LGD method defined. In this case, too, use is made of external sources that are combined with internal data to provide a representative CCF of the portfolio.

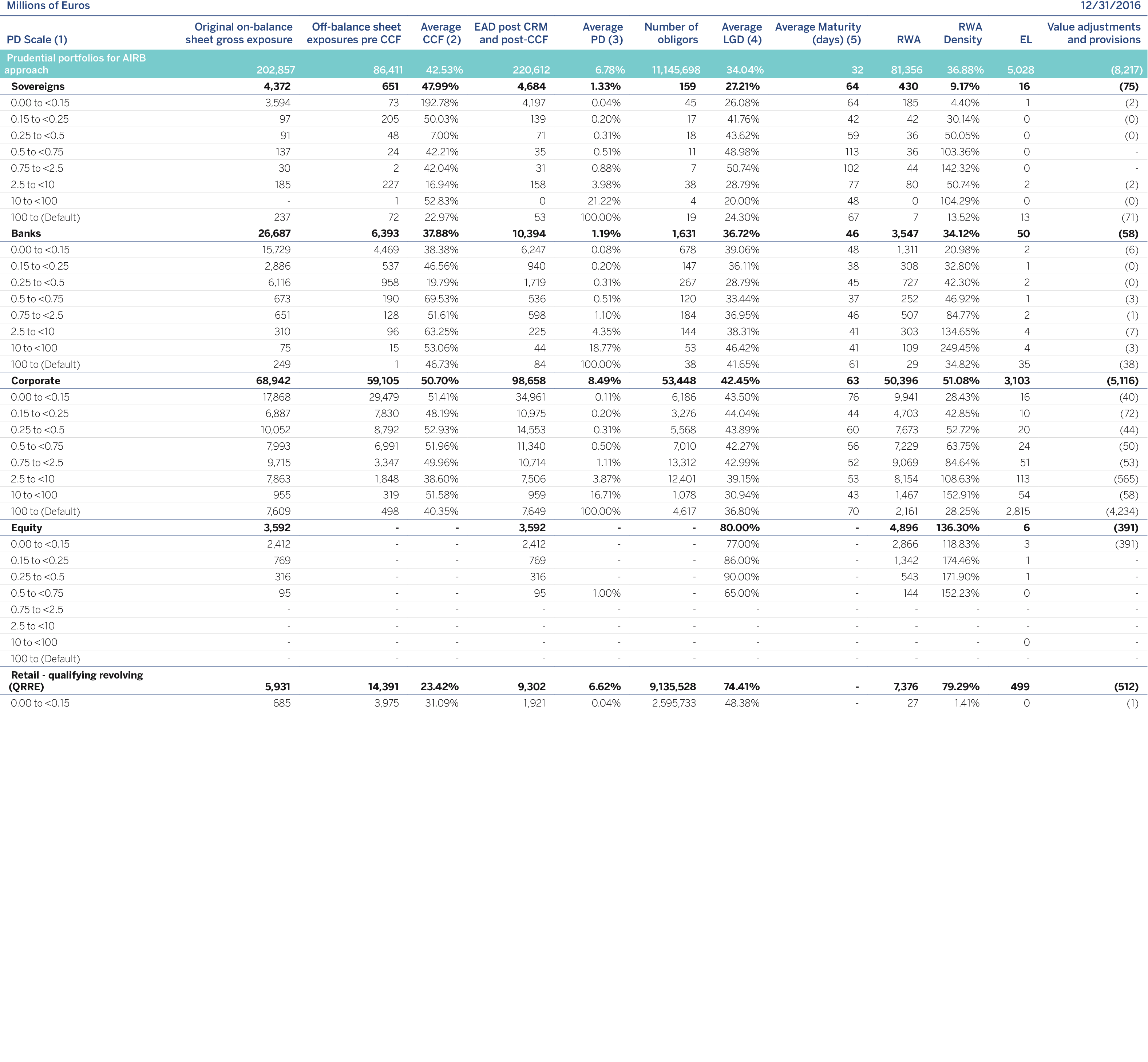

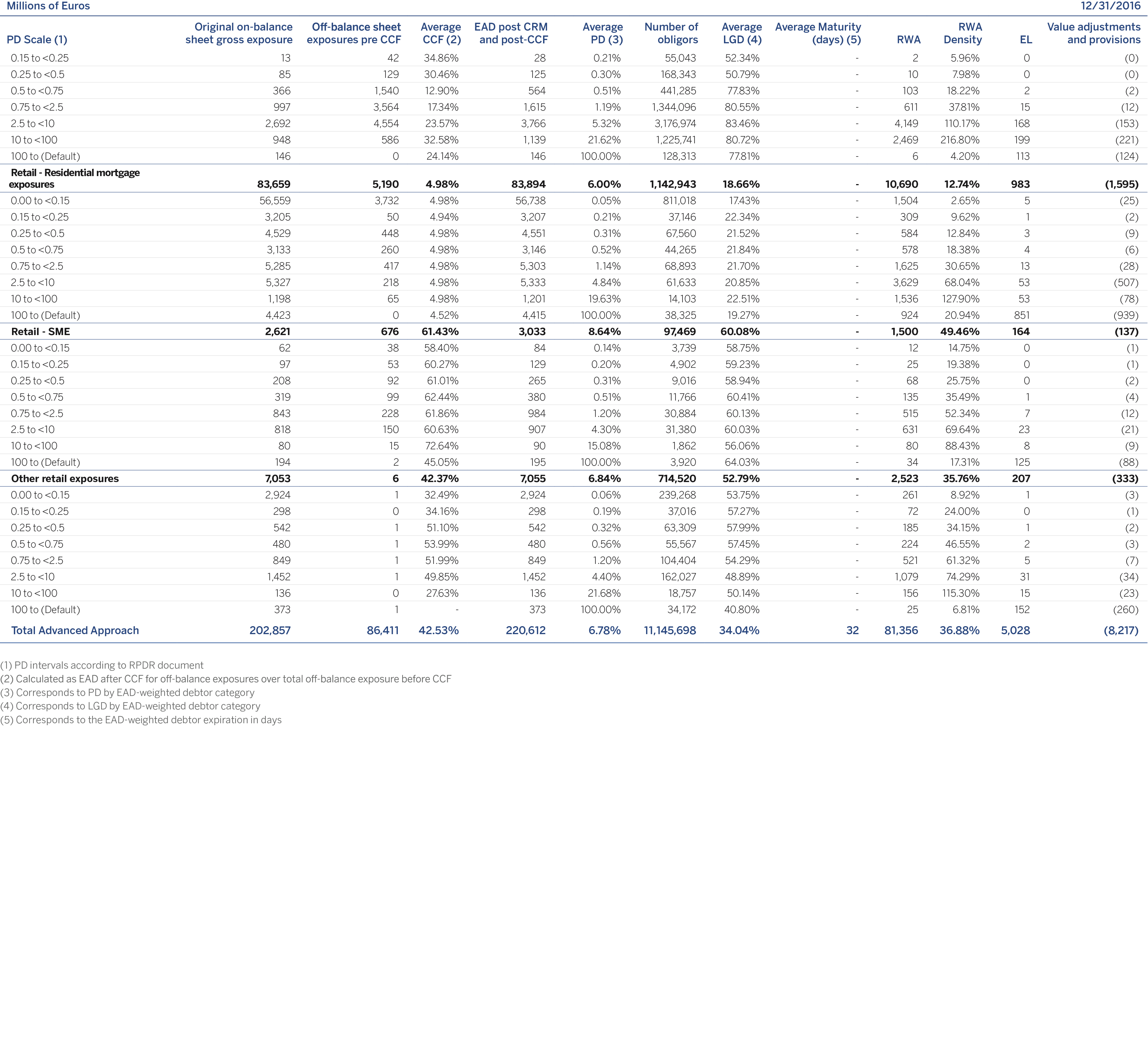

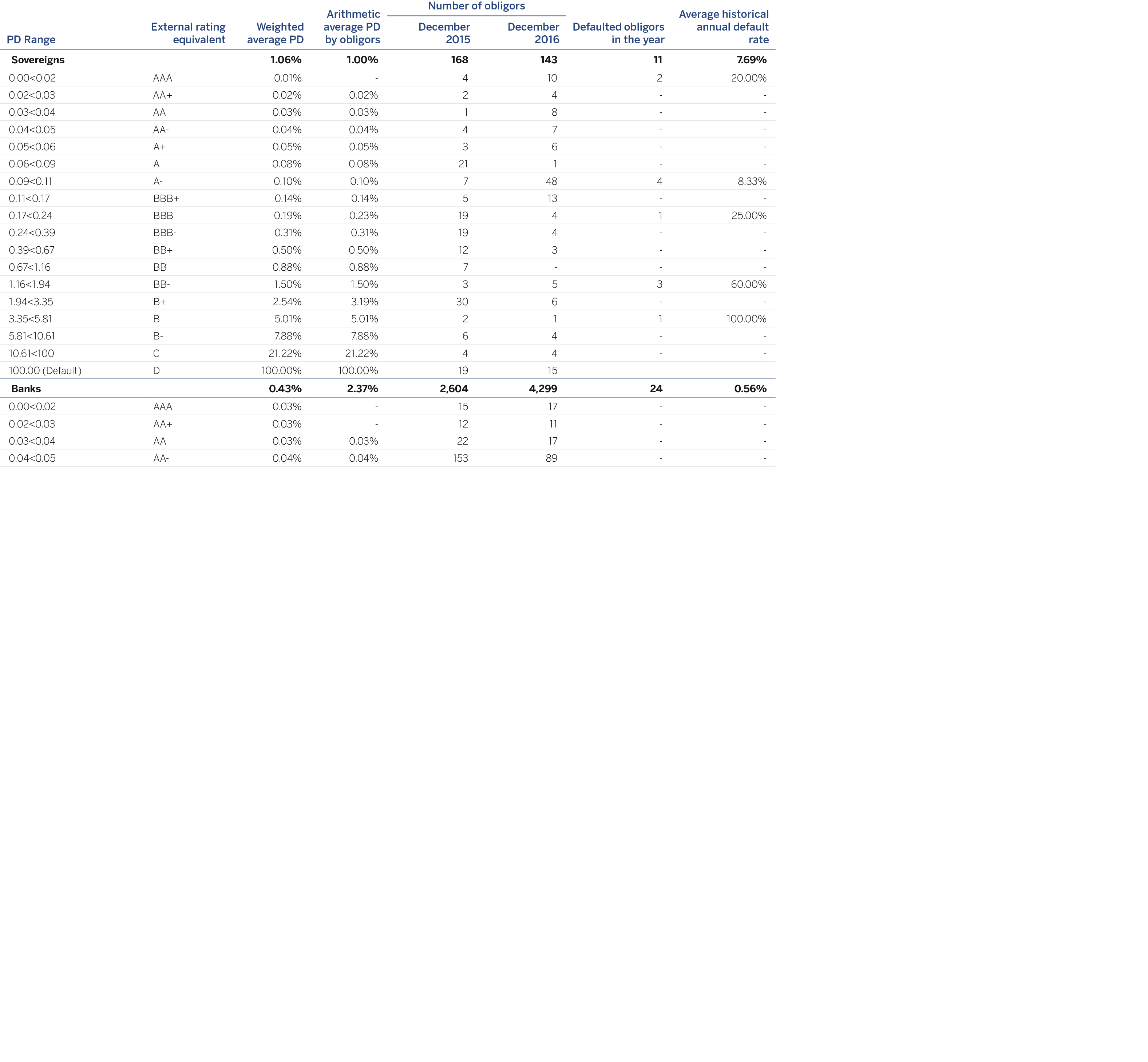

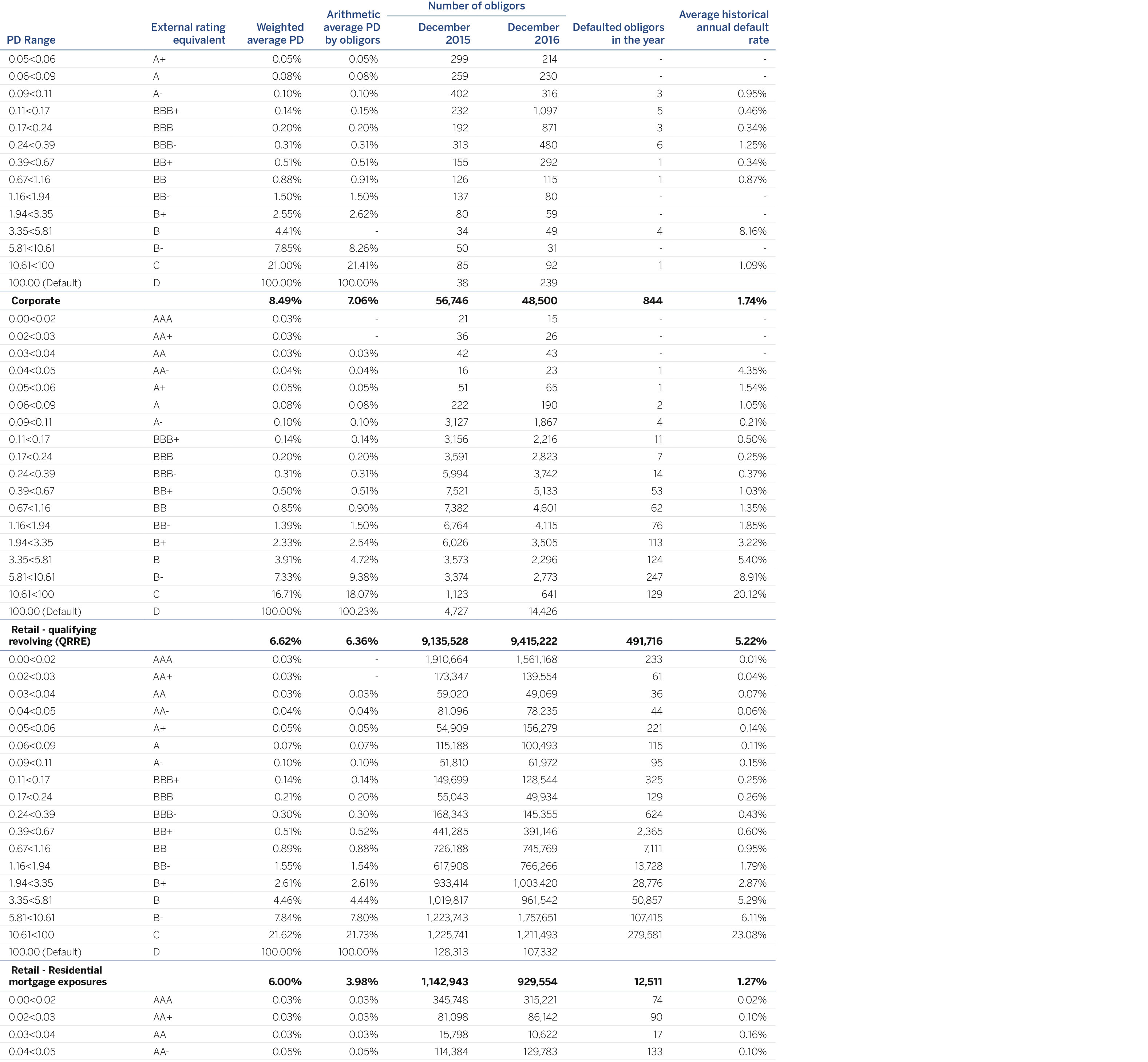

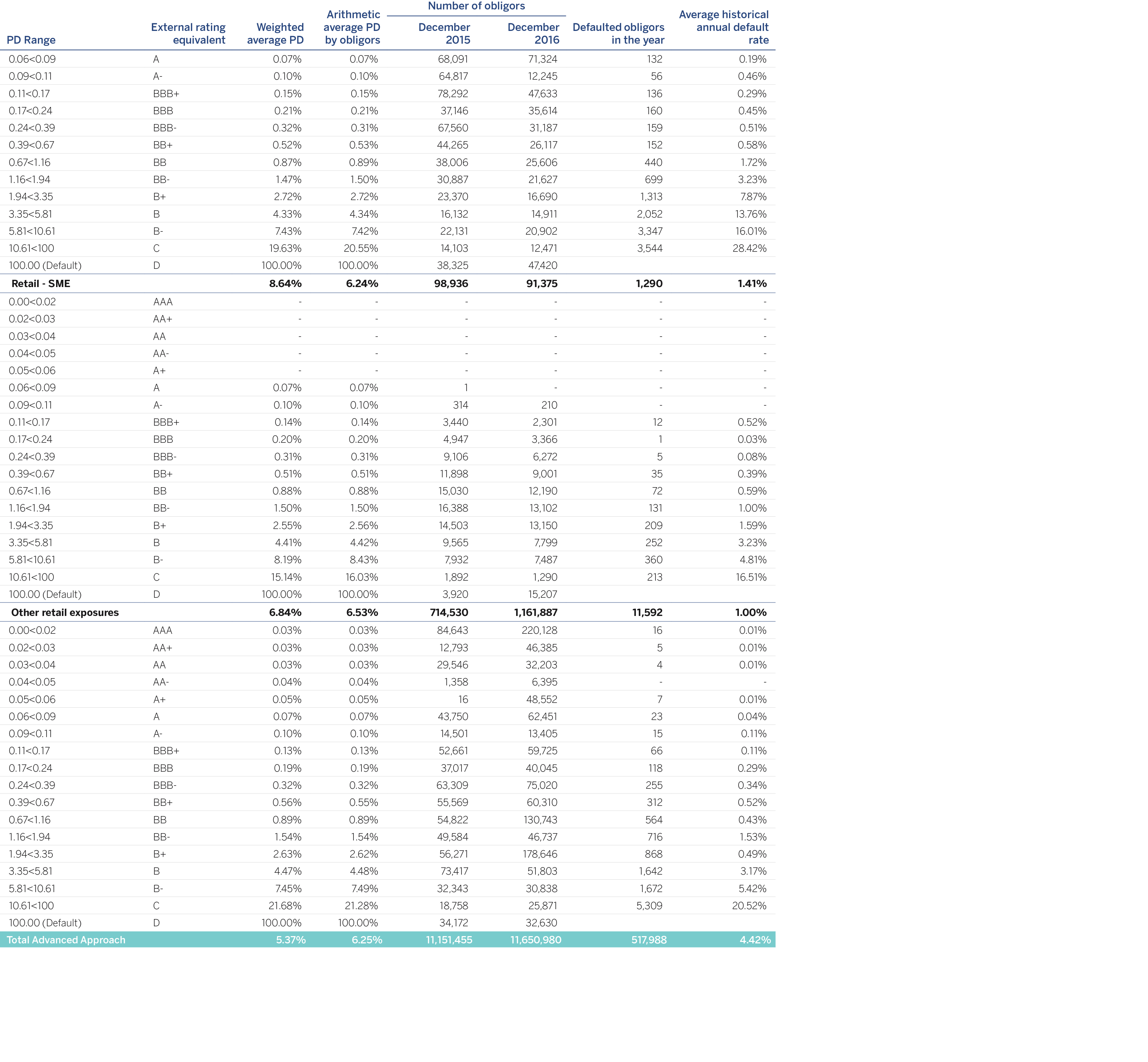

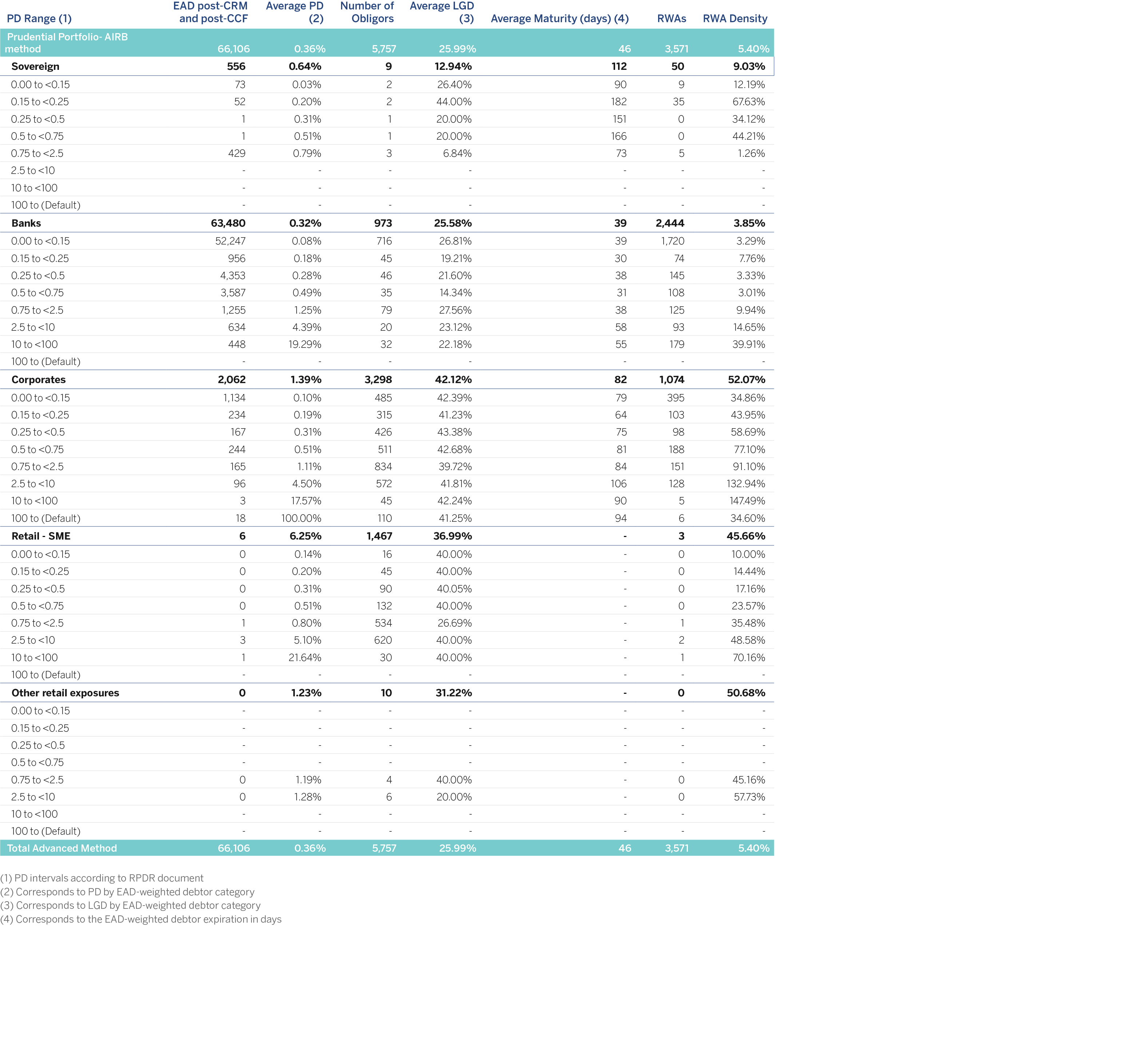

The following table shows the credit risk information as of December 31, 2016 (excluding counterparty credit risk which is detailed in table CCR4 of section 3.2.6.2.2; and specialized lending that follows the supervisory slotting criteria as explained in section 3.2.5.1.6) under the internal ratings based (IRB) method by level of obligors for the different exposure categories:

With the aim of providing backtesting data to validate the reliability of PD calculations, the table below gives a comparison of the PDs used in IRB capital calculations with the effective default rates of the Group’s obligors for credit and counterparty credit risks.

Specifically, the table compares the PD used in calculating capital by the advanced approach with the effective default rates of obligors.

The structure of the table is that recommended by the Basel Committee on Banking Supervision (BCBS) in its Revised Pillar 3 Disclosure Requirements. However, some flexibility is permitted in its interpretation.

The criteria adopted for presenting the information of the table are as follows:

Portfolio: The breakdown of the portfolios corresponds to that recommended by the RPDR, excluding the equity positions.

PD scale: Corresponds to the master rating scale in section 3.2.5.1.2 (Table 26).

External rating equivalent: Uses the equivalence between the PDs and the external ratings described in section 3.2.1.5.1.2.

Weighted PD and arithmetic average PD by obligors: Uses the PD after mitigation techniques i.e. that associated with guarantors.

Number of obligors: Presents the obligors at the close of the year and at the close of the previous year.

Defaulted obligors: For the purpose of guaranteeing the traceability of the table, columns “g” and “h” of the table included in the RPDR have been combined to report the information on transactions/customers that defaulted at some time in the last 12 months, so that the defaulted debtors in the last year are shown for each PD interval, except for the 100%-Default range.

Default rate: This presents the annual default rate, which is calculated as the defaults in the year divided by the total number of obligors the previous year.

The information contained in the above tables is set out below in graphic format (including counterparty credit risk):

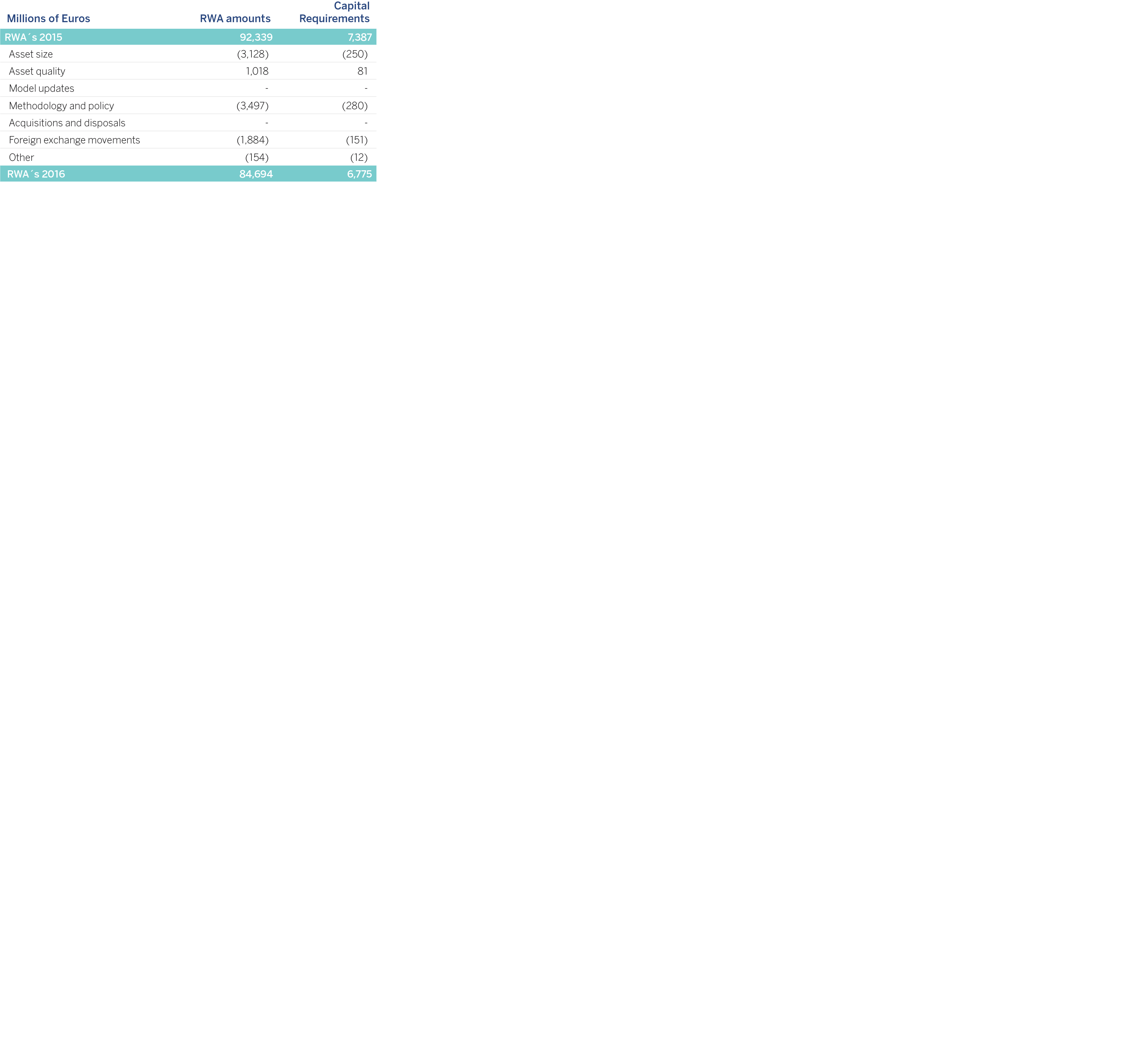

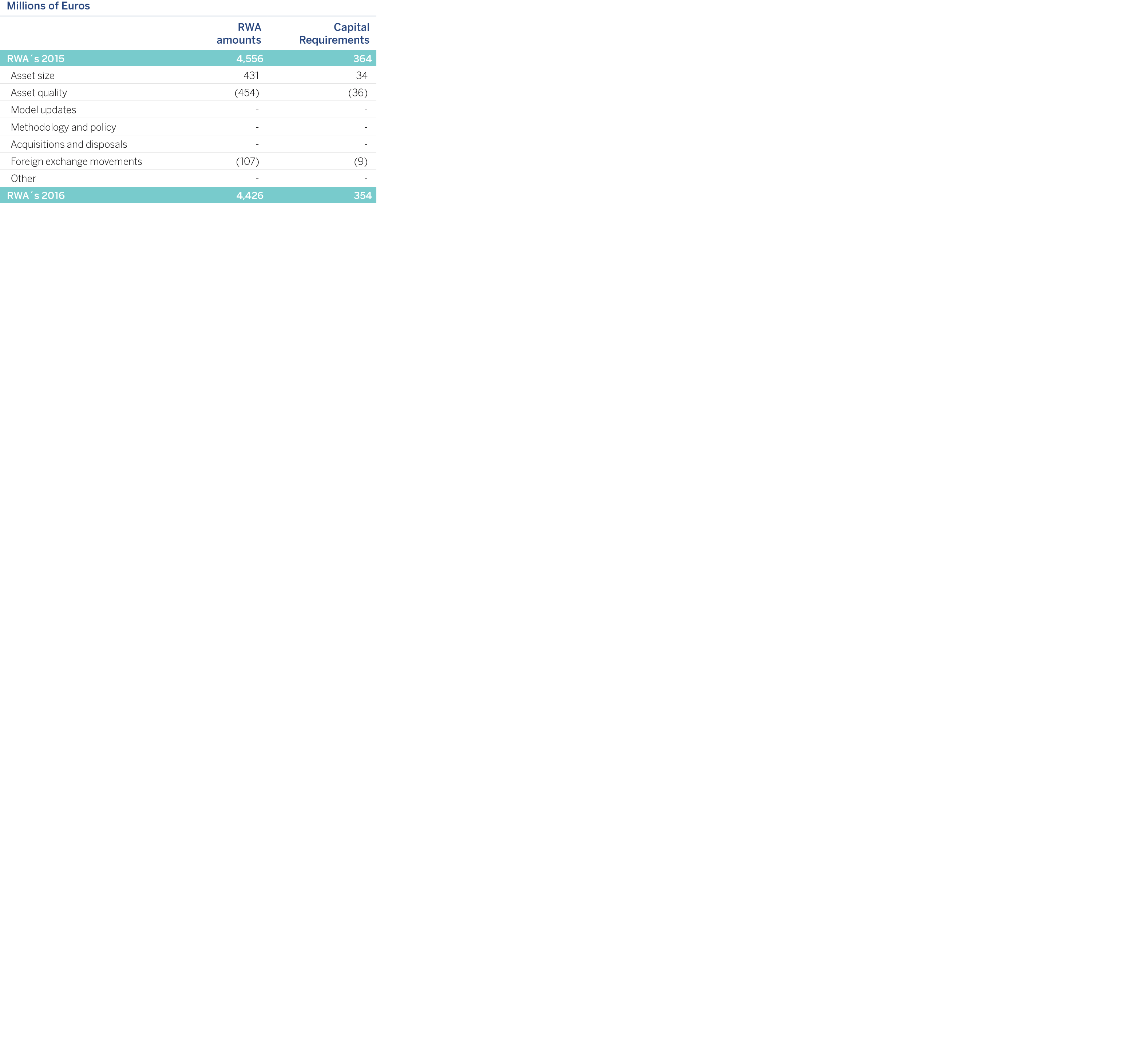

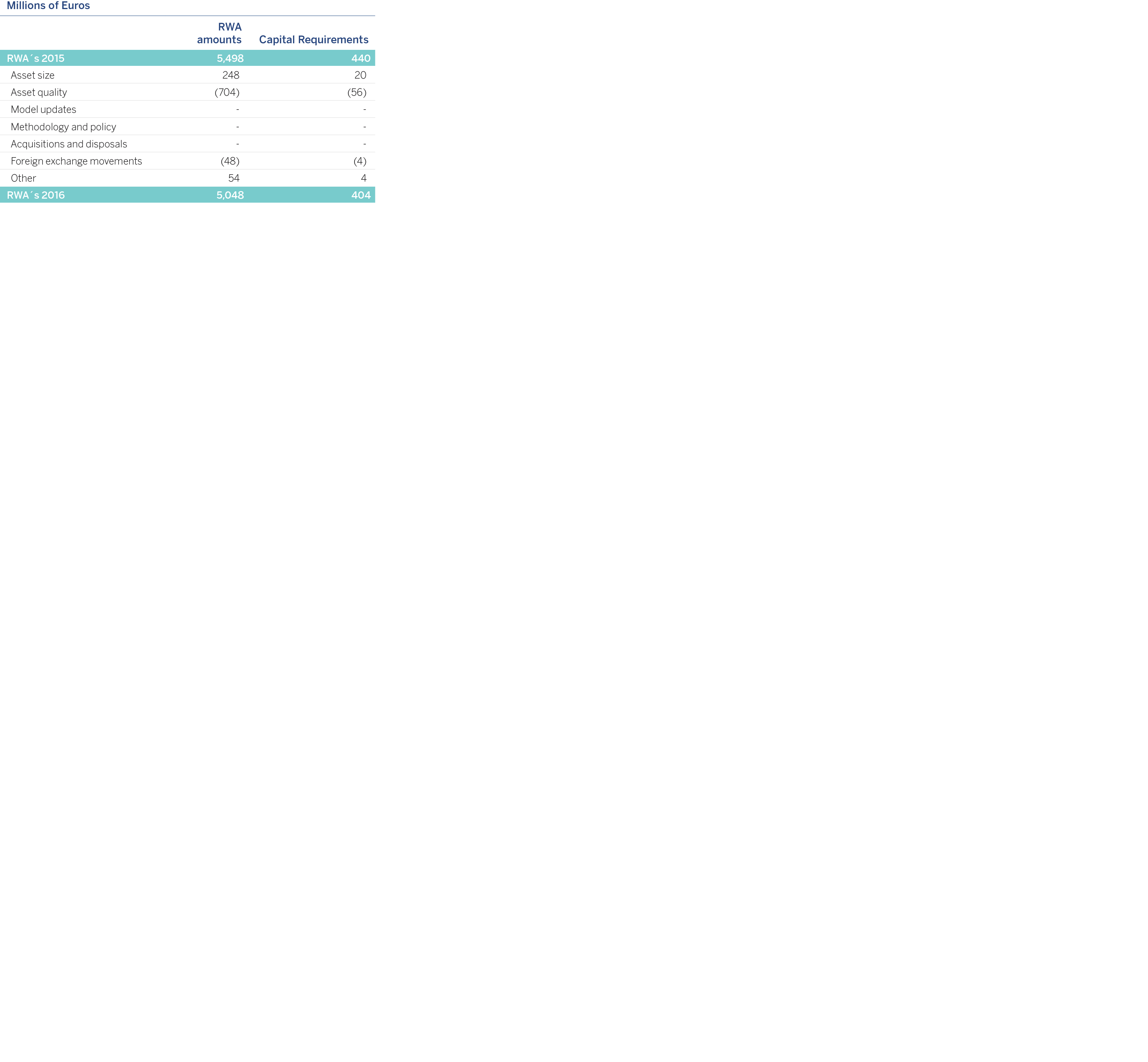

The following table presents the main variations in the year in terms of RWAs for the Credit Risk advanced measurement approach:

The following are the main variations in the credit risk-weighted assets in 2016, determined by the advanced measurement approach:

Asset size:There has been a drop in the exposures calculated by the advance measurement approach owing to the general deleveraging of credit exposure that has occurred in Spain, particularly in retail exposure secured by real estate collateral, which has in part been offset by the good loan-book behavior in Bancomer.

Methodology and policies:There has been a drop of approximately 3.6 million euros in exposure to Autonomous Communities and Local Authorities in Spain, which have sovereign guarantees, in accordance with article 56 of Royal Decree 84/2015 dated February 13, which implements Act 10/2014, dated June 26, on the regulation, supervision and solvency of credit institutions. This reduction includes the part from integrating Catalunya Caixa.

Currency movements:There has been a general depreciation of currencies that has reduced the amount of risk exposure for the corresponding Group subsidiaries. In this case, the exposure reduction in currency movements can practically entirely be put down to the depreciation of the Mexican peso against the euro.

The following charts compare the expected loss adjusted to the cycle calculated according to the Group’s core internal models approved by the Bank of Spain, with the effective loss incurred between 2001 and 2016. They also present the average effective loss between 2001 and 2016 in accordance with the following:

Estimated expected loss calculated with the internal models calibrated to 2016 2, and adjusted to the economic cycle (light green line), i.e. the annual average expected loss in an economic cycle.

Effective loss (light blue dotted line) calculated as the ratio of gross additions to NPA over the average observed exposure multiplied by the estimated point in time severity3.

Effective average loss (2001-2016), which is the average of effective losses for each year (light blue solid line).

The effective loss is the annual loss incurred. It must be less than the expected loss adjusted to the cycle in the best years of an economic cycle, and greater during years of crisis.

The comparison has been made for the portfolios of Mortgages, Consumer Finance Credit Cards and (2004-2015) Autos (retail), and SMEs and Developers (2009-2015), all of them in S&P. In Mexico, the comparison has been carried out for the Credit Card portfolio (2005-2016 window) and SMEs and Large Companies (2005-2016 window). Regarding the categories of Institutions (Public and Financial Institutions) and Corporate, historical experience shows that there is such a small number of defaulted exposures (Low Default Portfolios) that it is not statistically significant, and hence the reason the comparison is not shown.

The charts show that during the years of biggest economic growth, in general the effective loss was significantly lower than the expected loss adjusted to the cycle calculated using internal models.

The contrary was the case after the start of the crisis. This is in line with the major economic slowdown and the financial difficulties of households and companies, above all in the case of developers and construction companies.

The fact that in some portfolios the average observed loss is greater than the estimated loss is coherent with the fact that the observed time window may be worse than what would be expected in a complete economic cycle. In fact, this window has fewer expansive years (6) than crisis years (10). This is not representative of a complete economic cycle.

Starting in 2007, the effective losses are above the expected loss adjusted to the cycle, as they are losses incurred in years of crisis. The effective losses are slightly greater than the cycle-adjusted figures given the sampled number of years entailing more years of crisis than growth.

The chart shows that during the years of biggest economic growth the effective loss was lower than the expected loss adjusted to the cycle calculated using internal models. The contrary was the case starting in 2007. This is in line with the major economic slowdown and the financial difficulties of households. For 2016 a loss is expected in accordance with the loss adjusted to the cycle.

As in the case of Mortgages and Consumer Finance, the observed loss is lower than the Expected Loss adjusted to the cycle calculated using internal models at best periods of the cycle, and higher during its worst periods.

In the case of the Automobile portfolio, the expected loss adjusted to the cycle continues to be higher than the average effective losses for the last fifteen years, which suggests the conservative nature of the estimate.

Due to a methodological change in the estimate of LGD, only the expected loss for the 2009-2015 window is shown for the SME and Developer portfolios. It can be seen that since 2009 the observed losses are much higher than the average expected losses in the cycle. This is because the major difficulties suffered by companies in the years of crisis, particularly those in the Construction and Developer businesses.

The PD series is shown below for these very same portfolios, with the data from 2002 to 2016. Similar to the remaining portfolios, the observed series is much lower than the one adjusted to the cycle until 2007, calculated with the internal models in the best moments of the cycle, and greater during the lowest moments.

In the case of Bancomer's credit cards portfolio we can see how the average Expected Loss for the cycle calculated using internal models is below the average observed losses. The reason is the use of an observation window which is unrepresentative of a complete economic cycle (the estimate would be considering comparatively more years of crisis than of economic growth).

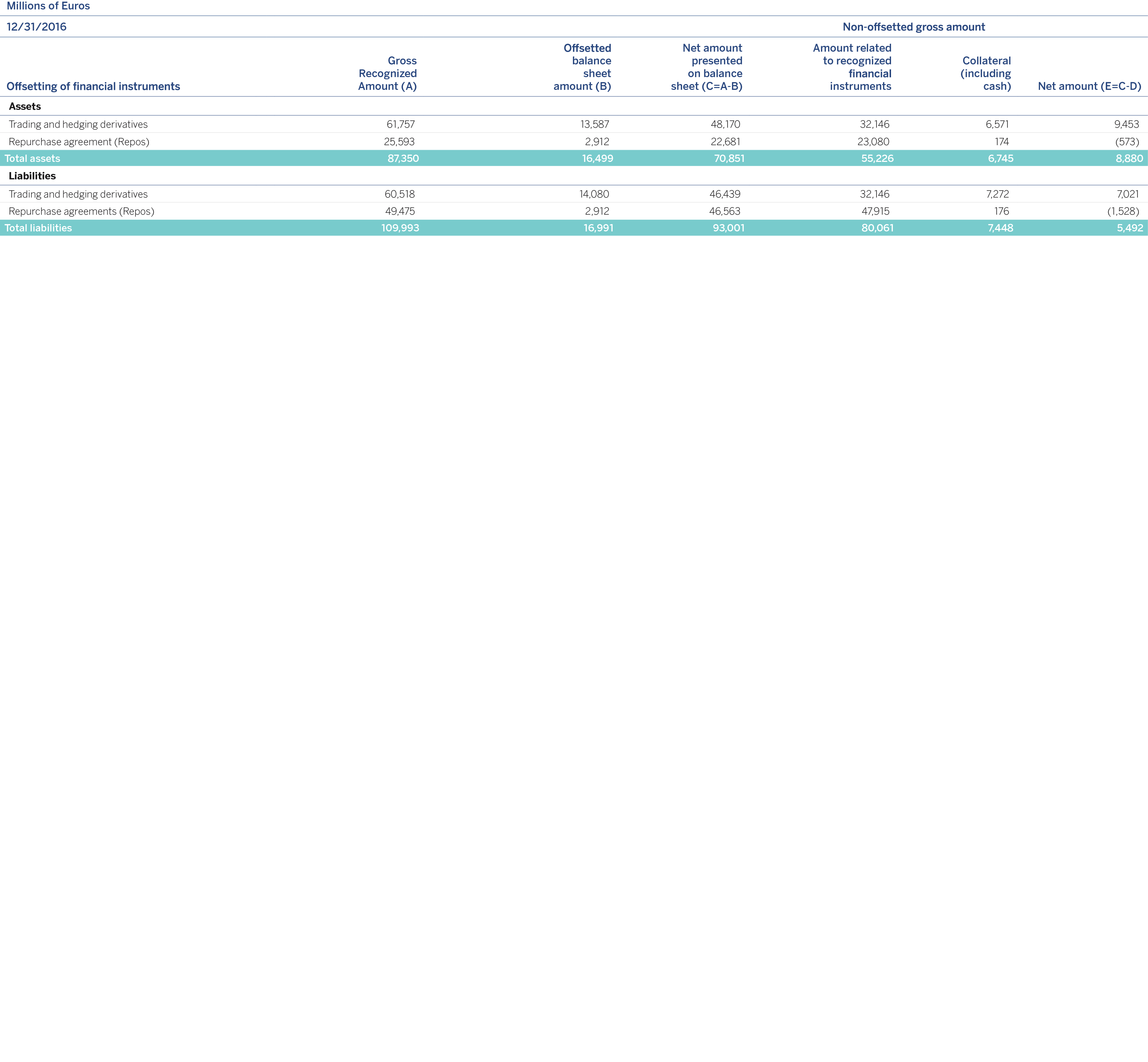

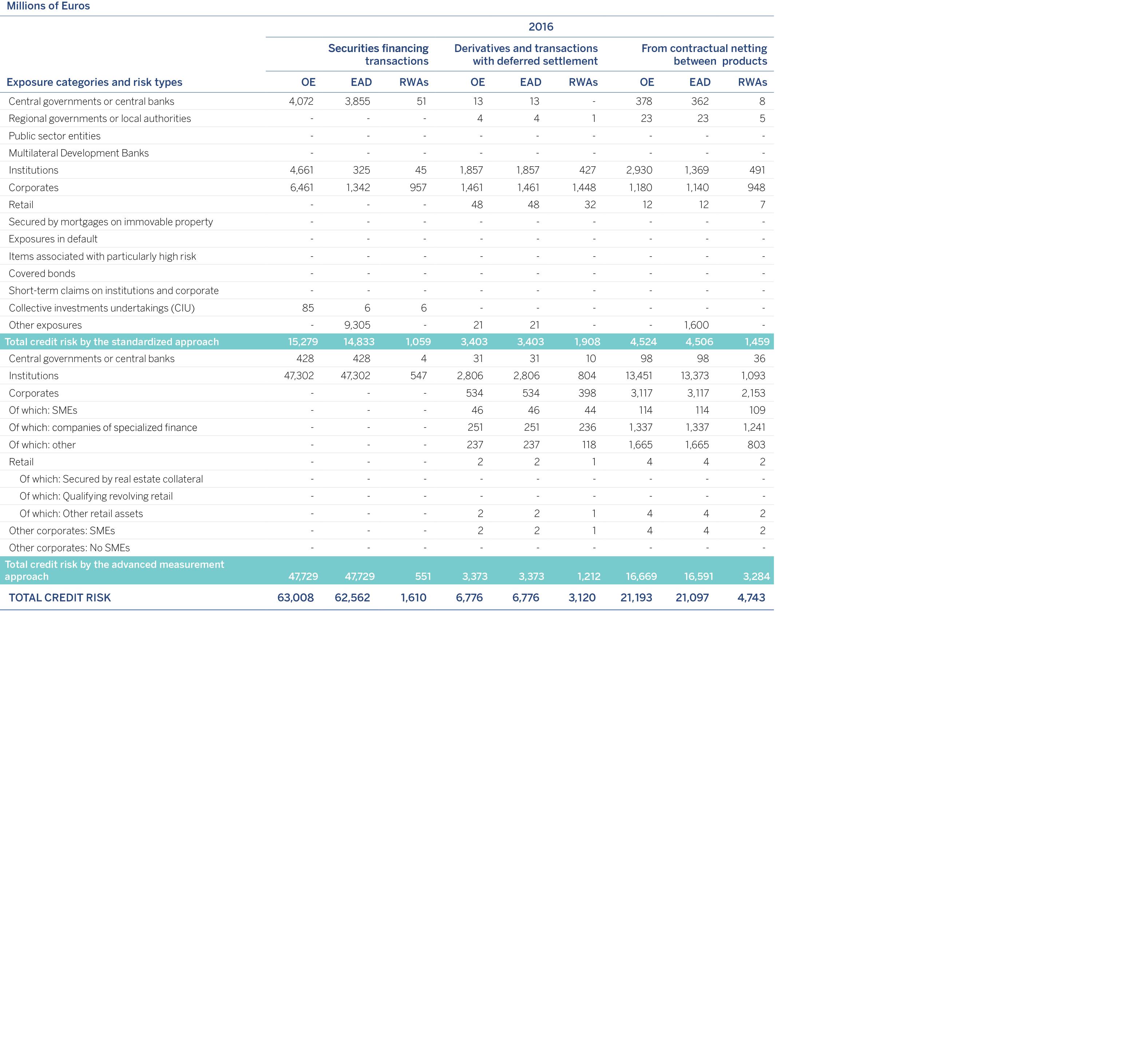

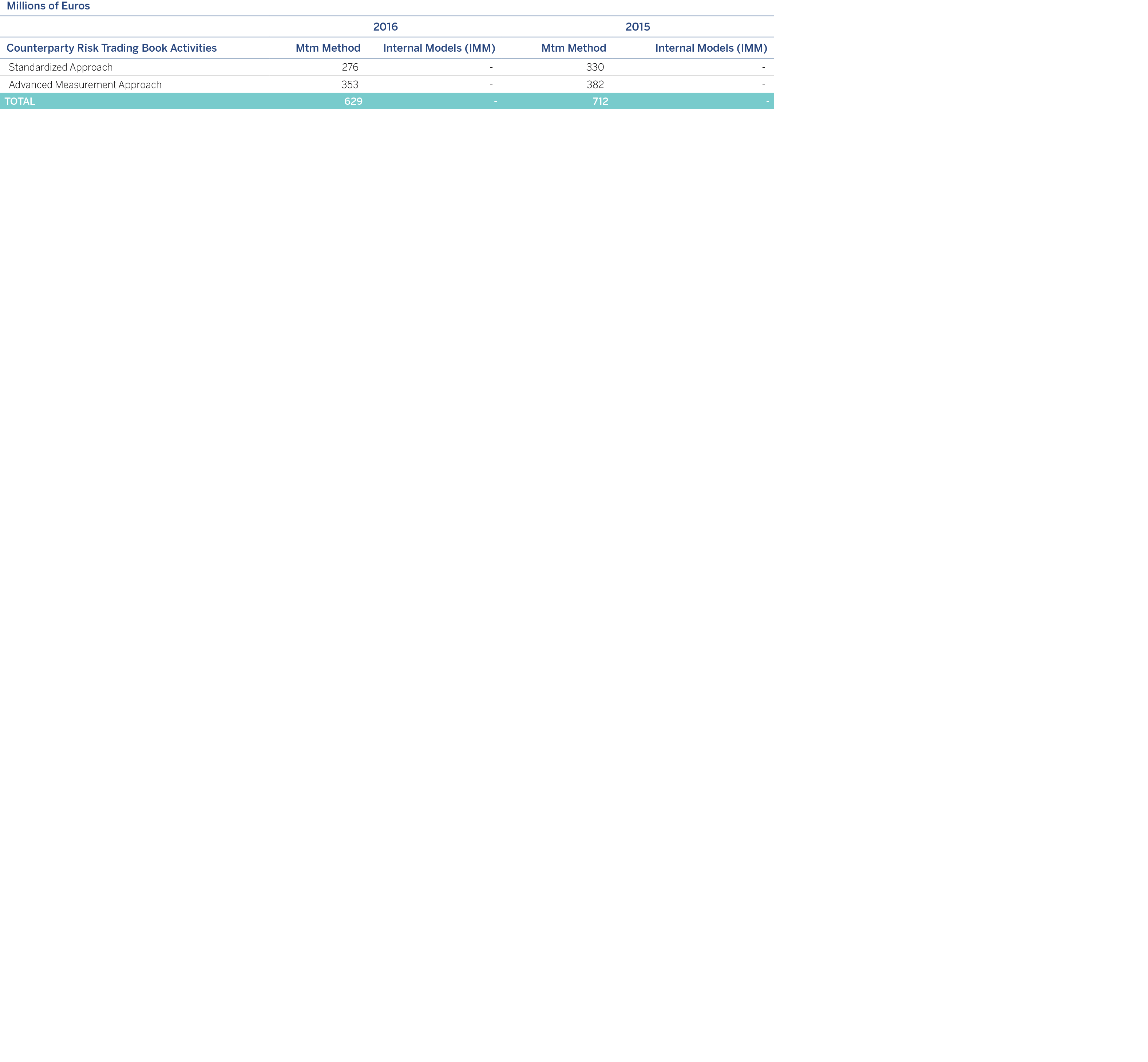

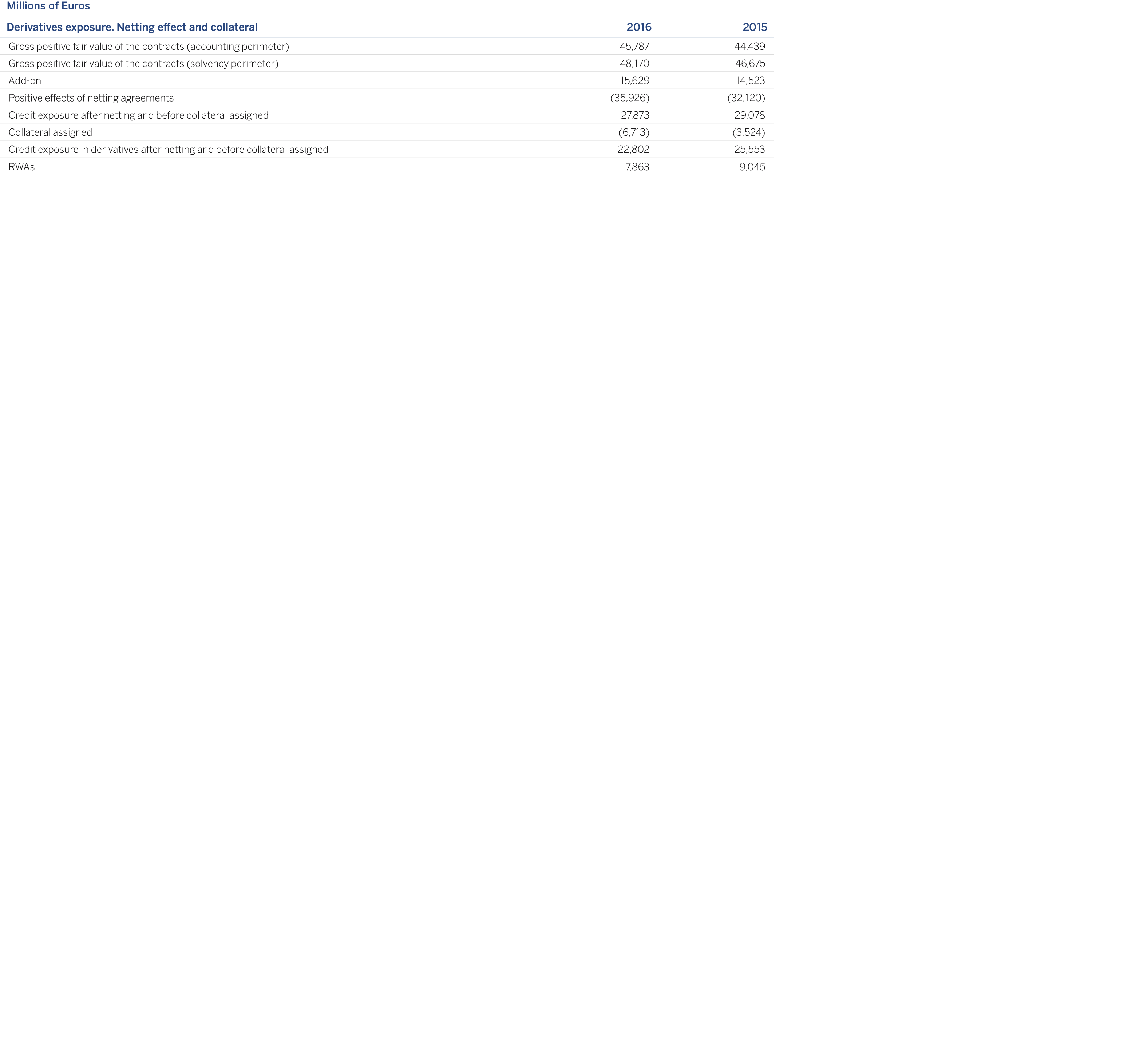

In the case of Bancomer's Corporates portfolio we can see how the average Expected Loss for the cycle calculated using internal models is below the average observed losses. The reason is the use of an observation window which is different from the window of a complete economic cycle (the estimate would be considering comparatively more years of crisis than of economic growth). The expected loss for 2012 is influenced by the recovery management carried out in 2015. This management particularly affects the 2012 defaults resulting in LGDs lower than in previous years. In Mexico it is defined as the complete cycle for the period 2002-2011.