The financial statements in the quarter have been influenced by the depreciation of the Argentinean peso and the use in Venezuela of the exchange rate resulting from the currency purchase-sale system called SICAD I, which complements the official market. According to the Exchange Agreement No. 25, this system is applicable to international investments.

Business activity continued its positive trend of previous quarters in both lending and customer funds, which exceeded the rates of growth of previous quarters.

In earnings, buoyant activity was reflected in the progress and strength of recurring revenue, which offset the effect of increased operating expenses resulting from the expansion plans and high inflation rates in some countries in the region, as well as loan-loss provisions, which increased in line with lending.

A glimpse into the area

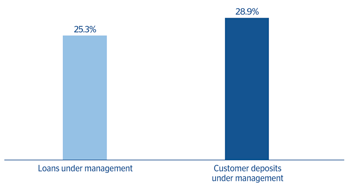

Business acitivity(Year-on-year change at constant exchange rates. Data as of 31-03-2014)  |

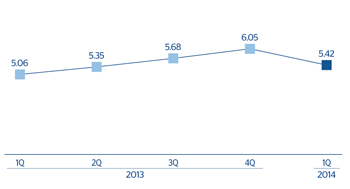

Net interest income/ATA(Percentage. Constant exhcange rates)  |

|---|---|

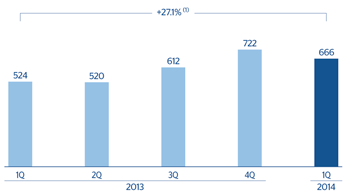

Operating income(Million euros at constant exchange rates)  (1) At current exchange rates: –12.6% |

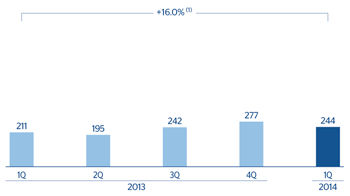

Net attributable profit(Million euros at constant exchange rates)  (1) At current exchange rates: –18.5% |

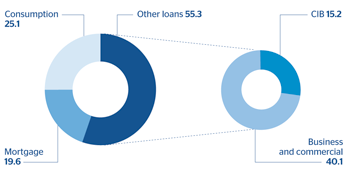

Loans under management breakdown

(Percentage as of 31-03-2014)  |

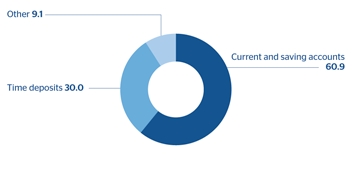

Breakdown of customer deposits under management(Percentage as of 31-03-2014)  |