Turkey

Highlights

- The dedollarization of the balance sheet continues in the quarter

- Progressive improvement of the NPL ratio in the year

- The cost of risk remains at low levels during 2023

- Net attributable profit growth in the quarter

Business activity (1)

(VARIATION AT CONSTANT EXCHANGE RATE COMPARED TO

31-12-22)

(1) Excluding repos.

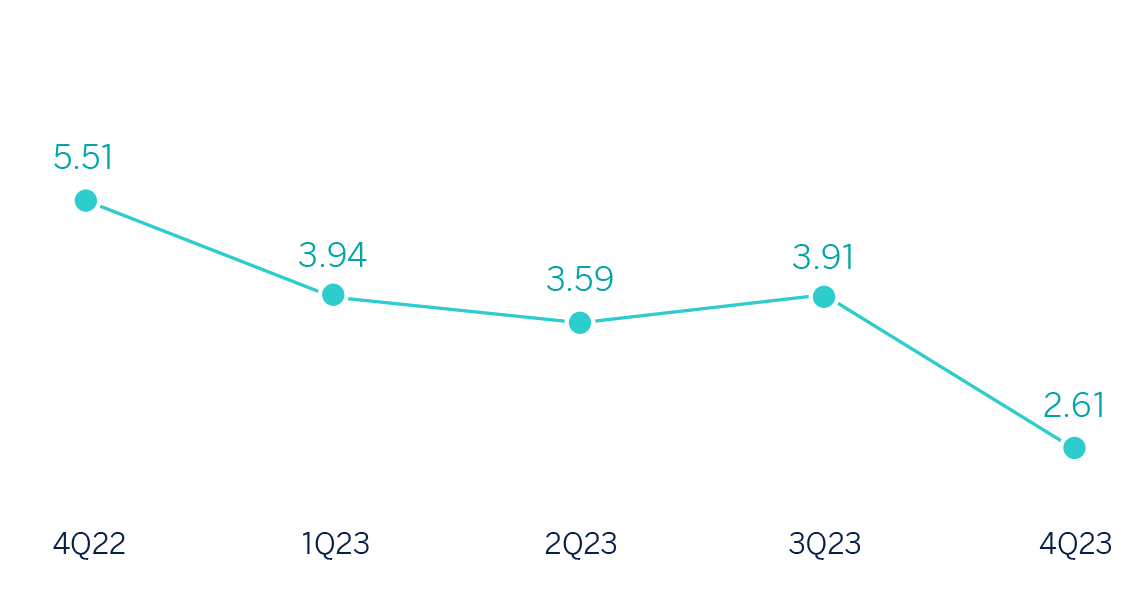

Net interest income / AVERAGE TOTAL ASSETS

(Percentage at CONSTANT exchange rate)

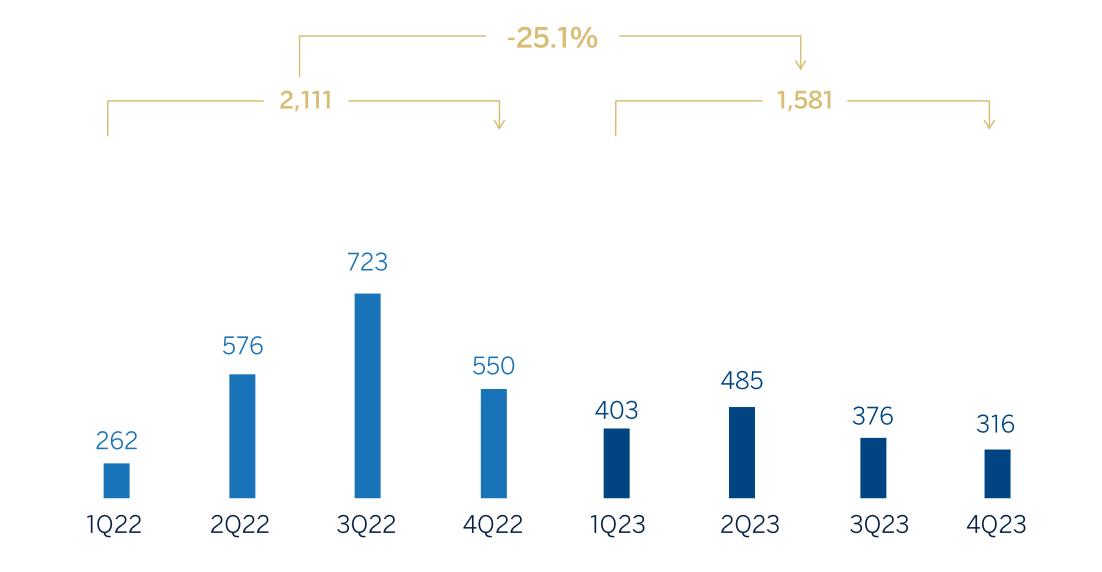

Operating income

(Millions of euros at current exchange rate)

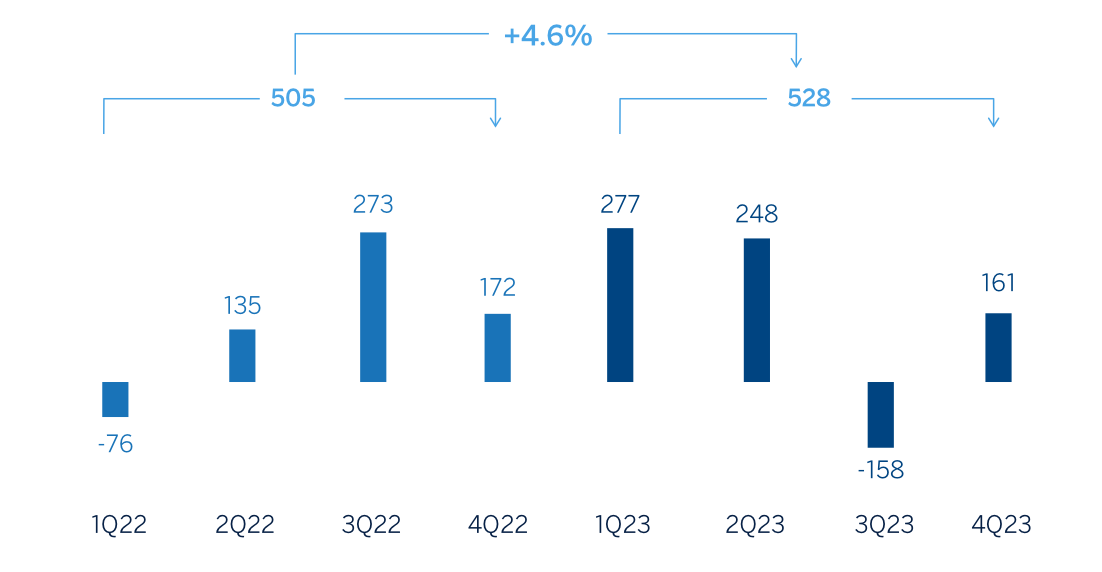

Net attributable profit (LOSS)

(Millions of euros at current exchange rate)

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 2023 | ∆% | ∆% (1) | 2022(2) |

|---|---|---|---|---|

| Net interest income | 1,869 | (28.4) | 8.0 | 2,611 |

| Net fees and commissions | 998 | 65.9 | 149.7 | 602 |

| Net trading income | 937 | 26.4 | 89.3 | 741 |

| Other operating income and expenses | (824) | 5.3 | (40.5) | (782) |

| Gross income | 2,981 | (6.0) | 140.3 | 3,172 |

| Operating expenses | (1,400) | 31.9 | 93.1 | (1,061) |

| Personnel expenses | (775) | 30.7 | 96.4 | (593) |

| Other administrative expenses | (475) | 40.0 | 110.0 | (340) |

| Depreciation | (150) | 16.4 | 43.7 | (129) |

| Operating income | 1,581 | (25.1) | 206.9 | 2,111 |

| Impairment on financial assets not measured at fair value through profit or loss | (118) | (69.4) | (53.9) | (387) |

| Provisions or reversal of provisions and other results | (137) | 55.4 | 138.2 | (88) |

| Profit (loss) before tax | 1,325 | (19.0) | n.s. | 1,636 |

| Income tax | (702) | (36.3) | (6.9) | (1,103) |

| Profit (loss) for the period | 623 | 17.0 | n.s. | 533 |

| Non-controlling interests | (95) | 243.9 | n.s. | (28) |

| Net attributable profit (loss) | 528 | 4.6 | n.s. | 505 |

| Balance sheets | 31-12-23 | ∆% | ∆% (1) | 31-12-22 (2) |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 9,700 | 60.0 | 161.7 | 6,061 |

| Financial assets designated at fair value | 3,692 | (29.0) | 16.1 | 5,203 |

| Of which: Loans and advances | 2 | (43.1) | (6.9) | 3 |

| Financial assets at amortized cost | 51,543 | (0.2) | 63.3 | 51,621 |

| Of which: Loans and advances to customers | 37,416 | (0.1) | 63.4 | 37,443 |

| Tangible assets | 1,496 | 23.4 | 86.0 | 1,213 |

| Other assets | 1,899 | (2.0) | 56.5 | 1,938 |

| Total assets/liabilities and equity | 68,329 | 3.5 | 68.9 | 66,036 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 1,878 | (12.1) | 43.7 | 2,138 |

| Deposits from central banks and credit institutions | 2,306 | (19.7) | 31.3 | 2,872 |

| Deposits from customers | 50,651 | 9.3 | 78.8 | 46,339 |

| Debt certificates | 2,737 | (15.4) | 38.3 | 3,236 |

| Other liabilities | 4,319 | (8.9) | 45.1 | 4,741 |

| Regulatory capital allocated | 6,438 | (4.1) | 56.4 | 6,711 |

| Relevant business indicators | 31-12-23 | ∆% | ∆% (1) | 31-12-22 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (3) | 37,339 | 0.4 | 64.2 | 37,191 |

| Non-performing loans | 1,965 | (24.3) | 23.7 | 2,597 |

| Customer deposits under management (3) | 49,321 | 8.2 | 76.9 | 45,592 |

| Off-balance sheet funds (4) | 7,768 | 12.0 | 83.2 | 6,936 |

| Risk-weighted assets | 54,506 | (3.1) | 57.9 | 56,275 |

| Efficiency ratio (%) | 47.0 | 33.5 | ||

| NPL ratio (%) | 3.8 | 5.1 | ||

| NPL coverage ratio (%) | 97 | 90 | ||

| Cost of risk (%) | 0.25 | 0.94 |

(1) At constant exchange rate.

(2) Balances restated according to IFRS 17 - Insurance contracts.

(3) Excluding repos.

(4) Includes mutual funds and pension funds.

Macro and industry trends

Since the general elections held in May 2023, there are increasing signs of normalization in economic policy in general, and monetary policy in particular, which point to a gradual reversal of the current macroeconomic distortions. Thus, benchmark interest rates were increased from 8.5% at the beginning of 2023 to 42.5% in December 2023, and they may continue to rise further in the coming months in order to curb inflation, which reached 64.8% in December on a year-on-year basis, and allowing for a greater stabilization of the Turkish lira. Economic growth is expected to moderate to 4.5% in 2023 and 3.5% in 2024 (unchanged from the previous forecasts), supported by a still dovish fiscal policy. Given the high uncertainty, it is likely that the pace of GDP growth will slow down. Eventually, pressures on inflation will ease, although it will remain at relatively high levels.

As for the Turkish banking system, the effect of inflation remains strong. Total lending in the system increased 54.7% on a year-on- year basis at the end of November 2023, at similar levels to the previous months. The credit stock continued to be driven by the increase of consumer finance and credit cards (+79.3% year-on-year) while credit to businesses grew slightly less (+49.6% year-on- year). Total deposits maintain their strength and increased at the end of November by 67.0% on a year-on-year basis. Turkish lira deposits continued to grow in the same month (+96.7%), while U.S. dollar deposits grew much more slowly (+36.5%). Dollarization decreased to 42% in November 2023 versus 50.6% a year earlier, boosted by regulatory measures put in place during the last months by the central bank. The system's NPL ratio continued to fall in recent months and in November 2023 was 1.63% (69 basis points lower than in the same month of 2022). Capital indicators remained at more than comfortable levels on the same date.

Unless expressly stated otherwise, all comments below on rates of changes for both activity and results, will be presented at constant exchange rates. These rates, together with changes at current exchange rates, can be observed in the attached tables of the financial statements and relevant business indicators. For the conversion of these figures, the end of period exchange rate as of December 31, 2023 is used, reflecting the considerable depreciation by the Turkish lira in the last year, in particular during the second quarter of 2023, with a negative impact in the accumulated results at the end of December 2023. Likewise, the Balance sheet, the Risk- Weighted Asset (RWA) and the equity are affected.

Activity

The most relevant aspects related to the area’s11 activity in 2023 were:

- Lending activity (performing loans under management) increased between January and December 2023, mainly driven by the growth in Turkish lira loans (+54.6%). This growth was mainly supported by the performance of credit cards business loans and, to a lesser extent, of consumer loans. Foreign currency loans (in U.S. dollars) increased by 7.4%, favored by the increase in activity with customers focused on foreign trade (with natural hedging of exchange rate risk).

- Customer deposits (74% of the area's total liabilities as of December 31, 2023) remained the main source of funding for the balance sheet and increased by 76.9%. The positive performance of Turkish lira time deposits (+122.2%), which represent 82% of total customer deposits in local currency, is noteworthy. Balances deposited in foreign currency (in U.S. dollars) continued their downward path and decreased by 12.3%, with transfers from foreign currency time deposits to Turkish lira time deposits observed under a foreign exchange protection scheme. Thus, as of December 31, 2023, Turkish lira deposits accounted for 62% of total customer deposits in the area. For its part, off-balance sheet funds grew significantly by 83.2%.

The most relevant aspects related to the area’s activity in the fourth quarter of 2023 were:

- Lending activity (performing loans under management) increased by 11.9%, mainly driven by the growth in Turkish lira loans (+8.9%) and, to a lesser extent, by the growth of foreign currency loans (+2.7%).

- In terms of asset quality, the NPL ratio decreased 3 basis points from that at the end of September 2023 to 3.8% and 129 basis points below the figure at the end of 2022 mainly as a result of the positive dynamics in the wholesale portfolio, with the recoveries and repayments, which continued in the quarter and have set the tone for the whole 2023. The NPL coverage ratio recorded a decrease of 320 basis points in the quarter to 97% as of December 31, 2023 (+664 basis points compared to the end of 2022), in part affected by the annual review exercise of the models parameters for the losses estimation and by the fewer requirements in wholesale with credit quality improvements.

- Customer deposits increased by 11.4%, mainly thanks to the performance of Turkish lira time deposits (+14.7%). Additionally, off-balance sheet funds grew by 10.6%. On the other hand, balances deposited in foreign currency (in U.S. dollars) registered a decrease of 1.3% originated in time deposits.

Results

Turkey generated a net attributable profit of €528m during 2023, which compares positively with the accumulated result reached at the end of December 2022, both periods reflecting the impact of the application of hyperinflation accounting.

As mentioned above, the year-on-year comparison of the accumulated income statement at the end of December 2023 at current exchange rate is affected by the strong depreciation of the Turkish lira in the last year (-38.9%). Excluding this effect, the highlights of the results for the year at constant exchange rate are summarized below:

- Net interest income recorded a year-on-year growth of 8.0%, mainly due to the growth in Turkish lira loans, as well as higher income from the securities portfolio in Turkish lira. This is partially offset by the decline in the Turkish lira spread.

- Net fees and commissions increased by 149.7%, favored by the performance in payment systems fees, brokerage activity, guarantees and asset management.

- NTI showed an excellent evolution (+89.3%) thanks to the increase in the results of the Global Markets unit, favored by foreign exchange operations and portfolio sales.

- The other operating income and expenses line showed a balance of €-824m, which compares favorably with the previous year. This line includes, among others, the loss in the value of the net monetary position due to the country's inflation rate, which stood below the loss recorded on 2022, partially offset by the income derived from inflation-linked bonds (CPI linkers). It is also worth highlighting the improved performance of the results of Garanti BBVA's subsidiaries, specially from renting and insurance, also included in this line.

- Operating expenses increased by 93.1%, with growth both in personnel, as a result of salary improvements to compensate for the loss of purchasing power of the workforce, and in general expenses, where higher expenses in technology stand out, as well as the institutional donation made by the BBVA Group to help those affected by the earthquake that struck an area in the south of the country in February 2023.

- Impairment on financial assets decreased by 53.9%, mainly due to improvements in credit quality and the repayments in the wholesale segments, which led to a significant improvement in the accumulated cost of risk as of December 31, 2023 to 0.25% from the 0.94% at the end of December of the previous year.

- The provisions and other results line closed December 2023 with a higher loss than in the same period of the previous year, mainly due to the update of the provisions for commitments with personnel and also as a result of higher provisions for contingent risks and commitments, linked to the earthquake and to the increase of the coverage of some specific clients.

- Lastly, the accumulated tax expense at the end of 2023 reflects both the positive impact of the revaluation, for tax purposes, of Garanti BBVA's non-cash assets that has generated a credit in corporate income tax rate, due to the higher tax base of the assets, and the increase of the corporate tax rate in Turkey from 25% to 30%, with retrospective application from January 1, 2023, which has negatively impacted the financial statements since the third quarter.

In the fourth quarter of 2023, the net attributable profit stood at €161m, which compares positively with the loss registered in the previous quarter, mainly due to the higher inflation rate in the previous quarter, as well as to the tax rate increase mentioned above.

11 The variation rates of loans in Turkish lira and loans in foreign currency (U.S. dollars) only refer to Garanti Bank. Thus they exclude the subsidiaries of Garanti BBVA, mainly in Romania and Netherlands.