South America

Highlights

- Growth in lending activity focused on the retail segments

- Excellent evolution of the net interest income and of the NTI

- Improvement in the efficiency of the area

-

Higher adjustment for hyperinflation in Argentina

and the Argentine peso devaluation in the fourth quarter

Business activity (1)

(VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO

31-12-22)

(1) Excluding repos.

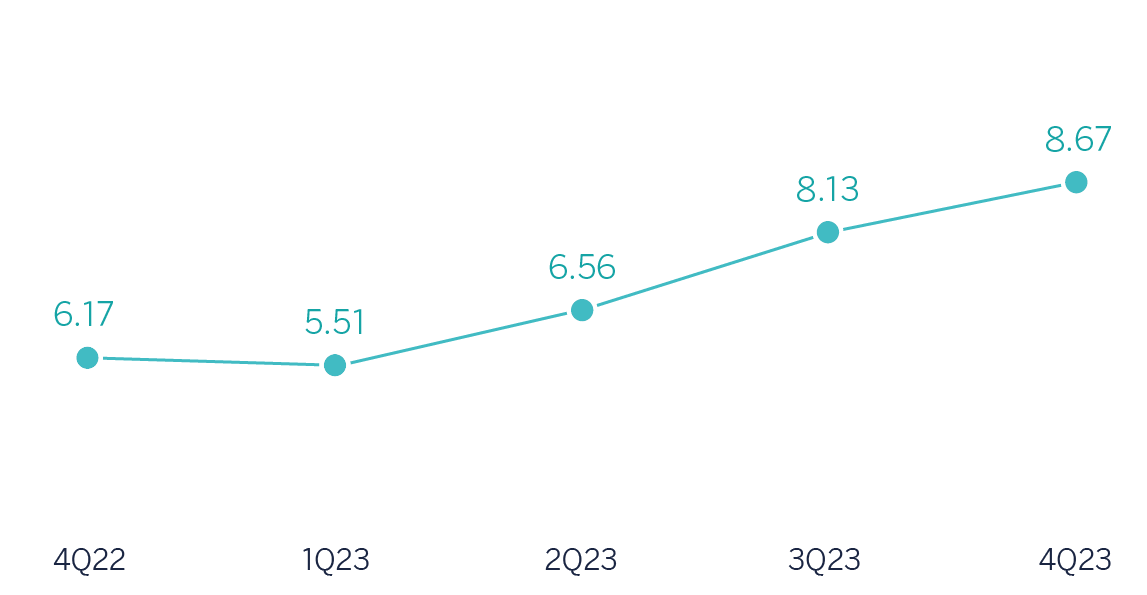

Net interest income / AVERAGE TOTAL ASSETS

(PERCENTAGE AT CONSTANT EXCHANGE RATES)

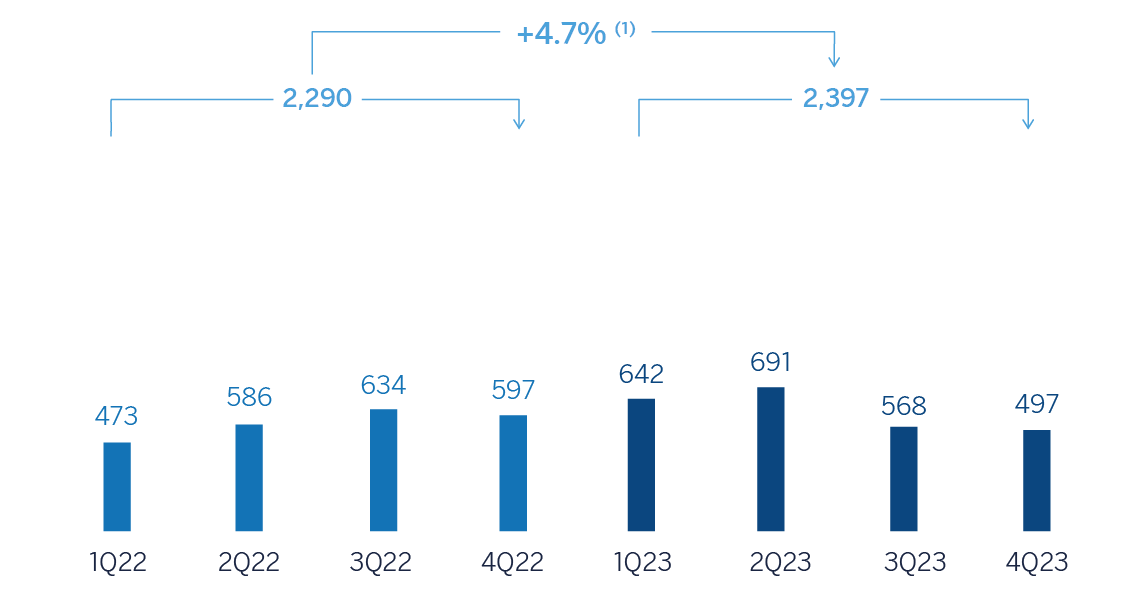

Operating income

(MILLIONS OF EUROS AT CURRENT EXCHANGE RATES)

(1) At constant exchange rates: +63.8%.

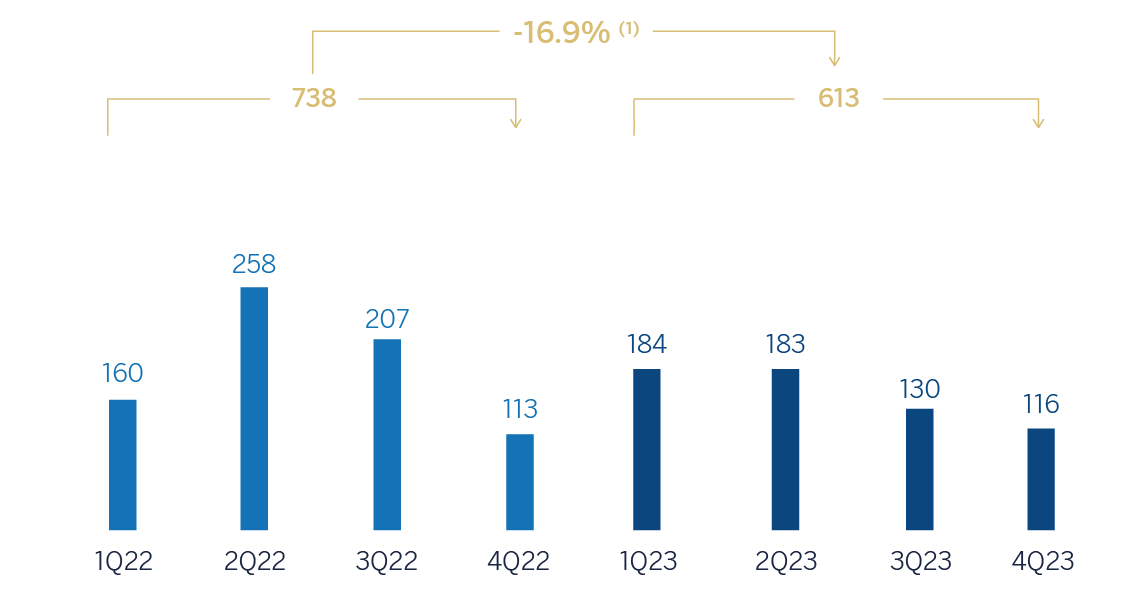

Net attributable profit (LOSS)

(MILLIONS OF EUROS AT CURRENT EXCHANGE RATES)

(1) At constant exchange rates: +43.2%.

(2) The variation in customer funds under management is affected by the transfer of the pension funds managed by the Pension Fund Administrator that the BBVA Group maintains in Bolivia to the Public Long-Term Social Security Manager of Bolivia.

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 2023 | ∆% | ∆% (1) | 2022 (2) |

|---|---|---|---|---|

| Net interest income | 4,394 | 6.2 | 47.5 | 4,138 |

| Net fees and commissions | 700 | (10.1) | 12.3 | 778 |

| Net trading income | 633 | 41.7 | 73.5 | 447 |

| Other operating income and expenses | (1,395) | 27.2 | 45.8 | (1,097) |

| Gross income | 4,331 | 1.5 | 43.9 | 4,265 |

| Operating expenses | (1,934) | (2.1) | 25.0 | (1,976) |

| Personnel expenses | (904) | (4.4) | 25.1 | (946) |

| Other administrative expenses | (864) | 0.6 | 29.7 | (859) |

| Depreciation | (165) | (2.8) | 5.1 | (170) |

| Operating income | 2,397 | 4.7 | 63.8 | 2,290 |

| Impairment on financial assets not measured at fair value through profit or loss | (1,134) | 48.9 | 75.3 | (762) |

| Provisions or reversal of provisions and other results | (58) | (38.5) | (16.5) | (94) |

| Profit (loss) before tax | 1,206 | (15.9) | 61.3 | 1,434 |

| Income tax | (291) | (16.3) | 156.4 | (347) |

| Profit (loss) for the period | 915 | (15.8) | 44.3 | 1,087 |

| Non-controlling interests | (302) | (13.5) | 46.7 | (349) |

| Net attributable profit (loss) | 613 | (16.9) | 43.2 | 738 |

| Balance sheets | 31-12-23 | ∆% | ∆% (1) | 31-12-22 (2) |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 6,585 | (14.4) | (2.8) | 7,695 |

| Financial assets designated at fair value | 10,508 | (2.1) | 21.9 | 10,739 |

| Of which: Loans and advances | 592 | 290.9 | 221.8 | 152 |

| Financial assets at amortized cost | 44,508 | 10.0 | 12.5 | 40,448 |

| Of which: Loans and advances to customers | 41,213 | 7.2 | 8.6 | 38,437 |

| Tangible assets | 939 | (13.7) | (3.4) | 1,088 |

| Other assets | 2,239 | 13.0 | 18.7 | 1,981 |

| Total assets/liabilities and equity | 64,779 | 4.6 | 12.0 | 61,951 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 3,289 | 16.9 | (1.3) | 2,813 |

| Deposits from central banks and credit institutions | 5,140 | (8.4) | (9.8) | 5,610 |

| Deposits from customers | 42,567 | 6.3 | 14.7 | 40,042 |

| Debt certificates | 2,986 | 1.0 | 4.1 | 2,956 |

| Other liabilities | 4,502 | (3.3) | 35.0 | 4,655 |

| Regulatory capital allocated | 6,294 | 7.1 | 14.7 | 5,874 |

| Relevant business indicators | 31-12-23 | ∆% | ∆% (1) | 31-12-22 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (3) | 41,013 | 6.6 | 8.1 | 38,484 |

| Non-performing loans | 2,302 | 25.4 | 21.4 | 1,835 |

| Customer deposits under management (4) | 42,567 | 6.3 | 14.7 | 40,042 |

| Off-balance sheet funds (5) | 5,525 | (68.9) | (65.4) | 17,760 |

| Risk-weighted assets | 49,117 | 4.9 | 11.8 | 46,834 |

| Efficiency ratio (%) | 44.7 | 46.3 | ||

| NPL ratio (%) | 4.8 | 4.1 | ||

| NPL coverage ratio (%) | 88 | 101 | ||

| Cost of risk (%) | 2.51 | 1.69 |

(1) At constant exchange rates.

(2) Balances restated according to IFRS 17 - Insurance contracts.

(3) Excluding repos.

(4) Excluding repos and including specific marketable debt securities.

(5) Includes mutual funds, customer portfolios in Colombia and Peru and pension funds in Bolivia as of 31-12-2022.

South America. Data per country (Millions of euros)

| Operating income | Net attributable profit (loss) | |||||||

|---|---|---|---|---|---|---|---|---|

| Country | 2023 | ∆% | ∆% (1) | 2022 (2) | 2023 | ∆% | ∆% (1) | 2022 (2) |

| Argentina | 483 | 3.0 | n.s. | 469 | 132 | (28.7) | n.s. | 185 |

| Colombia | 509 | (16.6) | (12.7) | 610 | 156 | (35.5) | (32.5) | 241 |

| Peru | 1,109 | 18.9 | 19.2 | 932 | 203 | (1.2) | (1.0) | 206 |

| Other countries (3) | 297 | 6.7 | 5.6 | 279 | 122 | 15.5 | 14.1 | 106 |

| Total | 2,397 | 4.7 | 63.8 | 2,290 | 613 | (16.9) | 43.2 | 738 |

(1) Figures at constant exchange rates.

(2) Balances restated according to IFRS 17 - Insurance contracts.

(3) Bolivia, Chile (Forum), Uruguay and Venezuela. Additionally, it includes eliminations and other charges.

South America. Relevant business indicators per country (Millions of euros)

| Argentina | Colombia | Peru | ||||

|---|---|---|---|---|---|---|

| 31-12-23 | 31-12-22 | 31-12-23 | 31-12-22 | 31-12-23 | 31-12-22 | |

| Performing loans and advances to customers under management (1) (2) | 2,259 | 809 | 16,951 | 16,134 | 17,179 | 16,747 |

| Non-performing loans (1) | 39 | 13 | 892 | 729 | 1,202 | 1,042 |

| Customer deposits under management (1) (3) | 4,060 | 1,470 | 17,875 | 15,855 | 16,939 | 16,035 |

| Off-balance sheet funds (1) (4) | 1,444 | 486 | 2,506 | 2,485 | 1,572 | 1,436 |

| Risk-weighted assets | 4,997 | 8,089 | 19,467 | 15,279 | 18,825 | 17,936 |

| Efficiency ratio (%) | 53.6 | 61.3 | 47.1 | 40.4 | 36.4 | 37.2 |

| NPL ratio (%) | 1.6 | 1.6 | 4.8 | 4.2 | 5.5 | 4.9 |

| NPL coverage ratio (%) | 136 | 173 | 89 | 106 | 84 | 91 |

| Cost of risk (%) | 2.18 | 2.61 | 2.13 | 1.56 | 3.04 | 1.58 |

(1) Figures at constant exchange rates.

(2) Excluding repos.

(3) Excluding repos and including specific marketable debt securities.

(4) Includes mutual funds and customer portfolios (in Colombia and Peru).

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. These rates, together with the changes at current exchange rates, can be found in the attached tables of the financial statements and relevant business indicators.

Activity and results

The most relevant aspects related to the area's activity during 2023 were:

- Lending activity (performing loans under management) registered a variation of +8.1%, with growth focused on the retail portfolio, which grew more than the wholesale portfolio (+11.6% versus +4.8%), mainly favored by the evolution of consumer loans (+11.5%), and credit cards (+44.0%). On the other hand, corporate loans also increased (+4.8%).

- Customer funds under management decreased (-9.3%) compared to the closing balances at the end of 2022, with an increase in both demand deposits (+7.4%) and time deposits (+28.7%) and a reduction of off-balance sheet funds (-65.4%) due to the transfer of pension funds managed by the Pension Fund Administrator that the BBVA Group maintains in Bolivia to the Public Long-Term Social Security Management Company of this country.

The most relevant aspects related to the area's activity during the fourth quarter of the year 2023 were:

- Lending activity (performing loans under management) recorded a variation of +3.5%, mainly boosted by corporate loans (+4.4%). Consumer loans and credit cards also showed a positive evolution (+1.3% and +13.0%, respectively).

- With regard to asset quality, the NPL ratio stood at 4.8%, with an increase of 20 basis points in the quarter at the regional level, partially affected by the lower relative weight of Argentina, with a NPL ratio below the average, and by the general increase of non-performing balances in constant terms in all the countries that form the aggregate. On the other hand, the area's NPL coverage ratio decreased to 88% affected by the impact of the annual review of the parameters for the loss estimation models, and by the above mentioned increase of the non-performing balances.

- Customer funds under management increased (+6.3%) compared to the previous quarter thanks to both good evolution of customer deposits (+5.7%), highlighting the demand deposits performance (+8.5%) and off-balance sheet funds (+11.6%).

South America generated a cumulative net attributable profit of €613m at the end of the year 2023, which represents a year-on-year increase of +43.2%, driven by the good performance of recurring income (+41.4%) and the area's NTI, which offset the increase in expenses, in a highly inflationary environment throughout the region and higher provisioning needs for impairment on financial assets, mainly in Peru and, to a lesser extent, in Colombia, both affected by the worsening of macroeconomic environment.

The heading "Other operating income and expenses" mainly includes the impact of the adjustment for hyperinflation in Argentina, whose net monetary loss stood at €1,062m in the period January-December 2023, which is higher than the €822m registered in the period January-December 2022.

It should be noted that the year-on-year comparison of the cumulative income statement at the end of December 2023 at current exchange rates is affected by the strong Argentinian peso depreciation during the last quarter of the year.

More detailed information on the most representative countries of the business area is provided below:

Argentina

Macro and industry trends

The new government since the elections in November 2023 has announced an adjustment plan in order to correct the strong macroeconomic distortions which, among other measures, includes a significant fiscal deficit reduction and a severe currency depreciation. In this context, it is likely that annual inflation will increase significantly from 211% at the end of 2023 and that GDP, which has fallen by around 3.0% in 2023 (50 basis points above the previous forecast), will contract significantly during the following months. The recent adjustments, despite their short term impacts and the high associated risks, eventually complemented with additional measures such as an interest rate hike, could lay the foundations for a gradual inflation decrease and a growth recovery from the second half of 2024 onward. In a context of persistently high uncertainty, BBVA Research estimates that annual inflation will close 2024 around 175% and that GDP will fall around 4.0% this year (150 points above what was forecasted three months ago).

The banking sector continues to grow at a stable pace but feels the burden of high inflation. At the end of October 2023, total credit had grown by 130% compared to the same month in 2022, favored by both consumer and corporate portfolios, which reached year-on-year growth rates of 124% and 147%, respectively. On the other hand, deposits continued the trend of the previous months and at the end of October had grown by 122% year-on-year at the end of October. Finally, the NPL ratio decreased slightly to 2.8% at the end of October 2023 (28 basis points below the same month in 2022).

Activity and results

- Between January and December 2023, performing loans under management increased by 179.3%, showing growth in both the business portfolio (+221.3%) and the retail portfolio (+142.1%), highlighting in the latter the growth in credit cards (+154.4%) and consumer loans (+100.9%). The NPL ratio stood at 1.6%, which represents a decrease of 24 basis points compared to the previous quarter, positively affected by activity growth, which offset higher NPL entries, mainly in credit cards and consumer loans. On the other hand, the NPL coverage ratio stood at 136%, showing a decline compared to the previous quarter due to the impact of the annual review of parameters for the loss estimation models and to the increase of non-performing balances.

- Balance sheet funds grew by 176.1% between January and December 2023, with demand deposits increasing at a faster rate than time deposits (+248.0% versus +73.9%). On the other hand, mutual funds also increased (+196.9%).

- The cumulative net attributable profit at the end of December 2023 stood at €132m, well above the figure achieved in the same period of 2022. This is mainly explained by the favorable evolution of the net interest income, driven by both volume and price effects (mainly in the credit cards and business portfolio, together with an adequate liabilities cost management), as well as a higher profitability of the securities portfolios. This evolution was partially offset by a larger negative adjustment for hyperinflation (mainly reflected in the other operating income and expenses line), higher expenses -both in personnel due to salary revisions, as well as general expenses-, and higher loan-loan loss provisions, due to both the credit and the fixed income portfolios. The quarterly evolution is impacted by the strong devaluation of the Argentine peso in December 2023.

Colombia

Macro and industry trends

Economic activity lost momentum throughout 2023, in line with BBVA Research's expectations that maintain an unchanged GDP growth forecasts of 1.2% in 2023 and 1.5% in 2024. Lower growth in domestic demand is expected to favor a gradual moderation of inflation from 9.3% in December to around 6.9%, on average, in 2024. This will probably allow interest rates, currently at 13.0%, after a 25 basis points cut in December, to reach 7.0% by the end of this year.

Total credit growth for the banking system stood at 4.0% year-on-year in October 2023, and continues to be driven by the growth in corporate lending at 5.6% and mortgages at 8.8%. Consumer credit deceleration stands out, as it slowed from a year-on-year growth rate of 20% during 2022 to a fall of 0.8% in October 2023. Total deposits showed a year-on-year growth rate of 10.4% at the end of October 2023, with a strong shift towards time deposits (up 36.5% year-on-year) and a fall in demand deposits. The NPL ratio of the system has climbed in recent months to 5.1% in October 2023, 142 basis points higher than in the same month of 2022.

Activity and results

- Lending activity registered a growth of 5.1% compared to the end of 2022, with growth in practically all products, with a better performance in consumer loans, credit cards, mortgages and, to a lesser extent, business loans, although the latter showed deleveraging in the fourth quarter (-2.2%). In terms of asset quality, the NPL ratio increased in the fourth quarter of the year (+8 basis points) to 4.8%, originating from retail portfolios, mainly consumer and credit cards portfolios. On the other hand, the NPL coverage ratio declined to 89% due to the higher volume of write-offs in the quarter as well as these NPL inflows.

- In 2023, customer deposits increased by 12.7% thanks to the positive evolution of time deposits (+26.6%), while off-balance sheet funds remained stable in the year (+0.8%).

- The cumulative net attributable profit at the end of 2023 stood at €156m, that is 32.5% lower than the previous year. The lower contribution from net interest income was affected by the high cost of funds and was partially offset by the net fees and commissions evolution. On the lower part of the income statement, there were higher operating expenses and an increase in provisions for impairment of financial assets due to higher requirements in the retail portfolio. In the fourth quarter of 2023, the growth of the NTI stands out due to Global Markets results, supported by growth in its recurring income. This was partially offset by higher expenses and loan-loss provisions due to the worsening of the macroeconomic environment.

Peru

Macro and industry trends

In a context marked by adverse weather shocks and the effects of high inflation and a contractive monetary policy, economic activity showed weakness in 2023, in particular in the last months of the year. BBVA Research has therefore revised its forecast for GDP growth in 2023 from 0.4% to -0.4%. The moderation of inflation (which reached 3.2% in December 2023 and will reach an average of around 2.8% in 2024) as well as the rates cutting process (which have fallen in the last months 125 basis points to 6.50% and will fall to around 4.5% through 2024) will presumably support a recovery in activity and GDP growth of 2.0% in 2024 (30 basis points below the previous forecast).

Total credit in the Peruvian banking system fell 2.4% year-on-year in November 2023. Performance by portfolio is uneven, with the biggest slowdown in corporate lending, with a year-on-year contraction of 7.7%. However, consumer finance remained buoyant, growing by 9.0% year-on-year in November 2023, while the mortgage portfolio maintained a stable growth rate of around 5.1% year-on-year, in line with previous months. Total deposits in the system remained stable at the end of November 2023, with a slight growth of 0.3% year-on-year, showing a continued shift towards time deposits (+18.3% year-on-year) to the detriment of demand deposits (-8.0% year-on-year). The NPL ratio across the banking system rose very slightly to 4.38% since the end of 2022.

Activity and results

- Lending activity remained flat compared to the close of December 2022 (+2.6%) supported by growth in consumer loans (+18.0%), credit cards (+21.5%) and, to a lesser extent, mortgage portfolios (+5.0%). This favorable evolution offset the slight deleveraging of the corporate portfolio (-0.7%) this year, mainly due to the maturities of the "Reactiva Perú" program (mitigated by the C&IB activity in the last quarter of the year). In terms of credit quality indicators, the NPL ratio increased by 15 basis points to stand at 5.5%, with entries mainly in retail portfolio, which were affected by the current macroeconomic environment. On the other hand, the NPL coverage ratio decreased to 84% in the quarter, affected by the annual review impact of the models parameters for the losses estimation.

- Customers funds under management increased during 2023 (+6.0%) boosted by the good performance of time deposits (+29.3%), favored by the high rates environment and, to a lesser extent, by the off-balance sheet funds (+9.5%), which offset the lower balances in demand deposits (-3.9%).

- BBVA Peru's net attributable profit stood at €203m at the end of December 2023, 1.0% below the figure achieved at the end of the previous year, despite the good performance of recurring income and the NTI. It was negatively impacted by the increase of provisions for impairment of financial assets (+92.1%), with higher requirements due to the worsening of the macroeconomic environment. During the fourth quarter of 2023, growth in both net interest income and net fees and commissions.