Integration of non-financial variables into risk management

By integrating social, environmental and reputational variables into risk management, BBVA aims to mitigate non-financial risks that could harm the credit rating for a borrower or funded project and consequently jeopardize debt repayment and go against the corporate principles of integrity, prudence and transparency. The impact that BBVA’s financing has on society must therefore be considered.

In 2011 work continued to improve the inclusion of environmental, social and reputational risks in traditional risk circuits. Risk analysts were also trained in these matters, a specific committee set up for this type of risk and, in accordance with audit recommendations from 2010, a new defense policy and a new procedure to apply and monitor the Equator Principles were drawn up.

SAR Risk Committee

The first Social, Environmental and Reputational Risk Committee meeting, chaired by the Group’s Risk Manager, was held in 2011. This committee will hold two meetings a year, and its main duties include promoting and monitoring the management of key reputational risks and the actions that are aimed at integrating social and environmental risks in the Group’s activities.

Equator Principles

BBVA adopted the Equator Principles (PE) in 2004. The EP are applied to the financing of new projects worth US$10 million or more, the expansion of projects that generate significant impacts and advice on project finance.

BBVA also applies EP to transactions worth less than US$ 10 million, projects, operational projects and other financial products such as bridge loans, the assignment of credit rights and buyer's credit. In 2011, 31.6% of the total finance volume was under this extended application of the EP.

Classification of projects in finance and advisory services according to the Equator Principles

(Million euros)

|

|

Category | 2011 | 2010 | 2009 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| No. of transactions | Total amount | Amount financed by BBVA | No. of transactions | Total amount | Amount financed by BBVA | No. of transactions | Total amount | Amount financed by BBVA | ||

| Europe and North America | A | 0 | 0.0 | 0.0 | 0 | 0.0 | 0.0 | 0 | 0.0 | 0.0 |

| B | 43 | 23,060.2 | 3,068.7 | 37 | 14,344.0 | 1,592.6 | 32 | 15,303.7 | 1,484.7 | |

| C | 26 | 1,687.3 | 571.9 | 30 | 3,679.2 | 962.6 | 29 | 4,773.9 | 986.8 | |

| TOTAL Europe | 69 | 24,747.5 | 3,640.6 | 67 | 18,023.2 | 2,555.2 | 61 | 20,077.6 | 2,471.5 | |

| Latin America | A | 1 | 158.1 | 52.7 | 0 | 0.0 | 0.0 | 2 | 664.9 | 159.6 |

| B | 13 | 5,381.2 | 1,245.4 | 22 | 4,379.0 | 974.6 | 6 | 88.5 | 34.8 | |

| C | 4 | 275.2 | 120.5 | 2 | 211.0 | 84.4 | 4 | 80.3 | 30.2 | |

| TOTAL Latin America | 18 | 5,814.5 | 1,418.5 | 24 | 4,590.0 | 1,059.0 | 12 | 833.7 | 224.6 | |

| Rest of Group | A | 0 | 0.0 | 0.0 | 0 | 0.0 | 0.0 | 0 | 0.0 | 0.0 |

| B | 2 | 689.8 | 161.0 | 4 | 1,624.8 | 205.6 | 3 | 2,222.6 | 152.3 | |

| C | 2 | 1,905.5 | 184.2 | 0 | 0.0 | 0.0 | 2 | 387.0 | 64.9 | |

| TOTAL Rest of Group | 4 | 2,595.3 | 345.2 | 4 | 1,624.8 | 205.6 | 5 | 2,609.6 | 217.2 | |

| TOTAL Group |

|

91 | 33,157.3 | 5,404.3 | 95 | 24,238.0 | 3,819.8 | 78 | 23,520.9 | 2,913.3 |

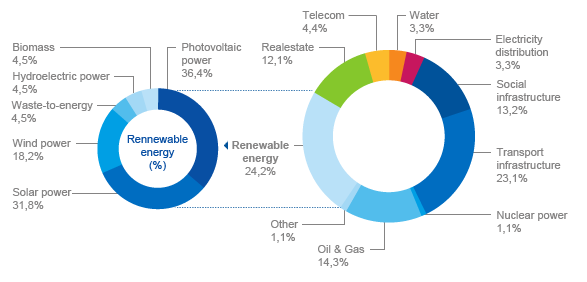

By sector, 42% of the total finance goes to social and transport infrastructure projects, benefiting 8.5 million people, and 20.2% to the renewable energy sector, with total installed capacity of 2,797 MW. In this last sector we must highlight three projects registered under the United Nations Clean Development Mechanism, which have helped reduce a total of 16.1 tons of CO2 emissions.

Transactions by sector (%)

Scope: BBVA Group

BBVA has a Corporate & Investment Banking (CIB) team that manages the EP. The team's responsibilities include analyzing projects that are subject to the EP, representing BBVA before stakeholders, reporting to Senior Management, and designing and implementing the management system, proposing best practices and contributing toward training and communication regarding EP-related aspects.

In 2011, BBVA established an action plan which defined measures, responsibilities and the deadline for implementation regarding the 2010 internal audit recommendations. The Internal Control Department monitors the implementation of these recommendations every quarter.

Work with multilateral regional development banks

Like in previous years, the BBVA Group held extensive institutional and business relations with Multilateral Financial Institutions (MFI) including the World Bank, the European Investment Bank (EIB), the European Reconstruction and Development Bank (ERDB), the Inter-American Development Bank (IDB) and Corporación Andina de Fomento (CAF).

This activity reaches across many products and regions, including internal trade finance, project co-financing, financial brokerage transactions and debt issuance on local capital markets.

The Group's strategic relationship with MFIs is particularly important during these times in light of the anti-cyclical role that multilateral institutions play in the current financial crisis.

During 2011, a large number of BBVA Group's subsidiaries joined International Finance Corporation (IFC) programs as issuing banks, and others stayed on as issuing banks in IDB programs. BBVA joined the Central American Bank for Economic Integration (BCIE) «I-FACIL» foreign trade program.

In Spain, BBVA was chosen to manage the first JESSICA (Joint European Support for Sustainable Investment in City Areas) Urban Development Fund in Andalucía. The fund is run by the European Investment Bank (EIB) and the Regional Government of Andalucía to back urban regeneration and development in this autonomous region.

In Latin America, most of BBVA Group's financial brokerage activities in 2011 were targeted at the agricultural industry, renewable energy and energy efficiency sectors. In October, BBVA Bancomer was the sole bookrunner for a CAF issuance worth 286 million Mexican pesos over 10 years. This is the first time since 2008 that an MFI has issued 10-year senior bonds and marks the return of MFIs to long-maturity bonds on the Mexican market.

New Defense Policy

In 2005 BBVA set up a defense sector lending regulation applicable to units and subsidiaries everywhere in the world that is based on current legislation and is under constant review to ensure it meets the strictest criteria.

Following the previous year's internal audit recommendations, the policy was reviewed in greater depth in 2011 in order to broaden its scope, make it clearer and simpler and ensure compliance with requirements.

This policy was submitted to the SAR Committee in December 2011 and was formally approved by the Risk Management Committee (RMC) on February 24, 2012, after six months of intensive work in several of the BBVA Group’s areas. Major discussions were also held with NGOs and important stakeholders in this sector.

Ecorating

The Ecorating tool evaluates the environmental risk of companies. A credit risk rating is assigned to each customer in accordance with several factors: location; polluting emissions; consumption of resources; the environment of the area around the company liable to be directly or indirectly affected by the business; legislative pressure; and tax treatment of environmental components, among others.

This tool has been implemented in Spain and is in the process of being implemented in Mexico.

In 2011 BBVA Continental implemented the new «Green Portfolio Program» system with US$30 million in IDB funds to finance energy efficiency, renewable energy, clean production, sustainable construction and other projects.

Prevention of money laundering and terrorist activity financing

The Prevention of Money Laundering and Terrorist Financing (henceforth referred to as PML/TF) constitutes an ever-present objective that BBVA Group associates with its pledge to promote and uphold the well-being of the different communities in which it operates.

For the BBVA Group, ensuring that its products and services are not used for illegal purposes likewise constitutes an essential requirement for safeguarding its corporate integrity, and thereby one of its main assets, namely, the trust of the people and institutions it deals with on a day-to-day basis (customers, employees, shareholders, suppliers, etc.) in the numerous areas where it operates.

To achieve the above objective, BBVA Group adopted a Corporate Model for Managing the Risk of Money Laundering. This Model is followed in all of the entities forming part of the BBVA Group, and not only takes into account the regulations on prevention of money laundering in the jurisdictions in which BBVA operates, but also incorporates the best practices of the international financial industry in this regard, as well as the recommendations issued by international entities, such as FATF (Financial Action Task Force).

In 2011, the BBVA Group continued to adapt policies and procedures to changes in regulations in countries in which it operates and adopt international best practices in this field, in particular, those arising from internal legislation in Mexico, Venezuela, Argentina and Peru in their primary laws on PBC/FT, as well as amendments to the regulation in Mexico.