Report 4Q 2024

BBVA earns €10.1 billion in 2024 (+25 percent)

The share

Economic growth remained relatively solid in 2024, mainly in the United States and in the services sector. BBVA Research estimates that global GDP expanded by around 3.2% in 2024, slightly above (3.1%) the forecast three months ago. This strength comes in an environment where the public expenditure was, in general, high and labor markets remained dynamic. In a context marked by general restrictive monetary conditions, despite the process of interest rates cuts, inflation moderated during 2024. This downward trend was supported by a moderation in energy prices (despite geopolitical tensions in some producing regions), and some productivity gains (at least in the United States). Inflation also remains above the target in many geographical areas, mainly in the United States and, pushed down by services prices. The main exception is China, where the process of structural moderation in growth, particularly in domestic demand, has contributed to very low and slightly positive inflation.

Policies adopted by the new administration in the United States, on which there is high uncertainty, will be key in 2025. The expectation of additional protectionist measures and high fiscal deficits would put upward pressure on inflation and downward pressure on growth, according to BBVA Research. Thus, despite recent resilience, US growth would moderate from 2.7% in 2024 (20 basis points above the previous forecast) to 2.0% in 2025 (10 basis points below the previous forecast). The likely upturn in inflation, which closed 2024 at 2.9%, will reduce the scope for the Federal Reserve (hereinafter FED) to ease monetary conditions further. In particular, interest rates, which were cut from 5.5% to 4.5% during 2024, would converge to around 4.0% during the first half of 2025, remaining at these relatively high levels during the second half of the year, which, among other things, would contribute to the strength of the US dollar.

The possible increase in tariffs in the US would be a negative shock to the global economy, whose GDP would moderate to around 3.1% in 2025 (20 basis points lower than previously expected). In particular, it would add to the structural challenges that China and the Eurozone currently face. In this context, BBVA Research forecasts that Eurozone GDP will expand by 1.0% in 2025 (40 basis points lower than previously forecast), having grown by 0.8% in 2024 (10 basis points higher than previously forecast), and that growth in China will moderate to 4.1% in 2025 (10 basis points lower than previously forecast) from 4.8% in 2024 (20 basis points higher than previously forecast). The relative weakness of economic activity would contribute to inflation remaining contained at around 2.0% in the Eurozone and remaining low in China. Against this macroeconomic environment, additional interest rate cuts are likely to be seen in both regions. In particular, in the Eurozone, the European Central Bank (hereinafter ECB), which cut deposit facility rates from 4.0% to 3.0% in the course of 2024, is expected to cut them further to around 2.0% in mid-2025.

Both geopolitical factors, including a further escalation of conflicts in Ukraine or the Middle East, and possible policies of the new US administration, such as those related to foreign trade, migration flows and fiscal policy, create risks for the global macroeconomic environment. In particular, they increase the risk that inflation, and thus interest rates, will remain higher than expected. In addition, they raise the risk of lower than expected GDP growth as well as macroeconomic and financial volatility.

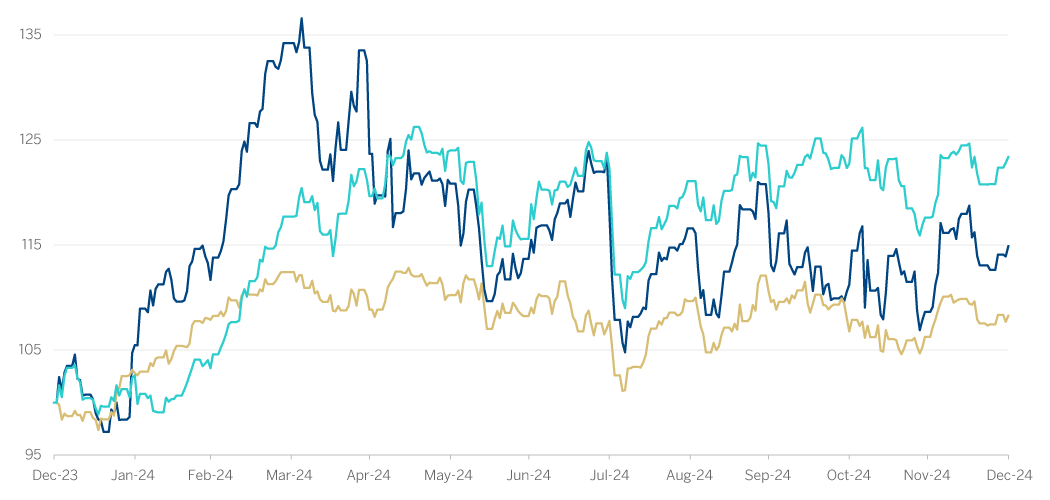

The main indexes have shown a positive performance in 2024. In Europe, the Stoxx Europe 600 index increased by 6.0% compared to the end of 2023, and in Spain the Ibex 35 rose by 14.8% in the same period, showing a better relative performance. In the United States, the S&P 500 index also increased by 23.3%.

With regard to the banking sector indexes, the performance during 2024 was better than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased by 26.0% and 23.4% respectively, while in the United States, the S&P Regional Banks sector index rose by 15.2% in the period.

As for BBVA’s share price, it increased by 14.9% during the year, outperforming its sector index, closing 2024 at €9.45.

BBVA share evolution

Compared with European indexes (base indice 100=31-12-23)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 31/12/2024 | 30/09/2024 | |

| Number of shareholders | 714,069 | 717,667 |

| Number of shares issued (millions) | 5,763 | 5,763 |

| Closing price (euros) | 9.45 | 9.71 |

| Book value per share (euros) (1) | 9.67 | 9.19 |

| Tangible book value per share (euros) (1) | 9.24 | 8.79 |

| Market capitalization (millions of euros) | 54,463 | 55,962 |

(1) For more information, see Alternative Performance Measures at the end of the quarterly report.

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.41 per share, to be paid presumably on April as final dividend of 2024 and the execution of a Share Buyback Program of BBVA for an amount of €993m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2024 will reach €5,027m, a 50% of the net attributable profit, of which €0.70 gross per share will be distributed in cash, taking into account the payment in cash of €0.29 gross per share paid in October 2024 as interim dividend of the year.

On December 31, 2024 the number of BBVA shares outstanding was 5,763 million. The number of shareholders reached 714,069, and by type of investor, 63.02% of the capital was held by institutional investors and the remaining 36.98% was in the hands of retail shareholders.

BBVA shares are included on the main stock market indexes. At the end of December 2024, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 9.5%, 1.6% and 0.5%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 5.3% and the Euro Stoxx Banks index for the eurozone with a weighting of 9.0%. Moreover BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

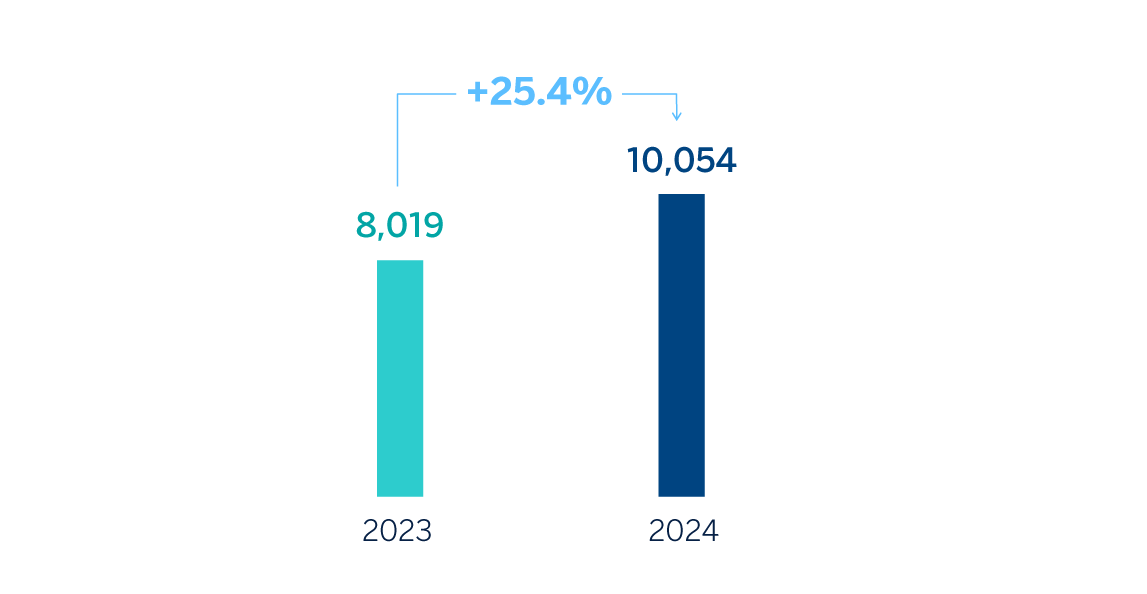

The BBVA Group generated a net attributable profit of €10,054m in 2024, once again driven by the performance of recurring revenues of the banking business, that is, net interest income and net fees and commissions, which together grew by 13.2%. These results represent an increase of 25.4% compared to the same period of the previous year, and include the recording of the annual amount from the temporary levy on credit institutions and financial credit institutions of €285m, included in other operating income and expenses in the income statement.

In constant terms, excluding the impact of currency variations, operating expenses increased by 18.3% at Group level, affected by an environment of still high inflation in the countries where the Group has a presence, the growth of the workforce in all of them and the higher level of investments made in recent years. Thanks to the remarkable growth in gross income (+25.0%), which was notably greater than the growth in operating expenses, the efficiency ratio stood at 40.0% as of December 31, 2024, with an improvement of 226 basis points compared to the ratio as of December 31, 2023. The level achieved consolidates BBVA's leadership, in terms of efficiency, in between the fifteen biggest banks across Europe, comfortably achieving the Group's target of reaching 42% by the end of 2024.

The provisions for impairment on financial assets increased (+32.4% in year-on-year terms and at constant exchange rates), due to a high rate of growth in lending, both in loans to companies and in retail products, the most profitable in recent years, as well as the timing of the economic cycle in some of the Group's geographical areas.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

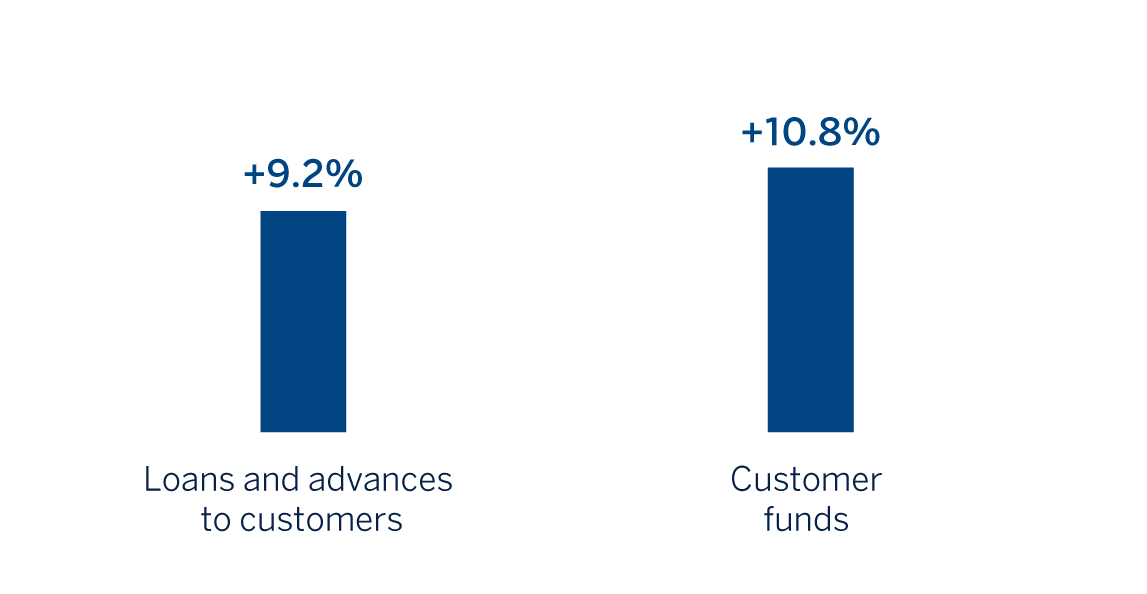

Loans and advances to customers recorded an increase of 9.2% compared to the end of December 2023, particularly driven by the evolution of corporate loans (+14.7% at Group level), and, to a lesser extent, by the positive performance of loans to individuals.

Customer funds increased by 10.8% compared to the end of the previous year, driven both by the growth in customer deposits and by the performance of investment funds and managed portfolios.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2023)

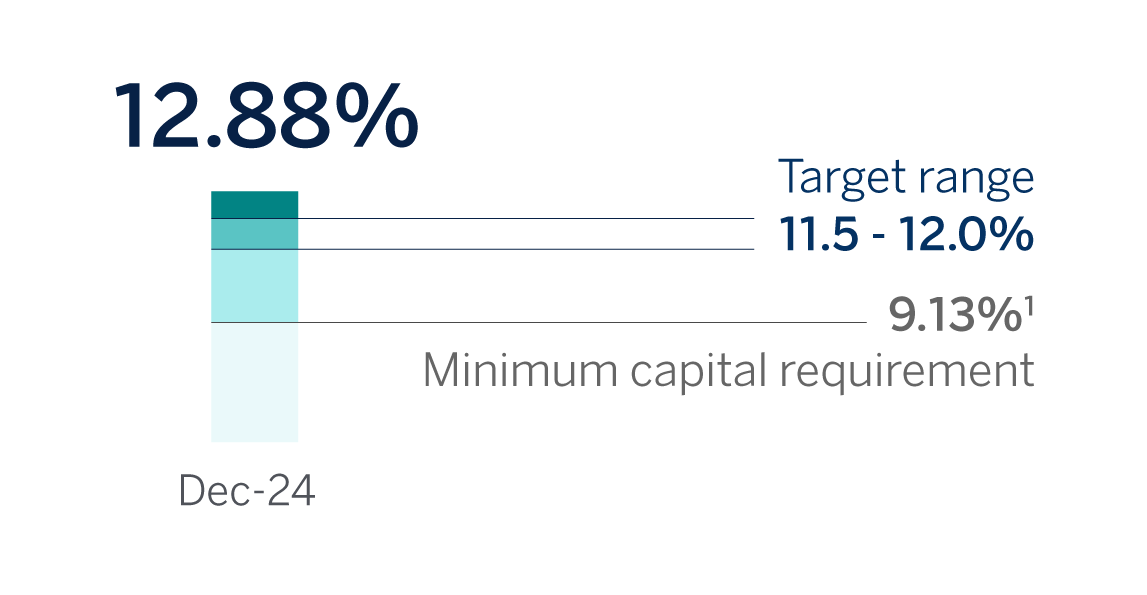

The BBVA Group's CET1 fully loaded ratio stood at 12.88% as of December 31, 2024, which allows it to maintain a large management buffer over the Group's CET1 requirement as of that date (9.13%1), and is also above the Group's target management range of 11.5% - 12.0% of CET1.

CET1 fully loaded

1 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of September 30, 2024.

1 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of September 30, 2024.

2023

Regarding shareholder remuneration, as approved by the General Shareholders´ Meeting on March 15, 2024, in its first item on the agenda, on April 10, 2024, a cash payment of €0.39 gross per each outstanding BBVA share entitled to receive, such amount was made against the 2023 results, as an additional shareholder remuneration for the financial year 2023. Thus, the total amount of cash distributions for 2023, taking into account the € 0.16 gross per share that was distributed in October 2023, amounted to €0.55 gross per share.

Total shareholder remuneration of 2023 includes, in addition to the cash payments mentioned above, the remuneration resulting from BBVA's buyback program for the repurchase of own shares announced on January 30, 2024 for a maximum amount of €781m, and which started being executed on March 4, 2024. Likewise, BBVA announced on April 9, 2024 the completion of the share buyback program upon reaching the maximum monetary amount, having acquired a total number of 74,654,915 own shares, between March 4 and April 9, 2024, representing, approximately, 1.28% of BBVA's share capital as of such date. On May 24, 2024, BBVA notified through an Other Relevant Information notice a partial execution of the share capital reduction resolution adopted by the Annual General Shareholders’ Meeting of BBVA held on March 15, 2024, under item 3 of the agenda through the reduction of BBVA’s share capital in a nominal amount of €36,580,908.35 and the consequent redemption, charged to unrestricted reserves, of 74,654,915 own shares of €0.49 par value each acquired derivatively by the Bank in execution of the own share buyback program scheme and which were held as treasury shares.

2024

Likewise, the Bank announced by means of an inside information notice (información privilegiada) dated September 26, 2024, that the Board of Directors of BBVA had agreed to pay an interim dividend for the year 2024, in the amount of 0.29 gross euros per share, which was paid on October 10, 2024.

Additionally, BBVA announced on January 30, 2025 by means of an inside information notice (información privilegiada) it is expected to be submitted to the relevant governing bodies for their consideration a cash gross distribution in the amount of €0.41 per share, to be paid presumably on April as final dividend of 2024 and the execution of a Share Buyback Program of BBVA for an amount of €993m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start. Thus, the total distribution for the year 2024 will reach €5,027m, a 50% of the net attributable profit, of which €0.70 gross per share will be distributed in cash, taking into account the payment in cash of €0.29 gross per share paid in October 2024 as interim dividend of the year.

Business Areas

Click on each area to learn more

Spain

Spain

HIGHLIGHTS

|

RESULTS

| |

| Net interest income | Gross income |

| 6,435 | 9,490 |

| +14.5% (2) | +20.3% (2) |

| Operating income | Net atributable profit |

| 6,140 | 3,784 |

| +30.8% (2) | +39.1% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-23. Balances as of 31-12-24. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +4.1% | +5.2% |

RISKS |

| NPL coverage ratio |

| 55% | 59% |

| NPL ratio |

| 4.1% | 3.7% |

| Cost of risk |

| 0.37% | 0.38% |

(2) Year-on-year changes.

Mexico

Mexico

HIGHLIGHTS

|

RESULTS

| |

| Net interest income | Gross income |

| 11,556 | 15,337 |

| +8.0% (2) | +11.1% (2) |

| Operating income | Net atributable profit |

| 10,689 | 5,447 |

| +12.1% (2) | +5.8% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-23. Balances as of 31-12-24. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +15.6% | +12.7% |

RISKS |

| NPL coverage ratio |

| 123% | 121% |

| NPL ratio |

| 2.6% | 2.7% |

| Cost of risk |

| 2.96% | 3.39% |

(2) Year-on-year changes.

Turkey

Turkey

HIGHLIGHTS

|

RESULTS

| |

| Net interest income | Gross income |

| 1,492 | 4,212 |

| -10.4% (2) | +72.4% (2) |

| Operating income | Net atributable profit |

| 2,101 | 611 |

| +77.2% (2) | +108.6% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-23. Balances as of 31-12-24. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +45.4% | +48.8% |

RISKS |

| NPL coverage ratio |

| 97% | 96% |

| NPL ratio |

| 3.8% | 3.1% |

| Cost of risk |

| 0.25% | 1.27% |

(2) Year-on-year changes.

South America

South America

HIGHLIGHTS

|

RESULTS

| |

| Net interest income | Gross income |

| 5,589 | 5,405 |

| +31.9% (2) | +30.3% (2) |

| Operating income | Net atributable profit |

| 2,838 | 635 |

| +27.0% (2) | +17.1% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-23. Balances as of 31-12-24. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +16.8% | +26.6% |

RISKS |

| NPL coverage ratio |

| 88% | 88% |

| NPL ratio |

| 4.8% | 4.5% |

| Cost of risk |

| 2.51% | 2.87% |

(2) Year-on-year changes.

Rest of business

Rest of business

HIGHLIGHTS

|

RESULTS

| |

| Net interest income | Gross income |

| 741 | 1,458 |

| +35.4% (2) | +29.7% (2) |

| Operating income | Net atributable profit |

| 715 | 500 |

| +35.3% (2) | +23.5% (2) |

ACTIVITY (1)

|

|

| Variation compared 31-12-23. Balances as of 31-12-24. |

|

| Performing loans and advances to customers under management | Customer funds under management |

| +26.0% | +103.4% |

RISKS |

| NPL coverage ratio |

| 69% | 102% |

| NPL ratio |

| 0.7% | 0.3% |

| Cost of risk |

| 0.08% | 0.17% |

(2) Year-on-year changes.

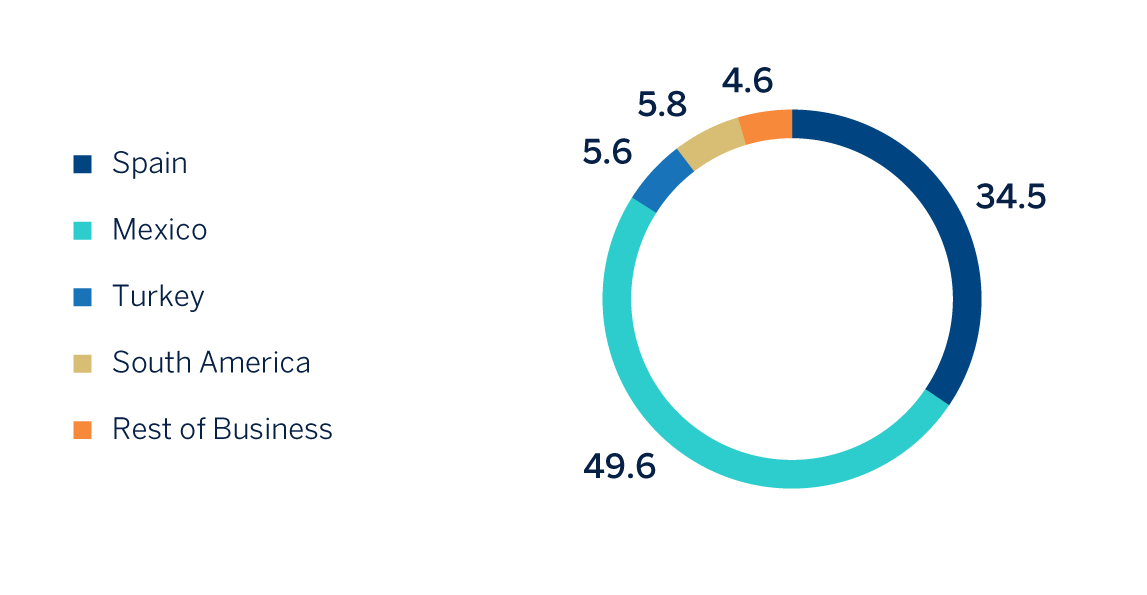

* Gross income.

(1) At constant exchange rate.

(2) At constant exchange rates.

According to the accumulated results of the business areas at the end of 2024 and excluding the effect of currencies fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain generated a net attributable profit of €3,784m, that is 39.1% above the result achieved in 2023. This result is driven by the favorable evolution of the recurring revenues from the banking business, particularly net interest income. These solid results include the negative impact of €285m, due to the recording of the annual amount of the temporary tax on credit institutions and financial credit institutions.

- BBVA Mexico achieved a cumulative net attributable profit of €5,447m, representing a growth of 5.8% compared to the end of the previous year, mainly due to the evolution of the recurring income from the banking business.

- Turkey generated a net attributable profit of €611m, which compares favorably with the result in the same period of the previous year.

- South America generated a net attributable profit of €635m, which represents a year-on-year variation of 17.1%, driven by the good performance of recurring income and the good performance of net trading income in the area (hereinafter NTI).

- Rest of Business achieved an accumulated net attributable profit of €500m, 23.5% higher than in the same period of the previous year, favored by the performance of the recurrent revenues and the NTI.

The Corporate Center recorded a net attributable loss of €-924m, which is an improvement compared with the €-1,544m recorded in the previous year, mainly due to the favorable evolution of the NTI.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business, Corporate & Investment Banking (CIB), carried out by BBVA in the countries where it operates. CIB generated a net attributable profit of €2,781m2. These results represent an increase of 29.6% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 2024)

(1) Excludes the Corporate Center.

2 The additional pro forma CIB information does not include the application of hyperinflation accounting or the Group's wholesale business in Venezuela.

News

Contact

Shareholder attention line

Shareholder attention line

912 24 98 21

Subscription service

Subscription service Shareholder Office

Shareholder Office Contact email

Contact email