Highlights

Results and business activity

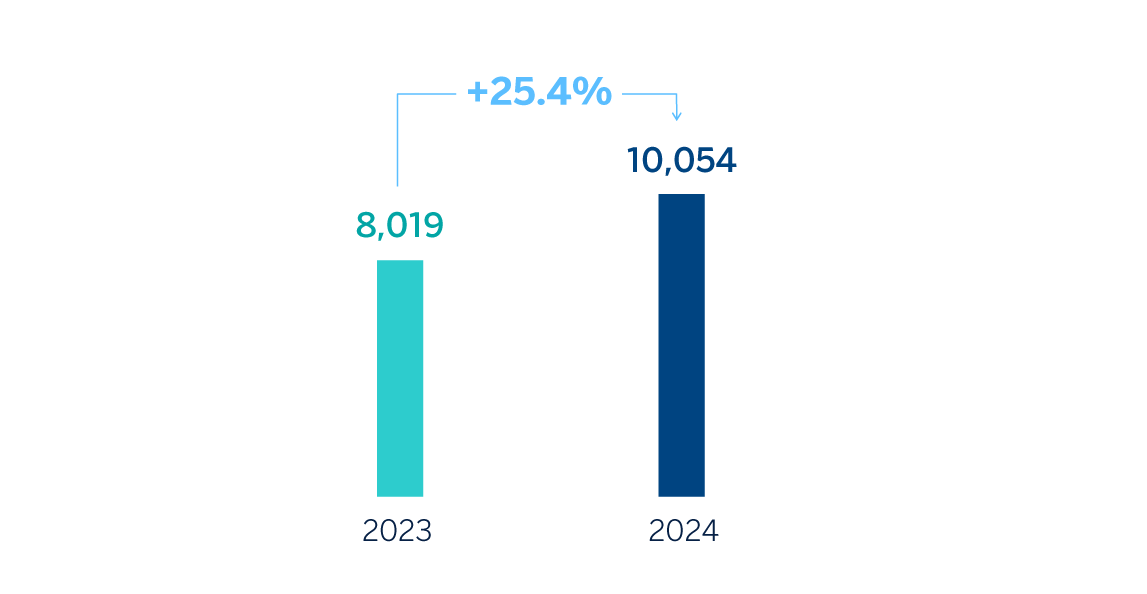

The BBVA Group generated a net attributable profit of €10,054m in 2024, once again driven by the performance of recurring revenues of the banking business, that is, net interest income and net fees and commissions, which together grew by 13.2%. These results represent an increase of 25.4% compared to the same period of the previous year, and include the recording of the annual amount from the temporary levy on credit institutions and financial credit institutions of €285m, included in other operating income and expenses in the income statement.

In constant terms, excluding the impact of currency variations, operating expenses increased by 18.3% at Group level, affected by an environment of still high inflation in the countries where the Group has a presence, the growth of the workforce in all of them and the higher level of investments made in recent years. Thanks to the remarkable growth in gross income (+25.0%), which was notably greater than the growth in operating expenses, the efficiency ratio stood at 40.0% as of December 31, 2024, with an improvement of 226 basis points compared to the ratio as of December 31, 2023. The level achieved consolidates BBVA's leadership, in terms of efficiency, in between the fifteen biggest banks across Europe, comfortably achieving the Group's target of reaching 42% by the end of 2024.

The provisions for impairment on financial assets increased (+32.4% in year-on-year terms and at constant exchange rates), due to a high rate of growth in lending, both in loans to companies and in retail products, the most profitable in recent years, as well as the timing of the economic cycle in some of the Group´s geographical areas.

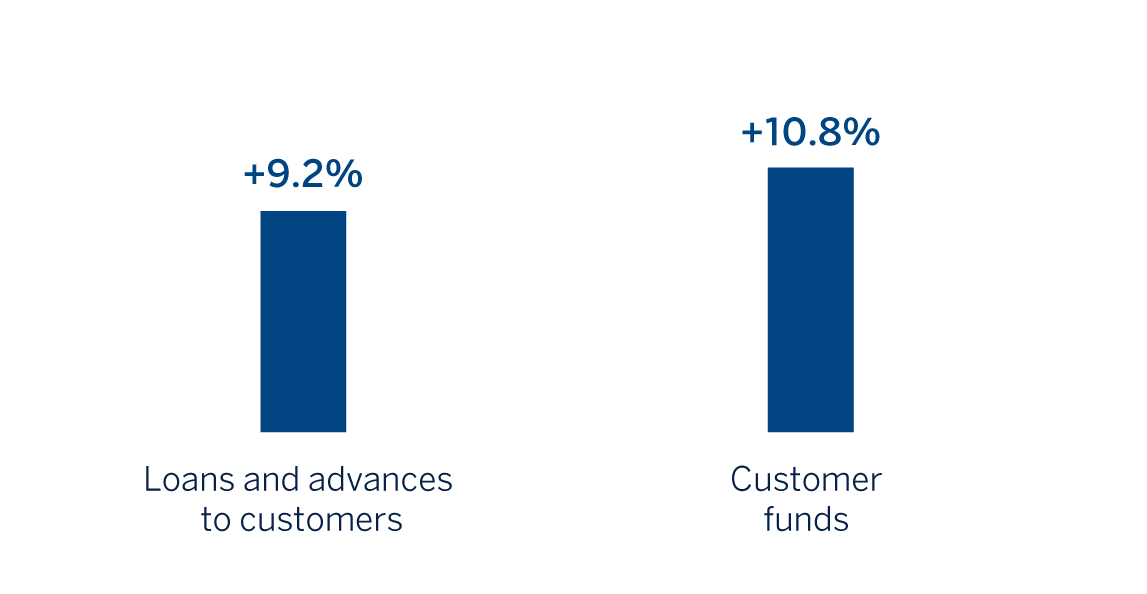

Loans and advances to customers recorded an increase of 9.2% compared to the end of December 2023, particularly driven by the evolution of corporate loans (+14.7% at Group level), and, to a lesser extent, by the positive performance of loans to individuals.

Customer funds increased by 10.8% compared to the end of the previous year, driven both by the growth in customer deposits and by the performance of investment funds and managed portfolios.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2023)

Business areas

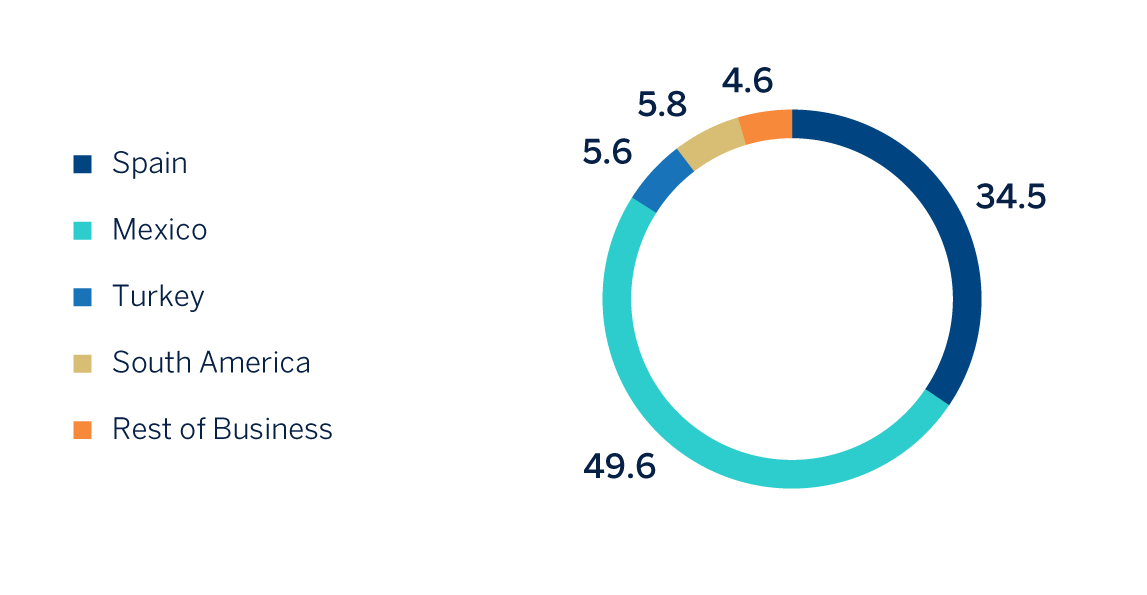

According to the accumulated results of the business areas at the end of 2024 and excluding the effect of currencies fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain generated a net attributable profit of €3,784m, that is 39.1% above the result achieved in 2023. This result is driven by the favorable evolution of the recurring revenues from the banking business, particularly net interest income. These solid results include the negative impact of €285m, due to the recording of the annual amount of the temporary tax on credit institutions and financial credit institutions.

- BBVA Mexico achieved a cumulative net attributable profit of €5,447m, representing a growth of 5.8% compared to the end of the previous year, mainly due to the evolution of the recurring income from the banking business.

- Turkey generated a net attributable profit of €611m, which compares favorably with the result in the same period of the previous year.

- South America generated a net attributable profit of €635m, which represents a year-on-year variation of 17.1%, driven by the good performance of recurring income and the good performance of net trading income in the area (hereinafter NTI).

- Rest of Business achieved an accumulated net attributable profit of €500m, 23.5% higher than in the same period of the previous year, favored by the performance of the recurrent revenues and the NTI.

The Corporate Center recorded a net attributable loss of €-924m, which is an improvement compared with the €-1,544m recorded in the previous year, mainly due to the favorable evolution of the NTI.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business, Corporate & Investment Banking (CIB), carried out by BBVA in the countries where it operates. CIB generated a net attributable profit of €2,781m1. These results represent an increase of 29.6% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 2024)

(1) Excludes the Corporate Center.

Solvency

The BBVA Group's CET1 fully loaded ratio stood at 12.88% as of December 31, 2024, which allows it to maintain a large management buffer over the Group's CET1 requirement as of that date (9.13%2), and is also above the Group's target management range of 11.5% - 12.0% of CET1.

Shareholder remuneration

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.41 per share, to be paid presumably on April as final dividend of 2024 and the execution of a Share Buyback Program of BBVA for an amount of €993m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2024 will reach €5,027m, a 50% of the net attributable profit, of which €0.70 gross per share will be distributed in cash, taking into account the payment in cash of €0.29 gross per share paid in October 2024 as interim dividend of the year.

Purchase offer to the Banco Sabadell shareholders

On April 30, 2024, due to a media report, BBVA published an inside information notice (información privilegiada) stating that it had informed the chairman of the Board of Directors of Banco de Sabadell, S.A. (the "Target Company") of the interest of BBVA’s Board of Directors in initiating negotiations to explore a possible merger between the two entities. On the same date, BBVA sent to the chairman of the Target Company the written proposal for the merger of the two entities. The content of the written proposal sent to the Board of Directors of the Target Company was published on May 1, 2024 by BBVA through the publication of an inside information notice (información privilegiada) with the Spanish Securities and Exchange Commission (hereinafter “CNMV”).

On May 6, 2024, the Target Company published an inside information notice (información privilegiada) informing of the rejection of the proposal by its Board of Directors.

Following such rejection, on May 9, 2024, BBVA announced, through the publication of an inside information notice (información privilegiada) (the "Prior Announcement"), the decision to launch a voluntary tender offer (the "Offer") for the acquisition of all of the issued shares of the Target Company, being a total of 5,440,221,447 ordinary shares with a par value of €0.125 each (representing 100% of the Target Company’s share capital). The consideration initially offered by BBVA to the shareholders of the Target Company consisted of one (1) newly issued share of BBVA for each four and eighty-three hundredths (4.83) ordinary shares of the Target Company, subject to certain adjustments in the case of dividend distributions in accordance with what was indicated in the Prior Announcement.

In accordance with the Prior Announcement of the Offer and as a consequence of the interim dividend against the 2024 financial year results in the amount of €0.08 per share paid by the Target Company to its shareholders on October 1, 2024, BBVA proceeded to adjust the Offer consideration. Therefore, after applying the adjustment in the terms set forth in the Prior Announcement, the consideration offered by BBVA to the shareholders of the Target Company under the Offer was adjusted, as result of the dividend payment of the Target Company, to one (1) newly issued ordinary share of BBVA for each five point zero one nine six (5.0196) ordinary shares of the Target Company.

Additionally, as a result of the interim dividend against the 2024 financial year results in the amount of €0.29 per share paid by BBVA to its shareholders on October 10, 2024, BBVA proceeded to adjust again the Offer consideration. Therefore, also in accordance with the provisions of the Prior Announcement, the Offer consideration was adjusted to one (1) newly issued ordinary share of BBVA and €0.29 in cash for every five point zero one nine six (5.0196) ordinary shares of the Target Company.

Pursuant to the provisions of Royal Decree 1066/2007, of July 27, on the rules governing tender offers ("Royal Decree 1066/2007"), the Offer is subject to mandatory clearance by the CNMV. Additionally, pursuant to the provisions of Law 10/2014 and Royal Decree 84/2015, the acquisition by BBVA of control of the Target Company resulting from the Offer is subject to the duty of prior notification to the Bank of Spain and the obtention of the non-opposition of the European Central Bank (a condition that was satisfied on September 5, 2024, as described below).

In addition, completion of the Offer is also subject to the satisfaction of the conditions specified in the Prior Announcement, in particular (i) the acceptance of the Offer by a number of shares that allows BBVA to acquire at least more than half of the effective voting rights of the Target Company at the end of the Offer acceptance period (therefore excluding the treasury shares that the Target Company may hold at that time), as this condition was amended by BBVA in accordance with the publication of the inside information notice (información privilegiada) dated January 9, 2025, (ii) approval by BBVA’s General Shareholders’ Meeting of the increase of BBVA’s share capital through the issue of new ordinary shares through non-cash contributions in an amount that is sufficient to cover the consideration in shares offered to the shareholders of the Target Company (which condition was satisfied on July 5, 2024, as described below), (iii) the express or tacit authorization of the economic concentration resulting from the Offer by the Spanish antitrust authorities, and (iv) the express or tacit authorization of the indirect acquisition of control of the Target Company’s banking subsidiary in the United Kingdom, TSB Bank PLC, by the United Kingdom Prudential Regulation Authority (“PRA”) (a condition that was satisfied on September 2, 2024, as described below).

On July 5, 2024, the BBVA’s Extraordinary General Shareholders' Meeting resolved to authorize, with 96% votes in favor, an increase in the share capital of BBVA of up to a maximum nominal amount of €551,906,524.05 through the issuing and putting into circulation of up to 1,126,339,845 ordinary shares of €0.49 par value each to cover the consideration in shares offered to the shareholders of the Target Company.

On September 3, 2024, BBVA announced, through the publication of an inside information notice (información privilegiada), that, on September 2, 2024, it received the authorization from the PRA for BBVA's indirect acquisition of control of TSB Bank PLC as a result of the Offer.

On September 5, 2024, BBVA announced, through the publication of an inside Information notice (información privilegiada), that it received the decision of non-opposition from the European Central Bank to BBVA's taking control of the Target Company as a result of the Offer.

On November 12, 2024, BBVA announced, through the publication of another relevant Information notice (otra información relevante), that it received the resolution of the Spanish National Markets and Competition authority (CNMC) in which it decided to initiate the second phase of the analysis of the economic concentration resulting from the Offer.

The Offer is subject to approval by the CNMV and to the approval of the economic concentration resulting from the Offer by the Spanish competition authorities. The detailed terms of the Offer will be set out in the prospectus, which was submitted to the CNMV together with the request for the authorization of the Offer on May 24, 2024, and will be published after obtaining the mandatory clearance of the CNMV.

1 The additional pro forma CIB information does not include the application of hyperinflation accounting or the Group's wholesale business in Venezuela.

2 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of September 30, 2024.